South Korea’s Global Nuclear Ambitions

David Adam Stott

Introduction

“We had been building nuclear power stations for 30 years but had failed in repeated attempts to break into international markets.”

South Korean President Lee Myung-bak in a January 2010 radio address. [1]

December 2009 was an historic month for the South Korean nuclear industry. In winning two bidding competitions to design and construct nuclear power plants in the Middle East, it dramatically signalled its arrival as an international force in the sector. The opening announcement concerned Jordan’s first nuclear research reactor whilst the second, and most important, was a massive contract to build at least four nuclear power plants in the United Arab Emirates (UAE). The South Korean team was one of nine original bidders and beat off competition from France and an American-Japanese consortium from the final shortlist of three. As the USA, France and Japan account for almost half of the world’s total nuclear reactors, this was an impressive achievement, especially since it will be the first nuclear power plant that Korea has exported.

The initial deal with the UAE to construct the reactors is worth around US$20 billion to KEPCO (Korean Electric Power Company) and its partners, whilst Seoul estimates that Korean firms will reap a further harvest of US$20 billion over the 60-year lifespan of the reactors by way of maintenance, servicing and fuel supply contracts. With a total value estimated at around $40 billion, this was the largest contract awarded in the Gulf last year, and the biggest single contract that South Korean firms have ever secured overseas. Indeed,, aside from military hardware, it is likely also the biggest contract ever signed in the Gulf region. Moreover, both sides view the landmark contract as a stepping stone to a much deeper economic relationship in which both countries pour greater foreign investment into the other. Indeed, Abu Dhabi has recently endowed South Korean firms with numerous large contracts to upgrade its petrochemical infrastructure.

|

Middle East states that have discussed bilateral nuclear cooperation agreements since 2008. |

Data from the International Atomic Energy Agency (IAEA) indicates that 436 nuclear reactors are presently operating in some 30 countries. However, with more than half of these 436 reactors due for retirement by 2030, countries which export nuclear infrastructure will likely be competing for a bounty of new contracts in the next decade. Indeed, worldwide another 53 nuclear reactors are currently under construction and a further 136 are in the planning stages. Emerging markets in the Middle East are keen to introduce nuclear power into their energy portfolios, and South Korean consortia have been at the forefront of Arab moves to diversify both their economies and energy portfolios by adopting nuclear power.

Given the increasing concerns over global warming and peak oil theory, nuclear power has been championed as a clean and sustainable alternative for producing electricity. Nuclear power does indeed emit comparatively low levels of carbon dioxide, and can generate a large amount of electricity from a single plant. Nevertheless, the drawbacks are many. Notably, nuclear waste is so hazardous that it has to be carefully managed for several thousand years. The environmental consequences of accidents or attacks can be catastrophic, as seen from the Chernobyl disaster of 1986, and it is a relatively easy step to move from peaceful power generation to weapons development. Moreover, nuclear energy is itself derived from uranium, a finite resource albeit one which the IAEA expects to last for at least 80 more years even without new discoveries in technologies or deposits. [2]

This paper assesses the development of the Korean nuclear power industry. It then shows why its clients in the Middle East want to harness nuclear energy and why they have chosen South Korea to lead this process rather than more experienced exporters such as France or the US-Japanese consortium. Finally, the article concludes with a brief outline of South Korea’s global nuclear export strategy and a wider discussion of economic ties between South Korea and the UAE.

Korea’s nuclear energy

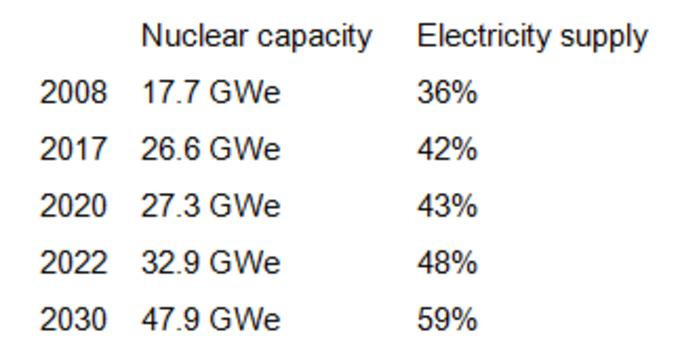

South Korea seems set to become a major force in the global nuclear energy business, exporting technology and expertise around the world. With few fossil fuel resources, like Japan, South Korea has sought to harness nuclear energy as a means to secure the country’s rapid economic development. Over the last three decades, South Korea has averaged 8.6% annual GDP growth, with a corresponding leap in electricity consumption. In 1980 the country consumed some 33 billion kilowatt hours (kWh), which had risen by 2006 to around 371 billion kWh. Today 20 reactors account for 28.5% of South Korea’s total capacity but actually provide 36% of the country’s electricity. A further 12 plants are in the construction or planning phases, which will further increase the nuclear share in the country’s electricity consumption, which is projected to reach 59% of electricity supply by 2030. All of South Korea’s nuclear power plants are operated by Korea Hydro & Nuclear Power Co Ltd (KHNP), a subsidiary of state utility Korea Electric Power Corporation (KEPCO).

The genesis of the South Korea nuclear industry can be traced to 1957 when it became a member of the IAEA and immediately implemented a nuclear research programme. The country’s first nuclear reactor, a small research unit, achieved criticality in 1962. Thereafter, its first commercial power plants were developed by foreign contractors, with Kori 1 being the first to supply electricity from April 1978. This was followed by a further eight reactors being constructed in the 1980s. Kori 1 and Kori 2, the first two commercial nuclear power stations, were built under contract by an American consortium, whilst Wolsong 1, the third plant, was bought from Atomic Energy of Canada (AECL). The next six, Kori 3 & 4, Yonggwang 1 & 2, Ulchin 1 & 2, again featured foreign-designed reactors but with a much greater involvement in the construction from local firms, particularly Hyundai. By the end of the 1980s, Korea had six nuclear power plants conceived by American firm Combustion Engineering (now part of Westinghouse Electric), two from France’s Framatome (now AREVA Nuclear Power) and one from AECL.

As in Japan, which imported its first turnkey plants from the UK in the 1960s, the indigenisation of the Korean nuclear power industry quickly gathered pace, and strove for greater self-sufficiency by standardising nuclear power plant design. To this end, in 1987 Korea began a ten-year reactor technology licence agreement with Combustion Engineering, a collaboration which yielded the Korean Standard Nuclear Plant (KSNP). This agreement was subsequently extended in 1997, and since 1995 all nuclear plants in South Korea have been built almost exclusively with local technology.

The KSNP is now an internationally recognised design, and has progressed to KSNP+, which was re-branded in 2005 as OPR-1000 (Optimised Power Reactor) for export to emerging Asian markets. In South Korea eight OPR1000 units are in now operation, whilst a further four are under construction and should be supplying electricity between 2010 and 2012. The KSNP+ project features numerous design improvements for enhanced safety and lower construction costs, and their advanced design, low operating costs and enviable safety record have positioned Korea at the forefront of the global nuclear power industry.

The next evolutionary stage in Korean nuclear technology is represented by the Advanced Pressurised Reactor-1400 (APR-1400), on which work began in 1992 and whose basic design was finalised in 1999. With a 60-year shelf life, it is anticipated that costs will be 10-20% under those incurred by OPR-1000 units, due to design advancements and enhanced construction techniques. It is these OPR-1000 and APR-1400 units that KEPCO has been marketing in the Middle East and North Africa.

Given its progress in developing the KSNP, in 2007 KHNP opted not to renew its technology transfer scheme with Westinghouse. Instead, the two firms agreed that either could market technology which they have developed together and implicitly not compete against each other for overseas contracts using APR-1400 units. Whilst Westinghouse still retains the patents for a few necessary technologies in the APR-1400 from its acquisition of Combustion Engineering, South Korea aims to become fully self-sufficient in this sector by 2012. Indeed, it is reported that Korean companies have already become proficient in the design and manufacture of all APR-1400 components. Whilst KEPCO has also offered APR-1400s in other territories such as Poland and Belarus, it is thought that Westinghouse is unlikely to let it compete in lucrative markets such as the US and China unless KEPCO purchases in full the design’s intellectual property. Therefore, the cooperation agreement also specifies that KHNP is to develop its own components to replace those in the AP-1400 which require licensing from Westinghouse. This would enable Korean firms to meet the Ministry of Education, Science & Technology’s target for the country to develop its nuclear industry into one of the world’s top five by 2011, and allow it to compete even more forcefully in the global market.

|

An artist’s impression of South Korea’s Shin-Kori 3 and 4 reactors |

A major step towards accomplishing this aim was made when the UAE selected the APR-1400 as the standard for its nascent nuclear power programme, with the first four reactors scheduled to be on line by 2020, and a further ten envisaged thereafter. Whilst there are no APR-1400 plants presently in operation, the first two units currently under construction in South Korea, Shin-Kori 3 and 4, are slated to be finished in 2013-14 and will act as a reference point for the UAE plants. The chief designer of these APR-1400 units is Korea Power Engineering Company (KOPEC) with Doosan as the lead manufacturer. Whilst Shin-Kori 3 and 4 are expected to take 51 months to be completed, construction of the UAE plants is scheduled to take 48 months.

Nuclear power in the UAE

The Arab states of the Middle East and North Africa look set to emerge as the next big regional market for civilian nuclear power, hence the efforts that Korean and other producers are making to court them. This technology would allow Arab states to move away from oil and gas for electricity generation, thus boosting exports volumes of both commodities. Such energy would also enable seawater desalination which is very costly and consumes large amounts of fossil fuels in this mostly arid region. Therefore it is hardly surprising that countries such as Algeria, Bahrain, Egypt, Kuwait, Libya, Morocco, Oman, Qatar, Saudi Arabia, Syria, Yemen and the UAE have been discussing bilateral agreements with established nuclear power producing countries and soliciting proposals from foreign contractors.

The six members of the wealthy Gulf Cooperation Council (GCC) – the UAE, Saudi Arabia, Bahrain, Kuwait, Qatar and Oman – announced in December 2006 that they were looking into harnessing nuclear energy. These countries all rely exclusively on fossil fuels for electricity generation and have been experiencing 5-7% annual demand growth in recent years. Given their locations, seawater desalination also consumes large qualities of fossil fuels, especially natural gas. Indeed, by 2007 around 75% of total world desalination capacity was concentrated in the Middle East. Removing excess salt and other minerals from sea water to make potable water is very energy intensive. A 2009 report estimates that electricity demand in the GCC block will increase 10% per annum to 2015, accompanied by desalination demand rising annually by 8%, in total requiring 60 gigawatts of electricity (GWe) of new capacity by 2015. [3]

All six GCC members are signatories to the Nuclear Non-Proliferation Treaty (NPT), and France quickly signalled its willingness to cooperate whilst Iran also promised assistance. GCC members, led by Saudi Arabia, agreed in February 2007 with the IAEA to launch a feasibility study into a GCC-wide nuclear power and desalination scheme, with Riyadh envisioning a programme emerging around 2009. However, since the IAEA submitted a pre-feasibility study to the regional body in late 2007 there has been no progress in any joint GCC nuclear programme, and various member states have consequently signed their own bilateral agreements with established nuclear energy producers.

The UAE’s plans are the most advanced with Abu Dhabi in the vanguard of such unilateral moves. In April 2008 it independently published a comprehensive nuclear energy policy outline, assembled with input from the IAEA and the governments of France, the US, Britain, Russia, China, Japan, Germany, and South Korea. This white paper forecast electricity demand growing by 9% per annum from 15.5 GWe in 2008 to over 40 GWe in 2020, with natural gas supplies sufficient for only half of this. At present, around 98% of the UAE’s total capacity is derived from gas. Indeed, in 2008 Abu Dhabi, the wealthiest and biggest of the seven Emirates with the largest oil reserves, began importing natural gas from Qatar as its own deposits contain too much sulphur to make power generation cost effective. Imported coal was dismissed as an option to meet this shortfall due to environmental and energy security implications, whilst buttressing extant oil and diesel generation was also discounted due to environmental and cost concerns.

The reason for this increasing demand has been the urbanisation and construction boom of the last decade, as record oil revenues have fuelled economic expansion and population growth. Indeed, the UAE was one of the fastest growing economies in the world between 2000 and 2007, achieving a compound annual growth rate of 9.3% in the five years to the end of 2007. [4] Whilst some of these mega projects are being delayed by the global credit crisis, they will nonetheless strain the UAE’s power grid. In addition, the UAE is also formulating a strategy for nuclear-powered seawater desalination, which consumes large quantities of fossil fuels to provide around 70% of the UAE’s water supply.

Therefore, the electricity from the UAE’s nuclear reactors will bring at least four main benefits. Firstly, and most importantly, it will enable more cost-effective water desalination. Second, nuclear energy will begin to replace costly natural gas imports in generating electricity. In addition, extra electricity capacity will help the UAE diversify its economy and expand output of finished goods. Lastly, these nuclear reactors could allow the UAE to become a net exporter of electricity to other countries in the region even though many of its neighbours are also looking at nuclear power. To achieve these goals will require major upgrades to the UAE’s electricity infrastructure, however.

The UAE’s nuclear plans gathered pace in April 2008 with the publication of its nuclear policy outline. This was followed in mid-2008 with appointment of the UAE ambassador to the IAEA, and establishment of a Nuclear Energy Program Implementation Organisation upon the IAEA’s recommendation. The national Emirates Nuclear Energy Corporation (ENEC) was subsequently founded, charged with facilitating all nuclear power projects within UAE. It is ENEC which has been dealing with all the prospective foreign suppliers of technology and expertise, and which chose the Korean consortium over the other bidders.

|

UAE Prime Minister and Vice-President Sheikh Mohammed with the Korean Prime Minister Han Seung-soo on June 22, 2009. |

In order to facilitate commercial agreements, the UAE has also been very active diplomatically to secure bilateral nuclear cooperation agreements with established industry players. The UAE first signed a full nuclear cooperation agreement with France in January 2008, followed by a MoU with the UK in May 2008 and subsequently the US and Japan in January 2009. On June 22, 2009, South Korea became the fifth country to sign such a deal during a visit by Prime Minister Han Seung-soo. Bilateral nuclear cooperation agreements are precursors to any commercial deals and in this sense those signed by the UAE contain significantly more substance than those of other Arab states. Seoul’s agreement with the UAE is similar to that signed by Washington, which permits the use of US technology and expertise in the UAE’s nuclear programme.

To secure their participation, and to maintain its image as an outward-looking, foreign investment-friendly nation, the Emirates has stressed that it will not enrich uranium itself but import nuclear fuel for its plants. These supplies will come from a foreign partner and, furthermore, the UAE will return all spent nuclear fuel rather than reprocess it. The IAEA will also have the right to conduct snap inspections and be allowed unlimited access to the nuclear sites. Those states and companies interested in exporting nuclear power probably hope that the UAE nuclear power programme will become the template for other interested governments in the Middle East and North Africa.

Rather than taking the more tortuous route of developing indigenous expertise, the ENEC has been proposing joint-venture schemes with foreign contractors to construct and operate its nuclear power plants. These will be similar to the UAE’s existing water and electricity set ups in which the government has a 60% stake and 40% is owned by joint venture partners. The ENEC originally invited nine companies to submit proposals for the construction of its first nuclear power plant, sparking stiff competition among foreign contractors to break into this lucrative new market. ENEC subsequently whittled their number down to a final short list of three candidates in mid-May 2009. These were the French team of GdF Suez, AREVA and Total; an American-Japanese consortium of General Electric and Hitachi; and a South Korean bid spearheaded by its national power company KEPCO, partnered by other Korean firms Samsung, Hyundai and Doosan Heavy Industries. It is understood the UAE will standardise on one technology.

Although the French consortium was considered by many the favourite, it was announced on December 28, 2009 that KEPCO won the contract to build and operate the four nuclear reactors. The Korean bid was considered the underdog because of the high-level diplomacy carried out by the French and the long-standing ties between Washington and the Emirates. Indeed, the French consortium was quietly confident given that French President Nicolas Sarkozy has been particularly proactive in nuclear diplomacy since entering office in May 2007. In trying to promote the French civilian nuclear industry worldwide, he has signed several bilateral agreements to build nuclear reactors or extend technical assistance, namely with Morocco, Algeria, Libya, Saudi Arabia, Qatar, UAE, Tunisia, Jordan, India and China. The agreement with the UAE is the most comprehensive of these and was sealed during Sarkozy’s tour of the Middle East in January 2008, during which he lobbied for French firms in the newly-announced power plant bid. French companies AREVA and Suez already jointly operate a power and desalination station in Abu Dhabi. Furthermore, France also opened a naval base outside Abu Dhabi in May 2009, and has recently been in advanced talks with the Emirates to replace its ageing fighter fleet with French-made Dassault Rafale multi-purpose fighter jets. France is already one of the UAE’s major suppliers of military hardware and has even proposed opening a branch of the Louvre museum in the country. Meanwhile, the Gulf state also plays host to more than 2,000 US military personnel, and has been a valued partner in recent American operations in Afghanistan and Iraq, as well as in the 1990 Gulf War and in Somalia in 1992.

Nevertheless Abu Dhabi, the driving force behind the deal, has ostensibly based its decision on the merits of the proposal. It is likely that KEPCO offered the lowest price, and the Korean government was also heavily involved in supporting the KEPCO bid behind the scenes. Emirati nuclear officials have praised Korea for its on-time delivery record and enviable safety history. Indeed, South Korea’s reactors have had the fewest production stoppages of any country in the world. Perhaps, the UAE government was also keen to strengthen its bilateral relationship with an emerging economy and reduce any leverage Paris, Tokyo or Washington might have in future arms or oil deals. [5]

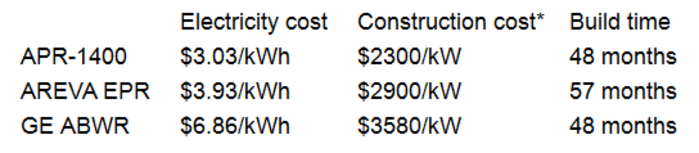

The Korean bid was considered very competitive in terms of both timeframe and cost. The French European Pressurised Reactor (EPR) design would take 57 months to construct. The US-Japanese consortium Advanced Boiling Water Reactor (ABWR), like the APR-1400, would take 48 months to build. Korean government data claims that both construction costs and electricity generation costs are significantly lower for its APR-1400 units than for the other consortia’s designs (see table below). Each APR-1400 unit can generate 1,400 megawatts (MWe) but the French EPR has a slightly larger capacity at about 1,600 MWe.

|

* This refers to the so-called ‘overnight cost’, or the cost if no interest was incurred during construction due to it being completed overnight. This term can also refer to the cost if the project is fully paid for up front in a lump sum. |

Given the cost benefits, UAE officials were reportedly impressed that the technical specifications of the APR-1400 were on a par with those from the other consortia. Indeed, the APR-1400 features innovative safety measures not found in other reactors. For example, given the tensions on the Korean peninsula the designers saw fit to include a missile shield, and the APR-1400 also showcases structural enhancements to prevent or reduce earthquake damage to the reactor. The APR-1400 also features a state-of-the-art control room with numerous innovative controls. All three short-listed consortia offered plants with an operating duration of 60 years, which is double the lifespan of most nuclear reactors on line today, and all three offerings require refuelling after around 18 months of operation.

If the KEPCO consortium can replicate its domestic success in the UAE, South Korea stands to become the world’s preeminent nuclear reactor exporter. At present, South Korean domestic build times are some of the fastest in the world, but the country’s nuclear power industry is unproven on foreign soil. Even though its engineers have forged a convincing technical reputation, project management has been something of an Achilles heel. To assist with the transition to working offshore, KEPCO has brought in AMEC, an experienced British engineering consultancy firm, to help with project management on nuclear and other energy projects overseas. Nevertheless, South Korean firms have certainly made great strides in the last decade as previously clients refused to consider them for large-scale resource developments as they lacked experience. Since then Korean engineering companies have built up a solid reputation around the world on a wide range of infrastructure projects. Moreover, the deal was a personal triumph for South Korean President Lee Myung-bak, a former CEO of Hyundai Engineering and Construction, who travelled to the UAE to lobby for the Korean bid just before the announcement. Furthermore, he sees exporting nuclear technology as a way for his country to be internationally recognised as an advanced nation during its 2010 presidency of the G-20 organisation of major economies.

Seoul expects the nuclear power plant deal to bring in about $40 billion over the life of the agreement. Construction of the reactors alone will cost $20 billion, which Korean media speculate will create around 110,000 jobs over the next 10 years. The remaining $20 billion will come from contracts to operate, maintain and supply fuel to the reactors during their 60-year lifespan. The Ministry of Knowledge Economy hailed the deal as the biggest single contract that Korean firms have ever secured overseas. Korean presidential spokesman Lee Dong-kwan expressed hope that the deal will transform nuclear infrastructure into a pillar of its export-driven economy similar to that of cars and electronic goods. The next step is for ENEC and KEPCO to establish a joint-venture entity to build and operate the four plants. ENEC is still assessing other potential contractors for ancillary services to its nascent nuclear energy programme, such as fuel suppliers, investment partners and education services.

It is clear that KEPCO will be deeply involved in all aspects of the project: construction, engineering, procurement, nuclear fuelling and maintenance. As well as being assisted by its own subsidiaries, the other consortium members Samsung, Hyundai and Doosan Heavy Industries will also play major roles. KHNP will be at the centre of the project as the construction contractor and operator, and also responsible for engineering and procurement. KOPEC will design the nuclear power plants, Korea Nuclear Fuel (KNF) will provide the nuclear fuel, while Korea Plant Service and Engineering (KPS) will be part of the maintenance team. In addition to AMEC, other non-Korean companies involved include Westinghouse, now 67% owned by Toshiba, and its Japanese parent company due to their control of patented technologies still necessary to build the APR-1400. Specifically, Westinghouse will supply equipment, engineering and fuel-service contracts to the KEPCO consortium.

It is not clear exactly how lucrative control of these patents will be for Westinghouse, particularly since KEPCO has expressed confidence that it can replace these components with its own designs by the end of 2012. Indeed, technology controlled by Westinghouse forms the basis of around 50% of the world’s presently operating nuclear plants. Nevertheless, the two firms still seem committed to their business cooperation mode as in early 2009 KEPCO subsidiary KNF established a new joint venture company with the American nuclear pioneer to manufacture control element assemblies (CEAs) for plants using Combustion Engineering designs operating in both the US and South Korea. Westinghouse and KNF hold 55% and 45% ownership respectively of the new company, KW Nuclear Components (KWN), located at the KNF fuel fabrication plant in Daejeon, south of Seoul. It seems that Shin Kori 4 will be the first plant to feature these new CEAs.

In addition to the direct economic benefits there could be trickle-down effects throughout the wider economy. UAE officials have stressed that 60% of the workforce to operate the plants will be Emirati nationals who will be trained both overseas and at Abu Dhabi’s Khalifa University. This should also lead to the development of specialised human resources in other areas, and should greatly spur the diversification of the Emirates economy away from a reliance on oil exports. The agreement calls for the first phase of the scheme to start delivering nuclear energy by 2017, with the four plants eventually meeting up to 25% of the country’s electricity needs after 2020 when all are scheduled to be operational.

|

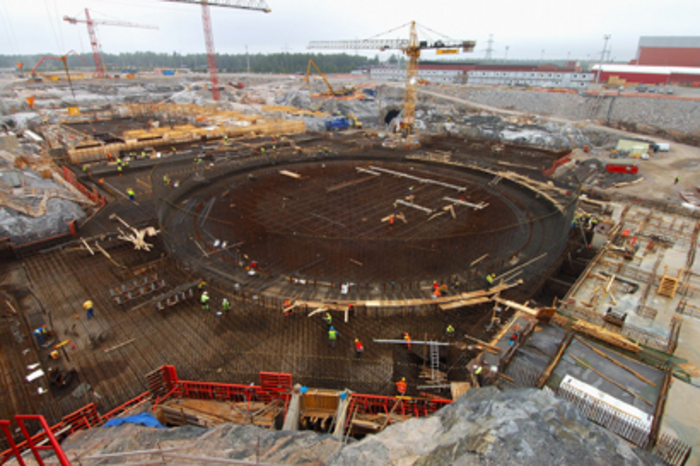

AREVA’s troubled Olkiluoto 3 reactor development in Finland. |

Despite their experience, the French bid was damaged by AREVA’s troubles pertaining to the Olkiluoto 3 reactor development in Finland, which is significantly behind schedule and over budget. The UAE’s review of the firm’s recent track record in Finland will have uncovered unseemly rows with both the Finnish nuclear regulatory agency and the project’s subcontractors, and would have hurt the French consortium’s reputation. Moreover, the French bid to construct the reactors was significantly higher than KEPCO’s, with speculation rife that it originally started at US $40 billion, double that of the Korean team. Whilst the French consortium reportedly lowered their bid in November 2009, it was not enough to convince the UAE authorities. The US-Japan bid fronted by GE and Hitachi offered a proven reactor design which is operating at various power plants in Japan, but one which will be almost 30 years old when the UAE’s first plant comes on line. From the outset Abu Dhabi has stressed its interest in the most cutting edge nuclear technology on the market.

Nuclear power in Jordan

Following the lead of wealthier Arab states, in May 2009 Amman outlined an ambitious plan to establish four nuclear power plants in southern Jordan over the next 30-35 years. Originally the scheme called for the first of these to become operational by 2017, but it is unlikely to meet this date and recent statements suggest a 2020 start is more realistic. As a necessary first step, Jordan has signed bilateral nuclear cooperation agreements or preliminary memoranda of understanding (MoU) with eleven different countries including South Korea, Japan, France, China, Canada, Russia, and the United States. Amman also plans to sign similar agreements with Romania and the Czech Republic before the end of 2010, in addition to seeking assistance from IAEA. The deals with South Korea and Japan cover infrastructure for both nuclear electricity generation and water desalination.

In November 2009 the Jordan Atomic Energy Commission (JAEC) chose Australian consultants WorleyParsons to prepare the pre-construction phase of the first power plant. WorleyParsons will also assist JAEC in selecting the contractors to build the nuclear reactors. By November 2009 the options had been narrowed down to five bidders: the KEPCO APR-1400, French firm AREVA, the Canadian Enhanced Candu 6 and two Russian Rosatom reactors. The deadline for deciding this final strategic partner is late 2012. In contrast to the UAE, which will standardise on one technology for its first four nuclear power plants, JAEC Chairman Khaled Toukan has stated that Jordan may turn to different technologies and contractors for the construction of its four proposed plants. Hence, unsuccessful bidders for the first power plant will retain the possibility to export their nuclear technology in subsequent projects. [6] Given Seoul’s recent success in securing the UAE deal, South Korea must be considered among the favourites. Moreover, Hyundai Heavy Industries recently selected WorleyParsons as its subcontractor for the Umm Shaif gas re-injection project in Abu Dhabi, in a deal that could be worth up to US$150 million for the Australian firm. This might give the KEPCO bid a further advantage.

In the meantime, Jordan is also looking to establish its first nuclear research reactor, and in early December 2009 JAEC announced that another South Korean consortium had won the contract to build it. This small-scale 5 MWe nuclear plant will be located at the Jordan University of Science and Technology (JUST) to facilitate research and training for indigenous nuclear engineering students and professionals. [7] The consortium of the Korea Atomic Energy Institute (KAERI) and Daewoo Engineering and Construction will build the reactor at the JUST facility in Irbid, 70 kilometres north of Amman. At present, there are around 240 research reactors in operation globally, and 50 new units are expected to be finished within the next decade-and-a-half. The JUST plant is due to be on line within the next five years, and is slated to also provide some commercial services to cover costs. Lee Jong-min, a KAERI researcher, has explained the Korean role. “About 97 percent of the whole design and construction process will be based on Korean technology, when calculated in cost. However, the fuel used in the reactor will be purchased from a foreign provider and a Jordanian construction company will be picked to build the reactor based on our blueprint.” [8] If this project is successful, it should further benefit Korean firms targeting the Middle East’s burgeoning nuclear energy market.

Like the UAE, Jordan is a very dry country which suffers from a ‘water deficit’ of about 1.4 million m3 per day but, unlike the UAE, has virtually no oil or gas resources to power large-scale seawater desalination. As such, the country has to import around 95% of its energy requirements at a cost of around one-fifth of its gross domestic product. Moreover, water scarcity will become an even greater problem in the near future due to population growth, measured at 2.5% per annum in the 2004 census, and climate change, which potentially makes precipitation more unpredictable in the region. Therefore, it is envisaged that the nuclear power plants will generate up to 750 MWe of energy for desalination and water pumping. Compounding water shortages is spiralling demand for electricity, increasing 5.4% annually, also spurred by demographics and an average economic growth rate of 7% per annum since 1999. At present, the country has a total generating capacity of around 2400 MWe but anticipates demand rising to 3600 MWe by 2015 and 4800 MWe by 2030, placing Jordan on the precipice of an energy crisis.

It is envisaged that Jordan’s nuclear project will work in tandem with the Red Sea-Dead Sea Water Conveyance Concept which aims to restore the Dead Sea, whose depth has been falling one metre a year mostly due to the overuse of water from the Jordan River for agricultural and industrial purposes. A feasibility study has been assessing the scheme’s plan to construct a canal from the Red Sea to pump sea water to the Dead Sea. Regional cooperation on water has been hampered by the long-running Arab-Israeli conflict, and the success of the Red-Dead scheme depends on cooperation between Jordan, Palestine and Israel. The project is also crucial to Jordan’s nuclear power programme and will, if realised, complement it by generating hydroelectric power for use in desalination. Raed Abu Saud, Jordan’s Minister of Water & Irrigation, envisages that, “Around 40% of the desalination plants that will be established in Jordan will use their energy from the nuclear plants, which will be our main consumers. This will encourage us to carry out the first phase of the Red-Dead project faster.” [9]

The first reactor will be located in Aqaba Governorate along the Red Sea coast, and should produce 750 – 1,100 MWe of electricity initially using seawater for cooling. Aqaba was chosen because of its proximity to the Red Sea, pre-existing infrastructure at the Port of Aqaba and the electrical grid. JAEC has plans to establish up to six reactors at the site. It is hoped that when the Red-Dead project is operational, likely after 2025, the three remaining power stations will be established using desalinated water from the Red-Dead project for cooling. The JAEC and the Ministry of Water and Irrigation envisage that the nuclear power plant will provide 726 MWe of electricity for the Red-Dead project’s water pumping and desalination procedures, with the reactors eventually receiving 400 million m³ per annum of desalinated water from the Red-Dead scheme for cooling. JAEC Chairman Khaled Toukan explained that, “With the two programmes, one is really supporting the other, and that is how we are going to move forward”. [10] Officials have even voiced the hope that nuclear power could provide as much as 60% of the Kingdom’s energy by 2035, thus reducing Jordan’s heavy dependence on fossil fuel imports. [11]

The genesis of Jordan’s nuclear initiatives can be traced back to 2007 when the Kingdom’s energy minister announced that significant uranium deposits had been discovered, estimated at two per cent of the world total. The most recent data states that Jordan has low-cost uranium resources of around 140,000 tonnes, with an additional 59,000 tonnes locked in four separate phosphate deposits. These discoveries have prompted a dramatic reversal of energy strategy, which King Abdullah II first alluded to in an interview with Israeli newspaper Ha’aretz on January 19, 2007. Since then Amman has moved faster than most other Arab countries to sign bilateral cooperation deals with established nuclear energy states, and to ink infrastructure development contracts with international nuclear consultants.

With many countries in the Arab world looking into nuclear energy schemes, Jordan could reap a commercial windfall if its uranium reserves are indeed large enough to make mining financially viable. Uranium would thus enable the country to reduce costly oil and gas imports to meet its energy needs and it would offer the Kingdom a potentially lucrative foreign revenue source. Naturally, its discovery has led to considerable international interest from major mining firms eager to secure a stake. The Kingdom has already signed uranium mining agreements with major players such as British-Australian resource giant Rio Tinto, Sino Uranium, a wholly owned subsidiary company of China National Nuclear Corporation, and the Jordanian-French Uranium Mining Company, a joint venture between the French energy conglomerate AREVA and the Jordan Energy Resources. Although no uranium deals with Jordan have been mooted as yet, Seoul is known to be casting around for supplies through investment in overseas extraction projects. At present South Korea’s self-sufficiency in uranium-based nuclear fuel is only enough to meet 6.7% of demand, but the government has set a goal of 25% by 2016 and 50% by 2030.

Other nuclear markets

The UAE deal has given rise to an outpouring of confidence in South Korea and ambitious government targets after years of trying to kick start nuclear exports. Seoul is hoping that the deal will showcase its nuclear power industry throughout the world, especially in developing markets where KEPCO’s units should be cost-attractive. This would be crucial to diversifying South Korea’s economy, particularly in heavy industry, which seeks to move away from declining sectors. In the short-term, Kim Young-hak, Vice Minister of Knowledge Economy, has said that South Korea is aiming to sign deals to build a further six reactors overseas by 2012, in addition to the four UAE reactors. In the longer-term, the Ministry has set a goal of exporting 80 nuclear reactors by 2030. It estimates that these would be worth around US$400 billion, making South Korea the third largest nuclear exporter with a 20% share of the global market. The Ministry sees nuclear power as integral to its approach as Korean firms offer increasingly customised export strategies to suit individual countries.

Consequently, KEPCO is targeting new markets in India, Indonesia, Vietnam, Thailand, Malaysia, South Africa, Turkey, and elsewhere in the Middle East to meet this goal. In doing so, it will face strong competition from the USA, France and Russia, however. Indeed, a KEPCO director has admitted that at present there are no other specific export deals on the table. “There are not many deals open to international bidding. But the UAE contract will help us win more deals as we now have a track record and some international recognition. Nuclear deals are often big national projects worth billions of dollars. So, strong national power and effective diplomacy are needed.” [12] KOPEC is also aiming to expand its reactor business and has targeted the European market in particular.

To consolidate their reactor exports, South Korean firms also have ambitions to provide services for the operation, maintenance and repair of reactors, in particular to overhaul and extend the shelf life of heavy water reactors. This market is worth an estimated US$78 billion per annum worldwide, and in order to compete Vice Minister Kim has stated that South Korea will train 2800 new nuclear experts by 2011. [13]

The most recent nuclear energy cooperation deal signed was with Turkey on March 15, 2010. KEPCO and the Turkish state power company Elektrik Uretim AS inked a joint feasibility study into deploying the APR-1400 in Sinop, a city near the Black Sea. If this collaboration bears fruit, a full nuclear cooperation agreement between Ankara and Seoul will be signed to facilitate reactor development. Whilst no formal bidding process has been mentioned as yet, KEPCO seems to be in a strong position and a decision might even be forthcoming by the end of 2010. However, Turkish Energy Minister Taner Yildiz has stated that Ankara is still open to alternative proposals from other foreign firms if any offer more attractive terms for the proposed Sinop plant. Moreover, whilst KEPCO estimates the scheme’s preliminary stages will take up to two years to complete, the Turkish authorities are keen to shorten this timeframe. This is because Turkey is looking to establish three nuclear power plants, and previously signed a similar deal with Russia’s Rosatom for a nuclear power plant at Akkuyu on the Mediterranean coast. The Turkish government is aiming to have nuclear reactors operating in two regions by 2023, and thus wants the Akkuyu and Sinop projects to carry on simultaneously. Ankara has stressed that the South Koreans will have to take onboard a local partner if any reactor project emerges. [14]

KEPCO and its subsidiary KHNP (Korea Hydro and Nuclear Power, a KEPCO subsidiary) have in place a similar agreement with the Indonesian state electricity firm PT Perusahaan Listrik Negara (PLN) to undertake a feasibility study for the archipelago’s first nuclear power plant. Moreover, in July 2007 KEPCO and KHNP also signed a memorandum of understanding with private sector energy firm PT Medco Energi Internasional to conduct another feasibility study into building two power plants for around US$3 billion. Rather than the APR-1400, it is thought that any scheme with Indonesia would more likely involve the older OPR-1000 design. KAERI has also designed an economical dual-use nuclear power plant with a daily production capacity of 40,000 m³ desalinated water and 90 MWe of electricity. The first of these was envisaged for Madura Island, close to Indonesia’s second largest city of Surabaya. It was originally forecast that this plant would be operational by 2015 but this now appears doubtful.

The Indonesian central government previously approved in principle the construction of four 1000 MWe units on the Muria peninsula on the north coast of Central Java. Whilst a commissioning date was provisionally set for 2016, the central government National Power Master Plan (RUKN) for 2008-2025 notably makes no mention of a nuclear power plant, despite the 2007 RUKN doing so. This climb down by President Susilo Bambang Yudhoyono is related to opposition since September 2007 by the local branch of Nahdlatul Ulama, Indonesia’s largest Islamic organisation, to the Muria peninsula nuclear scheme. This was followed by a large protest in Central Java against the proposed power plant in April 2009 when the President was on the campaign trail seeking re-election. Indeed, during the 2009 election campaign, no candidate spoke in favour of Jakarta’s nuclear plans. [15] Elsewhere in the region, Malaysia, Thailand and Vietnam have each informed the IAEA of their interest in harnessing nuclear power, and Korean firms will be among the favourites to construct and operate any such plants that materialise in the Association of Southeast Asian Nations (ASEAN). In February 2009, the Deputy Secretary General of ASEAN stated that most of its member countries were open to the idea of developing nuclear energy in future.

Whilst KEPCO’s plans in Indonesia are in jeopardy, in August 2009 it signed an agreement in Mumbai to conduct a joint study with Nuclear Power Company of India (NPCIL) to assess the ‘licensability and constructability’ of APR-1400 reactors in India. Since the de facto nuclear trade embargo against India was abandoned in 2008 there have been a string of suitors looking to sell nuclear reactors to such a potentially huge market. Seoul is now competing with Russia, France and the US to export power plants to India. Other memoranda exchanged at the Mumbai meeting between NPCIL and KEPCO covered a wide range of nuclear services and India is reportedly interested in establishing up to 50 nuclear power plants. However, no commercial deals can be sealed until both governments sign a bilateral nuclear cooperation agreement.

Potentially the most lucrative market in the Asia-Pacific for South Korean nuclear contractors is the People’s Republic of China (PRC), which is looking to construct more than 100 nuclear power plants in the coming decades. Nuclear energy is especially attractive for China given that most of its industry is located in fast-growth central and southern coastal areas very far from its main coal reserves concentrated in the north and northwest. Transporting coal causes huge logistical problems, and consumes almost half of China’s rail capacity, whereas nuclear power plants can usually be constructed relatively near to high demand areas. After securing the UAE deal KEPCO stated it was now focused on winning new reactor deals in Turkey, Jordan and China. Back in July 2004 KEPCO announced it was planning to establish four nuclear power plants in China, but progress since then has been scant. KEPCO has, however, since established a stronger reputation in China as the largest foreign wind power generator in the country. Interestingly, Seoul’s Ministry of Knowledge Economy has recently gone on record as saying that it is now considering tying up with other global players to penetrate major markets such as China and the US. In all likelihood this would mean Westinghouse and its parent company Toshiba, given their long-standing business ties. So far, KHNP has only secured contracts to sell nuclear components and support facilities to both China and the US. However, with China having ambitious plans for at least a 600% increase in nuclear energy capacity by 2020, South Korean firms will be keen to join the French, Russia, Canadian and American reactor manufacturers already active in China in commissioning some very advanced reactor designs.

Despite a wealth of new projects in the pipeline, KEPCO’s president and CEO, Kim Ssang-su, has hinted at the difficulties of opening up new nuclear markets. “Countries like Turkey and India have preconditions like the extent of technology transfer, mandatory use of local parts and components, and financing issues that need to be resolved.” Similar conditions prevail in China, too. Kim also revealed that Seoul has to engage both New Delhi and Beijing in substantial bilateral negotiations before any commercial breakthroughs can be made. Moreover, many prospective customers require outside financing to pay for their nuclear reactors, and some countries have been offering their mineral resources in partial exchange for KEPCO reactors. [16]

Non-nuclear markets

“Our relationship with South Korea, which has seen sustained growth in recent years, has ushered in a new age of strategic partnership which will serve the interest of the two countries.”

Sheikh Khalifa, President of the UAE and Ruler of Abu Dhabi, upon signing the nuclear contract with the South Korean President Lee Myung-bak. [16]

Nuclear cooperation with the UAE is already having wide commercial benefits for South Korean enterprises. Indeed, South Korean statistics indicate the total value of contracts secured by state companies such as KEPCO in the UAE during 2009 alone surpassed US$32 billion. Given that the total value of all such contracts won in the UAE is just over US$35 billion, it is obvious that the UAE’s rulers have recently began entrusting South Korean firms with their country’s transformation. Indeed, as stated by Kim Ji-ho, Samsung Engineering Abu Dhabi’s business development manager, “Two to three years ago there were no big contracts here with Korean companies”. [17] It seems likely that further deals are in the offing, in various sectors such as chemicals, renewable resources, nuclear energy, petrochemicals, defence and property.

Many of the other deals announced in 2009 concern upgrades to Abu Dhabi’s oil and gas infrastructure. For instance, in November South Korean firms secured the four main contracts with Abu Dhabi National Oil Company (ADNOC), worth a total of US $9.63 billion, for the US$10 billion expansion of the Emirate’s largest oil refinery at Ruwais. The following month, Hyundai Heavy Industries inked a US$1 billion scheme with the Abu Dhabi Gas Liquefaction Company (ADGAS) for the construction of a gas processing plant on Das Island close to Abu Dhabi. The 49-month project to process gas from Umm Shaif, an offshore field, is a significant undertaking involving multiple sites and large tracts of land reclamation. This deal followed the first major petrochemical contract award to a South Korean firm in 2006 when Hyundai was chosen to develop gas re-injection capabilities to increase production from Abu Dhabi’s Umm Shaif offshore oilfield. Since then, South Korean contractors have forged a strong reputation in the UAE which has culminated in profitable nuclear reactor development.

|

Source: Tamsin Carlisle, ‘South Korean companies strike it rich in UAE’, The National (Abu Dhabi), March 2, 2010 |

South Korean construction companies have also been very active in major property developments in both Abu Dhabi and Dubai. Upon winning the main contract to erect Dubai’s Burj Khalifa tower, the world’s tallest building, Samsung became the first South Korean enterprise to win such a large deal in the UAE. Numerous Korean firms are now bidding for contracts in lucrative property developments such as ADNOC’s new head office, the Louvre Abu Dhabi, Zayed National Museum, and the Arzanah Medical Complex.

Bilateral trade has been increasing too. The UAE’s imports from South Korea reached US$2.81 billion in late 2007, up from US$1.77 billion in 2005. Both sides see the contract as strengthening a relationship in which an increasing number of small and medium scale Korean enterprises are investing in the UAE. By the end of 2009, some 43 South Korean firms were operating in Abu Dhabi, and a further nine have registered in the Emirate since January 2010. Despite increasingly close commercial ties, foreign direct investment from South Korea in the UAE remains comparatively small. The Emirates are especially keen to boost Korean investment in order to help diversify their economy and enhance job opportunities for a burgeoning population. In particular, South Korean companies are being targeted by the UAE to invest in the IT, construction, automobile, and energy sectors, and to establish production and assembly units for electronics and automobiles. This campaign features Abu Dhabi highlighting its strategic location close to important markets in the Middle East and Europe, whilst offering competitive costs of production and transport.

For its part, Seoul sees a bilateral relationship founded on a secure and stable supply of oil and gas. Abu Dhabi is presently South Korea’s second-largest supplier of both commodities, whilst the UAE is South Korea’s second largest export market in the Middle East. During his visit to sign the bilateral nuclear cooperation agreement in June 2009, Prime Minister Han Seung-soo said he hoped to see bilateral business links deepen beyond energy and construction with greater investment in South Korean industry from Abu Dhabi. “Frankly, we would like to see more of the funds from Abu Dhabi come to Korea to invest. If we find really good partners in the private sector, even in the government sector, then we can make a much greater improvement in our relationship.” [18]

Nevertheless, for the medium-term at least, oil and gas will continue to form the bedrock of the relationship. In an era of increasing resource nationalism in which host governments seek greater control of the natural resources in their territories, foreign firms have been manoeuvring to retain exploration rights in the UAE. Even in the investment-friendly Emirates, the renewal of existing oil and gas concessions has been a concern. Seoul will be hoping its increasing participation in the development of the UAE’s industrial infrastructure will further cement the foundation of the bilateral relationship.

Conclusion

The UAE power plant deal is the biggest single contract that South Korean firms have ever secured overseas. Seoul claims that the deal makes South Korea the world’s sixth largest exporter of nuclear reactors by contract value, and it hopes to launch itself into the top three in the next 20 years with new demand from emerging markets where its price-competitive units are expected to be particularly attractive. It will face strong competition from the USA, France and Russia. Nevertheless, in a very competitive bidding process for the UAE’s nuclear power plants, KEPCO was able to outshine the French and US-Japanese consortia both financially and technically. Jordan is also looking to embrace nuclear energy, and a KEPCO consortium is one of five bidders being considered to construct and operate its first nuclear power plant. Given Seoul’s recent success in negotiating the UAE deal, and that another South Korean consortium has already signed a contract to build Jordan’s first nuclear research reactor, the KEPCO bid must be considered among the favourites.

Indeed, with more than half of the world’s inventory of 436 nuclear reactors scheduled for retirement by 2030, South Korean companies will likely be competing for a bounty of new contracts in the next decade, especially as China and India are keen to establish around 150 new nuclear power plants between them. In fact, KEPCO has been trying to enter the Chinese nuclear reactor market without success since at least 2004, and now recognises that a different approach is necessary. This will likely involve Seoul massaging its diplomatic relations with Beijing whilst KEPCO collaborates with more established nuclear reactor exporters such as Westinghouse which already has a presence in the Chinese market. This approach seemingly reflects Seoul’s realisation that the key to success in the reactor export market is the ability to offer increasingly customised nuclear energy packages to suit individual countries. Developing economies are likewise keen to introduce nuclear power into their energy portfolios, especially since reactors do not emit greenhouse gases and help reduce dependence on fossil fuels. With demand for nuclear technology likely to grow rapidly, along with the role that high-level lobbying plays in such deals, governments in nuclear power exporters will have to be increasingly proactive in their nuclear diplomacy, as both Seoul and Paris were with regard to the UAE deal.

If South Korean nuclear contractors can replicate their domestic success overseas, South Korea stands to become one of the world’s pre-eminent reactor exporters. At present, its domestic build times are some of the fastest in the world but the country’s nuclear power industry is unproven on foreign soil. Even though its engineers have forged a convincing technical reputation, project management has been something of an Achilles heel, which KEPCO is attempting to address by bringing in foreign engineering consultancies. Nevertheless, South Korean firms have certainly made great strides in the last decade as previously oil and gas developers were reluctant to award them large contracts due to a perceived lack of experience. Since then South Korean firms have established a solid reputation overseas for successfully completing major projects on time and within budget.

Moreover, China’s relentless rise is likely focusing attention in the Middle East and beyond towards East Asia as a whole. Whether this will indeed become a genuine ‘Look East’ economic policy is not yet clear, however. Nonetheless, the UAE-South Korea nuclear deal does indicate that this is a distinct possibility and seems to be already providing new opportunities for South Korean firms. For instance, since the bidding was opened for the UAE’s nuclear plants South Korean firms have secured numerous other big-ticket contracts in the Emirates. Given that it is still heavily dependent on oil and gas supplies from Abu Dhabi, Seoul is therefore hoping that nuclear cooperation with the UAE, and potentially other GCC members, will also have a positive spill over effect into stable and secure oil supplies.

Those states and companies interested in exporting nuclear power probably hope that the UAE nuclear power programme will become the template for other interested governments in the Middle East and further afield. Naturally, the UAE has its own interests in developing a civilian nuclear programme. Nuclear power will increase the sustainability of its oil and gas reserves, simultaneously allowing more of these resources to be exported, thus boosting earnings. The GCC relies exclusively on fossil fuels for electricity generation, and water desalination also consumes large qualities of oil and gas. Rising living standards, population and infrastructure requires ever greater electricity and desalination capacity which many Arab states want nuclear power to meet, whilst maximising economic growth by exporting their natural resources.

David Adam Stott is an associate professor at the University of Kitakyushu, Japan and an Asia-Pacific Journal associate. His work centers on the political economy of conflict in Southeast Asia, Japan’s relations with the region, and natural resource issues in the Asia-Pacific. From April 2010 he is on research leave at the University of Adelaide. He wrote this article for The Asia-Pacific Journal.

Recommended citation: David Adam Stott, “South Korea’s Global Nuclear Ambitions,” The Asia-Pacific Journal, 12-1-10, March 22, 2010.

See the following articles on related themes:

David Adam Stott, Japan and the United Arab Emirates – A Nuclear Family?

David Adam Stott, China, Japan and Indonesia’s LNG Ploys

Ruediger Frank, Mark Selden and Oh Young-jin, The Coming Crisis in Finance and Energy: Korea as a solution for East Asia?

Geoffrey Gunn, Southeast Asia’s Looming Nuclear Power Industry

Notes

[1] Christian Oliver, ‘S Korea eyes wider nuclear exports’, Financial Times, January 22, 2010.

[2] International Atomic Energy Agency (IAEA), ‘Global Uranium Resources to Meet Projected Demand’, June 2, 2006.

[3] World Nuclear Association, ‘Nuclear Power in the United Arab Emirates’, June 2009.

[4] Global Research figures, part of Kuwait’s Global Investment House. Link.

[5] Nevertheless, the UAE repeatedly asked the other two consortia to reduce their prices to make them more competitive with the South Korean bid. This seems to suggest that the UAE was trying to favour the other two bidders, not wholly surprising given the close ties the UAE has had with both France and the United States.

[6] Taylor Luck, ‘Nuclear power could provide 60% of Kingdom’s energy needs by 2035’, Jordan Times, July 9, 2009.

[7] Kim Tong-hyung, ‘Korea to Build Nuclear Research Reactor in Jordan’, Korea Times, December 4, 2009.

[8] Ibid.

[9] Taylor Luck, ‘Nuclear energy to supply Jordan desalination plants’, Jordan Times, May 22, 2009

[10] Taylor Luck, ‘Nuclear power could provide 60% of Kingdom’s energy needs by 2035’, Jordan Times, July 9, 2009.

[11] Ibid.

[12] Christian Oliver, ‘S Korea eyes wider nuclear exports’, Financial Times, January 22, 2010.

[13] World Nuclear News, ‘South Korea seeks to boost reactor exports’, January 13, 2010.

[14] Richard Tanter, Arabella Imhoff and David Von Hippel, ‘Nuclear Power, Risk Management and Democratic Accountability in Indonesia’, Austral Policy Forum 09-22A, December 7, 2009.

[15] Tamsin Carlisle, ‘South Korean companies strike it rich in UAE’, The National (Abu Dhabi), March 2, 2010.

[16] Ibid.

[17] Chris Stanton, ‘UAE to sign nuclear pact with S Korea’, The National (Abu Dhabi) June 21, 2009.