Japan’s Economy in 2012: Multiple Challenges

Vaclav Smil

“Adding insult to injury” sounds like a lawyerly phrase compared to its painfully evocative Japanese equivalent 泣面に蜂 nakitsura ni hachi — literally “a bee to a crying face”. But even that stinging proverb fails to convey what Japan has been through during the recent past. In March 2011 its economy, slowly recovering from the worst global post-World War II downturn, was hit by a powerful earthquake followed by a massive tsunami. That twin disaster disrupted many supply chains of Japan’s important manufacturing sector and caused a catastrophic failure of the Fukushima nuclear power plant; the ensuing fears led to the eventual shut-down of all of the country’s nuclear generating stations, limited electricity supply, increased imports of fossil energies and the first annual foreign trade deficit in a generation.

But even without these setbacks the country’s record during the past two decades would stand in sharp contrast to its 35 year-long rise from post-WW II destruction (pre-war GDP was equalled only in 1954) to the world’s second largest economy whose accomplishments by the 1980s were widely seen as a foundation for further advances toward possible global leadership in the 21st century. Japan’s economic face has not been smiling for more than two decades, since the early months of 1990 when the bursting of the real estate bubble and the falling stock market exposed the fragility of those seemingly solid pre-1990 achievements and ushered in decades of stagnation and uncertainty.

The first consequences of the great economic readjustment that began with the fall of housing and stock market values more than two decades ago were excesses of corporate equipment, staff and debt, all resulting from large losses of market capitalization. Then –- after a short period of renewed, albeit slower, growth following eight stimulus packages –- the double dip (GDP declined in 1997 and 1998) led to collapse of several major banks and brokerages and the contraction in aggregate demand resulting in chronic deflation (Saito 2012). Fiscal and monetary measures could not provide a rapid cure for massive balance-sheet recession, and long-term economic stagnation has been complicated by structural problems, primarily by aging, and soon also shrinking, population, growing income disparities and disappearing local economies.

Origins, extent and consequences of these challenges have been described in numerous books, reports and papers that cover every aspect of this socio-politico-economic malaise ranging from ageing, sordid party politics and dysfunctional governments to speculation, deflation, stagnation and rising inequality. A good sample of this literature might be seen by consulting (limiting the selection to English-language books) Wood (1992), Alexander (2002 and 2008), Nakamura (2004), Takatoshi and Mishkin (2004), Hamada and Kato (2007), Sato and Imai (2011) and Hamada, Kashyap and Weinstein (2011). There seems to be little disagreement among the economists (Japanese or foreign) about the gravity and persistence of these challenges, and a closer look at some basic indicators shows the extent of the post-1989 retreat and readjustment.

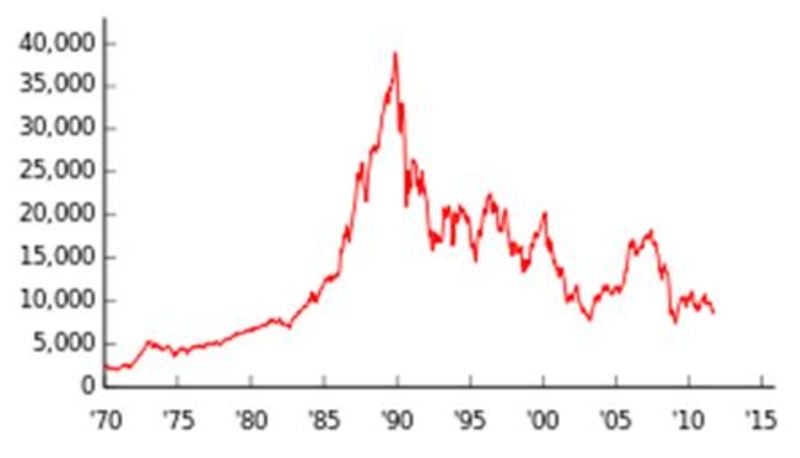

In December 1989 the Nikkei index stood at 39,900. A year later it was at 20,800 (48% down) but there was widespread belief that it could, and would, come back. But by 2000 it was at 13,800 and the talk of a lost decade became a cliché. Another decade later the Nikkei ended at 10,000 and by May 2012 it slipped below 9,000, nearly 80% below its peak value: that is as if the Dow Jones index, with its peak at 14,164 in October 2007, would now be bumping just above 3,000 instead of dancing around 13,000.

Of course, no stock market is a satisfactory proxy for the state of a country’s economy and Japan’s GDP. Although heavily affected by speculative trends that were the undoing of the Nikkei and registering minimal gains and even absolute declines in some years as in 1998 and 1999 and, again, during the global economic downturn in 2008 and 2009 overall the economy registered growth over the decade.

Expressed in constant monies, GDP was 17% higher in 2000 than it was in 1990, and in 2010 it was 7.3% above the 2000 level (Econstats 2012). That is a sharp deceleration compared to a 50% gain during the 1980s and 56% gain during the 1970s, but no economy of that size could have continued to grow at rapid pre-1990 rates. Given the country’s very low population growth (from 123.6 million in 1990 to 128 million in 2010, a gain of just 3.6% in two decades, the average per capita GDP in 2010 was 21% higher than in 1990. In comparison, the average US per capita GDP was 31% higher in 2010 than it was in 1990 despite the fact that during the intervening two decades the country’s population grew by nearly 25%. The French gain was almost identical to the Japanese increase (per capita GDP about 22% higher in constant monies, but the country’s population was more than 11% higher in 2010 than in 1990) while Germany, despite the high cost of unification, managed a per capita rise almost as high as in the US (29%), while its population grew by just 3% in 20 years.

And Japan’s share of the global economic product also declined faster than that in Germany or the US: between 1991 and 2010 it fell by 37% (from 9.2% to 5.8%), compared to 31% in Germany and only 11.5% in the US (from 21.8 to 19.3%, with all values calculated adjusted for purchasing power parity). Post-1990 years have also changed Japan’s often extolled low income inequality: during the late 1980s the average income of the top 10% was seven times that of the poorest 10%; by 2010 that gap was more than 10-fold, or roughly two-thirds higher than in Sweden, Europe’s leading paragon of income equality (OECD 2011; Sato and Imai 2011).

As a result, Japan is no longer the country with the least inequality among the major affluent economies: the latest international comparison (OECD 2012a) shows Japan’s Gini coefficient (0.329) still lower than in the UK (0.342) and the US (0.378) but higher than in Canada (0.324), Germany (0.295) and France (0.293). By the mid-2000s Japan’s poverty rate (share of the people with incomes below poverty line) reached 15% and among all OECD countries only the US, Turkey and Mexico were slightly higher (OECD 2010). Moreover, Japan’s poverty gap (percentage by which the mean income of the poor falls below the poverty line) was also very high: at 35% it was similar to the US and Mexican rate while Canada and Sweden had gaps of only about 25%.

Even more remarkably, Japan is the only country in this group where absolute poverty increased and, moreover, only South Korea’s poor have lower income among the OECD economies than do the poor in Japan (Katz 2012). And it gets even worse when looking at the elderly: for people above 65 years of age Gini coefficient is close to 0.4, and for those above 75 it is above 0.4 (Horie, Oshima and Tsukagoshi 2008). By 2010 30% of all retirees and nearly half of all retirees living alone (mostly widows) were living below the poverty line –- while the news about the disappearance of billions of dollars from pension funds, about underfinancing of those funds and about their mismanagement indicate more troubles ahead (Fukase 2012).

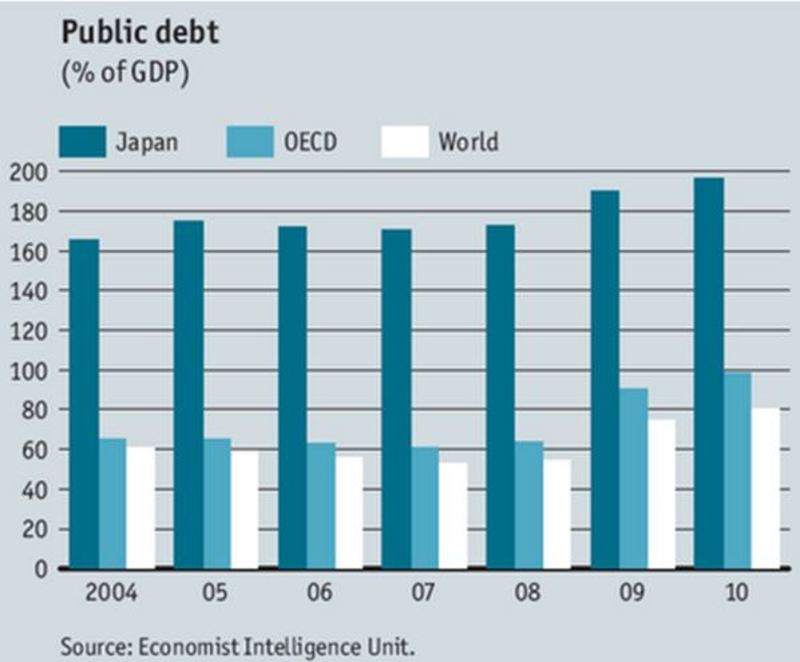

The recent global economic recessions has exposed unsustainable reliance on higher government debt in all major affluent economies, but Japan is in a category of its own.

|

By 2011 the country’s general government debt rose above 200% of annual GDP, compared to 130% in Greece and Italy. In terms of net financial liabilities the 2012 government debt was about 52% of nominal GDP in Germany, 66% in France, 80% in the US –- and 135% in Japan while Greece’s net liabilities were 145% of GDP and Italy’s 100% (OECD 2012b). As a result, the rating of Japan’s debt was repeatedly downgraded over the last decade: Moody was first to lower it from the top Aaa to Aa1 in November 1998, S&P followed in February 2001; by the end of 2011 Moody’s rating was down to Aa3, S&P’s long-term rating was down to AA-, and in February 2012 the agency announced that it will consider another downgrade if Japan’s unsustainable spending trend is not reversed.

Viewed from another perspective, however, Japan in that 93 of the government debt has been financed internally, most of it by deposits held by the country’s banks. In contrast, shares of general government debt held by non-residents have surpassed 50% for the US — with China now ranking first, followed by Japan and the UK (US Treasury 2012). Similarly, more than 40% of Spain’s and Italy’s general government debt are held by foreigners and the shares are nearly 50% in Germany and almost 60% in France (Global Finance 2012). Domestic debt ownership has obvious advantages. Above all it allows the country’s government finance to be isolated from the outside world and to keep bond yields very low. But there is also an obvious downside as the aging population with rising share of retired people cannot be expected to keep financing this burden for decades to come (Pettis 2012).

Japan’s average household saving rate has fallen sharply over four decades: using Cabinet Office data (expressed as shares of disposable household income), it fell from the peak of 18.6% in 1976 to less than 10% by 1994, less than 5% by 2001 and just 1.1% in 2006 (Campbell and Watanabe 2009). A different approach used by OECD (2012c) has the rate falling from nearly 15% in the early 1990s to 10% by 1999 and then to just 2.2% by 2008 before rebounding to about 6% by 2010 compared to more than 11% in Germany, nearly 11% in Sweden and more than 5% in the USA. Clearly, Japan has lost its exceptionally high standing in this category and in the future the government will not be able to continue as it has for decades to recycle consumer savings to finance its rising deficits.

Reversing these unsustainable trends should include both considerable spending cuts and substantial tax increases, but there is no agreement about how to proceed even within the ruling party. Indeed, a major cause of the continuing inability to strengthen the country’s finances has been its increasingly dysfunctional governance. Once the decades-long control exercised by the Liberal Democratic Party began to unravel, and as no party emerged strong enough to offer effective solutions, Japanese governments began to resemble those of post-WW II Italy: since 2005 the country has had seven prime ministers (just try how many of them even a well-informed international reader can recall) whose rapidly vanishing tenures remain notable for a crippling combination of denial, procrastination, evasion and wishful thinking.

Reduced rates of growth, rising indebtedness, higher income inequality and increasingly dysfunctional governance are hardly limited to Japan: their combination now amounts to a syndrome whose effects can be seen in virtually all other major high-income economies. National specifics differ but the US, Germany, France and the UK face very similar challenges. What makes the Japanese situation particularly worrisome is an unprecedented weakening of the country’s previously much admired manufacturing. Continuation of this trend would make it much harder to overcome those just outlined long-term negative trends.

There has been much discussion of America’s manufacturing retreat, offshoring of factory jobs, and the loss of entire industries –- but much less about the analogical shifts sapping Japan’s capacity to produce and to export, about relentless loss of market share to fiercely competitive South Korean companies and to state-subsidized Chinese manufacturers, about massive offshoring of production to other parts of Asia, (most Japanese cars are already made overseas; of all the Japanese electrical and electronic devices we own only one, an old Zojirushi rice cooker, is made in Japan, the others being made in China or Indonesia), about shortages of highly skilled labor in a country with virtually no population growth and with a rising number of young NEETs, people not in employment, education or training (Genda 2007).

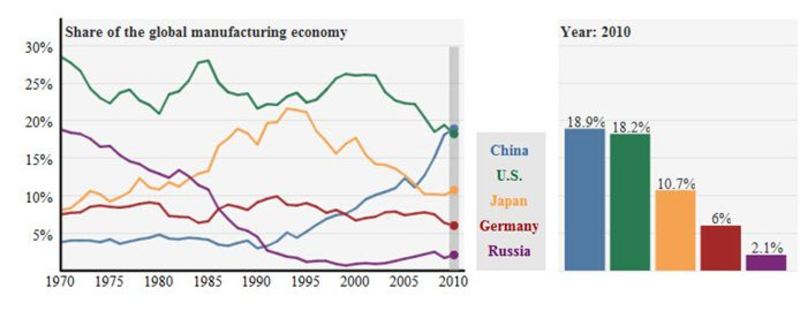

Perhaps most importantly, since 1990 Japan’s share of global value added by manufacturing has been sliding at a faster rate than that of the US. While the US share dropped from about 23% to 19% by 2010, Japan’s share slipped from nearly 18% to just 11% (World Bank 2012).

Along the way the former certainties of Japan’s labor market began to unravel: as Kambayashi and Kato (2011) showed, ten-year job retention rates for 1992-2002 were substantially lower for both sexes, for all ages above 19 and for educated employees and people without degrees. Moreover, many more workers had to be satisfied with part-time work without job security or benefits (Slater 2009).

During the past few years this weakening of Japan’s once formidable manufacturing base has affected even some of the country’s iconic companies. First came the retreat of Sony, the company whose name was synonymous with creating the modern world of small electronic gadgets (Nathan 1999). One might say it was the original Apple –- starting with its miniature transistor radio in 1955 to the planet-sweeping Walkman in 1979 and the PlayStation launched in 1994 –- whose sleek designs were envied but, for a long time, rarely successfully copied or surpassed. But in 2009 the company lost more than $2 billion, in 2010 more than $3 billion, and in the fiscal year ending March 31, 2012 more than $2.5 billion. Sony’s TV division has been a large money-loser for eighth straight yeara, and while the gaming addicts keep the PlayStation enterprise going, the cellphone addicts could not care less about Walkman while Ginza’s Apple store is full of eager customers. After cutting its global workforce by 16,000 people in 2008, Sony announced 10,000 more layoffs in April 2012.

|

Panasonic, another paragon of Japan’s former electronic prowess, is in even worse shape, with a net operating loss of nearly $10 billion in fiscal year 2011 and with announced layoffs of up to 40,000 workers. The latest record-beating claim for computer innovator NEC came in October 2007 when it revealed the fastest-ever supercomputer, SX-9, the first machine capable of more than 100 Gflops (100 billion floating operations per second). But in January 2012 NEC, with its market value down nearly 96% from its peak in 2000, announced that its loss for the fiscal 2011 will be well above one billion dollars (Reuters 2012a). Analogical declines in market value by April 2012 are almost 92% for Sony and about 79% for Panasonic.

Besides consumer electronics, automobiles have been the most visible mainstay of Japanese exports. Because quality has been their main selling feature, the 2010 public relations fiasco of mass vehicle recalls by Toyota, known as the relentless pioneer and practitioner of kaizen, constant product improvement and fierce quality control (Fujimoto 1999), has been particularly damaging. In their obsession to surpass GM as the world’s largest automaker, Toyota’s top managers let the quality of new cars slip and once the faults were revealed they failed to act resolutely to resolve the complaints and fears. After months of procrastination the company finally began to fix its problems –- but in 2011 GM, risen from bankruptcy, was once again the world’s largest automaker.

Even Honda has admitted losing its way. The company -– much smaller than Toyota but always an aggressive competitor in foreign markets –- has been praised for decades for its design, value, excellent engines and overall car durability. But in 2011 its new Civic was called a cheapened redesign and the company’s car lost market share both in the US and Canada. No wonder that even Asahi Yoshinori, one of the company’s creative directors, admitted that ‘’we have a lot of designers here, and when we ask ourselves, ‘Which Honda car would we want to buy?’ sometimes some of us draw a blank’’ (Reuters 2012b).

Nevertheless, given the breadth of Japan’s manufacturing there are still many strengths, particularly among companies whose names are hardly known internationally but whose high-quality products and components claim large shares of their respective global markets (Schaede 2008). These include Kyocera, primarily the maker of advanced ceramic components, but also diversified into connectors, cutting tools, computers, solar power and semiconductors (Kyocera 2012), and Fanuc, the world’s leading designer and manufacturer of industrial robots (Fanuc 2012). Unlike NEC or Sony these companies are thriving: in April 2012 Kyocera stock was only about 10% below its highs, and Fanuc stock reached a record level, nearly 85% higher than a decade ago. Another positive factor is the increasing value of Japan’s corporate holdings abroad, from Ireland to Thailand and from Alabama to Liaoning. The critical question is whether these continuing strengths, combined with much-needed reforms, will be enough to counterbalance the negative trends and to support a new economic equilibrium.

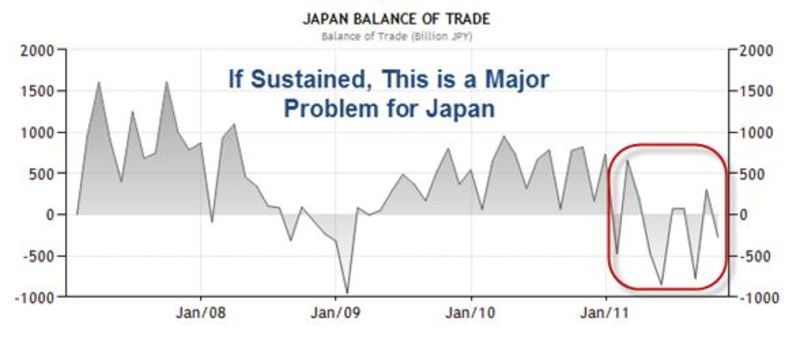

That is why the recent news concerning the country’s trade balance has been such a cause for concern: in January 2012 Japan posted its first annual trade deficit in three decades, $32.3 billion in 2011 compared to a surplus of 7.6 billion in 2010 (JETRO 2012).

|

This, of course, is a fundamental shift as few countries in history have been such prodigious exporting machines as post-1960 Japan. In 1964, a decade after the country’s GDP matched its pre-war record, Japan began to run substantial trade surpluses whose growth was barely affected by the collapse of fixed (Bretton Woods) exchange rates in 1971 and the yen’s revaluation (from ¥360/$ to ¥308/$). With Japan importing virtually all of its oil it was hardly a surprise that OPEC’s first (1973-74) round of oil price increases reversed the trend, but already in 1976 Japan’s efficient exporters erased those losses. Coincidentally, 1976 was also the year when Honda began making the Accord: five years later Car & Driver called it the best vehicle in its category, and the design made history as of one of the most consistent best-sellers in North America.

OPEC’s second (1979-1980) round of oil price increases dented the trade balance again in 1980 but the surplus was back the very next year, and although Japan’s trade surplus with the US declined after the 1985 Plaza Agreement brought yet another large yen revaluation (from ¥250 to ¥160 to the $) the country’s global trade surplus continued, after a short pause, to grow. In 2007 it reached about $83 billion and, despite the subsequent global economic downturn, it was still at $75 billion in 2010 (JETRO 2012). There were extenuating circumstances for the $32 billion deficit in 2011, the two most important ones being the damage done to many specialized plants located in the region destroyed and damaged by the March 2011 earthquake and tsunami (that reduced exports) and the need to buy additional costly energy abroad in the wake of closure of all but a few of the nuclear power plants that provided 30% of Japan’s power.

The latest available data show imports surpassing exports during every month for the first four months of 2012 and a total trade deficit of $25 billion by the end of April (JETRO 2012). Longer-term continuation of this trend would be particularly worrisome because over the past generation Japan’s current account surplus has not only remained constantly in the black, but it has grown in contrast to America’s widening current account deficit. That achievement had its roots in Japan’s status as a manufacturing superpower that was supplying substantial shares of advanced products imported by affluent economies of Europe and North America as well as by rapidly modernizing nations in Asia and Latin America. Even a gradual retreat would have major consequences, particularly when combined with rising cost of energy imports and continuing massive government deficits.

One thing is clear: Japan’s manufacturing is no longer on a seemingly unstoppable ascending trajectory, and in this respect the country has become much more like the US. Both countries have lost a great deal of industrial production (with China being the greatest beneficiary in both cases) but it is not easy in this new era of globalization to come up with a net assessment that includes the loss of domestic jobs, decline of regional economies and reduced taxation base on one side, and lower consumer prices, low inflation and higher (sometimes record) corporate profits resulting from the overseas manufacturing by Japanese and American multinational companies on the other.

Because many Japanese companies prefer to reduce working hours and wages rather than lay off regular employees, the country’s deteriorating job market is better measured by aggregate work hours than by unemployment rates: by 2012 the total number of employees was down by 3% compared to the year 2000 but the total work hours were down by 12% (Katz 2012). And while the capital and a few other large cities may be doing fine, Matanle et al. (2011) showed that the phenomenon of regional shrinkage is both widespread and multifaceted; a large variety of socio-economic variables mapped by Statistics Japan (2012) makes it possible to follow these regional declines on prefectural level.

That Japan remains –- in any global comparison and by using virtually any statistical measure –- a rich economy is a truism. But this brief survey of economic realities adds up to an equally undeniable conclusion: the country’s post-1989 performance has been a fraction of the rise anticipated during the late 1980s, and Japan now faces a concatenation of serious long-term social and economic challenges whose extent and intensity have been potentiated by the global recession. In some ways Japan still has a cumulative advantage (most notably the decades of current account surpluses), in others its challenges are very similar to those of other major affluent economies (loss of manufacturing, rising government indebtedness, dysfunctional governance), and in yet others it has performed even worse than the OECD mean (rising income inequality, regional economic decline and depopulation, and population aging).

Looking back at the last two decades Fingleton (2012) believes that ‘’in the fullness of time, it is likely that this era will be viewed as an outstanding success story.’’ He should have asked the Japanese: after all, a country’s economic performance is just the means toward a better life, and during the past decade a new discipline has been trying to quantify these critical intangible experiences and feelings. Results of recent global studies unfailingly show that Japanese are not satisfied with their lot. In 2006 the Satisfaction with Life Index put them in the 90th spot out of 178 countries, just behind Ghana and Papua New Guinea and far behind all Western economies (White 2007).

Happy Planet Index ranks them 75th out of 143 in 2009 (Abdallah et al. 2009); and the latest effort of this kind, OECD’s Better Life Index ranks Japan ranks 25th out of 34 OECD countries, on a par with South Korea and higher than Greece, Portugal, Turkey and Poland — but lower than all major Western economies (OECD 2012d).

Naturally, these rankings can, and should, be questioned and criticized, but, taken in their entirety, they reflect population-wide perception of economic performance and social well being that has not been an outstanding success story, that is no model of new, post-industrial development, and that is likely to lead to even greater socio-economic challenges unless its failings and shortcomings are managed with determination and principle guided by realistic expectations.

Vaclav Smil is Distinguished Professor, emeritus, University of Manitoba, Canada. His interdisciplinary research has roamed broadly over issues of environment, energy, food, population, economics, and policy studies. He is a Fellow of the Royal Society of Canada (Science Academy), the first non-American to receive the American Association for the Advancement of Science Award for Public Understanding of Science and Technology, and in 2010 he was listed by Foreign Policy among the top 100 global thinkers. His recent books include Japan’s Dietary Transition and Its Impacts (with Kazuhiko Kobayashi), Energy Myth and Realities: Bringing Science to the Energy Policy Debate, Global Catastrophes and Trends: The Next Fifty Years and Energy in Nature and Society: General Energetics of Complex Systems. His home page is here.

Recommended citation: Vaclav Smil, ‘Japan’s Economy in 2012: Multiple Challenges,’ The Asia-Pacific Journal, Vol 10, Issue 24, No 5, June 11, 2012.

References

Abdallah, S. et al. 2009. The Happy Planet Index 2.0. London: New Economics Foundation. 2009

Alexander, A. 2002. In the Shadow of the Miracle: The Japanese Economy Since the End of High-speed Growth. Lanham, MD: Lexington Books.

Alexander, A. 2008. The Arc of Japan’s Economic Development. London: Routledge.

Campbell, D.W. and W. Watanabe. 2009. Will the Future Japanese and US Personal Saving Rates be Relatively Equivalent? New York: The Leonard N. Stern School of Business, New York University.

Econstats. 2012. GDP, constant prices.

Fanuc. 2012. Fanuc’s history.

Fingleton, E. 2012. The myth of Japan’s failure. The New York Times January 6, 2012.

Fujimoto, T. 1999. The Evolution of a Manufacturing System at Toyota. New York: Oxford University Press.

Fukase, A. 2012. Tale of trouble at Japan pension funds. Wall Street Journal March 14, 2012.

Genda, Y. 2007. Jobless youths and the NEET problem in Japan.

Social Science Japan Journal 10: 23-40.

Global Finance. 2012. External Debt in Countries Around the World.

Hamada, K. and H. Kato, eds. 2007. Ageing and the Labor Market in Japan : Problems and Policies. Northampton, MA: Edward Elgar.

Hamada, K., Kashyap, A.K. and D.E. Weinstein, eds. 2011. Japan’s Bubble, Deflation, and Long-term Stagnation. Cambridge, MA: The MIT Press.

Horie, N., Oshima, Y. and Y. Tsukagoshi. 2008. Japan’s Widening Income Gap Among the Elderly: Necessary Measures for the Reconstruction of an Income Safety Net. Tokyo: Mizuho Research Institute.

JETRO (Japan External Trade Organization). 2012. Japanese Trade and Investment Statistics.

Katz, R. 2012. NBR’s Handwringing about aging.

Kyocera. 2012. Kyocera Global.

Matanle, P. et al. 2011. Japan’s Shrinking Regions in the 21st Century: Contemporary Responses to Depopulation and Socioeconomic Decline. Amherst, NY: Cambria Press.

Nakamura, M., ed. 2004. Changing Japanese Business, Economy, and Society : Globalization of Post-bubble Japan. New York: Palgrave Macmillan.

Nathan, J. 1999. Sony: The Private Life. Boston: Houghton Mifflin.

OECD (Organization for Economic Cooperation and Development). 2010. Poverty Rates and Gaps. Paris: OECD.

OECD. 2011. Divided We Stand: Why Inequality Keeps Rising. Paris: OECD.

OECD. 2012a. Income distribution – inequality.

OECD. 2012b. General government net financial liabilities.

OECD. 2012c. Household saving rates.

OECD. 2012d. Better Life Index: Life Satisfaction.

Pettis, M. 2012. Japan’s debt disaster and China’s (non)rebalancing: Stormy seas ahead? Japan Focus

Reuters. 2012a. Tokyo stock exchange charts.

Reuters, 2012b. Insight: After Civic bruising, Honda fights for its soul.

Saito, K. 2012. In Japan’s footsteps. In: OECD Yearbook 2012, Paris: OECD, pp. 24-25.

Sato, Y. and J. Imai, eds. 2011. Japan’s New Inequality: Intersection of Employment Reforms and Welfare Arrangements. Victoria, Australia: Trans Pacific Press.

Schaede, U. 2008. Choose and Focus: Japanese Business Strategies for the 21st Century. Ithaca, NY: Cornell University Press.

Slater, D.H. 2009. The Making of Japan’s New Working Class: “Freeters” and the Progression from Middle School to the Labor Market. Japan Focus

Takatoshi, I. and F.S. Mishikin. 2004. Two Decades of Japanese Monetary Policy and the Deflation Problem. Cambridge, MA: National Bureau of Economic Research.

US Treasury. 2012. Major foreign holders of Treasury securities.

White, A. 2007. A global projection of subjective well-being: A challenge to positive psychology? Psychtalk 56:17-20.

Wood, C. 1992. The Bubble Economy: Japan’s Extraordinary Speculative Boom of the ’80s and the Dramatic Bust of the ’90s. New York: Atlantic Monthly Press.

World Bank. 2012. Manufacturing, value added (current US$).