Sakuma Tomoko

Translated by Jean Inglis

While a handful of the wealthy routinely drink expensive, high function mineral water, ”boutique water”, as it is called, one out of five people in the world cannot count on getting any safe drinking water at all.

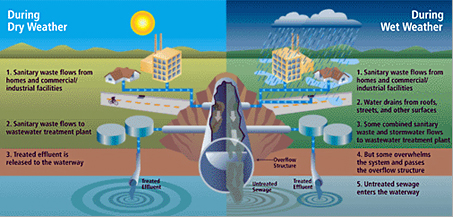

One in three of the world’s population lives in an environment lacking such basic sanitary facilities as toilets and sewers and where untreated waste is discharged into rivers, lakes and marshes. People who must use that water for drinking and cooking are at high risk of contracting diarrhea or diseases from parasites transmitted through the water.

To improve this situation, international development finance institutions like the World Bank and regional development banks like the Asian Development Bank, or development assistance organizations and development financial organizations in developed countries, have invested considerable funds in developing countries. But in exchange for assistance (investment) in infrastructure projects like water works, these institutions, particularly from the beginning of the 1990s, have required that all the costs incurred in providing water be collected from the users (“full cost recovery”) and that public water systems be privatized (referred to as “private partnership” or “private sector participation”).

With the exception of Germany, there is evidently no advanced nation that recovers the costs of its water system, a basic service indispensable for survival, solely from charges paid by users. In these countries a considerable amount of tax money normally goes into the water supply infrastructure. And yet in many developing nations, including the very poorest, even the most destitute people are required to bear the full cost of their tap water. In areas where water charges have risen sharply due to full cost recovery and privatization policies, even households connected to the water system are having their water cut off because they are no longer able to pay the charges. In South Africa, in the ten years since the water system was privatized, some ten million people have experienced having their water cut off. And as a result of people having to use contaminated river water because their water was cut off, there was a nationwide outbreak of cholera from 2000 to 2002 in which 300,000 people were infected, at least 300 of whom died. In Cochabamba in Bolivia, when a steep rise in water charges was accompanied by the outlawing of the use of well water, people took to the streets in large numbers, but the protests were put down with the loss of lives.

Although in many large cities in the developing world, global water businesses (mostly American or European, particularly French and German companies) which contracted to put in new water systems promised to make huge investments to expand the water system infrastructures to the slums surrounding the cities and to repair the existing infrastructure, they have flagrantly broken their promises and refused even to pay damages for breach of contract. In Manila the charges that residents have to pay to be linked up to the water system are so exorbitant that many households, unable to pay, have no recourse but to illegally connect.

Privatization that benefits the “water barons”

In most cases of the privatization of water systems that is spreading in developing countries, global water supply businesses, referred to as “water barons” have obtained contracts with extremely lucrative provisions. For example, the company involved in the privatization of Jakarta’s water system was given a fat 21% profit guarantee, and many other water system contracts have had provisions for dollar-based profit guarantees or compensation for foreign exchange loses. In the case of Manila, the contract stipulates that the company is to be paid an enormous amount in compensation at the time of withdrawal.

The U.S. firm Bechtel, on its withdrawal from Cochabamba, and the French firm Suez, on its withdrawal from Buenos Aires, sued in the International Center for Settlement of Investment Dispute (ICSID), a closed-door mediation court under the umbrella of the World Bank, for huge damages the companies claimed they suffered when they withdrew. Common to the operations of the two companies were the hardships which their steep rises in charges imposed on residents, the fact that their precipitous withdrawals created situations in which residents were unable to obtain adequate water service, and the fact that, not having invested enough of their own capital, the actual amounts they had invested did not come up to the figures they were demanding as compensation for damages.

Although one of the reasons proponents of privatization of water systems in developing regions have given is that “expansion of water system infrastructure and repair can be carried out in developing countries making good use of private capital”, in fact, a survey by PSIRU, the research arm of Public Services International, has shown that there are no grounds for that claim. PSIRU reports that in the fifteen years from 1990, water system expansion carried out with private sector capital covered a mere 600,000 households (or approximately 3 million people) in sub-Saharan Africa, South Asia, and East Asia and the Pacific, areas with the most intense concentrations of populations that need to be linked up with safe water supplies. And when you add to that the fact that, with privatization, at the very least more than 10 million people in developing countries have had their water cut off, albeit temporarily, the claim that private capital improves access for the poor to water systems is nothing but an illusion.

Only a mere 1% of the amount private companies promised to invest in the water sector was promised for areas like these. This reflects the fact that almost all private capital is invested in the more “attractive” wealthy markets of the affluent countries.

Water business prospering in the Middle East and Asia

Actually private capital started shifting in 1997 to developed and rising nations. Now the markets that global water companies are competing for are in places like North America, East Asia (particularly China), the Persian Gulf states and Eastern Europe. Countries in Europe slow to privatize like Germany and Italy are prime targets for these companies, as is Japan.

Behind the rapid water system privatization in developed countries with a history of providing basic services through the public sector is the adoption in these countries of financing regulations under which it is “bad” for municipalities to increase their debt to raise their own funds to cover the huge cost of upgrading their aging water system infrastructures. Also more and more central governments are cutting subsidies to local self-governing bodies or making the turning over of public utilities to the private sector a condition for receiving subsidies.

For private enterprise this is a good chance to penetrate the basic services market in developed countries where stable revenues from charges are assured. The upgrading of the water system infrastructure in the United States alone will cost at least $500 billion over the next twenty years.

But whether the capital is provided by the private sector or the public sector, in the end the one who pays it back is the taxpayer, the water user. And a private operator is not necessarily more efficient than a public sector one. Salaries being practically the only area where the former can cut costs, safety and quality are at risk. Considering the fact that even the profit that the private operator earns comes out of the taxpayer/water user’s pocket, and the fact that in most cases a private operator borrows at a higher interest rate than a public one, what is the point of privatization?

Incidentally, around the year 2000, nearly 80% of private water systems were monopolized by three companies: the French companies, Suez and Vivendi (presently Veolia), and Thames Water, bought up by the German firm RWE, and now under the umbrella of the Australian firm Macquarie. Today five water supply majors have cornered just under 50% of the market, while the number of new entrants is increasing.

One reason for this shift is that more municipal water systems depend on water treatment technologies using films (filters) such as technologies for recycling sewage water to use as tap water and technologies for desalinating seawater. The introduction of water treatment plants incorporating these technologies is taking place particularly in wealthy countries suffering water shortages like Saudi Arabia, the United Arab Emirates, Israel, Libya, as well as Australia and Singapore. China is a particularly big market. It already has several hundred sewage treatment plants contracted out to foreign capital, and it plans to invest $100 billion dollars over the next few years to introduce water treatment technologies.

Three US companies, General Electric, ITT, and Narco, lead in water treatment technology and account for 40% of the water treatment market. This is a brisk market in which a large number of small and medium-size companies, as well as other big firms like Siemans (Germany), Dow Chemical (USA), Suez and Veolia, are involved.

But whether it be water reuse or desalination, the problem is that substances dangerous to the human body may not all be removed when polluted fresh water and seawater are filtered. And cleaning the filters may result in pollution of the water environment in the area.

It is also necessary to be aware of the fact that nanotechnology of questionable safety and the use of nuclear power to run the plants are coming into use for water treatment. It is important to note too that, given the fact that management will be increasingly handed over to the private sector, introducing water purification systems using these water treatment technologies into public water supply systems is essentially privatization.

Big profits for water-related funds

Investment in water business is also increasing. There are cases like that of Great Britain’s Anglian Water (formerly a water management public corporation) in which the water company’s ownership rights themselves were transferred to Osprey Ventures, a British company that manages three pension funds, including Canadian and Australian. It is not unusual for the ownership rights of global private sector water companies to be frequently transferred.

On the other hand, there are many investment trusts that invest in several private sector water companies and a number of companies that supply water treatment technology and equipment, many of them with commodities that see the standard price increase several times in a few years and commodities that realize unparalleled high dividends.

In other words, the water business is raking it in. Water service for the wealthy takes priority, and state-of-the-art water treatment technology and equipment are sold off in wealthy countries. “Eco” catch words are featured in the brochures of many water-related funds, but profits spring from the fact that the poor population for whom it is harder and harder to get safe drinking water is growing, the public character of water supply services and water management is increasingly becoming a thing of the past, and pollution is making for deteriorating water quality.

Before falling into a situation where we completely turn over the right of deciding who gets water to investors and corporations, we must create a movement to take back control of the water that is so essential to our lives.

Sakuma Tomoko is a translator and globalization watcher.

Jean Inglis is the translator of Kaneko Fumiko, The Prison Memoirs of a Japanese Woman, and Suh Sung, Unbroken Spirits: Nineteen Years in South Korea’s Gulag.

This is an abbreviated version of an article that was published in ShÅ«kan KinyÅbi on July 4, 2008 and at Japan Focus on September 8, 2008.

For a North American perspective on the water crisis see Maude Barlow, “Where Has All the Water Gone,” American Prospect, May 27, 2008.