In the Eye of the Storm: Updating the Economics of Global Turbulence, an Introduction to Robert Brenner’s Update

R. Taggart Murphy

Introduction

Out in the academic cemetery to which avatars of market fundamentalism thought they had consigned their intellectual and political opponents, one can hear today the unmistakable scrape of coffin lids opening. And climbing out of their graves are the bodies of those who contend that the reductionist assumptions of neo-classical/ rational choice orthodoxy are not simply inadequate but flawed in the most fundamental sense.

The reason may seem obvious: the financial catastrophe of last year and the failure of so many established thinkers to see it coming. But there is more dogging the luminaries of mainstream finance and economics than the simple inability to have read the tea leaves properly – to their blindness, for example, in the face of the rise in U.S. housing prices to the point they no longer bore any relation to the earnings streams of much of the American population or to the fantastic assumptions about default rates built into the business models of too many Wall Street houses. To be sure, a few non-mainstream analysts did get these things right before the fact — Nouriel Roubini, for example, or Michael Lewis. But it was in the way the crisis took the entire policy establishment by surprise that we see signs of broader, systemic conceptual failure. Policy makers in Washington, London, Frankfurt and Basel were, after all, advised by intellectuals and analysts privy to the most supposedly up-to-date thinking about markets, about finance, about economic reality. That they could get things so very, very wrong points to deliberate, self-induced myopia over the complexity of and interrelationships among economic and political realities – a myopia that surely contributed to the worst economic crisis since the Great Depression.

So the world suddenly seems more receptive to those who contend that economic life is not all about interchangeably autonomous “actors” maximizing their utility, but that institutions matter, that culture matters, that history and place matter – and above all that power matters. Signs of this are everywhere. Frightened politicians have been reaching for the old Keynesian tool chest in their efforts to stave off economic meltdown. John Kenneth Galbraith with his notions of the “notoriously short memories of financial markets” and the overweening pricing power of large corporations is acquiring a new patina of respectability. Thorstein Veblen’s Theory of the Leisure Class and Anthony Trollope’s novels are being dusted off for offering better insight into the rapacious behavior of Wall Street than back issues of the Journal of Finance. And here and there in “respectable” publications, one even encounters the visage of Karl Marx: intellectual grandfather of the suspect discipline of sociology, proponent of dialectical materialism and the class struggle, and prophet of the demise of a capitalism hoisted on the petard of its own contradictions.

Veblen (left) and Marx

Thus for writers and analysts on the left, the recent economic events hold out the tantalizing promise of an end to the marginalization they have endured since the fall of the Berlin Wall. But for all their understandable schadenfreude at the sudden advent of an era in which it is scarcely possible to keep a straight face while uttering the words “efficient markets hypothesis” – not to mention “Washington Consensus” – does Marxist scholarship actually have anything to say that illuminates our present predicament? It is one thing to invoke Keynesian fears of liquidity traps at a time when it is obvious that waves of credit creation by the Federal Reserve and the Bank of Japan are barely moving the real economy of production and trade. Or to concede that regulators had become captives of those they were charged with regulating and that all the complex, formula-driven instruments that were supposed to diversify risk had done exactly the opposite. Or even to acknowledge that financial markets are more akin to herds of cattle driven alternately by greed and fear than the smoothly humming, risk-distribution machines of modern finance theory; that they can and regularly will overshoot with catastrophic consequences for the real economy – and that governments need proactive and deliberately intrusive oversight to head that off.

It is quite something else, however, to seek understanding from a 19th century thinker carrying all the intellectual baggage of his era: the grandiose pronouncements, the attraction to explain-it-all system building, the ponderous prose, the scientism and reflexive assumption that history was something that only unfolded in Europe. Particularly when that thinker had seen some of the world’s most murderous, despicable regimes established in his name.

And yet there is something there that may get at contemporary reality in a way that no subsequent thinker has wholly managed precisely because Marx was writing at a time when alternative means of organizing political and economic life were still imaginable – and imaginable in very concrete ways. Feudal arrangements and local, self-sufficient barter economies were still, after all, living memories in the Europe in which Marx thought and wrote. Among other things, the globalization of finance was sufficiently novel that the power of bankers trading bonds in London to overthrow settled arrangements halfway around the world provoked not just outrage but bafflement – how could such a system come into being? How did it operate? Where did its motive power come from?

Marx could thus take a holistic view of capitalism, something almost impossible for his successors in all but the most abstract ways. He could see it as a system among systems – one that had replaced earlier modes of production and would, in turn, be replaced because of contradictions inherent in the way it operated.

Of course this observation is so banal as to be almost a truism – everyone “knows” that Marxist thinking is obsessed with spotting contradictions that will ratchet up history through that old Hegelian formula: thesis, antithesis, synthesis. But for most of us, these are just words that carry no real force; they amount to the well-known, ritual chants of a dead religion that everyone mouths and no one lives by. For even the most ardent critics of today’s distributions of power and wealth tend to accept reflexively the pervasive reality of prices, markets, and money. We cannot really see these institutions that govern our lives as anything other than givens, and thus our grasp of the role of place, of history, of culture and power in shaping these institutions has indeed almost entirely loosened.

In this sense, despite the ease with which one can poke fun now at theorems such as Modigliani-Miller and Black-Scholes that underpin orthodox modern finance theory, [1] the hegemony of capitalism is complete, to paraphrase Gramsci. We can no longer conceive in any visceral concrete manner of different arrangements ordering our lives. We may be aware that our financial system has failed us; that our ways of doing things threaten to despoil irrevocably the water we drink and the air we breathe; that hundreds of millions of people live in unnecessary misery – unnecessary because we have the technologies at our disposal to feed, clothe, and shelter everyone alive in reasonable comfort and dignity. And yet our proposed “solutions” amount to tinkering – a little more regulation here, a bit more welfare spending there, turning over governments and supra-national organizations to the high-minded who will see to good educations for all, strict environmental standards, and a gradual reduction in armaments. Meanwhile, whether on the “right” or on the “left” we just assume as a matter of course that people will keep on earning salaries or wages with which to purchase necessities and comforts. That capital markets – regulated or otherwise – will continue to fund infrastructure spending and government deficits. That industries and companies will come into being because prescient entrepreneurs figure out better ways of satisfying market needs. That they will raise money to finance their operations from banks or investors. That money will go on forever being created by central banks while technocrats concern themselves with its velocity.

To be sure, doves on the “left” will predictably advocate accommodative monetary policies while hawks on the “right” will go on favoring tightening. Now and again crackpots will appear arguing for the abolition of central banking and a return to the gold standard. Or perhaps for cutting taxes while ignoring spending. Sometimes their recommendations will even be adopted for a spell until the whole economic edifice begins to quake and terrified politicians quickly retreat into orthodoxy. But no one really believes any more that the continuation of the system we live in is anything other than inevitable.

Robert Brenner may be an exception. Brenner is typically identified as a Marxist scholar and indeed he brings to his analysis of contemporary political and economic reality insights explicitly derived from Marx. But what gives Brenner’s work its breathtaking scope and insight is precisely that ability he shares with Marx – to see the capitalist world economy holistically as a system. And this derives not from some automatic recourse to a Marxian prism in which to view contemporary issues, but from his work as an historian – particularly his work as an historian of systems in transition.

Pyramid of capitalism

For before Brenner turned his attention to contemporary issues, before he staked out his claim that what we have been living through since 1973 points to an entire system of political economy under terrible strain, Brenner had immersed himself in two earlier defining eras: the transition from feudalism to capitalism in late medieval England. And the first emergence of globalized capital in the build-up to the English Civil War.

Brenner has thereby furnished his mind not with the reductive mathematics of most other scholars who have attempted to understand our current plight. But rather with an appreciation for the way power shifts under periods of rapid economic change, for the struggles between rising classes of new claimants to power and influence and those with vested interests in the old order, with a sense of the way economic and political systems tend not towards the natural equilibrium end-point of classical economics but to precisely its opposite: eternal flux and struggle. And while his understanding of the world we live in is rooted in a Marxian conceptual framework that sees capitalism as a dynamic, evolving system of power and class relations – a system beset, yes, with contradictions – Brenner has brought to his analysis matters that were beyond Marx’s purview: in particular the emergence of capitalism as a single, integrated global system revolving around the financial hegemony of the United States. The result, to quote Perry Anderson, is that “…it is plain that here, as in no other body of work today, Marx’s enterprise has found a successor. To have developed as coherent, detailed, and deep-going an attempt to understand the history of the world market – where Marx left off in Capital — since the Second World War must be regarded, by any standards, as an extraordinary accomplishment.” [2]

Anderson wrote these words after reading Brenner’s book The Economics of Global Turbulence (Verso, 2006), but before the financial collapse of September, 2008 and the onset of the Great Recession. Brenner has now added a long introduction that could almost stand as a separate volume. (Link) The depth and breadth of the analysis is unrivaled in the literature that has emerged since the crash[3] and underscores Anderson’s claim about the historical significance of Brenner’s work. And Brenner shows us how certain Marxian insights – suitably updated – can indeed shed light on the place we find ourselves in this fatal juncture of human history.

Brenner begins his analysis with a key Marxian concept – the falling rate of profit over time as businesses attempt either to capture or preserve market share. The result, inevitably, is overcapacity and downward pressure on wages. Marx expected that the resulting immiseration of labor would lead to revolutionary conditions. That has not happened. The conventional liberal explanation lies in the rise of labor unions, in the coming of the welfare state, and, most importantly, in the discovery by Western governments, tutored by John Maynard Keynes, of macroeconomics. The conceptual apparatus of “Keynesian macroeconomics” — the modifier is essentially redundant — gave governments the tools to identify and compensate for falling aggregate demand brought on by investment in excess capacity and downward pressure on wages.

In the conventional liberal view, Keynesian demand management thus provided the necessary conceptual and institutional framework for the greatest economic leap forward in human history in the quarter century following the Second World War. But the subsequent elections of Margaret Thatcher and Ronald Reagan, coupled with the re-emergence of right wing, monetarist or “neoclassical” economics and laissez-faire political thinking, brought in their wake an assault on the institutions of the welfare state and their Keynesian intellectual underpinnings. The assault was largely successful and, in this view, the results predictable: widening income disparities, the destruction of economic security for large swathes of the population, and a rise in both the frequency and severity of financial crises. But with the swing of the electorate back towards centrist political figures such as Barak Obama and the rebirth in the academy of the Keynesian discourse, right-wing excesses can be corrected. Institutions of economic security can be renewed and strengthened. Intelligent fiscal policy can be substituted for mindless tax-cutting. Finance can again be harnessed for the wider good rather than left unregulated as a plaything for plutocrats.

Brenner is skeptical. What sets him apart from both conventional liberal and conservative analysis that seeks to explain the crisis in terms of financial shenanigans is his view of the “decreasing vitality of the advanced capitalist economies rooted in a major decline, and stubborn failure to revive, of the rate of profit, finding its fundamental… source in a persistent tendency towards over-capacity in the global manufacturing sector, which originated in the intensification of international competition between the mid-1960s and mid-1970s.” (emphasis added). It is here that Brenner becomes so interesting to those of us who study East Asia. Because unlike any other Western economic historian of whom I am aware, Brenner fully grasps the significance to global capitalism of what has happened in East Asia since the appearance of the export-led, state-directed Japanese growth model in the 1960s and its spread throughout Asia since the 1970s. “Manufacturing over-capacity emerged, was reproduced, and has been further deepened by way of an extended process of uneven development in which a succession of newly-emerging manufacturing powers has been able, thanks to systematic state intervention and highly organized forms of capitalism, to realize the potential advantages of coming late, especially by combining ever increasing technological sophistication with relatively cheap labor and orienting for the world market.”

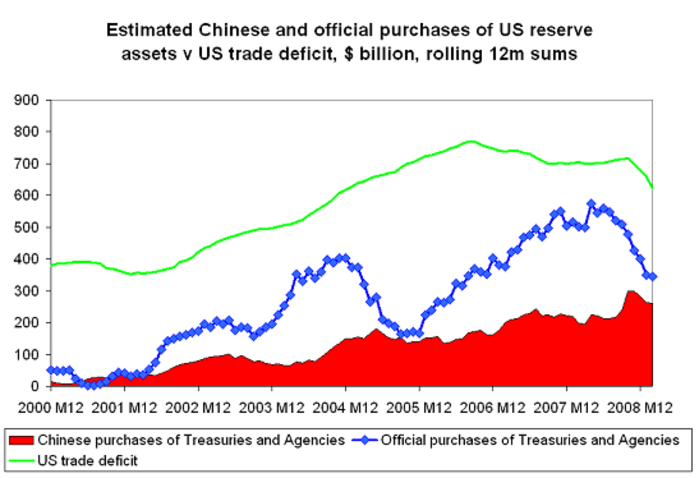

Brenner contends that “the premature entry of high-competitive lower cost producers, especially in the newly developing regions of East Asia” would have led to serious crisis were it not for the ability of advanced capitalist governments to make available “titanic volumes of credit.” For a while, “traditional Keynesian measures” did the trick in compensating for the decline in manufacturing profitability in the Western capitalist countries, but like a diabetic facing insulin-resistance, governments found that these measures became less and less effective over time. Instead, “artificially cheap domestic credit” opened the way for “domestic asset bubbles” made possible by the growing financialization of the economy and the migration of human and financial capital from industry to Wall Street and the City of London. Specifically, “the weakness of business investment made for a sharp reduction in the demand by business for credit. East Asian governments’ unending purchases of dollar-denominated assets with the goal of keeping the value of their currencies down, the competitiveness of their manufacturing up, and the borrowing and the purchasing power of US consumers increasing made for a rising supply of subsidized loans…One has therefore witnessed for the last dozen years or so the extraordinary spectacle of a world economy in which the continuation of capital accumulation has come literally to depend upon historic waves of speculation, carefully nurtured and publicly rationalized by state policy makers and regulators – first in equities between 1995 and 2000, then in housing and leveraged lending between 2000 and 2007. What is good for Goldman Sachs – no longer GM – is what is good for America.” (emphasis in the original).

If this is correct, there is no easy fix for our problems. The blowing of asset bubbles is not an unfortunate side effect of regulatory capture or Wall Street’s greed. It was the only way governments could keep economic growth from falling below politically dangerous levels once traditional Keynesian methods of fiscal stimulus through deficit spending were no longer adequate to compensate for the sclerosis at the heart of the advanced capitalist economies: “worsening difficulties with profitability and capital accumulation.” Brenner labels this bubble-blowing “stock market Keynesianism” referring to deliberate measures by governments to steer credit into equity markets.

Brenner identifies the first experiment in “stock market Keynesianism” as Japan’s bubble economy of the 1980s. “In 1985-6…a fast rising yen had put a sudden end to Japan’s manufacturing-centered, export-led expansion of the previous half decade, was placing harsh downward pressure on prices and profits, and was driving the economy into recession. To counter the incipient cyclical downturn, the Bank of Japan radically reduced interest rates, and saw to it that banks and brokerages channeled the resulting flood of easy credit to stock and land markets. The historic run-ups of equity and land prices that ensued during the second half of the decade provided the increase in paper wealth that was required to enable both corporations and households to step up their borrowing, raise investment and consumption, and keep the economy expanding.” My only quibble here is with Brenner’s identification of the Bank of Japan (“BOJ”) as the prime mover – the BOJ was more of an agent of the Ministry of Finance (“MOF”) in its attempts to compensate for the sudden surge in the yen’s value after the Plaza Accord of 1985 – the historic agreement among the world’s leading economic powers of the time to suppress the exchange value of the dollar, particularly against the yen. But Brenner has the essence of what happened in Japan in the mid 1980s right, and he goes on to argue that the Japanese experience formed a model that would be consciously emulated. “(US Federal Reserve Chairman Alan) Greenspan followed the Japanese example. By nursing instead of limiting the ascent of equity prices, he created the conditions under which firms and households could borrow easily, invest in the stock market, and push up share values. As companies’ stock market valuations rose, their net worth increased and they were enabled to raise money with consummate ease – either by borrowing against the increased collateral represented by their enhanced capital market valuations or by selling their overvalued equities – and on that basis, to step up investment. As wealthy households’ net worth inflated, they could reduce saving, borrow more, and increase consumption. Instead of supporting growth by increasing its own borrowing and deficit spending – as with traditional Keynesianism – the government would thus stimulate expansion by enabling corporations and rich households to increase their borrowing and deficit spending by making them wealthier (at least on paper) by encouraging speculation in equities – what might be called ‘asset price Keynesiansm.’”

A further parallel that Brenner may have overlooked between the Japan of the late 1980s and the US in the early 2000s lies in the deliberate manipulation of land prices. The financial authorities in Japan did not simply steer credit into the real estate market in order to pump up prices. They had both direct and indirect means of determining those prices. Briefly, the Official Public Land Price Quotation System – Chika Koji Kakaku Seido – essentially gave tax authorities the power to set a floor under prices while banks, operating under MOF “guidance,” could arbitrarily assign collateral value to real estate independent of any cash flow it might generate. Fifteen years later, as Brenner describes in relentless and riveting detail, their American counterparts would also proactively be boosting land prices not simply through interest-rate cutting but by the abdication of regulation of sub-prime lending and the emergence of the mortgage-backed securities market and the derivatives based thereon with what amounts to the active encouragement of the Federal Reserve and the Bush administration.

U.S. and Japanese land price bubbles

The key point here, however, is that Japan led the way. What makes it so fascinating is that the very same country that would initiate the blowing of asset bubbles had been the harbinger of the global crisis of manufacturing overcapacity. Japan had, from the mid 1950s on, deliberately staked its prosperity on the construction of excess global capacity in a series of key industries beginning with textiles and marching up the value-added chain from ship building and steel through machine tools, a wide range of consumer durables, and capital equipment, as well as a host of important upstream components. Japan did not launch industries. Rather, it targeted markets that were already served by existing capacity in other countries. Japanese companies built their own capacity to capture these markets and then, backed by patient financing and enjoying the advantage of an undervalued currency with predictable labor costs and meticulous attention to quality control, flooded global markets with “torrential rain-type exports” to quote a Japanese government term. The result was to destroy profitability in these industries, forcing foreign competitors either to abandon the industry in question or to cut costs drastically – most commonly, by shifting production to low wage, developing countries.

Subsequently, in its momentous shift away from the Stalinist economic model of autarkic industrialization, China would follow the road blazed by Japan: the deliberate creation of overcapacity in targeted industries aimed at the global market and with the necessary cheap financing overseen and/or organized by the state. Deng Xiaoping’s visit to Japan in 1978 – the first ever by a de facto head of the Chinese government – may well be the most important foreign trip ever made by a Chinese leader.

Deng and Prime Minister Fukuda Takeo

These two countries – and the smaller economies of East and Southeast Asia that followed in their wake ¬– could not, however, escape the consequences of their systematic creation of overcapacity and the resultant decline in manufacturing profitability. To save the global system on which they themselves had come to depend, they were forced to turn around and provide the waves of credit that permitted the financial lynchpin of the global capitalist system – the United States ¬– to continue to act as the world’s primary engine of demand.

As Brenner notes in discussing how the explosion in deficits by the George W. Bush administration was financed, “… Japanese economic authorities saved the day by unleashing an unprecedented wave of purchases of dollar-denominated assets. Between the start of 2003 and the first quarter of 2004 … Japan’s monetary authorities created 35 trillion yen, equivalent to roughly one percent of world GDP, and used it to buy approximately $320 billion of US government bonds and (the debt of government-sponsored institutions such as Freddie Mac), enough to cover 77 per cent of the US budget deficit during fiscal year 2004. Nor were the Japanese alone. Above all China, but also Korea, Taiwan, and other East Asian governments taken together increased their dollar reserves by $465 billion and $507 billion….”

Chinese and official purchases of U.S. Treasuries, 2000-2008

These countries thus found themselves tightly wedded to the global system that revolves around the financial hegemony of the United States and its currency. Brenner completed his study in March, 2009 and since that time, we have seen at least one momentous event: an explicit rejection by the Japanese electorate of the political guardians of the postwar model of economic growth. After the deflating of the land and stock market bubble in the 1990s, Tokyo’s financial authorities had found themselves unable to blow new ones. They had reverted to the crassest kind of old-style Keynesian stimulus, blanketing the country with environmentally destructive public works. These measures probably kept the economy from tipping directly over into recession until last year, but Japan was then overwhelmed by the global collapse in demand that followed the events of 2008, plunging into the worst economic conditions it had endured since the immediate postwar years. A new government has now come to power led by men who have made it clear they intend to break with the old order – among other things, they are letting the yen rise in foreign exchange markets and are at least talking about such matters as a transition to a “green” economy and the construction of an explicit safety welfare net that should theoretically encourage more risk-taking by young people and entrepreneurs. But as much as one wishes them well, neither they nor anyone else has any clear blueprint for springing the jaws of structurally anemic demand in which their country has been trapped for twenty years.

Meanwhile, in the United States, it is now obvious that the stimulus package enacted by the Obama administration was too small to do anything more than prevent the onset of a full-scale depression. The failure to enact a more robust package can be attributed partly to the seeming ease with which the White House allows itself to be intimidated by the Republican rabble in Congress. But it also seems rooted in fear that the Treasury may be approaching the limit to the amount of U.S. government debt it can cram down the throats of the bond markets. Wall Street is back blowing bubbles, but this time they are not translating into any wider upsurge in consumer purchasing power. Unemployment remains stuck at politically dangerous double digit levels, mortgage defaults are still frighteningly high, while lending to businesses – as opposed to the financing of these new bubbles – continues to stagnate. Brenner described the situation at the end of 2008: “with nothing to induce expenditures by either businesses or households, the economy was experiencing a self-reinforcing downward spiral in which falling consumer demand made for declining profits, which brought about cutbacks in both investment and employment, which reduced aggregate demand, and had entered into free fall.” The fall may have slowed since then, but there has been no real revival of the broader economy. The partial recovery in equity prices we have seen in the last few months seems a function mostly of Wall Street’s euphoria in dodging the bullet that a year ago appeared inevitable. It is certainly not due to any recovery in corporate profits unrelated to finance or any loosening of household purse strings.

The one bright spot is China. China’s economy is again growing smartly. Waves of government-mandated stimulus and credit creation combined with an undervalued currency have revived Chinese exports and with them, the broader economy. But China’s rising industrial production is not translating into any revival in global demand. As Hung Ho-Fung writes in an important article in the New Left Review,

“(China’s) export competitiveness has been built upon long-term wage stagnation, which arose in turn from an agrarian crisis under an urban-biased policy regime. Rather than sharing a greater part of profits with employees and raising their living standards, the thriving export sector has turned most of its surplus into enterprise savings … from the late 1990s onwards total wages declined as a share of GDP, in tandem with a fall in private consumption.”

See the debate over Hung’s analysis here.

The profits from China’s exports are being plowed back into investment in more global excess capacity. Or into financing of the twin U.S. trade and government deficits.

China’s growing share of the U.S. trade deficit

China’s exports are coming at the expense of exports from other countries. The World Trade Organization expects global trade to fall by 9% this year – the very year that China will surpass Germany to become the world’s number one exporter. (Link) However, this way of doing things – exporting into the teeth of a global downturn and turning the proceeds not into domestic demand but into savings deployed as investments or dollar reserves – can only continue as long as China together with the likes of Japan and South Korea are able and willing to prop up the buying power of its principal customer and lynchpin of the global capitalist order: the United States. As I wrote elsewhere about China’s financing of the US deficits and its support of the dollar in light of Japan’s modern economic history: “Once your economy is so large that whatever you do affects global economic architecture, the ‘free rider’ option begins to close. If you manage your economy in such a way as to maximize exports and trade surpluses at a time when global growth is sluggish or non-existent, you are willy-nilly forcing other countries to run trade deficits. What happens if they refuse to go along? The 1930s suggests the answer, when the United States itself attempted to preserve its surpluses and helped foster a global depression instead. And if they do go along, running the trade deficits by others that the laws of accounting require if you are going to run surpluses? Then you end up accumulating large reserves in the currencies of the deficit countries; if you don’t want to walk away from those reserves and you want the mechanism to keep running, you find yourself forced to bail out the system again and again and at ever higher cost.” (“China’s Outward Swinging Trade Doors – More Lessons from the 1970s?” The Asia-Pacific Journal)

Hung maintains that China’s leadership understands this, but they are trapped by the power of the newly arisen coastal elite. “ The (Chinese) government is … very aware of the need to reduce the country’s export dependence and stimulate the growth of domestic demand by increasing the working classes’ disposable income. Such a redirection of priorities has to involve moving resources and policy preferences away from the coastal cities to the rural hinterland, where protracted social marginalization and underconsumption have left ample room for improvement. But the vested interests that have taken root over several decades of export-led development make this a daunting task. Officials and entrepreneurs from the coastal provinces, who have become a powerful group capable of shaping the formation and implementation of central government policies, are so far adamant in their resistance to any such reorientation. This dominant faction of China’s elite, as exporters and creditors to the world economy, has established a symbiotic relation with the American ruling class, which has striven to maintain its domestic hegemony by securing the living standards of U.S. citizens, as consumers and debtors to the world. Despite occasional squabbles, the two elite groups on either side of the Pacific share an interest in perpetuating their respective domestic status quos, as well as the current imbalance in the global economy…Unless there is a fundamental political realignment that shifts the balance of power from the coastal urban elite to forces that represent rural grassroots interests, China is likely to continue leading other Asian exporters in diligently serving—and being held hostage by—the U.S.”

Indeed, Hung entitles his article in referring to China, “America’s Head Servant?”

So where does this leave us? Pretty much where Robert Brenner does – a global capitalist system ever more dependent on “titanic” waves of credit creation and repeated jolts of Keynesian stimulus that grow less effective and more costly with each round. Japan long led the world in that credit creation. But it has now been surpassed by a China that finds itself today where Japan has been for decades: locked into an entangling embrace with the system’s hegemon – ironic, in that it is occurring at just the time when new leaders in Japan are contemplating ways of running their economy that may involve extrication from their own reflexive support for American hegemony. The new U.S.-China embrace is held together by the same dynamic that re-enforced the long-standing U.S. – Japan financial relationship: the mutually assured destruction that would ensue should either set of arms loosen. That one party to today’s embrace is the world’s leading avatar of capitalism while the other was born out of implacable opposition thereto is another irony – dare I say “contradiction?” – that perhaps only a Karl Marx – or a Robert Brenner – could fully savor.

Notes

[1] See for example two best-sellers: Justin Fox, The Myth of the Rational Market (Harper Collins, 2009) and Nassim Nicholas Taleb, The Black Swan: The Impact of the Highly Improbable ( Random House, 2007).

[2] Perry Anderson, /Spectrum: from right to left in the world of ideas /(London:Verso, 2005) p. 258.

[3] An exception is Leo Panitch, Martijn Konings, Sam Gindin, and Scott Aquanno, “The Political Economy of the Subprime Crisis” in Leo Panitch and Martijn Konings (eds.), American Empire and the Political Economy of Global Finance, 2nd ed., New York: Palgrave, 2009, pp. 253-292. This piece does indeed rival the depth of Brenner’s analysis, albeit without the focus on Asia, and underscores the wider point that Marxian scholarship may ultimately have both a more penetrating and a more comprehensive take on the current crisis than mainstream neo-classical and neo-Keynesian writing.

Brenner’s article, “What is Good for Goldman Sachs is Good for America: The Origins of the Current Crisis,” is available here.

Robert Brenner is Professor of History and Director of the Center for Social Theory and Comparative History at UCLA. His book, The Boom and the Bubble: The US in the World Economy is available in Korean, Chinese, Portuguese, German and Spanish translations with Japanese and Turkish forthcoming.

R. Taggart Murphy is Professor and Vice Chair, MBA Program in International Business, Tsukuba University (Tokyo Campus) and a coordinator of The Asia-Pacific Journal. He is the author of The Weight of the Yen and, with Akio Mikuni, of Japan’s Policy Trap. He wrote this article for The Asia-Pacific Journal.

Recommended citation: R. Taggart Murphy ‘In the Eye of the Storm: Updating the Economics of Global Turbulence, an Introduction’ The Asia-Pacific Journal 49-1-09, December 7, 2009.” The Asia-Pacific Journal, 49-1-09, December 7, 2009. 台風の目の中でーー世界的動揺の経済、ロバート・ブレナーによる新対応への手引き