Ruediger Frank, Mark Selden and Oh Young-jin

I Ruediger Frank and Mark Selden

The Republic of Korea is a county like most others in that it has no or insufficient fossil fuel reserves of its own and depends on imports of oil, gas and coal for various vital purposes, including electric energy production, heating, and fuel for its transportation system. Like many other countries it now feels the pinch of high prices for oil and other raw materials, and like most others it is affected by the downturn in global stock markets and the failure of major banks in the aftermath of the subprime crisis in the United States. This interdependency in good and in bad times is the price of globalization.

With a small industrial base and few privately owned cars, the first oil shock in the early 1970s turned out to be a blessing for Park Chung-hee’s plans to build up a heavy and chemical industry almost out of nothing. Unable to reduce their oil consumption quickly, the industrial nations of the West had to pay the fourfold increased oil prices. The OPEC countries then brought this exploding revenue to their banks, which were happy to dispense big loans to even the poorest borrowers at favourable terms, as long as they could only recycle these Petrodollars quickly. What developed into a debt crisis in South America and keeps haunting North Korea until the present day provided the South Korean chaebol with financial means to make the heavy investments needed for industrialization. For over two decades, South Koreans were able to reap the benefits.

In 1997, the Asian financial crisis hit Korea, its economy, and its pride. There were many lessons to be learned. Some of them were taken seriously while others resulted in lip service or superficial change. On one point all Koreans agreed: never again. Korean economists have been watching their country’s economic indicators ever since with even greater caution, paying special attention to short-term debts and foreign exchange reserves. In July 2008, however, South Korea’s capital account recorded its biggest deficit since the Asian crisis, as the JoongAng Daily (August 30, 2008) reports. Investors are leaving Korea. They are leaving other markets, too. At the same time, Korea faces rising expenses, especially for vital raw materials including oil. The consequences of such a combination of shrinking capital and higher expenses are as obvious as they are alarming.

Like most others, Korea can do nothing about a global crisis, except attempt to weather it. In a country like Korea, where the state is seen and portrays itself as omnipotent, the people will expect and demand government action to solve the problem, but this is wishful thinking. When investors are leaving on such a large scale, and the reasons are external to the country, there is nothing that can be done to stop them. But it is possible to fight against a worsening current account balance by reducing imports of costly products. The known alternatives to fossil fuels are the various forms of green energy, like solar, water or wind power; or nuclear energy. The latter is heavily debated, with security being a major issue, the cost of nuclear power a second when externalities and uncertainties are factored in, and, most troubling, the question of what to do with nuclear waste. North Korea has demonstrated that used fuel rods can be turned into weapons, something South Korea had in mind in the 1970s before its program was discovered and stopped by the United States. More nuclear power plants, depending on their type, mean more such material. North Korea is also a factor that increases the risk of South Korea’s power plants beyond the normal level. A conventional attack can produce disastrous consequences if it hits a nuclear reactor.

However, like in the U.S., there seems to be no strong lobby for green energy in Korea; moreover, it is technology intensive and requires huge investments with not always secure results. Investing more in nuclear energy seems to Korea’s leaders the easier solution, and it is one that corresponds well with the South Korean tradition of the big gesture, to focus on a few big champions instead of a large number of medium-sized enterprises. The plans as laid out in the article that follows, therefore, have a certain logic.

We should not forget, however, that oil and gas are not the only limited resources: uranium is also limited, and it is far from being without its downside. Estimated North Korean uranium resources range from 300,000 to 4.5 million tons. The price for U308 has jumped from about 15 US$ per kg in 2004 to about 60 US$ at present, with a peak last year at about 135 US$ per kg.

Korea is not the only country with an energy problem. If China, newly sensitized to coal after the Olympics, builds another 100 nuclear power plants, and if the Europeans (less likely) and the Americans also follow, the price of uranium might reach similar heights to those of oil price. As a side effect, this will make North Korea an even more attractive and powerful partner, since the country possesses its own uranium reserves. This might be a way to achieve the 3,000 US$ per capita in that country, although surely not the way South Korean President Lee Myung-bak has had in mind.

On the other hand, as every crisis offers opportunities, this might be the time for Korea to seriously think about focussing its superior capabilities on improving existing technologies for alternative sources of energy, to develop new products, and benefit from the ever-deepening scarcity of natural resources. With the biggest energy market in the world right at its doorstep, Korea could achieve what has not worked according to plan so far in biotechnology: creating a new pioneering sector and repeating the 1990s success of IT and telecommunications. There are some positive indicators. In 2006 Korea announced construction of the world’s largest tidal power plant followed and the world’s largest solar power station to be built. In 2007 it announced plans to increase renewable energy from present two percent levels to nine percent by 2030, although such lofty plans were met with skepticism. The state’s control of the economy and the domination by a few big conglomerates has been a blessing and a curse in the past, depending on conditions. Alternative sources of energy might require exactly what Korea’s economic system and policy have to offer (and a liberal economic system does not): the forward-looking pooling of scarce resources in a strategic sector with state support for R&D, with state protection, and with big players who can be sure to get their share of the long-term benefits and hence are ready to play along. Heavy investments in nuclear energy as announced in the article that follow could prove to be a temporary remedy, but a forward-looking strategy would include at least a similar focus and bold action on alternative energy sources. This could be the “Bulldozer’s” best opportunity to apply his famed abilities and to leave a positive mark on Korea’s history.

II Oh Young-jin

Korea plans to build 10 more nuclear power plants by 2030 and to raise its reliance on alternative energy sources five-fold in order to wean itself from fossil fuels.

In a report to President Lee Myung-bak, Knowledge Economy Minister Lee Yoon-ho said Wednesday that a total of 111 trillion won or about $100 billion will be needed to increase the portion of non-fossil energy sources from 4.6 percent of projected overall energy needs at present to 11 percent by 2030. The energy plan covers 22 years starting this year and is up for renewal every five years.

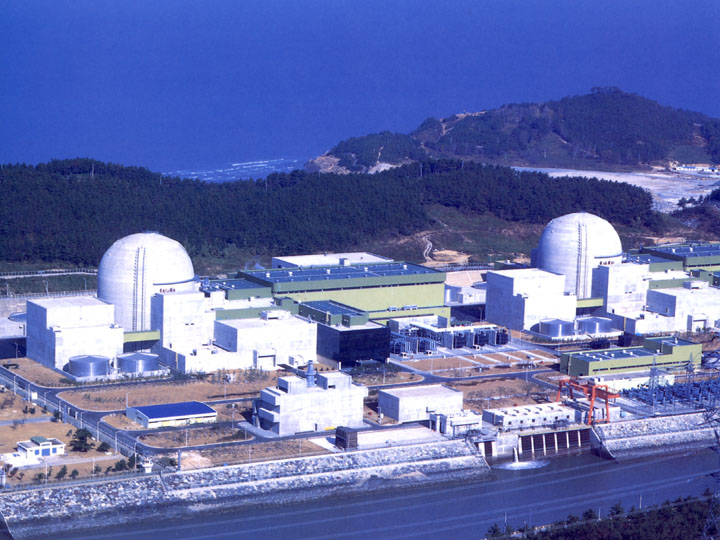

ROK Yonggwang Nuclear Power Plant

ROK Yonggwang Nuclear Power Plant

The long-term energy plan is regarded as overly ambitious considering the country lags in the development of new energy sources technology, Critics said it was hastily devised following President Lee’s Aug. 15 Liberation Day speech, which highlighted so-called “green growth” that was more attentive to environmental protection.

At the same time, 11 new nuclear power plants will be built to provide for 59 percent of energy needs, up from the current 36 percent now. Twenty nuclear power plants are in operation at the moment, generating 17,716 mega watts. This accounts for 15 percent of the total energy consumption and 26.7 percent of electricity generation. France, which relies the most heavily among developed countries on nuclear power, produces 43 percent of all its energy generation and 79 percent of electricity through nuclear power, according to 2005 data.

In terms of alternative energy development, the plan sees a whopping 4,400 percent jump in solar energy use; 33-fold for wind power; 19 times for bio-fuels and 51 times for thermal heat.

As part of its solar energy promotion, 1 million households will be designated as “green homes” that will use solar panels as source for heating by 2020. Power plants will be also required to generate portions of their power generation by harnessing bio-fuels, wind and tidal power.

Minister Lee said that of the 100 trillion won needed, 72 trillion will come from the government and 28 trillion won from the private sector. An additional 11.5 trillion won will be spent on research and development.

In order to lay the groundwork for the expansion of nuclear power generation, Lee said that land for 10 nuclear power plants will be secured by 2010, with each being the size of the existing Gori Nos. 3 and 4, and being capable of producing 1.4 million kilowatts.

”The new nuclear power plants will be built to accommodate development demands by residents in the pertinent areas,” the minister said. In an extreme case of ”not in my backyard” or nimby phenomenon, residents have shunned the construction of power plants or waste disposal sites with violent demonstrations occurring in the process. Lee’s offer of incentives is intended to stem such public shows of dissatisfaction in advance.

In terms of electricity bills, Lee said that moves will be made to bring the bills to the real costs of power generation by, among other things, cutting down on subsidies.

If the ambitious energy plan is implemented, Korea will be able to save about $34.3 billion in energy imports; reducing its reliance on fossil fuels by 22 percentage points to 61 percent and create nearly 1 million jobs, the ministry said

Ruediger Frank is Professor of East Asian Economy and Society at the University of Vienna and Director of the Vienna School of Governance, and an Adjunct Professor at Korea University. He is a Japan Focus Associate and wrote this article for Japan Focus. He can be reached at [email protected]

Oh Young-jin is a Korea Times staff reporter.

Oh’s article was published in Korea Times on August 27, 2008.

Published at Japan Focus on August 31, 2008.