The US and the Temptation of Dollar Seignorage

Kosuke Takahashi

With a Comment by R. Taggart Murphy

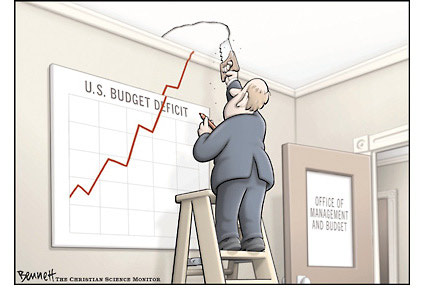

As the United States seeks to finance its ballooning budget deficits by printing more US dollar bills, Japanese economists are increasingly concerned that the excessive use of dollar seignorage by US financial authorities will further shake confidence in the US currency at a time when the world lacks an alternative globally accepted currency.

The US government projects that even without the forthcoming US$825 billion fiscal stimulus package, the national budget deficit to September 2009 will be $1.19 trillion, the biggest since World War II, or 8.3% of gross domestic product (GDP). This amount is likely to grow as the US government continues to rescue failed parts of the economy. How will the US cope with its enormous and growing debt obligations?

Therein lies the issue of the dollar’s international seignorage as a savior for the US national interest.

Seignorage is the revenue that a government raises by printing money. Suppose it costs one dollar to print a US$100 bill. As long as the world deems this bill worth $100, the US government receives the revenue of $99 every time it prints out a $100 bill (the difference being an approximation of the costs related to producing the bills) and circulates it to the markets at home and overseas. This is a perquisite of the US under the present world currency system. Neither Europe nor Japan, among other major economies, can enjoy the benefits of seignorage globally because the euro and the yen have not become international settlement currencies.

“The US is the only nation in the world, as the key currency nation, to have privileges to earn huge seignorage,” Nakatani Iwao, a renowned economist in Tokyo, wrote in his recent best-selling book, Why did capitalism self-destruct?, which is sparking a debate in Tokyo, the financial center of the world’s second-biggest economy, over United States-led global capitalism.

“If the FRB [Federal Reserve Board] or the US government issues dollar bills and spreads them abroad, that’s sufficient to earn enormous seignorage – as long as people around the world see the dollar’s value as stable,” he wrote.

In the book, Harvard-educated Nakatani made a “confession” by saying he had been doing the wrong thing, surprising many Japanese by indicating that what he had learned in the US had proved harmful to Japanese society. The easing of regulations and the liberalization of markets in Japan had brought about an American-style widening disparity between Japan’s haves and have-nots and an accumulated discrepancy between society’s winners and losers, he pointed out.

Nakatani had been an ardent advocate of globalization and national structural reforms since the early 1990s under the Hosokawa Morihiro and Obuchi Keizo administrations. Nakatani’s strong support of global capitalism later influenced reform policies conducted by popular former prime minister Koizumi Junichiro, a symbol of Japan’s reformist policy, from 2001 to 2006.

Bernanke’s views on seignorage

It’s intriguing to note what Federal Reserve chairman Ben Bernanke, then Princeton University economics professor, said about seignorage. He wrote in his Macroeconomics textbook, co-authored with Andrew Abel, that the government can print money when it cannot (or does not want to) finance all of its spending by taxes or borrowing from the public. In the extreme case, imagine a government wants to spend $10 billion (say, on submarines) but has no ability to tax or borrow from the public. One option is for the government to print $10 billion worth of currency and use this currency to pay for the submarines.

If you replace the word “submarines” with “bailout funds”, that would mirror the present US situation.

Bernanke and Abel continue:

“Governments that want to finance their deficits through seignorage do not simply print money but use an indirect procedure. First, the Treasury authorizes government borrowing equal to the amount of the budget deficit, and a correspondent quantity of new government bonds are printed and sold. However, the new government bonds are not sold to the public. Instead, the Treasury asks (or requires) the central bank to purchase the $10 billion in new bonds. The central bank pays for its purchase of new bonds by printing $10 billion in new currency, which it gives to the Treasury in exchange for the bonds.”

This is what the Bernanke Fed is thinking of doing in the coming months and years. It has already snatched up a big chunk of soured mortgage-backed securities guaranteed by beleaguered mortgage-guarantors Fannie Mae and Freddie Mac. Bernanke has also said the Fed may buy “longer-term Treasury or agency securities on the open market in substantial quantities”, using the Fed’s balance sheet and money-creation authority to aid the ailing US economy.

The latest Fed data showed the monetary base jumped to more than $1.7 trillion this month, more than double from around $840 billion in August – a vertical takeoff in the supply of dollars.

Temptations of seignorage

The US economy has benefited from seignorage by printing dollar bills to finance a huge current-account deficit, for which the trade imbalance is by far the greatest reason. This enabled Washington to carry out its expansionary monetary and fiscal policy amid ballooning debts.

Unlike Japan, China and Europe, among other nations, the US did not have to desperately tap the market of its own goods and services. Simply put, by just printing money, it could get whatever it wanted abroad, even without any cash on hand. Instead, the spread of the US debt bubble overseas enhanced the networking power of dollar hegemony, which in return boosted the power of dollar seignorage. This is all debt-forgiveness resulting from the dollar key-currency system.

“Should the US Federal Reserve have properly managed money supply, being conscious of the role of the world’s central bank, today’s financial crash could have been avoided,” Nakatani wrote. “But in reality, Alan Greenspan, who had served as Fed chairman for a long time, gave top priority to economic upturn and accommodated the housing bubble. The dollar’s oversupply continued. This is the root cause of today’s financial crisis.”

The US dollar has strengthened against other major currencies, with the notable exception of the yen, in the past months, even as the country has been at the epicenter of the deepening financial crisis. Many currency analysts see risk reduction among investors causing the money that US financial firms had invested in the world to be repatriated to the US, triggering dollar-buying.

But that dollar strength may not last. Once people around the world start to think that an excessive dollar supply will diminish the value of the currency, they may suddenly start selling dollar-denominated assets, causing devastating damage to the world economy. This is why world leaders such as Japan’s Prime Minister Aso Taro have repeatedly expressed support for the dollar in the international financial system, easing people’s lingering concerns over the greenback.

Early signs of the worst scenario for the US are, however, beginning to show. International demand for long-term US financial assets fell in November as foreign investors sold Treasury, agency and corporate debt, a government report showed on January 16. Net selling of all long-term assets in November was the most since August 2007, as investors sold bonds issued by Fannie Mae, Freddie Mac and other government-sponsored enterprises for the fourth month in the past five.

“For the moment, governments around the world are supporting the dollar key-currency system,” said Fukui Masaki, senior market economist in Tokyo at Mizuho Corporate Bank Ltd, a unit of Japan’s second-largest financial group by market value. “But there is still a deep-seated structural problem, causing some concern. We can never say a dollar crisis won’t come.”

When risk aversion begins to abate, as will happen at some point, the Fed needs to act quickly to drain excessive dollar supply, or money supply. Otherwise, the dollar will be doomed and hyperinflation and economic bubbles will occur once again, which could lead to a recurrence of the global financial crisis.

Should the US give in to the temptation of dollar seignorage, as it has done in the past, loosening money to feed debt bubbles, investors would be well advised to diversify their currency positions to hedge against dollar risk. This could be yet another catalyst for undermining dollar hegemony, which the US for sure does not want to see happen.

Kosuke Takahashi is a Tokyo-based journalist.

He published this article at Asia Times on January 23, 2009.

Recommended Citation: Kosuke Takahashi, “The US and the Temptation of Dollar Seignorage” The Asia-Pacific Journal, Vol. 5-1-09, January 28, 2009.

U.S. Seignorage, the World Economy and Japan

R. Taggart Murphy

Takahashi Kosuke has written a piece that may be more interesting for what it says about the fears of Japanese officialdom than for its actual content.

The content is unexceptional — that the U.S. has, for better than a half century now, enjoyed the benefits that come from issuing the world’s primary settlement and reserve currency; that Washington has succumbed to the political temptation to abuse the privilege, and that if American authorities are not careful, this privilege — and all the benefits, that Americans have enjoyed from it — could be lost. Economists label the financial benefits that accrue to the issuer of a currency “seignorage.” The term originally referred to the difference between the cost of issuing coin and the revenues accrued thereby; the sovereign (“seignor”), being the issuer, pocketed the difference. Takahashi introduces a somewhat labored update — the very large gap between the cost of printing a hundred dollar bill and what the bill will purchase — but this largely misses the point since most money today consists not of currency in circulation but computer entries in the accounts of central banks and other financial institutions. All central banks enjoy seignorage — which today amounts to the ability to issue liabilities without paying any interest (all currencies today are ultimately liabilities of central banks) — but the U.S. central bank, the Federal Reserve System, is more central than others because the dollar is the most widely used settlement and reserve currency in the world. This enables the United States to finance both its government and its trade and current account deficits with impunity — it can simply issue more money on which the Federal Reserve need not pay interest.

Takahashi exaggerates when he writes that “neither Europe nor Japan…can enjoy the benefits of seignorage globally because the euro and the yen have not become international settlement currencies” since both currencies can be and are used to settle claims across borders. That they are not more widely used — particularly in the case of the yen — is as much a conscious political choice on the part of the Japanese authorities (For an explanation of the reasons for this, see Saori Katada and Taggart Murphy, From a Supporter to a Challenger? Japan’s Currency Leadership in Dollar-Dominated East Asia at the Brink of Financial Collapse) as for any other reason. But he is essentially right that the U.S. has benefited hugely from this privilege.

Foreign holdings of US Treasuries (August 2008)

What Takahashi doesn’t say is that this privilege has as much to do with Japan’s willingness to hold dollars over the past generation as it does with policy in Washington. He does, however, refer to a book that is making a huge splash in Japan: Nakatani Iwao’s “Why did Capitalism Self-destruct?” Nakatani is one of Japan’s best-known political economists; the author of the term “network capitalism” as a sobriquet for Japan’s variant thereof, and heretofore a purported champion of reforming the Japanese economy along neo-liberal lines. His latest book is something of a mea culpa, pointing to what Takahashi and others like him have come to fear, particularly in the wake of the meltdown of US financial institutions and the trillion dollar bailouts that are the signature of the era, namely that Japan’s blind support for a dollar-centered international financial order has put the country in a bind. It cannot unload its dollars without provoking a global catastrophe. Yet if it hangs on to them, Japan risks being pulled down anyway into the possible collapse of that order which it has supported now for nearly 40 years.

The newspapers are filled with the pressures Washington may or may not be putting on the Chinese to stop “manipulating” their currency and the risks those pressures pose to China’s role in supporting the global reach of the American currency; after all the principal means by which China “manipulates” its currency is by absorbing financial instruments denominated in U.S. dollars. But Japan was there first and even today holds some two to three times as many dollars as China does, according to Akio Mikuni, the head of Japan’s only independent investor supported ratings agency and a well-known economic commentator. Mikuni explains that while China’s external public reserves are some two trillion dollars, almost all China’s holdings are on the books of official institutions. By contrast, if Japan’s holdings of foreign exchange in private hands are added to its official reserves, the number reaches some six trillion dollars, most of which are denominated in the American currency. Japan’s net as opposed to gross external holdings are, to be sure, only some $3 trillion, but the $2 trillion Chinese number is at the same time a gross, not a net number. Thus, however one slices it, Japan’s dollar holdings far exceed China’s. Critical China’s role may be in propping up a dollar-centered financial order and thus the ability of the United States to finance its deficits in its own currency, but that of Japan is even more important.

The origins of Japan’s dollar holding policies go back to the collapse of the postwar Bretton Woods regime in 1971. The Bretton Woods regime had institutionalized the dollar as the world’s key reserve currency. When it crumbled, however, Japan embarked on a policy of supporting the dollar through a steady buildup of dollar reserves. The motive was to avoid deterioration in Japan’s external accounts and a concomitant need to restructure its economy to put domestic demand rather than exports in the drivers seat. But particularly once Japan was joined by China and the rest of Asia in running export-led economies with the inevitable corollary of accumulating dollars (see my “Asia and the Meltdown of American Finance“), the world was presented with a fait accompli — the dollar would continue as the global currency.

Takahashi and Nakatani are right that American politicians and central bankers have been unable to resist the temptation to abuse what amounts to seignorage covering the whole planet. That abuse began with the so-called Reagan Revolution of cutting taxes without concomitant spending reductions, continued through the “irrational exuberance” of the dot.com era and culminated in the housing bubble whose bursting has thrown the world into an economic tailspin. All were possible because the global monetary order allowed the U.S. in the famous words of French economist Jacques Rueff to run “deficits without tears.” And Takahashi and Nakatani are also right that navigating a way out of the tailspin is fraught with peril; that the U.S. can no longer take for granted the willingness and ability of the rest of the world to absorb the vast number of additional dollar debts Washington will have to issue to finance the huge economic recovery package now being contemplated.

But what Takahashi does not discuss is the degree of Japanese complicity in the danger Japan now faces. Japanese policy makers may have felt at each point during the last generation that they had no alternative but to continue to finance American profligacy; that the domestic political and economic ramifications of a restructuring of the Japanese economy around domestic demand were too frightening to contemplate. But in the event of the dollar collapse that Takahashi rightly fears, exports will no longer be able to pull the economy out of the doldrums. Tokyo’s power holders will have to watch their country sink into a long, intractable economic trough. Or prepare to cede some of their control of economic arrangements to new centers of economic and political power that would inevitably arise with moves to make domestic demand the driving force of the Japanese economy.

R. Taggart Murphy, a former investment banker, is Professor in the MBA Program in International Business at the University of Tsukuba’s Tokyo campus and an Asia-Pacific Journal coordinator. He is the author of The Weight of the Yen (Norton, 1996) and, with Akio Mikuni, of Japan’s Policy Trap (Brookings, 2002).

He wrote this comment for The Asia-Pacific Journal.