Immanuel Wallerstein interviewed by Jae-Jung Suh

The financial crisis sweeping the world has led many to reconsider the neoliberal premises of the U.S. government. Jae-Jung Suh sits down with sociologist and world systems theorist Immanuel Wallerstein to consider the paradigm shift in global thinking on economic policy and the future of capitalism. This interview originally appeared at Hankyoreh on January 8, 2009.

Crisis? What Crisis?

Suh: These days, everybody is talking about a crisis. But everyone has a different definition of crisis. Some talk about a financial crisis, others about a more general economic crisis, including production. Still others talk about a crisis of neoliberalism, a crisis of American hegemony, and, of course, some talk about a crisis of capitalism. I would like to start by asking how you define the current crisis.

Wallerstein: First, I think the word crisis is used very loosely. As most people use it, it simply means a situation in which some curve is going down that had been going up. And they call that a crisis. I don’t use the term that way. But, in fact, I think we are in a crisis and a crisis is a very rare thing.

We have to separate a number of elements here. If you take the world since 1945, we had a situation for about 25 years in which the United States was the unquestioned hegemonic power in the world system and it was also true that it was a period of enormous economic expansion. It was, in fact, the single biggest economic expansion in the history of the world economy. The French like to call it the “Thirty Glorious Years.”

Kondratieff Cycles

Both came to an end roughly at about the same time, circa 1970, although it’s very hard to date these things. I think U.S. hegemony has been in decline ever since that time. I analyze these things in terms of what are called Kondratieff (Kondratiev) phases, and we entered a Kondratieff B phase at about that time. The world economy has been in relative stagnation for 30 years. Typical characteristics of a stagnation include the fact that what were largely monopolized industries that have earned enormous profits no longer do so because others have entered the markets efficiently at that point, and so the profit levels of the most profitable industries basically collapse.

There are two things that can be done about that. One is to move the industries to areas of historically lower wages. Why you don’t do that earlier is that doing so involves a loss — a loss in transaction costs. I have this crisis of profits. Korea develops as so many other countries develop. They take up the less profitable industries and become the locus of them.

The second thing that happens when you have a Kondratieff B phase is that people who want to make a lot of money shift to the financial sphere; basically, speculation through debt mechanisms of various kinds. I see this from the point of view of the powerful economic players circa the 1970s, the United States, Western Europe and Japan. I call it exporting unemployment. Since there is a relative amount of unemployment in the world system as a result of the decline of industrial production, the question is: Who is going to suffer? So each tries to export the unemployment to the other. And my analysis is that in the 1970s Europe did well, and in the 1980s Japan did well, and in the beginning of the 1990s the United States did well. Basically, by various mechanisms — I don’t want to go into the details of the analysis of how they did it — but financial speculation always leads to a bust. It’s been doing that for 500 years, why should it stop now? It comes at the end of a Kondratieff B phase. Here we are. So what the people are calling a financial crisis is simply the bust. This recent business of Bernard Madoff and his incredible Ponzi scheme is just the most perfect example of the impossibility of continuing to make profits off financial speculation. At some point, it goes. If you want to call it a financial crisis, be my guest. That’s not important.

Suh: What is particularly interesting about the current phase of the Kondratieff cycle, to use your preferred term, is that the world economy is reaching the bottom of the cycle just as U.S. hegemony is being questioned more seriously than before. It has been declining for some time, perhaps for about 30 years since its defeat in Vietnam. Various U.S. administrations have tried to reverse the process by various means. Some tried human rights diplomacy or some version of liberal measures. Others attempted more realist policies by expanding military capability or turning to high-tech military power such as “Star Wars.” None were able to reverse the process, but everyone sought to find the most efficient way to manage the world with less power. What happened in recent years is that George W. Bush came along with the neocons who thought they were going to reverse this by policy of militarism and unilateralism. But instead of reversing the process and restoring U.S. hegemony, they accelerated the process of decline.

Financial Crisis/Geopolitical Crisis

Wallerstein: Here we are, about to be 2009, and we are in a multi-polar situation, which is irreversible from the point of view of the United States and a very complicated messy one. And we are in a so-called financial collapse. We are in a depression. I think that all this pussy-footing about language is nonsense. We are in a depression. There will be serious deflation. The deflation, conceivably might take the form of runaway inflation but that’s just another form of deflation, as far as I’m concerned. We might not come out of that for four or five years.

It takes awhile. Now all of that is what I think of as normal occurrences within the framework of the capitalist-run system. That’s how it operates. That’s how it always has operated. There’s nothing new in the decline of hegemony. There’s nothing new in the Kondratieff B phase and so forth. That’s normal.

Suh: The long economic stagnation, combined with the decline of hegemony, may just be part of a normal operation of the historic world system. But how is the capitalist world economy itself doing? Is it possible that the whole system is in such deep trouble this time that it may find it impossible to get out of the current trouble? In other words, the capitalist world system has had several crises before and succeeded in getting out of them. The current trouble is a definite downturn. But is it another turn in the normal cycle? Or is there anything that makes this time different from previous periods of trouble?

Wallerstein: That’s the other question, which is crisis. There is a crisis of the capitalist system, that is to say we have the conjuncture of normal downturn processes. What I think of as the fundamental crisis of the system is such that I don’t think the system will be here 20 or 30 years from now. It will have disappeared and been completely replaced by some other kind of world system. The explanation of that I have given a number of times in a number of my writings in the last 30 years is that there are three basic costs of capital which are personnel costs, input costs and taxation costs. Every capitalist has to pay for these three things, which have been rising steadily as a percentage of the price at which you can sell products. They have gotten to a point where they’re too large and the amount of surplus value that you can obtain from production has gotten so squeezed that it isn’t worth it to sensible capitalists. The risks are too great and profits too small. They are looking for alternatives. Other people are looking for other alternatives. For this I use a Prigogine kind of analyses where the system has deviated so far from equilibrium that it cannot be restored to any kind of equilibrium, even temporarily. Therefore, we are in a chaotic situation. Therefore, there is a bifurcation. Therefore, there is a fundamental conflict between which of the two possible alternative outcomes the system will take, inherently unpredictable but very much the issue. We can have a system better than capitalism or we can have a system that is worse than capitalism. The only thing we can’t have is a capitalist system. Now, I have given you a short version of the whole argument.

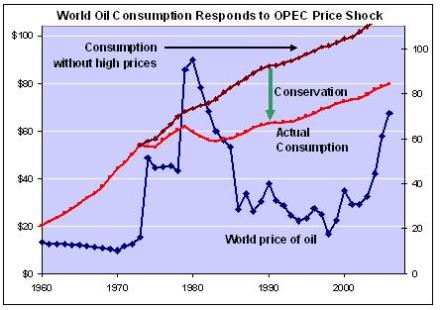

Suh: So, even if the world system as a whole has been on the decline, has been in the B phase, there were also many “dangerous moments,” let’s say, so as not to use the word “crisis,” in the early 1970s, 1980s and 1990s. And each time there were pundits who forecast the end of the system or the end of the capitalist world. But each time the world system found a way out of the difficulties. In the 70s, for example, the capitalist world economy found a way to survive the oil crisis. It found a way out of the difficulties of the 80s and 90s also. From a longer term perspective, the capitalist world economy managed to get out of more serious troubles like the Great Depression or earlier ones in the 19th century. So what is that makes this time different?

Longue Durée Perspective

Wallerstein: You see, this time is a tricky phrase. You’re assuming a collapse is a matter of a year or even a decade, whereas a collapse of a system takes 50, 70, 80 years. That’s the first thing to be said. The second thing to be said is that all of what you’re pointing at are exactly the mechanisms by which you exported unemployment. Basically, the OPEC oil crisis was a mechanism which was very much supported by the United States. Indeed, one could even argue that it was instigated by the United States. We have to remember that the two key governments that pushed for the 1973 oil rise were Saudi Arabia and Iran, then under the Shah of Iran, the most pro-American government in the whole of OPEC. The major consequence of that oil rise and price rise, the first one, was in fact to shift money to the oil-producing countries, which was immediately placed in U.S. banks. It was harder for Europe and for Japan to deal with this than it was for the United States. At which point, I don’t know if you are aware of this, but there were people from the banks, who in the 70s, went on missions to countries all around the world and spoke to the finance ministers and said: “Wouldn’t you like to have a loan, because, after all, you have balance of payment problems that give you political difficulties and we’re very happy to give you a loan. And that will solve your balance of payment problems in the meantime.” Of course, you make some money on the loan. But quite aside from anything else, you create this indebtedness which bursts because loans always have to be paid back.

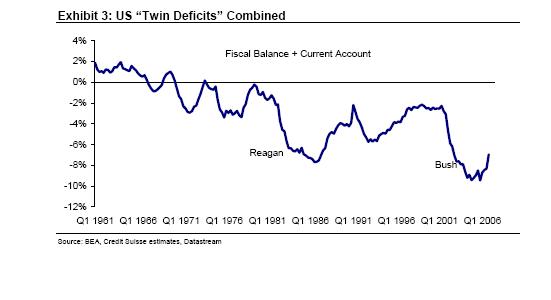

Chronic US Debt

There was the so-called debt crisis, which is often dated at ’82 because of Mexico. I date it at ’80 because, I think, Poland started it. And if you analyze the Polish situation, it was a loan problem of the same kind, and they tried to handle it same way by squeezing the workers who rebelled and so forth. As a result of that, all of these countries got into trouble. So we had to find some other loans. The eighties was the period of the junk bonds. You’re getting this mechanism by which companies are buying up other companies and creating junk bonds and making loads of money. Of course, when that explodes, you have to look for new mechanisms.

The new mechanism is the U.S. government and the U.S. consumer. That is the ’90s and 2000s. That is to say, we get the U.S. government under Bush becoming indebted. You get the consumer becoming highly indebted, which then gives way to a symbiotic relationship with China and a number of other countries, including Korea, who invest their money in treasury bonds. That creates this incredible situation where the U.S. is totally dependent on the loans, but loans have to be repaid at some point. We’re at that point right now. Countries like China — of course, not only China, it’s just the one most talked about, it’s true of Norway, it’s true of Qatar — are in this delicate situation where on the one hand they want to sustain the United States so they continue to buy their products and on the other hand the money that they’ve invested is losing value all the time because it’s in dollars. And the dollar is going down. So, it’s two curves that cross. You’ve got to lose more one way or the other.

Basically, they’re moving slowly out of the dollar and the dollar is collapsing. And that adds more to the collapse of U.S. hegemony because the last two pillars of U.S. hegemony in the first decade of the 21st century have been the dollar, which is now kaput as far as I can tell, and the military is useless.

It’s useless because you have all this magnificent machinery, 10 times more than I don’t know who else and so forth: all these planes, all these bombs and everything that is up to date, but you don‘t have soldiers. Iraq and Afghanistan and everywhere else have proved you’ve got to send in soldiers. You don’t have soldiers because politically it’s impossible in the United States. The last time we used actual American soldiers we got a rebellion called the Vietnam crisis. So, we don’t use soldiers, we use mercenaries. So you buy the services of the poor: blacks, Latinos and rural white youth. That’s what makes up the U.S. Army and Marine Corps. They’re being a little bit overused at the moment, so even they don’t find it good enough to re-enlist. Then there’s the National Guard and those are more middle class types. They never expected to be spending years and years in Iraq, so they don’t re-enlist. So, we have no soldiers. Basically, the U.S. has no soldiers it can send anywhere. All the talk about North Korea, all the talk about Iraq, all the talk about Somalia is nonsense. There are no soldiers and you can’t just bomb them. It doesn’t work. So, we don’t have armed power, suddenly everybody realizes this and everybody is saying we’re not afraid of you because you don’t have any power. You don’t have military power. You’re spending your money on a big machine, but it doesn’t work. You can’t win a war with it. Now that people have suddenly really realized that, the U.S. has nothing to play with.

There it is. It’s got a big financial crisis, the U.S., worst of all, I suppose. The dollar is just one currency among several and one power among others. From the U.S. point of view, we are in a bad situation, which is why we elected Obama. But he’s not going to do any magic. The most he can do is a little bit of social democracy within the United States, which is very nice and I’m all for it. It reduces the pain, but he cannot restore U.S. hegemony in the world and he cannot get us out of the world depression by some magic policy of his own. He doesn’t have that power, but nobody else does. There we are. This is why it’s a chaotic situation that fluctuates wildly. Nobody knows where to put their money. Literally nobody knows where to put their money. It may go up and it may go down. It changes almost daily. It is truly a chaotic situation and it will continue to be that for some time. So, it’s a very unpleasant situation in terms of an ordinary life. A very dangerous one on the individual level and, I suppose, on a collective level. I have a friend who said despite Mumbai, he is going off to India on this trip. I said, “OK.” It is dangerous, every place is dangerous now. What is a non-dangerous place? It used to be that those nice hotels were the non-dangerous places.

Suh: Now, they’re the targets.

Wallerstein: They’re the targets. There’s no way. I mean, so-called terrorists have all the advantage when they can pick the place. There’s no way to defend everything. There’s just no way. You can choose a limited number of places and put up enormous concrete barriers. That’s what the U.S. has done in Baghdad with the green zone. So, you can be relatively safe, but it’s not perfectly safe. People do manage to get even in there. It’s just one unit, if you’re outside that unit then. . .

Suh: What’s different about this time, you suggest, is that we are entering not only a particularly turbulent Kondratieff B phase but we have also entered the terminal crisis of the world economy. If we have been in this terminal stage for some time, what does the current economic crisis do? What does it mean?

A Terminal Crisis of Capitalism?

Wallerstein: It means that the normal mechanisms of getting out of it won’t work any longer. We’ve had this kind of depression before; one in ’29. We’ve had many such depressions: 1873-96 was our Kondratieff B phase, 1873-96 was like this period. There have been many over the last four, five hundred years. The way you get out of it, there are standard modes of getting out of it. The modes of getting out of it aren’t working this time because it’s too hard. The standard modes of getting out of it; one of them is you create a new, productive leading industry, which you monopolize and get high profits and protect it very well, and so forth. You do a little bit of redistribution so that there are markets for these things. So, we’ve gotten out of it before, but it’s not going to be so easy this time. That is to say, there may be an upturn. It’s not impossible that there will be a relative upturn five years from now. It accentuates the problem because the upturn itself is raising the three basic curves, making them higher and higher and higher. There was an analysis done in the physical sciences a long time ago, which showed if a curve moves up towards an asymptote and gets to about 70, 80 percent of the way, at that point what happens is it begins to shake enormously. That’s the analogy. We’re at the 70, 80 percent point on these three essential curves and it is shaking enormously. There are great fluctuations and is very unstable; that is why we talk about being chaotic. But it can’t move up another 10 percent because it’s just too near. We haven’t had that problem before because when the curve was way down here at 20 percent, it worked very well. And you go from 30 to 40 percent, it worked very well. When you get all the way up there, there’s nowhere to go. That’s what the concept of asymptote is. I want to analyze this in terms of percentages of possible sales prices. The whole point is you can’t just expand the amount of money which you demand indefinitely for selling because people don’t want to buy at a certain point, because it’s just too much. And they don‘t.

Does the Obama Administration Offer an Alternative?

Suh: How would you then characterize the Obama administration? It is at least conceivable, theoretically, that he would try to address the three problems that you argue are at the core of the current crisis of the capitalist system: the rising wage cost, the rising input cost and taxation. One of the main reasons for high wage costs in the U.S. is the incredibly expensive health care cost, which significantly increased over the past few decades as the health care industry rode the high tide of neoliberalism. Neoliberalism has reached a point where the unrestrained market is starting to hurt the economy. So Obama is trying to bring in some kind of universal health care, which can potentially contribute to reducing wage costs overall. Also, his ambitious domestic expenditure programs can be seen as an effort to rein in the rising input cost by investing in infrastructure and new technologies. A state-led drive to invest in “green technologies” may be designed not only to reduce environmental externalities that add to the rising input cost, but also to create a new industry that generates a higher profit rate at a lower input cost. The problem of taxation will be evaded by deficit spending. So Obama seems to be trying not only to cure the excesses of neoliberalism but also to address the deeper problems of the world capitalist economy. The question is how successful he can be in accomplishing these goals.

Wallerstein: I don’t think he can attack any of those because I don’t think he has much power on the world scene. It isn’t that the U.S. is a non-entity, but it’s in a situation in which there are eight or ten foci of power and the U.S. options are limited. Look at the meeting of the Rio Group in Brazil. Here we have the first meeting in 200 years, 200 years, of all the Latin American and Caribbean countries, in which the U.S., Canada and the European powers were not invited. Every single head of state came, with two exceptions. Who were the two exceptions? Columbia and Peru — two, currently, mostly pro-American countries. But also, they didn’t boycott it. They sent a number two or number three. Even Mexico came. Of course, Raul Castro was there, who was the hero of this meeting. They took very strong positions and the U.S. was absolutely out in the cold.

Latin American and East Asian Challenges to US Hegemony

Now the U.S. has a plan and there’s another structure called the Summit of the Americas. And that’s met a couple of times and that gets all the heads of state of the Western Hemisphere, except for Cuba. They’re supposed to meet in April in Trinidad and Tobago. I wonder how many heads of state are actually going to show up.

But what Brazilian President Lula da Silva did was he undercut that meeting completely by this other meeting. This was absolutely inconceivable five years ago. Then what’s Obama going to do? He can’t change that. He can’t change the fact that the European Union hailed his victory and said in a unanimously passed resolution “we want to renew our friendship with the United States, but this time not as junior partners.” The picture is very clear. It’s very clear.

Just a couple days ago you had a China, Japan, South Korea meeting asserting what I’ve been arguing for sometime would come, which is a kind of political collaboration of some kind among these three countries — none of which the U.S. wants and none of which Obama can change. He can bless it. He can talk a much more palatable language to the rest of the world, but that doesn’t make the U.S. the leader. He’s still thinking that the U.S. is the leader. He has to be disabused of this idea. Nobody wants the U.S. as the leader; people want the U.S. as a possible collaborator on many things that have to be done like climate change, but not as a leader. I think his hands are tied there in terms of the world economy. What he can do is what everybody else can do, which is use the state machinery at home to do social democratic things to keep from having an uprising nationally.

Everybody is worried about that in the United States, in China, in South Africa, in Germany. Everybody is worried that they’re going to have something like what happened recently in Greece — a spontaneous uprising of angry people. That’s very hard for governments to deal with. When people are a little bit angry, which is what is basically happening now, they get even angrier. All the governments are trying to appease them. OK, fine. That’s what he can do. He will do things domestically. He will spend money on building bridges, which gives jobs. He will try to get a new health program through that will cover people. All good things, but they’re national things, they’re local things. They’re the same kind of good things that other leaders are trying to do in their countries. If he recognizes his limitations, he could be a great success. If he doesn’t recognize his limitations, he could be dragged into something.

I just wrote a piece on Pakistan; I called it “Pakistan: Obama’s Nightmare.” There ain’t nothing he can do about Pakistan. We’ve done enough damage already and if he tries to do any more… but he’s been very reckless. Part of his business of getting elected is to show “I’m a tough guy, too.” So he made statements about Afghanistan, which he can’t carry through on. He made statements about Pakistan he can’t carry through on. He made statements on Israel-Palestine he can’t carry through on. He should stop making statements. He should start, how shall I say, lowering the rhetoric. There’ll be all sorts of people who tell him that’s not what he should do, but I’m telling him that is what he should do.

Suh: We are now witnessing a very different world. The dollar, which has served as the world’s currency since the Bretton Woods system and survived the 1970s crisis, is significantly weak. It is facing the challenges of other currencies, particularly the Euro and the Japanese yen, that are vying to become the next global currency. The financial crisis fundamentally shook faith in the dollar, and some even suggest that it has already collapsed as the world currency. On the other hand, the U.S. maintains unchallenged military power and spends a disproportionate amount on keeping up its military dominance. Washington spends on its military as much as the rest of the world combined. And yet, U.S. military power, however technically sophisticated it may be, has proven to be rather ineffective, even useless, in theaters like Iraq and Afghanistan. All in all, the two main pillars of U.S. hegemony have been shaken to the core. How do these changes affect the geopolitical cleavages?

Regional Alternaives

Wallerstein: Ah, well, yes. That’s a reasonable question. As I see it now, there are maybe eight or ten foci of geopolitical power in the world. And that’s too many. All of them will start trying to make deals with each other and see what kind of arrangements are optimal because with 10, none of them have enough power. So, we’re in for a juggling period. People will try out possibilities and see what they can do. For example, I see the Shanghai Cooperation Organization as one possible combination, but Russia is not sure how it feels about it, India is not sure how it feels about it, and maybe even China is not sure how it feels about it. OK, maybe Russia and China both are playing footsie with Brazil and Latin America to see if they can arrange things. The United States can play that game too. We are in a period of, how shall I say, without clarity. I have long argued that the likely combination, I argued this as early as the article I wrote in 1980, is an East Asian combo with the United States, Europe with Russia, with India not sure where it wants to go.

Suh: One of the cleavages you talked about in your writing is the divide between the Davos Forum and the World Social Forum. Of course, these are not cleavages in geographical terms.

Wallerstein: That’s right. It’s a political cleavage.

Suh: Political cleavages and cleavages in terms of differing political visions.

Davos and Porto Alegre: the shape of the future?

Wallerstein: This has to do with the real crisis. If, as I say, we’re in a period of bifurcation, which means two possible solutions, then Davos represents one possible solution and Porto Alegre the other possible solution, with total uncertainty as to who will win out, but obviously, very different visions. The important thing, which I insist on, is that the people in Davos not try to restore capitalism. They’re trying to find an alternative, that is, how shall I say, which maintains the principles, the inequality, hierarchy, and so forth. We can have another system other than capitalism that does that. The Porto Alegre thrust is for a relatively democratic, relatively egalitarian system. Neither side has a clear image in its own mind what kind of structure this would require. Neither side is totally unified. That is to say, I see the Davos camp split between those who have a slightly longer range vision and those who are only worried about the next three years, and they go in different directions. Porto Alegre is totally unsure of what kind of system this other world that they’re talking about would be. And they are particularly unsure of what kind of strategy they would use to get there. Basically, the next five or 10 years, there’s something going on in the camp of Davos; I call it “the spirit of Davos,” although I don’t mean literally “Davos.” There’s something going on in the camp of “the spirit of Porto Alegre.” At this point I don’t know how it’s going to come out. That is, who is going to have the clearer strategy and what it is, and so forth. So in that sense, we’re in a period of great uncertainty as to what will happen. And that may determine, if one side or the other has a better strategy or clear vision that may win out.

Suh: You’ve suggested that we’re in the terminal stages of the world capitalist economy. Then, those who talk about how to save the current financial crisis or how to institute an oversight mechanism for financial transactions across the border are, in a way, trying to hold on to a system that’s dying out. They are trying to lengthen the life of the dying system with some kind of life support. Their debate is about what the best life support system is, for example whether a bailout of $5 billion or $10 billion is more efficient. But the real competition is about a new historical world system that will eventually replace the current world capitalist economy. Here you have two camps envisioning different worlds, competing to articulate their visions, and struggling to chart new possibilities. One of them wants to create a world system that would more or less replicate the current uneven distribution of power and production in a different way. This world could be based on a developmental role and regulative function of the state and an oversight management role of international institutions that will help to more effectively address the systemic problems of today’s world. The other camp, however, envisions a different world that is more democratic and egalitarian. This is a collection of divergent ideas and visions, but there seems to be a growing convergence on the importance of empowering the local in a way that frees it from the commodification of life. There are many experiments that seek to find a way to free the people and nature from the chains of commodification, and yet free them from the tyranny of parochialism by networking local communities in a mutually reinforcing and mutually nourishing way.

Wallerstein: Well, you know, that’s what people are debating. They’re debating very much what an egalitarian world means. For example, one of the things that is under much debate in the world left for the last 200 years has been Jacobinism. Therefore, it has been basically not only for a state oriented policy but for a homogenizing outcome, like everybody should be the same. We should transform people into the same kind of person. That’s what they’ve been trying to do. That’s what the French Revolution was trying to do. That’s what the Russian Revolution was trying to do. That’s what the Chinese Revolution was trying to do. Now, that Jacobin vision has been called into severe question. There are people who say, I don’t know, we want to allow the flourishing of multiple cultures. Exactly what does that mean?

I’ve argued what makes sense is a two-pronged strategy. On the one hand, always struggle for the lesser evil in the very, very short run because people live in the very short run and they don’t want to postpone to 10 years from now or 20 years from now what needs to be done today. And there’s always a lesser evil. You have to, at the same time, keep your eye on the larger ball of the new kind of world you want to construct, and that’s a matter of constant discussion, negotiation, integration of visions.

Suh: Thank you so much.

Immanuel Wallerstein is a sociologist known for his work as a historical social scientist and world-systems analyst. He is currently a senior research scholar with Yale’s Sociology department. He received the Career of Distinguished Scholarship Award from the American Sociological Association in 2003. He is the author of the three volume series The Modern World-System, his most well-known work, and Historical Capitalism (Verso 1995); The Decline of American Power: The U.S. in a Chaotic World (New Press 2003) and European Universalism: The Rhetoric of Power (New Press 2006).

Jae-Jung Suh is a professor of International Relations at Johns Hopkins and an expert on the international relations of the Korean Peninsula. He is the author of Power, Interest and Identity in Military Alliances.

The Hankyoreh is publishing a series of interviews with foreign scholars examining issues of economic growth and social welfare, international trade and monetary order, the environment and social development, income distribution, and production and consumption.

This interview appeared at The Hankyoreh on January 8, 2009.

Link to the English language homepage of The Hankyoreh.

http://www.hani.co.kr/arti/society/society_general/330706.html (01/01/2009

– newspaper version in Korean)

http://www.hani.co.kr/arti/society/society_general/330710.html (01/01/2009

– full text version in internet)

http://english.hani.co.kr/arti/english_edition/e_national/332037.html

( full text version in english)

This slightly edited version of the interview, one of a series of reports on the economic crisis in the Asia Pacific, is published at Japan Focus on January 8, 2009.

Recommended Citation: Immanuel Wallerstein and Jae-Jung Suh, “Capitalism’s Demise?” The Asia-Pacific Journal, 2-1-09, January 8, 2009.

![Capitalism’s Demise? [Korean translation available]](https://apjjf.org/wp-content/uploads/2023/11/iw.suh_.jpg)