After Kyoto: Japanese firms rush to cash in on gas emission reductions

By Hisane MASAKI

TOKYO – Japanese businesses are on an investment spree of greenhouse-gas reduction projects abroad, especially in Asia, as the nation is in hot water over its target for slashing emissions of such gases under the Kyoto Protocol on global warming.

The “credits” these firms earn in return for gas-reduction investments in developing countries can be counted as cuts in their own emissions – and in turn, for Japan – under a system called the Clean Development Mechanism (CDM), one of three Kyoto mechanisms introduced under the protocol to help industrialized countries meet their reduction targets. Developing nations that take part can receive technology transfers from their industrialized partners.

The two other mechanisms are the Joint Implementation (JI) and international emissions trading. JI is a scheme similar to CDM but it covers gas-reduction projects in industrialized countries that can afford to cut more gases than required by the protocol, such as Russia and some former Soviet republics. In international emissions trading, greenhouse-gas emission credits are traded.

The Ministry of Economy, Trade and Industry (METI) and the Environment Ministry have supported CDM projects conducted by Japanese companies and approved by the government. As of February 7, the government had approved a total of 41 CDM and JI projects since the end of 2002; almost all the approved projects are in the CDM category.

The number of CDM projects approved by the government has been rising sharply since the Kyoto Protocol entered into force on February 16, 2005. And the number has been growing at an accelerated pace in recent months. More than half of the 41 projects approved by the government – 22 – have been approved since October. Of those, 13 are CDM projects in Asian countries, including Malaysia, India, South Korea, Indonesia, China and Vietnam. Some of the projects approved so far by the government have already been registered with the United Nations’ CDM executive board, which screens and approves CDM projects.

At an international conference in Montreal in December, delegates finalized a rule book for implementing the Kyoto Protocol, including CDM and other mechanisms, formally making it fully operational after years of negotiations and ratification. Taking their cue from the agreements reached at the Montreal conference, Japanese firms are expected to step up investment in CDM projects.

Meanwhile, the Japanese government this month approved bills to revise two laws for submission to and approval by the diet (parliament) to make full-scale use of the CDM and other Kyoto mechanisms starting in fiscal 2006. Under the revised laws, the government-affiliated New Energy and Industrial Technology Development Organization (NEDO) will engage in efforts to acquire greenhouse-gas emission credits abroad. The credit-purchase expenses will come from the government’s special oil account. The government earmarked 5.4 billion yen (US$45.9 million) in the fiscal 2006 budget plan, now pending in the diet, for purchasing credits.

Firm commitment

The Kyoto Protocol entered into force more than seven years after it was adopted at the third Conference of Parties to the UN Framework Convention on Climate Change, or COP3, in the ancient Japanese capital in late 1997. Under the protocol, industrialized countries must reduce their emissions of carbon dioxide and several other greenhouse gases, widely blamed for the warming of Earth, by an average of 5.2% from 1990 levels during the first commitment period of 2008-12. The protocol sets separate gas-reduction targets for individual industrialized countries – 6% in Japan’s case.

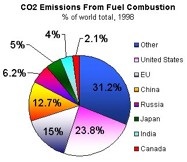

The Kyoto Protocol’s effectiveness is in doubt since the United States, the world’s largest emitter of greenhouse gases, withdrew from the pact in early 2001, and China, the second-biggest emitter, is classified as a developing country and therefore exempt from the reduction requirement. Australia followed the US lead by opting out of the protocol.

The 1997 Kyoto agreement set gas-reduction targets for its first commitment period of 2008-12. Only industrialized countries are bound by them. In December, COP11 and the first meeting of parties to the Kyoto Protocol (MOP1) were held in Montreal. The focus was how to secure the involvement of the US and the developing countries refusing to accept binding targets for the post-2012 second phase. In the end, delegates agreed to set up a “dialogue” on steps to combat global warming that includes the US and developing countries. Industrialized countries, meanwhile, promised to work out post-Kyoto targets. The agreement was reached only after the text was watered down to accommodate the positions of the US and developing nations. The final text says the dialogue forum “will not open any negotiations leading to new commitments”.

Still, the Montreal agreements, which were reached amid strong pressure from thousands of members of environmental and citizens’ groups who flocked to the conference, have been widely seen as a significant step forward. The alarming effects of harmful climate changes have become clear; for example, many see rising global temperatures and violent hurricanes such as Katrina as manifestations of global warming, although it is not possible conclusively to attribute any single adverse weather event to the phenomenon.

Japan joined the first ministerial meeting of what is widely seen as the Kyoto Protocol’s US-led rival, the Asia-Pacific Partnership on Clean Development and Climate, in Sydney last month. The Sydney powwow brought together politicians and industrialists from Australia, China, India, Japan, South Korea and the US. The partnership aims to develop and promote technologies such as “clean coal” and nuclear and renewable energy. It involves four of the world’s top five coal-producing countries, which all depend heavily on that fuel for their domestic energy. Environmental groups criticize the partnership as emasculating the Kyoto Protocol and being merely a business deal between producers and consumers of coal and uranium.

Japan has a foot in both camps, but remains firmly committed to the Kyoto Protocol. There has been a strongly shared feeling among many Japanese that as the country where the protocol was born, Japan has a special mission to keep the pact afloat and rally international efforts to build on it toward the common goal of saving Earth. Even many Japanese businesses have come to realize the risks of losing their competitiveness in the global markets if they lag in prevention of global warming and energy-saving technological development.

Uphill battle

Despite its commitment to the Kyoto Protocol, however, Japan’s gas emissions are on the rise. Although Japan must cut its emissions of carbon dioxide and other greenhouse gases to 6% below the 1990 levels, emissions have actually risen by more than 8% since 1990.

Resource-poor Japan, which imports almost all of its oil, made strenuous energy-saving efforts and technological innovation since the two oil crises of the 1970s, making it the most energy-efficient in the industrialized world. As a result, it faces great difficulties in making further dents in greenhouse-gas emissions through domestic measures alone, such as further energy-saving efforts and carbon “sink” plantation projects. According to one estimate, it costs Japan about $110 to eliminate a ton of carbon dioxide, compared with about $80 for Europe and $50 for the US, on average.

Although the Environment Ministry has tenaciously pushed for the introduction of an environment tax on fossil fuels – which would be equivalent to 1.5 yen per liter in the case of gasoline – METI and domestic industry have opposed the idea, claiming that any such extra tax burden would erode corporate Japan’s international competitiveness. Therefore, the government and businesses are increasingly turning to the Kyoto mechanisms as attractive means to reach the reduction target at a lower cost while maintaining international competitiveness.

New horizon

Many Japanese companies not only feel the necessity to hedge against future risks but also see new – and potentially lucrative – business opportunities in CDM, since demand for the right to emit greenhouse gases is growing. Firms that earn greenhouse-gas emission credits through CDM projects abroad can count them in their reduction efforts, and surplus credits can be sold through an emissions transaction on the market. If credits start being traded as a commodity such as gold and soybeans, analysts predict a huge market could emerge. Firms that buy cheap credits and then sell them off at a higher price would reap profits.

The global emissions-trading market is expected to top $222 billion by 2010 and eventually reach $854 billion. The 25-nation European Union established the world’s first multilateral emissions-trading market in January last year. In Japan, an emissions-trading market will be introduced on a trial basis this year. The Environment Ministry has set up Japan’s Voluntary Emissions Trading Scheme (J-VETS). It will start operation in April, with emission allowances allotted to each participant and participants allowed to trade allowances. Asia Carbon International BV, a major emissions-trading broker headquartered in the Netherlands, reportedly plans to open an emissions exchange in Tokyo as early as this summer in cooperation with Japanese firms.

Energy-related firms such as electric-power, oil and gas companies are not alone in rushing to gas-reduction projects abroad. Major Japanese trading firms are also intent on cashing in on the new business bonanza.

Marubeni Corp, for example, joined a comprehensive business alliance in November with Britain’s ICECAP, one of the largest private-sector providers of emission credits in the emissions-trading markets. Mitsui & Co signed a contract to set up a joint venture with a firm in Chile in November to implement greenhouse-gas-reduction projects. A gas-reduction joint project in India between Sumitomo Corp and a British firm in India was registered with the CDM executive board early last year as the first Japanese government-approved project to be included in the board’s list.

Manufacturing firms are also making inroads into the gas-reduction market abroad. Matsushita Electric Industrial Co, for example, has had three projects in Malaysia approved by the Japanese government as CDM projects this month alone.

Thriving funds

There are three ways to acquire greenhouse-gas emission credits: participation in CDM projects, participation in funds, and participation in trading. Among the three, acquiring credits through funds is becoming particularly popular in Japan, as project-hosting countries tend to prefer large-scale customers and it is becoming difficult for individual Japanese businesses to strike deals there.

The World Bank set up the Prototype Carbon Fund (PCF) in January 2000. It has since set up two other funds, the Bio Carbon Fund (BCF) and the Community Development Carbon Fund (CDCF). In Japan, Natsource Japan plays a leading role in credit transactions, as well as advisory services, including feasibility studies of greenhouse-gas mitigation projects, the development of corporate risk management strategies and the design of emissions-trading schemes. Natsource Japan was created in May 2001 as a joint venture between several Japanese firms and Natsource LLC, a New York-based energy and environment solution provider.

Last February, Natsource launched the Greenhouse Gas Credit Aggregation Pool. GG-CAP is the world’s first operational private-sector mechanism designed to help firms and governments manage their greenhouse-gas compliance requirements. GG-CAP purchases and manages the delivery of a large pool of gas-emission reductions that GG-CAP buyers can use to comply with the EU’s emissions-trading scheme and the Kyoto Protocol’s emission-reduction requirements. Participants in GG-CAP’s closing at the end of September comprise 26 companies, including nine from Japan. The amount of money committed by the participants exceeded $550 million.

In late 2004, two government-affiliated banks and more than 30 private firms established the Japan Greenhouse Gas Reduction Fund (JGRF). The two banks and several major fund investors also set up Japan Carbon Finance Ltd (JCF), Asia’s first greenhouse-gas reduction fund. JCF uses the funds from JGRF – totaling about $140 million – to develop greenhouse-gas reduction projects and purchase gas-emission credits.

China and India

Among developing countries, China and India, the world’s two most populous nations and emerging economic powers, are probably the most attractive CDM investment destinations.

China is the world’s second-largest emitter of carbon dioxide. Although China, like other developing countries, is adamantly opposed to accepting legally binding greenhouse-gas reduction targets, it has become enthusiastic about energy saving and environmental protection as it faces both serious energy shortages to feed its high-flying economy and monumental problems of environmental degradation. India is the fifth-largest emitter of carbon dioxide after the US, China, Russia and Japan.

Some Japanese firms have already embarked on CDM projects in China and India.

In China, JCF has signed an emission reduction purchase agreement (ERPA) with Shanxi Jincheng Anthracite Mining Group Co Ltd (JMC), a major coal-mine development company, to acquire greenhouse-gas emission reductions generated from its Coal Mine Methane Power Generation Project. This agreement was the first ERPA signed by JCF and a Chinese company. From now to 2012, JCF will purchase greenhouse-gas emission reductions equivalent to about 2 million tons of carbon dioxide generated from the project.

Another gas-reduction project being carried out by JGC Corp, Marubeni Corp and Daioh Construction, was approved by the Chinese government as a CDM project in late November, after approval by the Japanese government. The project involves the recovery and decomposition of the global-warming gas HFC23 emitted by Zhejiang Juha’s HFC (hydro-fluorocarbon) production plant in Chuchou, Zhejiang, China. The aim of the project is to acquire greenhouse-gas credits equivalent to 40 million tons of carbon dioxide over seven years. This is China’s first large-scale CDM business.

Mitsui & Co signed a contract with Tiefa Coal Mining Group in China’s Liaoning province, in late December to collect methane generated at Tiefa’s coal mines. Mitsui & Co plans to acquire greenhouse-gas emission credits equivalent to about 3.5 million tons of carbon dioxide by 2012 and sell them primarily to Japanese steel and electric-power companies. Mitsui & Co plans to register the CDM project with the CDM executive board around April after getting approval from the Japanese and Chinese governments.

Meanwhile, JCF has signed an ERPA with Enercon India Ltd (EIL), a major manufacturer of wind power generators in India, to acquire greenhouse-gas emission reductions generated from its Bundled Wind Power Project. JCF will purchase greenhouse-gas emission reductions equivalent to about 2 million tons of carbon dioxide generated from the project by 2012. JCF and Indian Farmers Fertiliser Cooperative Ltd (IFFCO), India’s largest fertilizer producer, have also signed an ERPA for carbon credits generated by improving energy efficiency at IFFCO plants.

Hisane Masaki is a Tokyo-based journalist, commentator and scholar on international politics and economics. Masaki’s e-mail address is [email protected].

This is slightly abbreviated from a February 16 article in Asia Times. Posted at Japan Focus on February 16, 2006.