Toward a Global Green Recovery: The G20 and the Asia-Pacific Region

Edward B. Barbier

The green policy response

A unique feature of the global policy response to the 2008-9 recession is that, as part of their efforts to boost aggregate demand and growth, some governments adopted expansionary policies that also incorporated a sizable “green fiscal” component. Such measures were wide ranging, including support for renewable energy, carbon capture and sequestration, energy efficiency, public transport and rail, and improving electrical grid transmission, as well as other public investments and incentives aimed at environmental protection.

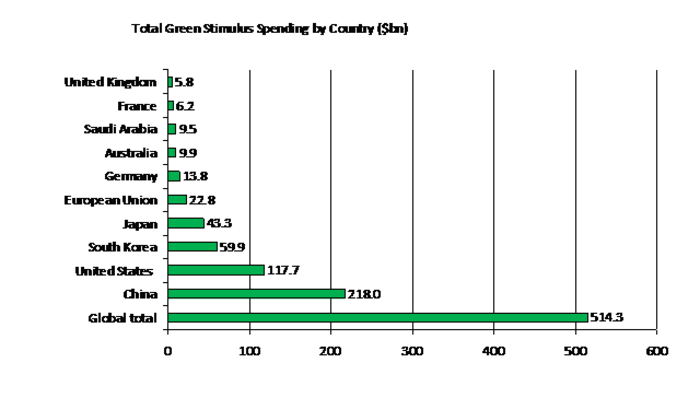

Of the $3.3 trillion allocated worldwide to fiscal stimulus over 2008-9, $522 billion was devoted to such green expenditures or tax breaks (Robins et al. 2009 and 2010). Almost the entire global green stimulus was by the G20, which comprise the world’s twenty largest and richest countries.1

As Figure 1 indicates, the United States and China accounted for over two thirds of the global expenditure on green fiscal stimulus during 2008-9. The world’s largest economy, the European Union, contributed substantially less to the global total. Total green spending by all of Europe totaled only $57 billion; in contrast, the Asia Pacific region spent $342 billion (Robins et al. 2010). The governments of key European economies, such as France, Germany, and the United Kingdom, spent much less on clean energy and other environmental investments than the major Asia-Pacific economies, Japan and South Korea. Several G20 governments did not commit any, or very little, funds to green stimulus, including the large emerging market economies of Brazil, India and Russia.

Figure 1. Global Green Stimulus Spending, from September 2008 through December 2009

Source: Barbier (2010); Robins et al. (2009); Robins et al. (2010).

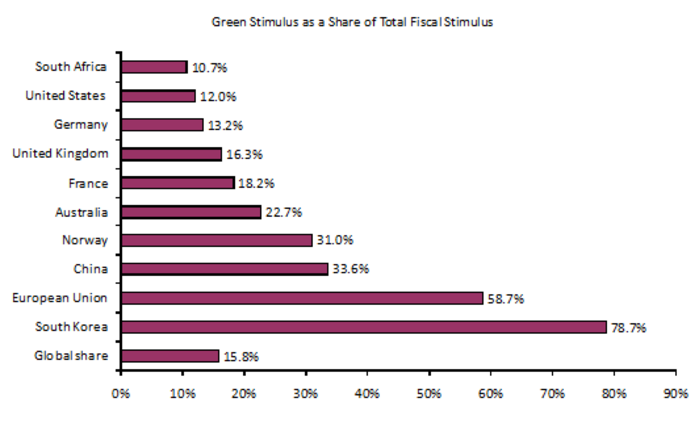

As shown in Figure 2, green measures and investments amounted globally to around 16% of all fiscal stimulus spending during the recession. However, only a handful of economies devoted a substantial amount of their total fiscal spending to green initiatives. The most notable is South Korea, which allocated nearly 80% of its total expenditure to green investments. China apportioned around a third of its total fiscal spending to green measures. Around 60% of the European Union’s fiscal stimulus was for green investments, but as indicated in Figure 1, the overall size of this investment was relatively small. In comparison, whereas the United States’ total expenditure on green stimulus was large, it comprised only 12% of total fiscal spending. Overall, most G20 governments were cautious as to how much of their stimulus spending was allocated to low-carbon and other environmental investments during the 2008-9 recession.

Figure 2. Green Stimulus as a Share of Total Fiscal Stimulus, from September 2008 through December 2009

Source: Barbier (2010); Robins et al. (2009); Robins et al. (2010).

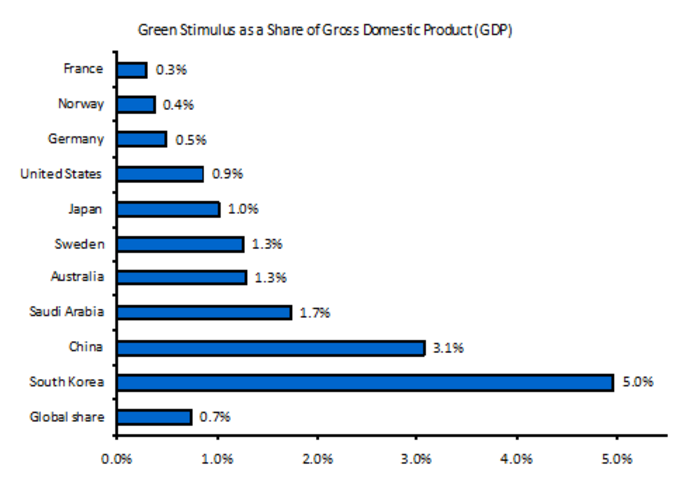

Perhaps most revealing, however, was the share of green stimulus measures in gross domestic product (GDP), as illustrated in Figure 3. Very few governments spent 1% or more of GDP on green investments during the recession. With the exception of Sweden, all these countries were from the Asia-Pacific region. Large-scale green stimulus programs, such as the 5% of GDP planned by South Korea and the 3% by China, were the exception rather than the norm. The United States spent 0.9% of GDP on green stimulus, more than the global average, but the European Union spent only 0.2% of GDP.

Figure 3. Green Stimulus as a Share of GDP, from September 2008 through December 2009

Source: Barbier (2010); Robins et al. (2009); Robins et al. (2010).

Why green stimulus measures are not enough

However, relying on green stimulus alone is not enough to instigate a global “green” recovery (Barbier 2009 and 2010a).

Fossil fuel subsidies and other market distortions, as well as the lack of effective environmental pricing policies and regulations, will diminish the impacts of G20 green stimulus investments on long-term investment and job creation in green sectors. Without correcting existing market and policy distortions that underprice the use of natural resources, contribute to environmental degradation and worsen carbon dependency, public investments to stimulate clean energy and other green sectors in the economy will be overwhelmed by counter trends that result in rising emissions. The failure to implement and coordinate green stimulus measures across all G20 economies also limits their effectiveness in “greening” the global economy.

Finally, the G20 has devoted little effort to assisting developing economies that have faced worsening poverty and environmental degradation as a result of the global recession. Nor has it taken a leadership role in facilitating negotiations towards a new global climate change agreement to replace the Kyoto Treaty that will expire in 2012.

In sum, more than ever, the world needs a global green recovery, and it needs the G20 to implement and coordinate this strategy.

The need for a global green recovery

There are several reasons why such a worldwide policy initiative is urgent.

First, the global recession will not diminish the costs of climate change and energy insecurity. The 2008-9 recession was preceded by a surge in global energy prices, with the price of oil reaching $150 a barrel in July 2008. Due to rising energy costs, prices for food traded internationally increased almost 60% during the first half of 2008, with basic staples such as grains and oilseeds showing the largest increases.

The International Energy Agency (IEA 2008) estimates that, once growth resumes, fossil fuel demand will rise by 45%, and the oil price could reach $180 per barrel. The remaining oil reserves will be concentrated in fewer countries, the risk of oil supply disruptions will rise and oil supply capacity will fall short of demand growth. Greenhouse gas (GHG) emissions are likely to increase by 45% to 41 gigatonnes (Gt) in 2030. If atmospheric concentrations of GHG lead to 5-6°C warming, GDP could fall by 5-10% globally, and by more than 10% in developing economies (Stern 2007).

Second, the right mix of investments and policies today could not only reduce carbon dependency and improve the environment, but also create jobs and stimulate innovation and growth in key economic sectors.

But perhaps the most important contribution of a green recovery to the world economy is that it may help alleviate global imbalances (Barbier 2010a and 2010b). A global green recovery strategy of reducing carbon dependency and improving energy security may help to control both the large current account deficits incurred by major oil-importing economies, such as the United States, or even smaller economies that are facing chronic debt crises, such as Greece, Portugal and Spain. Globally, such a strategy would also reduce the trade surpluses of fossil fuel exporting economies.

Is the Asia-Pacific region taking the lead?

Certainly, the recovery policies adopted by China and South Korea reflect the belief that investments in clean energy technologies can have a major impact on growth, expanding exports, and creating employment.

For example, one reason that China has adopted green fiscal measures is that its renewable energy sector already has a value of nearly U$17 billion and employs close to 1 million workers. Other green initiatives included promoting fuel-efficient vehicles, rail transport, electricity grid improvements, and pollution control. China has also raised taxes on gasoline and diesel and reduced the sales tax on more fuel-efficient vehicles. In addition, China is the world’s largest recipient of carbon emission reduction credits under the Clean Development Mechanism (CDM), currently earning US$2 billion from these credits. Overall, China views promotion of green sectors as sound industrial policy; it aims to be the world market leader in solar panels, wind turbines, fuel-efficient cars, and other clean energy industries.

South Korea is also tieing its industrial strategy to green growth. In addition to the Green New Deal, the South Korean government plans to establish a US$72.2 million renewable energy fund to attract private investment in solar, wind and hydroelectric power projects. In July 2009, South Korea launched a five-year Green Growth Investment Plan, spending an additional US$60 billion on reducing carbon dependency and environmental improvements, with the aim of creating 1.5-1.8 million jobs and boosting economic growth through 2020.

Although the role of any sustained global green recovery in reducing the chronic trade surpluses in Asian and other emerging market economies is more complex, a necessary step will be to rebalance the pattern of economic growth in these economies to absorb more of their savings domestically. Most policy prescriptions advocate moderating the excessive reliance on exports and export-promoting investments, and instead expand imports of capital goods for key sectors with future growth potential and shifting industrial output structure away from labor-intensive goods to skill-, capital- and technology-intensive production (Cline 2009; Feldstein 2008; Park and Shin 2009). Such an approach may actually be helped by key elements in a global green recovery strategy (Barbier 2010a and 2010b).

In contrast to the apparent commitments of South Korea, China and the Asia-Pacific region generally, the highly publicized “green” policies the United States enacted during the 2008-9 recession look less substantial. For example, the February 2009 US$787 billion American Recovery and Reinvestment Act included around US$78.5 billion to retrofit buildings, expand mass transit and freight rail, construct a “smart” electrical grid transmission system and expand renewable energy supply. It was suggested that these green stimulus measures could create up to 2 million new jobs over the next few years. However, the original plan called for a comprehensive cap-and-trade system to limit CO2 emissions and the removal of fossil fuel subsidies to finance and improve the effectiveness of green sector investments (Podesta et al. 2007). So far, these important policies have failed to materialize, and without them, the current stimulus to private investment and job creation in green sectors may be largely temporary.

Unfortunately, such an outcome could be the norm. Without additional policy measures, some of the recent upsurge in global green spending by the G20, including its Asia-Pacific members, will ultimately go to waste: its impact on long-term investment and job creation in green sectors will be countered by ongoing fossil fuel subsidies and other market distortions, as well as the lack of effective environmental pricing policies and regulations (Barbier 2010a; Strand and Toman 2010). For example, many clean energy investments are still too costly compared to conventional energy sources. Fossil fuel subsidies further distort this cost competitiveness. The lack of policies and regulations to include the costs of carbon emissions and pollution also artificially lowers the market price of using conventional energy. Evidence from the United States suggests that such “direct emission” policies are critical for spurring private investment and inducing technological change in clean energy sectors (Goulder 2004).

Perhaps the biggest failing is that neither the G20 nor its Asia-Pacific members have promoted a green recovery globally. Compared to domestic fiscal spending, the G20 has devoted less effort to reducing the economic and environmental vulnerability of the world’s poor. As a result of the food and fuel crises preceeding the 2008-9 recession, the annual cost of lifting the incomes of all of the poor to the poverty line rose by $38 billion or 0.5 percent of developing country GDP (World Bank 2009). Aid flows for improved water and sanitation would need to double, rising by US$3.6 to US$4 billion annually, to bring within reach the Millennium Development Goal of halving the proportion of the population without these services by 2015 (UNDP 2006). Nearly $15 billion in development assistance is required by developing countries if they are to adopt hybrid and alternative fuel vehicles, improve the efficiency of all motorized transport and develop second-generation biofuels (UNFCCC 2007). To adapt to the impacts of climate change, developing countries are estimated to need around $15 to $30 billion in additional development assistance from 2010 to 2020 (Project Catalyst 2009).

The continuing stalemate on climate negotiations before and after Copenhagen is also a failure of global governance by the G20. By not taking a leadership role in facilitating international talks to replace the Kyoto Treaty that expires in 2012, the G20 is prolonging the uncertainty over future global climate policy. The delay caused by inaction increases sharply the costs of an agreement to reduce global greenhouse gas emissions and puts at risk the global financing of carbon-reducing projects and clean energy investments in developing economies.

The Toronto G20 summit of 26-27 June 2010 was also notable more for its emphasis on reducing deficits and long-term debt than in promoting a global green strategy. For example, the Summit Declaration stated that “advanced economies have committed to fiscal plans that will at least halve deficits by 2013 and stabilize or reduce government debt-to-GDP ratios by 2016.” Moreover, as an example of the new policy commitment the G20 Summit Declaration states: “Recognizing the circumstances of Japan, we welcome the Japanese government’s fiscal consolidation plan announced recently with their growth strategy.” No mention is made in the Leaders’ Declaration of the green stimulus packages and growth strategies adopted by South Korea, China, Japan and other Asia-Pacific members.2

The Asia-Pacific paradox

Thus the Asia-Pacific region’s approach to a global green recovery appears paradoxical.

On the one hand, as described previously, the major Asia-Pacific economies, led by South Korea and China, have adopted recovery policies that promote investments in clean energy technologies as the way to sustain growth, expand exports, and create employment. Such a “green growth” strategy has featured prominently in their policy response to the 2008-9 recession.

On the other, the Asia-Pacific members of the G20, which include some of the same economies that have adopted strong national green growth strategies, have failed to use any political leverage they might have at the G20 to promote a green recovery globally. The failure of the Asia-Pacific region to lead on global green governance issues is now notorious. At the 2009 Copenhagen climate convention, there are even accusations that China “wrecked” a climate change deal.3

What are the reasons for this Asia-Pacific paradox concerning a global green recovery?

One possible explanation focuses on the reluctance of Asian economies, even China that has emerged as a global economic superpower, to take on any prominent global governance role. As summarized by Gu et al. (2008, pp. 280-281), for example, China’s failure to take a more assertive global policy role reflects “the collective mentality of a country anxious not to make the world afraid of it, while it pursues a pathway of rapid economic development”, which includes any “implications for securing resources and energy”. Viewed in this way, China and other Asian-Pacific emerging economies are likely to pursue national green growth strategies as a way of reassuring the West about its overall development strategy, especially with regard to global energy and resource use. At the same time, China and other Asian economies are less willing to assume a greater global governance role because it “may give rise to misunderstandings and exacerbate the tensions created by the shifting balance of global power” (Gu et al. 2008, p. 282).

A second reason is that China, India and other emerging Asian economies remain uncomfortable with the global environmental agenda that has largely been defined by the developed nations. As pointed out by Kaplinsky and Messner (2008, pp. 201-202), “the huge natural resource hunger and energy needs of China and India will in the future serve to place the issue of sustainability squarely back on the agenda of global politics and development policies”, and as a result, “the flip side of the discussion on sustainability and global climate change is the renaissance of geo-economics and geo-politics: competition between the ‘old’ and ‘new’ global powers for energy and resources in Africa, Latin America, Central Asia and Russia. Pushing for a global green recovery agenda may therefore focus more attention, rather than less, on the growing demand and use of global energy and resources by the Asia-Pacific Region.

For these reasons, the natural tendency for Asia-Pacific economies is to stress the domestic economic development benefits of a green recovery and growth strategy rather than the need for better global governance and international policies to ensure economic sustainability and combat global climate change. For example, Richerzhagen and Scholz (2008) have noted that, for some time, China has been pursuing energy efficiency and clean energy strategy, but this has been motivated less by its concern over global climate than by the perceived economic benefits gained through decreasing costs, enhancing energy security and promoting growth.

Promoting a global strategy

However, there are several reasons why the Asia-Pacific members of the G20 should use their considerable influence to urge the entire G20 to promote a global green recovery.

For one, a global green recovery is one area of potential great complementary interests among all G20 economies, which could prove to have additional lasting benefits in terms of promoting global economic cooperation. As pointed out by Gu et al. (2008, p. 288), “it would be important to identify global governance arenas characterized by level playing fields (like the WTO) and converging or at least complementary interests between China and Western countries, to make rapid progress in reducing mistrust and bringing forward cooperative patterns of interaction.”

But equally important are the multiple global economic benefits that could arise from concerted action by the G20, both within their economies and through assistance to developing economies.

With the right policies supporting it, green spending can be effective. It has been estimated that every $1 billion invested in energy efficiency and clean energy in the US could eventually generate energy savings of $450 million per year, reduce annual GHG emissions by 592,600 tons by 2020, and lead to approximately 30,000 job-years – a 20% increase in job creation over more traditional fiscal stimulus measures such as income tax cuts or road building (Houser et al. 2008). In China, every $1 billion of public green investment is expected to increase household consumption by $61 million and tax revenues by $10 million, with 42,000 new jobs created (UNEP 2009).

In developing economies, every $1 invested in improving the energy efficiency of electricity generation saves more than $3 in operating costs (ESCAP 2008). Small hydropower, biomass and solar photovoltaics (PV) already provide electricity, heat, water pumping and other power for tens of millions of people in many rural areas. Developing economies currently account for 40% of existing global renewable resource capacity, 70% of solar water heating capacity and 45% of biofuels production (REN21 2008). Expansion of these sectors may be critical for increasing the availability of affordable and sustainable energy services for the billions of poor households in these economies currently without access to these services.

G20 economies should therefore follow the lead of South Korea and China and turn their green stimulus investments into a serious long-term commitment. If the G20 economies coordinated the timing and implementation of these investments and policies, the cumulative impact on increasing economic growth and employment, while saving carbon, would have a significant impact globally. Together these economies account for almost 80% of the world’s population, 90% of global gross domestic product (GDP), and at least three quarters of global greenhouse gas emissions. In addition, with the right policies supporting them, existing green stimulus packages already adopted by G20 governments could increase G20 GDP from 0.7% to 2.2%. But, coordination of these stimulation packages and policies would increase G20 GDP even further, from 1.1% to 3.2% (Barbier 2010a).

To support the public green investments, the G20 should adopt environmental pricing policies, whether through cap and trade or taxes, that would ensure that carbon and other pollutants, as well as water and scarce ecological resources, are no longer ‘free’ to use, or even subsidized, via state policies. They should also instigate pricing and regulatory reforms for reducing carbon dependency, including removing perverse subsidies and other distortions in energy, transport and similar markets. Globally, fossil fuel consumption subsidies amounted to $557 billion in 2008 (IEA/OPEC/OECD/World Bank 2010). Production subsidies accounted for an additional $100 billion. Together, these subsidies account for roughly 1% of world GDP. Phasing out these subsidies by 2020 could result in a 5.8% reduction in global primary energy demand and a 6.9% fall in greenhouse gas emissions. The financial savings could be redirected to investments in clean and renewable energy R&D and energy conservation, further boosting economies and employment opportunities.

As the dominant sources of international aid, the G20 should mobilize international policy in support of the Global Green New Deal. For example, collectively the G20 could help secure a post-Kyoto global climate change framework by, first, agreeing to the broad outline of such a framework among themselves, including a realistic aid package for adaptation and mitigation funding for developing economies, and second, finalizing the framework through negotiations with the international community. In addition, the G20 should foster a global aid strategy that provides social safety nets, vulnerability funds, sustainable agriculture assistance, improved water and sanitation, and payments for ecosystem services targeted to the poorest of the poor in developing economies.

Edward B. Barbier, Department of Economics & Finance, University of Wyoming

Edward B. Barbier is the John S Bugas Professor of Economics, Department of Economics and Finance, University of Wyoming. Professor Barbier has over 25 years experience as an environmental and resource economist, working on natural resource and development issues as well as the interface between economics and ecology. He has served as a consultant and policy analyst for a variety of national, international and non-governmental agencies, including many UN organizations and the World Bank. He has authored over 150 peer-reviewed journal articles and book chapters, written or edited seventeen books and published in popular journals. His works include Blueprint for a Green Economy (with David Pearce and Anil Markandya, 1989), Natural Resources and Economic Development (2005), and the UN Environment Programme report A Global Green New Deal (2009).

He wrote this article for The Asia-Pacific Journal.

Recommended citation: Edward B. Barbier, “Toward a Global Green Recovery: The G20 and the Asia-Pacific Region,” The Asia-Pacific Journal, 28-2-10, July 12, 2010.

References

Barbier, Edward B. 2010a. A Global Green New Deal: Rethinking the Economic Recovery. Cambridge University Press, Cambridge, UK.

Barbier, Edward B. 2010b. “Green Stimulus, Green Recovery and Global Imbalances.” World Economics 11(2):149-175.

Cline, William R. 2009. “The Global Financial Crisis and Development Strategy for Emerging Market Economies.” Remarks presented to the Annual Bank Conference on Development Economics, World Bank, Seoul, South Korea, 23 June 2009

Feldstein, M.S. 2008. “Resolving the Global Imbalance: The Dollar and the U.S. Saving Rate.” Journal of Economic Perspectives 22(3):113-125

Goulder, Lawrence. 2004. “Induced Technological Change and Climate Policy.” Pew Center on Global Climate Change, Arlington,VA.

Gu, Jing, John Humphrey and Dirk Messner. 2008. “Global Governance and Developing Countries: The Implications of the Rise of China.” World Development 36(2):274-292.

Houser, Trevor, Shashank Mohan and Robert Heilmayr. 2009. A Green Global Recovery? Assessing US Economic Stimulus and the Prospects for International Coordination. Policy Brief Number PB09-3. Peterson Institute for International Economics and World Resources Institute, Washington, DC, February.

International Energy Agency (IEA). 2008. World Energy Outlook 2008. Organization for Economic Cooperation and Development and the International Energy Agency, Paris.

IEA/OPEC/OECD/World Bank. 2010. Analysis of the Scope of Energy Subsidies and the Suggestions for the G-20 Initiative. Joint Report Prepared for Submission to the G-20 summit Meeting Toronto (Canada), 26-72 June 2010.

Kaplinsky, Raphael and Dirk Messner. 2008. “Introduction: The Impact of Asian Drivers on the Development World.” World Development 36(2):197-209.

Park, D. and K. Shin. 2009. “Saving, Investment, and Current Account Surplus in Developing Asia.” ADB Working Paper Series No. 158, Asian Development Bank, Manila, Philippines, April 2009

Podesta, John, Todd Stern, and Kit Batten. 2007. Capturing the Energy Opportunity: Creating a Low-Carbon Economy. Center for American Progress, Washington, D.C.

Project Catalyst. (2009). Scaling Up Climate Finance. Policy Briefing Paper. September 2009. ClimateWorks Foundation, San Francisco, CA.

REN21. (2008). Renewables 2007 Global Status Report. REN21 Secretariat, Paris and Worldwatch Institute, Washington DC.

Richerzhagen, Carmen and Imme Scholz. 2008. “China’s Capacities for Mitigating Climate Change.” World Development 36(2):308-324.

Robins, Nick, Robert Clover and Charanjit Singh. 2009. Taking stock of the green stimulus. 23 November 2009. HSBC Global Research, New York

Robins, Nick, Robert Clover and D Saravanan. 2010. Delivering the green stimulus, 9 March 2010. HSBC Global Research, New York.

Stern, Nicholas. 2007. The Economics of Climate Change: The Stern Review. Cambridge University Press, Cambridge, UK.

United Nations Development Programme (UNDP). (2006). Human Development Report 2006. Beyond Scarcity: Power, Poverty and the Global Water Crisis.

United Nations Economic and Social Commission for Asia and the Pacific (ESCAP). 2008. Energy Security and Sustainable Development in Asia and the Pacific. ESCAP, Bangkok, Thailand.

United Nations Environment Programme (UNEP). 2009. Global Green New Deal: An Update for the G20 Pittsburgh Summit. UNEP, Geneva, September. Link.

United Nations Framework Convention on Climate Change (UNFCCC). (2007). Investment and Financial Flows to Address Climate Change. UNFCCC, Bonn.

World Bank. (2009). Global Economic Prospects 2009.Commodities at the Crossroads. The World Bank, Washington DC.

Notes

1 The members of the G20 include 19 countries (Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, the UK and the US) plus the EU.

2 From “The G-20 Toronto Summit Declaration June 26-27, 2010”. Available here.

3 See, for example, Lynas, Mark. “How do I know China wrecked the Copenhagen deal? I was in the room.” guardian.co.uk, 22 December 2009. Available here. Peter Lee with Eric Johnston, The Copenhagen Challenge: China, India, Brazil and South Africa at the Barricades. The Asia-Pacific Journal, Feb 22, 2010.