Japan’s Response to Financial-Economic-Environmental Crisis

Andrew DeWit

“If you think this is only a cycle you’re just wrong. This is a permanent reset” Jeff Immelt, chair and CEO GE

“…I know that oil and gas companies won’t like us ending nearly $30 billion in tax breaks, but that’s how we’ll help fund a renewable energy economy that will create new jobs and new industries. I know these steps won’t sit well with the special interests and lobbyists who are invested in the old way of doing business, and I know they’re gearing up for a fight as we speak. My message to them is this: So am I.” Barack Obama

Think back to this time last year. The market-fundamentalist model of economic governance was clearly in serious trouble. A quasi-religious fervour for even dumb deregulation had led to the injection of over 10 trillion American dollars worth of toxic assets into the arteries of global finance, sending a profound shock towards the real economy of production and consumption. It was also clear that the carbon-intensive consumption bubble of the past few years was unsustainable. Highly sensitive to even small shifts in demand and supply, oil prices were high, and then they shot up to nearly USD 150/bbl last summer. They’ll skyrocket again in due time. And all credible evidence on greenhouse gas emissions and global warming suggested that the Inter-Governmental Panel on Climate Change (IPCC)’s worst-case scenarios were in fact hopelessly optimistic. Now, just a year later, we seem trapped in some B-grade Hollywood epic where Antarctic ice fields are collapsing and you can ignite the methane pouring forth from the melting tundra up north.

Methane flame

And this time last year, the idea that the Asian economies were “decoupled” from the US was still strong. America’s misery seemed contained to it and the UK as well as some parts of Europe. But now we have a truly global crisis.

In spite of this multifaceted crisis and its implications for economic policymaking, the Japanese elite continue to hamstring the country in the midst of an incipient green industrial revolution. It takes a Bush-league scale of incompetence to toss away a lead in solar technology, as Japan has done. Japan axed its solar subsidy in 2005, and saw its market share slide. Meanwhile, the Germans in particular were making green technology the core of their domestic energy supply and world-beating export machine. Germany is now “accelerating its efforts to become the world’s first industrial power to use 100 percent renewable energy – and given current momentum, it could reach that goal by 2050.” [link]

German solar technology

And progress in the advanced American states and cities, especially California, has laid a strong foundation for federalizing America’s localized green revolution. Keep in mind that Texas has become a world leader in wind power thanks to a Renewables Portfolio Standard that Bush signed in 1999, when he was Governor. [link]

Roscoe wind farm, Texas

But stuck in a politico-economic impasse where policymaking choices are trapped between either the pork barrel state or the unfettered market, the Japanese elite risk prosperity and competitiveness. In contrast to the Germans and even Bush of 1999, the Japanese elite have been unwilling to use smart public-sector mechanisms to accelerate technological innovation in the environmental and energy fields or even to promote the rapid diffusion of already available technology. Their unwillingness to use public sector mechanisms is due to the dominance of carbon-intensive or just plain backward-looking incumbent industries, especially the electrical utilities and heavy-industry elements organized in the peak association Keidanren. Moreover, these industries have the powerful backing of the Ministry of Economy Trade and Industry and the compliance of incompetent or ideologically blinkered political elites.

Meanwhile, the global crisis has morphed well beyond a simple recession into a daily worsening financial meltdown that threatens to bring on a global depression. At the same time, however, this crisis is providing an historic opportunity to accelerate the incipient industrial revolution. That’s one reason the Koreans have devoted 81% of their fiscal stimulus to green technology.

Let me emphasize these points. The global economy is in its worst crisis since the 1930s, perhaps its worst ever. The numbers are stark and rapidly getting worse: Global stock exchanges lost about USD 50 trillion last year, a figure roughly equivalent to one year of total global economic output. Within the American economy alone, the collapse of the so-called “shadow banking system,” composed of highly leveraged firms trading exotic financial instruments, has opened a USD 10 trillion hole in finance. The American financial authorities have sought to fill this hole temporarily, hoping that the provision of hundreds of billions of taxpayer dollars to failed financial institutions will enable toxic assets to become tradable and recover some value. But they have been unsuccessful in restoring trust to credit markets, and now we hear that the USD 5 trillion life-insurance industry is holding lots of toxic assets (pardon me: “legacy assets”).

The crisis in financial markets is inundating the real economy, where goods and services are produced and consumed. We see this fallout on Main Street in the deep contraction in domestic US consumption and steadily climbing unemployment and underemployment. This contraction in the economy is exacerbating the toxic asset problem and has also led to free-falling production in overseas markets that formerly sent goods and services into the maw of American overconsumption.

Among other miseries, collapsing US consumption has delivered a massive shock for Japan. Though not especially high compared to the EU countries, Japan’s dependence on exports is still 16.3% of GDP, and American demand is 20.1% of that total (China’s is 15.3%). Exports were to be the growth engine for the Japanese economy, as domestic consumption is flat or declining. The past several years have seen enormous amounts of capital investment in export industries (especially cars, machine tools, and electronics) and a corresponding campaign to cheapen labour costs for young and female workers; hence, for example, the expansion of temporary work sans safety nets and retraining. The business, political and bureaucratic elite essentially bet the farm on a continuation of the China-US bubble.

The failure of that strategy is now exacting an enormous human and economic cost. Japan’s exports overall plunged by nearly 50% in February and its economy is contracting at an annualized rate that exceeds 12%. Equally ominous, Japan’s hitherto seemingly permanent trade surplus has fallen towards what looks like structural deficits.

Japan’s exports plummet

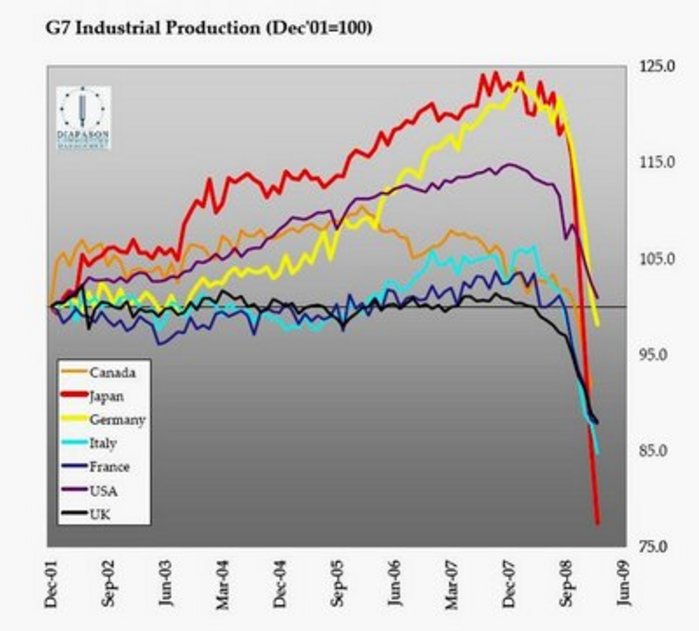

Simply put, the pace and scale of the damage being endured by the Japanese economy is without precedent among the major industrial economies.

G7 Industrial Production, 2001-2009

A host of important issues arises from recognizing these facts. Japan’s export-dependent and market-centred model of post-bubble recovery, recently touted as the only rational choice, is certainly comatose. Japan desperately needs sustainable growth in order to pay down its enormous debt, fund rapid aging and provide extent women and the young a much better deal than they’ve been getting hitherto.

But Japan’s immediate problems are not the heart of the matter. Rather, the core issue follows from the fact that there is no alternative option in the face of this crisis but to use the public sector to stimulate demand. To varying extents, this is the aim of all major countries. This includes Japan, where the LDP longingly eyes massive pork barrel spending as a doorway out of defeat in the impending election. Yet the question of “what kind of demand to foster?” follows, and “more pork” is the wrong answer. Allowing this crisis to unfold on its own invites disaster, but so does attempting to return to business as usual.

Business as usual means more emissions and more oil. The former is obviously a problem, since even the IPCC’s direst scenarios now appear hopelessly optimistic in the face of the mounting facts. As to the latter, note that the Saudis and Cambridge Energy Research Associates (the fossil-fuel and nuke industries’ major lobby) are deeply worried that supply destruction (through depletion and the cancellation of projects) is setting the stage for a massive energy-price spike in the near future. Take note that CIBC World Market chief economist and oil wizard, Jeff Rubin (who foretold last summer’s price spike), has quit his day job to promote his new book on the looming oil shock, aptly and ominously titled: “Why Your World is About to Get a Whole lot Smaller.”

As the Obama administration’s principal actors argue, we need to shift away from the economic model that is currently collapsing around us. That is why they place so much emphasis on a green new deal, which seeks to restructure economic incentives and the American economy in sustainable directions. The Obama team, which includes powerful representatives of America’s most innovative firms and investors, is thus a hybrid of Keynesian and Schumpeterian approaches to resolving the central issue of how to reignite demand. In the stimulus package, the proposed 2009 budget, and by other means, they have committed themselves to using the public sector and industrial policy to shape investment incentives. They aim to break free from an exhausted, toxic paradigm and open up a new and vast frontier of investment and innovation in renewables and the application of IT to the electrical grid. Keep in mind that the public sector is always at the core of defining the political economy of industrial revolutions, but this time the definition is far more deliberate and the stakes unprecedentedly high.

This rapid emergence of explicit industrial policy in America is of immediate relevance for Japan. Growing the economy through smart public policy was once Japan’s forte. In fact, given Japan’s history of industrial policy and sensitivity to external energy, environmental and other shocks, it should be the leader in crafting the industrial policy mechanisms to extricate the global economy from this steadily unfolding catastrophe.

Of course, many people believe that Japan is in fact the global leader in green policies and technologies. This view is reinforced by Tokyo’s relentless greenwash as it seeks to obfuscate its abandonment of Kyoto. From Koizumi on, the Japanese conservative political elite have shamelessly used Kyoto as a brand name while failing to achieve its targets and even seeking to undermine its content through “sector-based” (rather than national) targets. In Tokyo’s self-serving account, Japan patiently awaits a laggard America. But Tokyo had its eyes focused on Washington and thus missed what was happening in the progressive states and cities. The Bush White House rejected Kyoto, but Schwarzenegger and other governors (along with leagues of Mayors) committed their jurisdictions to often even more stringent cuts than specified by Kyoto. And they largely emphasized efficiency and renewables as the means to achieve those targets, along the way innovating policymaking tools.

Shell oil ad: A supreme example of greenwashing

There are a host of matters that deserve closer examination here. Among them are the specific details of Japan’s energy-environmental policies, especially seen in a comparative context. Allow me to deal with that elsewhere, since the evidence is voluminous and will lead to a lengthy digression. Suffice it to say, for the moment, that Japan is at present well behind its main competitors in innovating and adopting green technology. Years of “we’re number 1” nationalism and “mottainai” culturalist rhetoric ended with even the Nikkei, in a March 11 editorial, warning that the country is far behind and calling for a massive Japanese green new deal and smart public policies.

Savour that morsel for a moment: the Nikkei, long the champion of emasculating the state, has come to understand that a smart public sector is essential in the face of a tsunami of externalities.

But let’s return to the core issue. We need to find sufficient and sustainable demand in a collapsing global economic order. The last time the world experienced anything like the current crisis its resolution came through global war. That kind of Keynesianism we can do without, but we risk drifting in that direction if we don’t act intelligently. Our collective challenge is to foster sufficient sustainable economic demand to pull the global economy out of its current plunge into depression and the attendant political and social chaos. Energy and environmental policy must be at the core of this global project.

If what needs to be done is so obvious, then why is it necessary even to state it? The answer is vested interests. At USD 6 trillion in transactions annually, energy is the world’s largest single business. And it is dominated by the fossil-fuels sector, which accounts for 85% of supply. Costing carbon means shrinking the market share for these producers, as it makes alternative and sustainable forms of energy even more competitive. This scenario is something the oil producers, in particular, and their allies are loath to accept. That is why looking at each country’s debate over this crisis, as well as how to resolve it, affords a real-time view of how the fight between incumbent and emerging industries plays out in varying institutional contexts. A great many voices within the United States, for example, insist that the Obama regime is unwise to emphasize an energy and environmental shift. They argue that it is critical to reignite demand now, and that we should only consider longer range goals afterwards. In short, they argue for a return to business as usual. Many of the voices that argue this line from within Congress, for example, are representatives of states in which the primary means of generating electricity is the combustion of coal. Coal-fired electricity contributes the largest share of America’s emissions of carbon dioxide, and is the single greatest threat to global warming. A similar mindset is evident among those who argue that fuel-efficiency targets for Detroit are unwise, and best left to some future time. They too are seeking to return to business as usual and thus avoid any fundamental change in the context of crisis. They portray themselves as reasonable, as offering achievable, short-range goals and insist that the effort to restructure in the midst of crisis is unrealistic and dangerous.

Of course, if one believes that business as usual is not problematic, then this approach makes sense. To believe that business as usual is both responsible as well as possible requires, however, ignoring a great deal of evidence to the contrary. For one thing, it is indisputable that business as usual is leading to dangerously accelerating global warming. Moreover, the resource requirements, especially in the oil sector, of business as usual are outstripping the capacity to supply them. Indeed, during this financial crisis, supply capacity in the oil sector has been declining such that a return to the last year’s levels of demand would likely drive energy prices well beyond the spikes recorded in the summer of 2008.

Is it realistic to look at the energy sector as a source of new demand, sufficient to pull us out of our current crisis? Again, energy is a huge industry, totaling about US$6 trillion per year or somewhat more then 10% of global GDP. The scale of the energy industry, and the market share held by fossil fuels (85%), gives some indication of the incentives confronting incumbent industries in this sector and those they are linked to. The big energy firms, especially Exxon, the perennial profit leader among US corporations, have no interest in pursuing sustainable energy policies. They have even pulled out of most of the investments that earlier sought to give a greenish cast to their business. They are hunkering down for the hard fight to block emissions caps, carbon taxes or other mechanisms that would raise fossil fuel prices and thus further erode their products’ attractiveness. The oil and coal industries are almost certainly at the peak of their market share, and are fully aware that any change in the status quo is likely to mean shrinkage for them. Allied with them are industries whose production processes are carbon intensive. They, too, understand that their costs are likely to increase the more they compromise on pricing carbon. Their stance is one of seeking to contain these costs by blocking moves towards sustainability. For some of us, of course, this seems a somewhat more stark matter of do or die. If that sounds extreme, note that James Hansen, director of NASA’s Goddard Institute for Space Studies and one of the world’s foremost climate experts, refers to coal-fired power plants as “death factories.”

In short, this is a year in which a great deal is riding on whether a new Japanese leadership reverses Japan’s decline with smart industrial policies and gets seriously in the race to lead in sustainable energy. Hitherto, Japan has faithfully followed the United States into the maelstrom of wars in Korea, Vietnam, Iraq and Afghanistan. Now it has the opportunity to collaborate as well as compete with a US administration that recognizes the primacy of combining economic recovery with sustainable energy and environmentalism.

Andrew DeWit is Professor of the Political Economy of Public Finance, Rikkyo University and an Asia-Pacific Journal coordinator. With Kaneko Masaru, he is the coauthor of Global Financial Crisis published by Iwanami in 2008.

He wrote this article for The Asia-Pacific Journal.

Posted on April 12, 2009.

Recommended citation: Andrew DeWit, “Japan’s Response to Financial-Economic-Environmental Crisis,” The Asia-Pacific Journal, Vol 15-3-09,