Abstract: The clean energy transition is complicated by material constraints that threaten national security. Idealized proposals for a rapid decarbonization via a greatly accelerated diffusion of solar, wind, battery and other technologies entails massive amounts of critical raw materials (CRM). These CRM include copper, aluminum, cobalt, lithium, graphite, rare earths, and other minerals and metals. In the international debate, CRM are also referred to as “critical minerals,” “critical strategic minerals,” “battery minerals,” “energy transition metals,” and various other terms. The International Energy Agency (IEA) aggressively supports decarbonization, but also warns that zero-carbon scenarios imply that the energy sector’s overall demand for CRM could sextuple by 2040. Japan aims for net-zero greenhouse gas (GHG) emissions by 2050, and India’s net-zero target is two decades later. But like all countries, their CRM supply chains are at present unable to satisfy ambitious goals for deploying solar, wind, battery storage, power transmission, and green hydrogen. Multilateral cooperation is imperative to address the growing challenges of CRM, especially their price volatility, security of supply, and Environment, Social, and Governance (ESG) issues. Building a sustainable and diversified global supply chain is crucial to building security in clean energy. One step in this direction was seen in September 2021, when Japan, India and other members of the Quadrilateral Security Dialogue, or QUAD, signed an agreement for cooperation in procuring rare earths. This paper discusses potential additional cooperation between India and Japan, for bolstering both countries’ CRM supply security.

Keywords: Critical Raw Materials; Decarbonization; Energy Security; QUAD, India-Japan Collaboration

Introduction

The 2015 Paris Agreement has seen signatory countries announce ambitious targets for reducing their greenhouse gas emissions (GHG), reflecting the consensus on the need to limit the global temperature rise to 1.5 °C. As of November 2021, more than 140 countries have announced targets for net-zero GHG by 2050 (or later), which is equivalent to 90% of global GHG emissions.1

Japan is the sixth largest GHG emitter in the world, after China, U.S, E.U, India, and Russia. Japan is also explicitly committed, by law, to reducing its GHG emissions to net-zero by 2050. The “Green Growth Strategy” launched in 2020 by the Ministry of Economy, Trade, and Industry (METI) set the framework for Japan’s carbon neutrality. In addition to restarting extant nuclear assets, Japan’s decarbonization will emphasize the expansion of renewable energy, particularly offshore wind, in addition to ammonia and “green hydrogen.”2,3 The strategy calls for renewable energy to reach between 50 to 60% of the country’s electricity generation in 2050, with hydrogen and ammonia supplying 10%.4 To this end, the Japanese Cabinet office approved the 6th Basic Energy Plan in Oct. 22, 2021, which aims to double the 2019 share of renewable energy in the power mix to 36-38% by 2030. It also seeks to increase the level of nuclear power to 20-22% by the same year.5

However, Japan’s clean energy transition faces serious material challenges. Clean energy includes nuclear power, hydropower, solar photovoltaic, onshore and offshore wind, hydrogen production, geothermal and biomass, battery storage, and electric vehicles (EV) plus fuel-cell vehicles. All of these extant technologies – and some yet to be developed – are required to meet the country’s net-zero ambitions. But many decarbonization options require very high densities of CRM per unit of generation, storage, and mobility compared to conventional fossil-fuel power generation, heat delivery, and transport.6

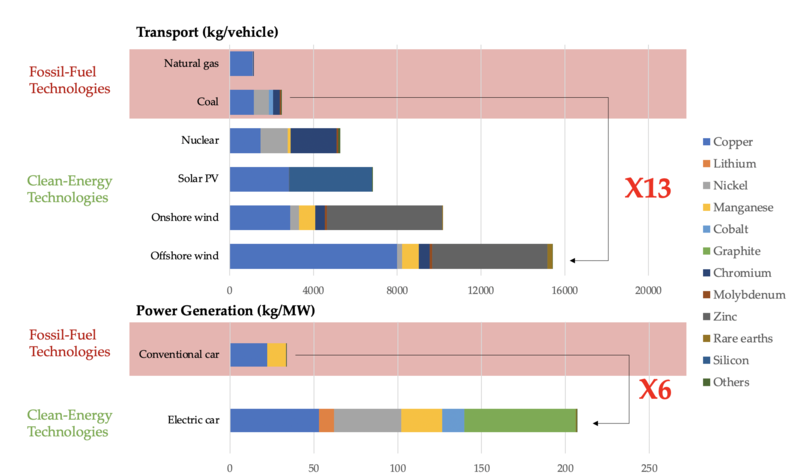

Securing the CRM needed for a clean energy transition is especially challenging for resource-scarce Japan. We can see why in the IEA’s flagship report on “The Role of Critical Minerals in Clean Energy Transitions.” The IEA assesses the average amount of CRM (specifically copper, lithium, nickel, manganese, cobalt, chromium, molybdenum, zinc, rare earths, and silicon) required to build an electric vehicle (EV) or a megawatt (MW) of generation capacity for representative power-generation technologies (offshore wind, onshore wind, solar PV, natural gas, coal, and nuclear).

Figure 1 shows that the IEA’s research warns that building the average EV requires 6 times more CRM than a conventional gasoline-powered vehicle, while offshore wind plants require 13 times more minerals than a gas-fired power plant.7 It is important to note that – unlike the burning of fossil fuels to generate power or transport a vehicle – CRM are generally not consumed (aside from uranium in nuclear power). Rather, CRM are used in constructing the power stations, batteries and other infrastructure that compose fossil-fuel or clean-energy technology.

Figure 1. CRM used in representative energy technologies and vehicles (adapted from IEA, 20218,9)

The scale of CRM demand is phenomenal. The IEA reports are not alone in pointing this out. The World Bank estimates that achieving the Paris Agreement will require roughly 3 billion tonnes of minerals and metals.10 Another representative assessment is the highly regarded 2021 White & Case report on “Taking ESG Seriously: The crucial role of mining investors in the energy transition.” This report suggests that, by 2050, global production of CRM is expected to increase by 965% for lithium, 585% for cobalt, 383% for graphite, 241% for indium, and 173% for vanadium.11 Moreover, CRM supply chains are already quite vulnerable. In May 2022 the IEA cautioned that the rising demand and the tightening supply of CRM are driving significant price increases.12 In less than 5 months from the start of 2022, the price of lithium increased by over 738%, and cobalt by 156%.13

For a resource-scarce country like Japan that imports virtually all the CRM required for clean energy technologies, establishing robust CRM supply chains is crucial.

In 2021, the Quadrilateral Security Dialogue (QUAD), comprising Australia, Japan, India, and the US, agreed to cooperate in funding new production technologies and establishing a global CRM supply chain. Among the QUAD, India is seen as a potentially significant supplier of critical minerals. For example, current geologic surveys suggest India has the world’s fifth largest mineral deposits of rare earth elements (REE). 14 However, despite its geological potential in supplying many CRM, India’s mining and refining capacity is minimal. To foster a stable supply of CRM, in 2019 the Indian Ministry of Mines, set up an expert committee to expand India’s exploration and procurement.15

In addressing Japan and India’s energy security issues, this paper will first analyze global approaches in tackling CRM energy security issues. One focus is regional cooperation on the “Earth MRI” initiative, including the EU, US, and Canada, and the need for developing a domestic supply chain. The paper will then analyze the current mining issues and the CRM situation in India. Lastly, the paper suggests QUAD-level cooperation to develop an “Earth MRI” map for alleviating CRM security issues. We also suggest means for Indian and Japanese collaboration in establishing skills-development for CRM mining, refining and related areas.

CRM and Security Debates

The surge in demand for critical minerals poses a global challenge to decarbonization and energy security. Over the past decade, the volume of CRM required to build new power generation capacity has increased by 50% in tandem with the rise in global low-carbon power generation.16 This demand is expected to increase rapidly as countries scale up their batteries, solar panels, wind turbines, and other low-carbon technologies to meet climate goals. And the more ambitious the decarbonization goals, the greater the CRM demand. Figure 2 displays the IEA assessment of CRM demand by 2040 for a “Sustainable Development Scenario” approach to the Paris Agreement. This scenario will require quadrupling mineral requirements. But the IEA warns that an even more ambitious “Net zero by 2050 scenario” implies mineral inputs 6 times current levels.17 And the more CRM-intensive intermittent solar and wind, and battery storage, in the power mix, the higher the draw on CRMs.

Figure 2. Mineral demand for clean energy technologies under SDS and STEPS scenario (Source: adapted from IEA, 2021.18)

The current supply capacity of CRM is insufficient to meet this projected demand. The IEA’s studies reveal that existing and planned mining projects will at best meet only half of 2030’s projected lithium and cobalt requirements, and only 80% of copper demand.19 Prodigious new investments in mining are imperative to meet these targets, but mining projects take many years from surveys to actual CRM production. Indeed, the IEA data show that between 2010 to 2019 the average lead times – from discovery to production – of the world’s top 35 CRM projects was 16.5 years. These lead times include 12 years for exploration and location of feasible sites and then 4-5 years for construction of roads, power supply, mine assets and other infrastructure.20 The average duration varies among CRM types and site locations, but even the shortest project was 4 years for a lithium mine in Australia.21 The long lead times for projects suggest that simply ramping-up investment in CRM mining and refining is not the quick fix that many governments, businesses, and civil society organizations seem to project.

Other serious problems include the ongoing depletion of ore-grades (percent of copper/ton of rock) in existing copper projects, increasing costs. Worse yet, global mined production may plunge from the current 20 million tonnes (Mt) to below 12Mt by 2034, leading to a copper supply shortfall of more than 15Mt.22 The current decline in production of copper and certain other CRM thus threatens to widen the already serious gap between production and demand.23

Global CRM supply chains are also more monopolized than fossil fuels. In particular, China dominates the processing and refining for cobalt, graphite, rare earths, lithium, platinum, and other critical minerals.24 Figure 3 displays the share of the top three producing nations in total production and extraction of selected minerals in 2019. It shows that China mined and processed at least 60% of rare earths, the Democratic Republic of the Congo (DRC) processed roughly 70% of cobalt, and Australia processed about 50% of lithium. Again, these levels of concentration in CRM supply chains exceed fossil fuels, where the US and other major producers and processers have significantly smaller shares of the overall supply chains. Because of the lead time required for CRM mining and refining projects, China and other countries’ dominance of CRM extraction and processing is likely to continue over at least the coming decade.25

Figure 3. Share of top three producing countries in extraction and processing of selected minerals and fossil fuels in 2019 (Source: adapted from IEA, 202126)

The geographic concentration of some CRM processing is even greater, with China dominating the majority of the mineral processing industry. China’s share of refining is about 35% for nickel, 50-70% for lithium and cobalt, and nearly 90% for rare earth elements.27 The global dependence on a limited group of countries to supply such increasingly important materials is risky. Disruptions from natural disasters and geopolitics could severely impact the global supply of CRM, driving up prices and threatening conflicts.28

CRM and ESG Debates

Supply security is not the only driving concern in strategic debates on CRM. Global investors are shifting capital to ESG funds, and ESG regulations are becoming mandatory in certain countries, advantaging mining firms that can credibly offer the prospect of lower emissions.29 A January 2021 White & Case survey of 68 high-level stakeholders shows that 45.6% believe ESG issues to be the key risk for the metals and mining sector, exceeding the risk of Covid-19 supply chain disruptions at 13.6%.30 The same survey was also conducted in 2022, targeting 63 senior decision-makers. In the 2022 survey, ESG issues were again first at 24%.31 While the percentage is lower compared to 2021, this number rises to 40% when combined with risks for climate-related regulation and activism. Thus, for the second year in a row, ESG issues are seen as the biggest threat for the mining and metals sector. One reason is the energy-intensity of extraction and processing of many CRM. Mineral extraction overall accounts for 15 to 17% of worldwide energy consumption.32

The Paris Agreement has led to increasing pressure on mining firms for reduced GHG emissions. ESG rules are expected to set increasingly high bars for the mining and metals sector going forward.33 Recent research reveals that 21 of the world’s 30 largest metals and mining companies (measured by market capitalization), have already claimed carbon-neutrality in their operations or have adopted such a target.34

In fact, the 2022 White & Case Mining & Metals market sentiment survey shows that 46% of respondents think that reducing the carbon footprint of its own operation and production will be their top challenge through expanding ESG rules.35 Campbell, Tivey, and Wright (2022) indicate that lenders are more likely to finance projects with robust ESG credentials, and government agencies are also stepping in to ensure that supply of critical minerals meet their energy transition requirements.36 ESG rules are increasingly a “must-have” agenda among investors, global finance agencies and government bodies for judging the sustainability of the entire value chain, from mining to processing, manufacturing, and recycling.37

The top concerns in ESG rulemaking are scope 1, 2 and 3 emissions. These three scopes can be summarized as follows: scope 1 are the firm or organization’s own emissions, scope 2 are the emissions from purchased power and other energy services, and scope 3 emissions are all the indirect emissions generated along the firm’s value chain. For mining, scope 1 and 2 emissions derive from extraction and processing, including fuels used in mining operations and power consumption for crushing ores. Scope 3 emissions are all along the value chain, including transportation of product and its use in downstream manufacturing.38 Increased scrutiny for all three scopes is expected, but Kuykendall (2021) states that scope 3 emissions will be the most challenging obstacle for investors and mining businesses.39 Delevingne, Glazener, and, Grégoir (2020) suggest the global mining industry generates between 1.9 and 5.1 gigatons of CO2 equivalent (CO2e) GHG emissions annually.40 Their data indicate that the mining sector’s scope 1 and 2 emissions account for 4-7% of global GHG emissions, but that adding scope 3 raises the total to 28% of global emissions.41 As scope 3 represents a much larger share of emissions, addressing scope 3 emissions for CRM and other critical minerals involves a complex assessment of ESG implications and requires coordination and cooperation between a range of companies at the upstream (eg, mining) and downstream (eg, product manufacture) of the supply chain.42 However, despite the increased attention to ESG rules, El-Shahat and Almulla (2021) caution that the ESG implications of the projected surge in demand for CRM are barely taken into account in current energy transition scenarios.43 Most scenarios are satisfied with rhetoric about “circular economy” recycling of CRM. They either downplay or ignore the unpleasant empirical fact that even if 100% recycling were possible, the present stock of installed EV batteries, renewable generation, electronic devices (including discarded waste) and other assets is one or two decades away from providing even one tenth the required CRM flow from recycling.44

That said, there are suggestive data on regional differences in ESG implications of CRM extraction and processing. Figure 4 shows the result of a comparative assessment of carbon footprints for selected CRMs – specifically, aluminum,

nickel, silicon, and zinc – produced in China and in the EU. The data indicate that a unit volume of aluminum produced in China – where power generation is largely coal – was 2.8 times more carbon-intensive than its EU counterpart, and that nickel was 8 times more carbon intensive.45 Silicon and zinc showed similar results, with Chinese production being 2.5 and 3.4 times more carbon-intensive. China’s carbon-intensive CRM may become a handicap as industries become more sensitive to such “additional costs” as carbon taxes. These costs are directly related to the carbon footprint and the environmental impact of CRM.46

Figure 4. Carbon footprint of primary metal production in China vs. EU, 2017 (Source: adapted from IEA, 202147)

By comparison, commodities such as coal could be taxed at more than 150% of their product value under more intense carbon pricing initiatives.48 Carbon taxation may seem distant in the midst of the current global energy crisis, but it remains on the agenda. And aggressive carbon taxation advantages nuclear and renewable energy sources, while increasing the demand for CRM.

Indian CRM Debates

Like Japan, India also aims to become carbon neutral, though India’s target is 2070, two decades after most countries. India’s short-term energy transition target includes building 280 GW of solar and 140 GW of wind within an overall commitment to install 500 GW of renewable energy capacity by 2030, when total generation capacity is projected to be 820 GW. 49 Including hydropower, India’s current renewable energy capacity is 100GW. 50 Half of India’s generating capacity is coal, and it accounts for about 70% of total power output because it operates 24/7 whereas wind and solar do not. An important part of India’s low-carbon development is the “Make in India” initiative launched in 2014. India aims to strengthen its domestic manufacturing and reduce its reliance on imports.51 Achieving these goals will require ramped-up CRM supplies, and the ambition is to expand domestic extraction as a fillip for domestic manufacturing.52

In 2020, the Indian economy was severely hit by COVID-19, with GDP falling by around 7.3% in FY2021.53 The economic shock was a wakeup call for the country to act quickly on exploring and developing CRM deposits as well as monitoring the CRM supply chain necessary for clean energy and other advanced technologies.54 In May of 2020, Indian PM Narendra Modi declared the “Atmanirbhar Bharat Abhiyan” or “Self-Reliant India,” campaign, which aims to boost the country’s economy through Rs. 21 trillion (USD 267 billion) in economic stimulus packages.55 This economic program is equivalent to 10% of Indian GDP and includes policy reform to encourage domestic manufacture of solar panels, electric vehicles, IT and aviation equipment.56 The program aims at making India self-reliant in energy over 25 years, with localized CRM mining and processing to play a large role.57

In tandem with the rich and industrialized countries, India has its own definition of CRM. India’s version was outlined in its July 2016 report on “Critical Non-fuel Mineral Resources for India’s Manufacturing Sector” (hereafter: “Critical Non-fuel Minerals for India”), authored by India’s Department of Science and Technology and the Council on Energy, Environment and Water (CEEW). Out of 49 non-fuel minerals surveyed, the report highlights 12 critical minerals as especially important to Indian manufacturing. India has no known domestic reserves for most of these 12 CRM and is 100% import-dependent for seven of them. The report warns that current policies on mining and mineral processing are not adequate for ensuring a stable CRM supply for manufacturing, and cautions that minimal and siloed Indian research on CRM hinders the country’s transition to low-carbon development.

Moreover, Table 1 displays the result of a criticality assessment of 23 minerals in India conducted by the Centre for Social and Economic Progress (CESP) released in its December 2021 working paper “Critical Minerals for India: Assessing their Criticality and Projecting their Needs for Green Technologies.” The study evaluates the 23 minerals in terms of economic importance and supply risk. The economic importance (EI) is measured using the share of manufacturing value-added foregone in India and indicates the impact of the availability of the selected minerals in the supply chain to the manufacturing sector. The “supply risk” figure is a composite measure. It assesses the vulnerability of the mineral in the context of import reliance, substitutability, end-of-life recycling potential, governance, and market concentration. The governance and market concentration supply risks, which are two of the most important indicators for determining the supply risks, are offset by three factors: 1. India’s import reliance on the mineral, 2. India’s rate of end-of-life recycling, and 3. supply risk substitutability.58

Table 1. India’s Critical Minerals Assessment for 23 Minerals.

|

Mineral |

Economic Importance |

Supply Risk |

|

Bauxite |

1.0% |

5.1 |

|

Chromium |

1.2% |

14.2 |

|

Cobalt |

1.3% |

18.5 |

|

Copper |

0.8% |

5.0 |

|

Graphite |

0.5% |

20.8 |

|

Heavy rare earths |

0.8% |

36.6 |

|

Indium |

0.1% |

20.6 |

|

Iron |

1.5% |

13.7 |

|

Lead |

0.4% |

2.5 |

|

Light rare earths |

0.3% |

17.0 |

|

Limestone |

1.3% |

15.3 |

|

Lithium |

2.4% |

9.0 |

|

Manganese |

1.0% |

2.5 |

|

Molybdenum |

0.9% |

5.7 |

|

Neodymium |

0.2% |

17.7 |

|

Nickel |

1.3% |

3.6 |

|

Niobium |

2.6% |

29.5 |

|

Silicon |

0.9% |

23.5 |

|

Silver |

0.5% |

3.9 |

|

Strontium |

2.3% |

13.9 |

|

Titanium |

0.6% |

2.8 |

|

Vanadium |

0.6% |

13.8 |

|

Zinc |

0.5% |

11.1 |

* Compiled by the authors based on data from the Centre for Social and Economic Progress (CESP) adapted from “Critical Minerals for India: Assessing their Criticality and Projecting their Needs for Green Technologies.” 59

The study shows that supply risks were highest for heavy rare earths (eg, the dysprosium and terbium that are crucial for permanent magnets in wind turbines and EVs), with a weighted supply risk of 36.6%, followed by niobium at 29.5% and silicon at 23.5%. An analysis by “Critical Non-fuel Mineral for India” reveals that India was 100% import-dependent for both heavy rare earths and niobium. At the same time, fully 94% of the global supply of heavy rare earths is controlled by China. To decrease the CRM supply risk, Chadha, and Sivamani (2021) point out that increasing end-of-life recycling is crucial. Except for copper, iron and aluminum, however, India lacks significant recycling capacity for CRM.60

Table 1 reflects a quantitative analysis on the CRM that India requires to achieve its clean energy targets. The study identified several key clean energy technologies essential for India’s decarbonization transitions.61 One of those technologies is solar power. India plans to install an additional 280GW of solar power capacity by 2030 to achieve its FY2030 renewable energy target, and hopes to become second only to China in manufacturing solar cells.30 The key CRM for solar power include silicon, silver, indium, arsenic, gallium, germanium, and tellurium, but India produces none of them. Chadha, and Sivamani (2021) note that until 2011 India was one of the largest exporters of solar modules, led by manufacturing companies such as Tata Power Solar Systems, Moser Baer, and BHEL. However, over the subsequent decade, India’s domestic solar production has stagnated due to minimal financial support, inconsistent government policy, and competition from low-priced Chinese exports.62

Following up on the above, Table 2 summarizes India’s CRM needs and geological potential. It shows that India has practically no proven reserves of indium and lithium, which are key to manufacturing solar panels and batteries respectively. India does have significant geological potential in chromium, cobalt, graphite, manganese, molybdenum, nickel and silicon, which are used for clean technologies such as wind turbines, batteries, electrical conductors, and steel alloys. In particular, it has very high potential for rare earths, which are not in fact “rare” geologically.63 In addition, minerals such as lithium, tantalum, niobium, titanium, vanadium, nickel and platinum group elements (PGE), can be sourced from within the minerals ilmenite and monazite, which are abundant in beach sand and other sources.64 While India has some expertise in extracting and processing rare earths and other materials, it currently lacks a developed supply chain for them, leading to low domestic availability.65

Table 2. Critical mineral needs for green technology in India

|

Minerals |

Clean Technology Use |

India’s Geological Potential |

Top Three Global Extractors |

|

Chromium |

Stainless steel alloys (wind turbines) |

Yes |

South Africa, Turkey, Kazakhstan |

|

Cobalt |

Steel alloys, batteries, pigment |

Yes |

DR Congo, China, Canada |

|

Graphite |

Electrical conductors |

Yes |

China, India, Brazil |

|

Indium |

Photovoltaic cells, display technology |

None |

China, South Korea, Japan |

|

Lithium |

Batteries |

None |

Australia, China, Chile |

|

Manganese |

Steel and aluminum alloys |

Yes |

South Africa, China, Australia |

|

Molybdenum |

Steel alloys |

Yes |

China, Chile, United States |

|

Nickel |

Stainless steel alloys |

Yes |

Indonesia, Philippines, Russia |

|

Rare earth elements |

Batteries, electronics, magnets |

Some |

China, United States, Myanmar |

|

Silicon |

Electronics, infrastructure |

Yes |

China, Russia, Norway |

* Compiled by the authors based on the data from Centre for Social and Economic Progress (CESP) adapted by the “Critical Minerals for India: Assessing their Criticality and Projecting their Needs for Green Technologies.” 66

India accounted for 2.8% of total global rare earth reserves in 2014.67 However, poor policy coordination, limited expertise, and minimal domestic exploration and investment have hindered India’s extraction and refining of these materials. In addition, India has the world’s third largest reserves of titanium and plans to produce titanium alloys. But India’s mineral processing industry does not have an established technology to convert the raw ores into usable form.68 As a result, India depends on foreign imports for titanium, despite its high geological potential.69

Moreover, India’s gross expenditure on R&D is roughly 0.7% of GDP, which is quite low compared to 2% in China, 2.9% in the U.S. and 3.3% in Japan. 0verall, India’s limited policy support and lack of domestic research initiatives are significant handicaps to taking a strong role in CRM development.

Indeed, the two major studies we have reviewed above – “Critical Non-fuel Mineral for India“ and “Critical Minerals for India: Assessing their Criticality and Projecting their Needs for Green Technologies” – both conclude that the current mineral exploration and extraction in India is insufficient, including lack of effective government legislation, making it difficult for India to satisfy its green technology CRM requirements through domestic mining alone. Thus Chadha, and Sivamani (2021) highlight the importance of developing a resilient supply chain for India through trade agreements and strengthening government-to-government efforts.70

Going forward, India’s Ministry of Mines has set up an expert committee for enhancing the domestic exploration and procurement of select CRM.71 The items under deliberation include joint collaboration with Australia, Argentina and Bolivia to source cobalt and lithium, of which India has practically no proven domestic reserves. Under the Indian Ministry of Mines, several major firms are collaborating in a joint venture to engage in overseas mineral exploration and acquisition.72

The Earth MRI Initiative

Addressing the urgency of CRM issues requires many developments, including accurate assessments of the resource base. Poor understanding of the resource base is an impediment to increased investments in CRM mining. In this regard, there are instructive examples for Indo-Japanese cooperation. One such initiative is the Earth Mapping Resource Initiative, or Earth MRI, developed by the United States Geological Survey (USGS).73 Like Japan and India, the U.S depends heavily on foreign sources for its critical minerals.74 In 2021, of the 35 critical minerals defined by the US Department of Interior, the U.S was 100% import-reliant for 14 of its critical minerals, and at least 50% import reliant for a further 16 minerals.75 Earth MRI seeks to facilitate domestic CRM development through 3-D mapping of domestic mineral reserves using advanced drone and other technology.76

The Earth MRI delivers important ancillary benefits because it maps groundwater resources, natural hazards, and energy resources including geothermal.77 And since 2021 the US Earth MRI has expanded to include Australia and Canada.78 The international collaboration – referred to as the Critical Minerals Mapping Initiative – aims to develop a diversified supply of critical minerals in the US, Australia, and Canada.79

This CRM-oriented partnership also highlights the synergy-effect, bringing together the knowledge and expertise of each nation to form new knowledge, which bolsters the economy and national security of the participant countries. Institutionalized information-sharing about CRM can also help foster stable domestic supply chains and reduce the supply vulnerability caused by dependence on foreign imports. The three countries’ collaboration on mineral science will also almost certainly help to fill in significant research gaps concerning CRM.

QUAD Cooperation on Critical Minerals Mapping and Energy Security

Going beyond the Earth MRI initiative, the Quadrilateral Security Dialogue nations – generally referred to as QUAD – have formed an alliance on securing a global supply chain for rare earths and other CRM. In September 2021, the QUAD nations, composed of Australia, Japan, India, and the US, agreed to partner on bolstering CRM supply chains. This measure is an explicit effort to develop a more diversified CRM supply chain to alleviate the security risk posed by China and other countries’ monopoly of key CRM extraction and processing.80 Prior to this, the 4 nations formed the “Gateway House Quad Economy and Technology Task Force” in 2020, to enhance corporations in the five study areas: pharmaceuticals, space and 6G, critical minerals, fintech and cybersecurity, and undersea communication cables.81 One key element of the task force is the “QUAD Working Group on Critical Minerals,” initiated to study issues related to lithium, cobalt, nickel, and rare earth elements.82

Of particular concern among the QUAD nations has been the refining and component manufacturing of rare earth elements, where China controls 58% of the global production, and 37% of world reserves.83 China has a near-monopoly in both the separation and purification of rare earths84 and its influence has deeply affected both Japan and the US, the leading export markets for Chinese rare earths.85 In 2010, China suspended exports of rare earths to Japan during a diplomatic dispute,86 leaving Japanese electronics and automobile industries scrambling to secure essential resources.87 This was followed by Chinese export restrictions between 2010 and 2014,88 raising the global price of rare earths nearly ninefold.89

Japan has therefore sought to diversify its supply of rare earths by increasing its investments on foreign mining projects other than China, as well as enhancing minerals recycling and promoting R&D for rare earth substitutes.90 Japan’s strategy has had some success. In 1990, Japan’s dependency on Chinese rare earths was over 90%, but by 2020 was reduced to 58%. In short, Japan reduced its rare earths import dependency on China by more than 30% within a decade. And Japan aims to reduce its reliance on China to 50% by 2025.91

The US faces similar challenges, as it relies on China for 80% of its rare earths.92 In January 2020, China’s Ministry of Industry and Information Technology (MIIT) released a draft rare-earth management rule to strengthen its control of the rare earths industry, including quota management of domestic rare-earth production plus investment management and supervision. These proposals have raised concerns among US and other Western nations.93

Collectively, the QUAD nations recognize the need to diversify rare earth supply chains.94 Within the QUAD, Australia and India are two of the biggest rare earths suppliers outside of China, while Japan and the US are the largest consumers of rare earths.95 Combining the needs, assets and expertise of each of the QUAD nations affords one avenue towards a diversified supply chain for rare earths.

Enhancing supply security is easier said than done. For example, the mining and extraction of rare earths can be broken down into two processes: upstream and downstream. Figure 11 depicts the overall value chain of mining and extracting rare earths. The upstream processes include a series of electrochemical reactions that convert rare earth compounds into an economically viable form, known as rare earth concentrate.96

Figure 5. Upstream and Downstream Process for Mining and Extraction of Rare Earths (Source: adapted from Kanisetti, Pareek, and Ramachandram, 202097)

As a first step in developing a QUAD supply chain on rare earths, the QUAD nations have proposed development of rare-earth refining technologies.98 In general, the upstream process is less complicated and the products are sold at low prices in the global market.99 This is often phrased as the “low-cost, low-reward process.”100 On the other hand, the downstream process is more capital and energy intensive, with much larger value-added.101 Within the downstream process, the biggest challenge has been the refining of rare earths, which is more energy-intensive and harmful to the environment. In the refining process, rare earth concentrates are treated to produce rare earth oxides, which then undergoes extraction and alloying to produce rare earth metals.102 Rare-earth minerals contain rare-earth veins that are often mixed with radioactive materials.103 Refining rare earths produces significant amounts of radioactive waste, a major constraint for developed countries with stricter environmental regulations.104 Their stricter environmental regulations make production comparatively expensive. By contrast, China’s looser environmental restrictions and lower labour costs give it a competitive advantage in the global rare earths market.105 As Dominguez (2022) points out, mining operators are at present sending thousands of tons of concentrated rare earths to China, as there is no separation facility in the US.106 This is in spite of the fact that the US has the world’s second-largest rare earth reserves. The result is that the US relies on Chinese imports for 80% of its refined rare earth supplies.107 But QUAD cooperation on rare earths includes the development of low-radioactive-waste refining technologies that are environmentally sustainable. This collaboration could help the QUAD become competitive through meeting strict ESG rules that could advantage more environmentally friendly mining of CRMs in general.

While bilateral partnership on rare earths refining has already been established among QUAD member countries, it has not yet been established as a QUAD initiative. In February 2021, the US signed a $30.4 million investment deal with an Australian mining company, Lynas Rare Earths to set up a rare earths processing facility in Texas to process Australian ores in the US.108 Japan is currently considering joining this investment. If the project proceeds, it will help diversify Japan’s rare earth supplies.109 Additional mining and processing initiatives have also started in the US. According to Rajiv Biswas, Asia-Pacific Chief Economist at IHS Markit, the Rare Earth LLC project in Texas plans to produce a range of critical minerals starting from 2023, linking with a rare earth processing facility in Colorado.110

Deepened QUAD collaboration could be useful in this regard. India could play a major role in this initiative given its abundant monazite, a source of rare earths.111 Monazites are found in Indian coastal areas, including West Bengal, Kerala, Tamil Nadu, Odisha, and Andhra Pradesh. However, as Kanisetti, Pareek and Ramachandran (2020) highlight, monazite production in India has been stagnant.112 Therefore, collaborating on rare earths refining technologies through a dedicated QUAD initiative could see India increase its output and reduce its dependence and that of its allies on Chinese supplies. Through collaboration and overseas investment deals with foreign companies, India could also move higher up in the value chain. Kanisetti, Pareek and Ramachandran (2020) point out that the introduction of global mining companies to the Indian rare earths market could bring in more competition, leading to better utilization of rare earth deposits and increased innovation.113

An additional option is for the QUAD to establish a “Critical Minerals Mapping Initiative” (CMMI), expanding the current collaboration between the US, Canada and Australia to include India and Japan. The purpose of CMMI is to conduct collaborative research on critical minerals, and to help expand and diversify the critical minerals supply chain. The portal contains CRM data for more than 7,000 mineral samples from over 60 countries.114 The CMMI could be adapted as a QUAD initiative via upgrading the aforementioned supply-chain resilience working group on critical minerals.115 The four nations could pool their geological survey data to establish an interactive geo-scientific mapping portal. To this end, expertise from the Earth MRI could also be utilized. As noted earlier, the Earth MRI uses advanced 3D mapping technologies to address multiple issues simultaneously: identifying potential critical mineral deposits, bolstering disaster risk reduction, assessing new energy resources including geothermal, in addition to mapping groundwater reserves.

Japan could bring a lot to the table. It is a leader in 3D mapping technology, especially in the field of disaster resilience. Japan’s “Society 5.0” initiative aims to combine advanced ICT technologies with existing urban planning, disaster planning, disaster-risk communication, and other functions. These technologies include the world’s most advanced weather radar systems, GSI (Geographic Information System) and satellite images for mapping topography, and creating multi-hazard (eg, flood, seismic, and other hazards) mapping. For example, NTT DATA’s 3D mapping service combines satellite images from JAZA and Maxar Technologies to build topographic maps with up to 50 cm resolution.116 Japan’s expertise could greatly benefit multi-parameter mapping for a QUAD CMMI expansion of the Earth MRI.

India could also bring new assets to the CMMI through its unique high resolution geological mapping of critical minerals. The Geological Survey of India (GSI) conducts geoscientific data collection for the whole of India, including high priority geological target areas. A key feature of India’s geological map is its high-resolution scale of 1:50,000, which covers 98% of the country’s geology. This is a significantly higher resolution level compared to other countries, such as Canada and Australia, whose baseline geological survey data are scaled at 1:250,000.117Using very high-resolution geological maps allows for more detailed and accurate analyses.

However, there are several challenges. Chatterjee and Chadha (2020) argue that while there is a primary geological survey in India, it lacks detailed geophysical and geochemical mapping for a more accurate classification of resources and reserves.118 The Indian Ministry of Mines indicates that only 4% of the country’s total land mass had been evaluated through geochemical surveys, while the current geophysical survey covers less than 40% of India’s total landmass. Chatterjee and Chadha, 2020 suggest that better survey data could help incentivize CRM projects for investors and mining companies, as being able to see resources in situ reduces risks associated with mineral exploration.119 Together with Japan, Indian participation in CMMI and other CRM mapping initiatives could help expand critical mineral exploration and result in better understanding of potential and existing mineral reserves.

India Japan Bilateral Collaboration – Deep Sea Mining

Besides the QUAD’s CRM exploration, there are several other potential areas for Indo-Japanese collaboration on CRM. These include: (1) Indo-Japan deep sea mining collaboration on REEs, and (2) Indo-Japan collaboration on rare earths recycling and substitution.

In March 2020, the Japanese government released its “New International Resource Strategy,” outlining how Japan aims to secure its critical minerals and materials going forward.120 The strategy defines 34 minerals as CRM, referring to them as “rare metals.”121 The strategy focuses on international collaboration on CRM research, technical innovation in mineral substitution and recycling, aligning mineral-specific criticality profiles, increased stockpiling of emergency CRM reserves, and lastly, expanding Japan Organization for Metals and Energy Security (JOGMEC) initiatives for private-sector mining and smelting.122

A key element of Japan’s resource strategy is reducing dependency on imported CRM, with an aim to achieve 80% self-sufficiency – defined as including Japanese overseas projects – for base metals such as copper and nickel by 2030.123 For rare earths, Japan has set a separate target of reducing its import reliance on any single supplier country below 50% by 2025. To achieve these targets, Japan has been investing in deep-sea exploration activities.124 Between 2013 and 2017, Japan discovered six seabed deposits off the southern island of Okinawa,125 which are reputed to contain the world’s richest seabed deposits of gold, silver, and rare earth elements.126 From 2028, Japan plans to undertake commercial exploitation of these and other seabed deposits of CRM in its Exclusive Economic Zone (EEZ), the eighth largest in the world.127

Japan is working on innovative technologies for exploring seabed CRM and other resources. To this end, the “Japan Agency for Mineral-Earth Science and Technology” (JAMSTEC), a government-based research institute for conducting marine science and technology, established the “Cross Ministerial Strategic Innovation Promotion Program” (SIP). The SIP is tasked with devising the means for mineral exploration to depths as great as 6,000 meters.128 Also via the SIP program, Japanese researchers have discovered large areas of rare-earth mud that reportedly contains “extremely high grades” of rare-earth elements.129

Japanese experts suggest there may be in excess of a million tons of rare earths in the sediment within Japan’s EEZ, with even a single area of mining potentially able to supply at least 3 to 10 times Japan’s current annual demand for such rare earth as yttrium and europium.130 The high concentration of rare earth may not be the only advantage of deep-sea mining. Once the technological challenge of mining in deep marine environments have been met, the CRM may generally be easier to extract and more environmentally friendly than terrestrial mining. Among other things, seabed mining does not require large volumes of fresh water, which is an increasingly serious challenge for extracting declining terrestrial ore grades of copper and other CRM. And unlike terrestrial rare-earth deposits, deep-sea rare-earth muds contain only small amounts of radioactive materials.131

JAMSTEC argues that Japan is the only country in the world that has discovered rare-earth mud in its own EEZ, and plans to pioneer deep-sea extraction and mining of rare earths.132 But there are several challenges. At present, the maximum depth of Japan’s seafloor mining capability is 2,000 meters. Analysts point out that mining at 6,000m will require an extremely long pipe to pump large quantities of mud. Currently the longest pipe – often used for surveying new oil reserves – is only 3,500 meters, which is insufficient for pumping rare-earth muds from depths of 6,000 meters.133 Another challenge is that the clay-like texture of rare-earth mud makes it difficult to extract using pipes. The lack of cost-effective technology means there are as yet no economically sustainable methods for seabed mining of rare earths.134

To solve these problems, JAMSTEC teamed up with Toyo Engineering Corporation (TOYO), an engineering firm with vast experience in oil and gas R&D, and TOA Corporation, a marine construction company that specializes in plant engineering and building soil structures. Using its long experience in dredging and reinforcing soil foundations, TOA is developing a mud-liquefaction process to mix the rare-earth mud with cement and create a slurry. TOA is also devising means to minimize environmental impacts. One example is using the radioactive waste – including uranium and thorium – as land reclamation material.135

Japan is the second-largest consumer of rare earths globally, because it manufactures a lot of permanent magnets and other devices. Japan is also a pioneer in extracting rare-earth muds in addition to being a technical innovator in deep-sea exploration activities for rare earths and other CRM. Thus Japan can offer India a lot via Indo-Japan collaboration.

By contrast, Indian initiatives in deep-sea mining are recent, including the 2013 construction of a deep-sea exploration ship. And in 2022, India signed a 15-year term contract with the International Sea Bed Authority (ISA), for a license allowing mining corporations to explore deep sea mineral deposits.136 But the research vessel and related scientific initiatives are not sufficient to explore and extract India’s CRM materials.137 Kanisetti, Pareek, and Ramachandran (2020) also point out that India’s mineral exploration will need to be undertaken at depths of 5,500 meters.138 Technological support and expertise from the Japanese government would therefore seem crucial.

One possible avenue to achieve strong Indo-Japanese cooperation in deep-sea mining and production technology is for India to work with JAMSTEC.139 Joining JAMSTEC’s initiative would help strengthen India’s potential for deep-sea mining. The collaboration could be backed by government-based partnerships, along the lines of what Japan is already doing. For example, Japanese government-funded partnerships include Sumitomo Corporation and Kazakhstan National Mining Co, Toyota Tsusho and Sojitz partnering with Vietnam’s Dong Pao Project, and a partnership between JOGMEC and India to establish a processing facility for rare earths.140 Indo-Japanese deep-sea mining activities could be added to these initiatives.

India Japan Bilateral Collaboration – Rare Earths Recycling and Substitution of CRM

Another possible collaboration for India and Japan is to partner on recycling and substitution of CRM. A key aspect of Japan’s mineral strategy is CRM recycling and substitution technology.141 As highlighted in Section 4, one of the challenges for India is its low recycling and substitution rate, increasing its resource scarcity risks. To address this issue, India has sought to bolster “urban mining,” or the extraction and recycling of materials from electronic waste (“e-waste”) in urban scrapyards, garbage dumps, and landfills.142

One driver of the growing demand for urban mining is India’s expanding electronics industry. India boasts one of the largest electronics industries in the world, one whose economic value is at present $118 billion and accounts for 2.7% of the country’s GDP. The industry has been projected to grow to $300 billion by FY 2026, with smartphones leading the boom. In 2021, India had 1.2 billion mobile subscribers, and is likely to become the second-largest smartphone manufacturer in the next five years.143 However, despite the rapid increase in India’s electronics industry, only 1.5% of India’s e-waste is currently being recycled, with over 95% ending up in landfills.144 For REEs, data reported in 2018 shows that only less than 1% of global REEs have been recycled145.

Indian e-waste is a large but uncertain potential resource for urban mining of CRM. The biggest challenge of urban mining is its low efficiency rate due to the difficulty of purifying the material and then extracting the rare earths and other CRM.146 India generates about 2 million tons of e-waste annually.147 Thus a global partnership between Japan and India for recycling e-waste could help increase private sector inclusion in India’s e-waste market. This partnership could be achieved as part of Japan’s critical mineral recycling initiative, which has strong government support.

Discussion

We have seen that the growing demand for clean energy technologies makes it imperative to develop a more sustainable, resilient, and innovative supply chain of CRMs. The IEA warns that CRM demand is climbing as prices skyrocket, while current and planned production are insufficient to meet even present demand for lithium and several other CRMs. At the same time, both Japan and India face critical but complementary challenges: Japan has almost no domestic reserves of critical minerals and relies on imports, while India lacks the capacity to foster technical innovations and R&D research for exploiting its comparatively plentiful terrestrial CRM reserves. Our analysis indicates that there is scope for India-Japan collaboration on CRM. The potential includes collaboration on seabed mineral exploration as well as enhancing mineral recycling and substitution. Japan’s energy strategy includes a focus on the circular economy, through actively recycling and reusing CRM and other materials (eg, plastic). In terms of critical minerals, Japan has been strengthening its research on CRM recycling and substitution. India, on the other hand, is an emerging e-waste market. Recycling CRM from e-waste could perhaps become more profitable than extracting minerals from mining, further enhancing CRM security.

That said, immense challenges confront the circular economy. The IEA cautions that recycling will not be a significant source of supply for the next couple of decades. Their estimates indicate that – judging from current EV goals – recycled battery minerals will only account for 1% of total global demand by 2030; and even in 2040, recycling will only provide 8% of material demand.148 While Japan’s critical minerals strategy emphasizes recycling, it seems unwise to expect circular-economy strategies to meet much of near-term CRM demand. The current process for recycling minerals is both labour intensive and energy intensive. Extracting CRMs entails first crushing the electronic device, separating it, separating the alloyed components, melting the alloys, and then extracting the elements so as to isolate the valuable minerals.149 As Japanese energy expert Yuriy Humber notes, the overall process generally results in “using more energy to create materials that are claimed to be ‘green’.” 150

In addition to CRM recycling, developing a framework for seabed mining also presents challenges. One of the more obvious hurdles is the technology. Seabed mining requires infrastructure that can cope with the immense water pressure at 5-6km (over 500 times atmospheric pressure). There are as yet few demonstration projects. However, as we have seen with the development of marine mining for oil and gas, technical challenges are not invariably a show-stopper. The major mining-equipment manufacturers, including Japan’s Komatsu, are in fact already harnessing their technical prowess towards smart terrestrial and sea-bed mining of CRM.151

A more difficult area for Indo-Japan seabed CRM mining are legal frameworks and social license. The latter refers to gaining agreement from local communities and other stakeholders who could otherwise veto projects or lobby to have seabed CRMs deemed unacceptable in ESG commitments. Expert Indian observers warn that deep sea mining can at times lead to significant environmental impacts, especially to marine organisms and sensitive ecosystems.152 The growing debate over the environmental impact of deep-sea mining could potentially hinder Indo-Japan’s collaboration unless they can show it is less damaging than its terrestrial counterpart.

Japan and India should therefore consider additional avenues for collaboration. Chatterjee and Chadha (2020) highlight the importance of training well-rounded and materially literate academic specialists, business managers, and researchers in addition to ramping up the already scarce number of mining engineers, geologists, and geo-informatists.153 Some of the requisite training projects could take place in Japan, which would allow both India and Japan to exchange technical expertise and other relevant ideas. Further, Bhattacharya (2022) points out that India’s highly skilled chemistry workforce is already an asset for expanding processing facilities using predominantly imported ores, including Indian-acquired mines in Africa and Latin America. These areas are essential sources of heavy rare earths and other CRM, and Japanese capital could help facilitate industrial development in India.154 These kinds of collaborations could enable both countries to address CRM supply-chain constraints that risk derailing decarbonization.

There are no silver-bullet solutions to the CRM condundrums, so it is imperative that multiple large-scale actions on mining and refining unfold. And one key catalyst for this is widening the scope of cooperation by dedicated multilateral engagement. That is what helps open the doors for significant exchanges on the myriad essentials, such as bolstering human resources, simplifying permitting procedures, and getting capital flowing into projects. Industrial policy in the era of decarbonization is inherently collaborative, because it requires the rapid expansion and diversification of CRM supply chains. Japan and India have plenty of opportunities for collaboration on CRM supply chains.

Acknowledgements

The paper acknowledges support from the India Japan Laboratory of Keio University.

Notes

Stockwell, C.; Geiges, A.; Ramalope, D.; Matthew, G.; Hare, B.; de Villafranca Casas, M.J; Moisio, M.; Hans, F.; Mooldijk, S.; Höhne, N.; Fekete, H. Glasgow’s 2030 credibility gap: net zero’s lip service to climate action. Baxter, C, Merrett, C, Spagopoulo, F, Beer M, Eds. Warming Projections Global Update 2021, November, pp1-28. Available online: https://climateactiontracker.org/documents/997/CAT_2021-11-09_Briefing_Global-Update_Glasgow2030CredibilityGap.pdf (03 April 2022).

DeWit, A. Decarbonization and Critical Raw Materials: Some Issues for Japan. The Asia-Pacific Journal | Japan Focus 2021, Volume 19, pp1-13. Available online: https://apjjf.org/-Andrew-DeWit/5532/article.pdf (accessed 17 February 2022).

The Government of Japan. Japan’s Green Growth Strategy Will Accelerate Innovation. Available online: https://www.japan.go.jp/kizuna/2021/09/green_growth_strategy.html#:~:text=It%20also%20puts%20emphasis%20on,20%20million%20tons%20in%202050 (accessed 28 January 2021).

Ministry of Trade Economy and Industry. Overview of Japan’s Green Growth Strategy Through Achieving Carbon Neutrality in 2050 (Provisional translation); METI: Tokyo, Japan 2021; pp 1-11. Available online: https://www.meti.go.jp/english/press/2020/pdf/1225_001a.pdf (accessed 27 January 2021).

Agency for Natural Resources and Energy. Outline of Strategic Energy Plan; METI: Tokyo, 2021; pp 1-13. Available online: https://www.enecho.meti.go.jp/en/category/others/basic_plan/pdf/6th_outline.pdf (accessed 29 January 2021).

IEA. The Role of Critical Minerals in Clean Energy Transitions. 2021, pp 1-246. Available online: https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf (accessed 02 January 2022).

IEA. Minerals used in clean energy technologies compared to other power generation sources. 2021. Available online: https://www.iea.org/data-and-statistics/charts/minerals-used-in-clean-energy-technologies-compared-to-other-power-generation-sources (accessed 22 May 2022).

IEA. Minerals used in clean energy technologies compared to other power generation sources. 2021. Available online: https://www.iea.org/data-and-statistics/charts/minerals-used-in-clean-energy-technologies-compared-to-other-power-generation-sources (accessed 22 May 2022).

IEA. Minerals used in electric cars compared to conventional cars. 2021. Available online: https://www.iea.org/data-and-statistics/charts/minerals-used-in-electric-cars-compared-to-conventional-cars/

The World Bank. Climate-Smart Mining: Minerals for Climate Action. Available online: https://www.worldbank.org/en/topic/extractiveindustries/brief/climate-smart-mining-minerals-for-climate-action (accessed 29 March 2022)

Ahmad, K.; Campbell R. Taking ESG Seriously: The crucial role of mining investors in the energy transition. Mining & Metals 2021: Forces of Transition and influencers of change 2021. Available Online: https://www.whitecase.com/publications/insight/mining-metals-2022-esg-and-energy-transition-sectors-biggest-opportunity# (accessed 29 January 2021).

Jenkins, L. The minerals we need to save the planet are getting way too expensive. Protocol. 2022

IEA. Critical minerals threaten a decades-long trend of cost declines for clean energy technologies; IEA: Paris, France, 2022. Available Online: https://www.iea.org/commentaries/critical-minerals-threaten-a-decades-long-trend-of-cost-declines-for-clean-energy-technologies {accessed 22 May 2022).

Kanisetti, A. Opinion: Here’s how India can end Chinese dominance in rare earths. Business Insider, Available Online: https://www.businessinsider.in/policy/economy/news/heres-how-india-can-end-chinese-dominance-in-rare-earths/articleshow/80883001.cms (accessed 12 March 2022).

Gupta, V; Biswas, T; Ganesan, K. Critical Non-Fuel Mineral Resources for India’s Manufacturing Sector: A Vision for 2030. CEEW Report; Department of Science & Technology: Government of India, Council on Energy Environment and Water: New Delhi, India, 2020. Available online: https://www.ceew.in/publications/critical-non-fuel-mineral-resources-indias-manufacturing-sector#:~:text=The%20critical%20minerals%20including%20beryllium,%2C%20nuclear%20energy%2C%20and%20smartphones (accessed 30 January 2021).

IEA. The Role of Critical Minerals in Clean Energy Transitions. 2021, pp 1-246. Available online: https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf (accessed 02 January 2022).

IEA. The Role of Critical Minerals in Clean Energy Transitions. 2021, pp 1-246. Available online: https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf (accessed 02 January 2022).

Gupta, V; Biswas, T; Ganesan, K. Critical Non-Fuel Mineral Resources for India’s Manufacturing Sector: A Vision for 2030. CEEW Report; Department of Science & Technology: Government of India, Council on Energy Environment and Water: New Delhi, India, 2020. Available online: https://www.ceew.in/publications/critical-non-fuel-mineral-resources-indias-manufacturing-sector#:~:text=The%20critical%20minerals%20including%20beryllium,%2C%20nuclear%20energy%2C%20and%20smartphones (accessed 30 January 2021).

IEA. The Role of Critical Minerals in Clean Energy Transitions. 2021, pp 1-246. Available online: https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf (accessed 02 January 2022).

DeWit, A. Decarbonization and Critical Raw Materials: Some Issues for Japan. The Asia-Pacific Journal | Japan Focus 2021, Volume 19, pp1-13. Available online: https://apjjf.org/-Andrew-DeWit/5532/article.pdf (accessed 17 February 2022).

IEA. The Role of Critical Minerals in Clean Energy Transitions. 2021, pp 1-246. Available online: https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf (accessed 02 January 2022).

IEA. The Role of Critical Minerals in Clean Energy Transitions. 2021, pp 1-246. Available online: https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf (accessed 02 January 2022).

DeWit, A. The IEA’s Critical Minerals Report and its Implications for Japan. Rikkyo Economic Review 2022, Volume 75, pp.1-32. Available online: https://economics.rikkyo.ac.jp/research/paper/pudcar00000002ed-att/p001-032_75-1.pdf (accessed on 16 March 2022).

IEA. The Role of Critical Minerals in Clean Energy Transitions. 2021, pp 1-246. Available online: https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf (accessed 02 January 2022).

IEA. The Role of Critical Minerals in Clean Energy Transitions. 2021, pp 1-246. Available online: https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf (accessed 02 January 2022).

IEA. The Role of Critical Minerals in Clean Energy Transitions. 2021, pp 1-246. Available online: https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf (accessed 02 January 2022).

IEA. The Role of Critical Minerals in Clean Energy Transitions. 2021, pp 1-246. Available online: https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf (accessed 02 January 2022).

IEA. The Role of Critical Minerals in Clean Energy Transitions. 2021, pp 1-246. Available online: https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf (accessed 02 January 2022).

DeWit, A. Decarbonization and Critical Raw Materials: Some Issues for Japan. The Asia-Pacific Journal | Japan Focus 2021, Volume 19, pp1-13. Available online: https://apjjf.org/-Andrew-DeWit/5532/article.pdf (accessed 17 February 2022).

Campbell, R.; Tivey, J. Mining & Metals 2021: ESG momentum reaching a crescendo in a resilient market. White & Case LLP. 2021. Available online: https://www.whitecase.com/insight-our-thinking/mining-metals-2021-esg-momentum-reaching-crescendo-resilient-market (accessed 29 January 2021).

Campbell, R., Tivey, J. and Wright, O., Mining & metals 2022: ESG and energy transition – the sector’s biggest opportunity. White & Case LLP. 2022. Available online: https://www.whitecase.com/publications/insight/mining-metals-2022-esg-and-energy-transition-sectors-biggest-opportunity# (accessed 7 February 2022).

de Brier, G.; Arian, H.; Hoex, L. IPIS Briefing May 2021 – Reducing the carbon footprint at the expense of a mineral footprint?. 2021. Available online: https://ipisresearch.be/weekly-briefing/ipis-briefing-may-2021-reducing-the-carbon-footprint-at-the-expense-of-a-mineral-footprint/#IN_FOCUS_REDUCING_THE_CARBON_FOOTPRINT_AT_THE_EXPENSE_OF_A_MINERAL_FOOTPRINT (accessed May 24, 2022).

Kuykendall, T. Path to Net-zero: Drive to Lower Emissions Pays in Metals, Mining Sector. 2021. Available online: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/path-to-net-zero-drive-to-lower-emissions-pays-in-metals-mining-sector-67951431 (Accessed 04 January 2022).

Kuykendall, T. Path to Net-zero: Drive to Lower Emissions Pays in Metals, Mining Sector. 2021. Available online: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/path-to-net-zero-drive-to-lower-emissions-pays-in-metals-mining-sector-67951431 (Accessed 04 January 2022).

Campbell, R., Tivey, J. and Wright, O., Mining & metals 2022: ESG and energy transition – the sector’s biggest opportunity. White & Case LLP. 2022. Available online: https://www.whitecase.com/publications/insight/mining-metals-2022-esg-and-energy-transition-sectors-biggest-opportunity# (accessed 7 February 2022).

Campbell, R., Tivey, J. and Wright, O., Mining & metals 2022: ESG and energy transition – the sector’s biggest opportunity. White & Case LLP. 2022. Available online: https://www.whitecase.com/publications/insight/mining-metals-2022-esg-and-energy-transition-sectors-biggest-opportunity# (accessed 7 February 2022).

DeWit, A. The IEA’s Critical Minerals Report and its Implications for Japan. Rikkyo Economic Review 2022, Volume 75, pp.1-32. Available online: https://economics.rikkyo.ac.jp/research/paper/pudcar00000002ed-att/p001-032_75-1.pdf (accessed on 16 March 2022).

Delevingne, L.; Glazener, W.; and Grégoir, L. Climate risk and decarbonization: What every mining CEO needs to know. McKinsey & Company. 2020. Available online: https://www.mckinsey.com/business-functions/sustainability/our-insights/climate-risk-and-decarbonization-what-every-mining-ceo-needs-to-know (accessed on 10 February 2022).

Kuykendall, T. Path to Net-zero: Drive to Lower Emissions Pays in Metals, Mining Sector. 2021. Available online: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/path-to-net-zero-drive-to-lower-emissions-pays-in-metals-mining-sector-67951431 (Accessed 04 January 2022).

Delevingne, L.; Glazener, W.; and Grégoir, L. Climate risk and decarbonization: What every mining CEO needs to know. McKinsey & Company. 2020. Available online: https://www.mckinsey.com/business-functions/sustainability/our-insights/climate-risk-and-decarbonization-what-every-mining-ceo-needs-to-know (accessed on 10 February 2022).

Delevingne, L.; Glazener, W.; and Grégoir, L. Climate risk and decarbonization: What every mining CEO needs to know. McKinsey & Company. 2020. Available online: https://www.mckinsey.com/business-functions/sustainability/our-insights/climate-risk-and-decarbonization-what-every-mining-ceo-needs-to-know (accessed on 10 February 2022).

Kuykendall, T. Path to Net-zero: Drive to Lower Emissions Pays in Metals, Mining Sector. 2021. Available online: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/path-to-net-zero-drive-to-lower-emissions-pays-in-metals-mining-sector-67951431 (Accessed 04 January 2022).

El-Shahat, S.; Almulla, M. The Energy Transition Needs Metals. But it Needs Social Awareness Too. 2021. Available online: https://www.weforum.org/agenda/2021/10/decarbonization-energy-transition-metals-esg/ (accessed 04 January 2022).

IEA. Critical minerals threaten a decades-long trend of cost declines for clean energy technologies; IEA: Paris, France, 2022. Available Online: https://www.iea.org/commentaries/critical-minerals-threaten-a-decades-long-trend-of-cost-declines-for-clean-energy-technologies {accessed 22 May2022).

Institute for European Studies. Metals for a Climate Neutral Europe A 2050 Blueprint; Eurometaux, 2019; pp 1-9. Available online: https://eurometaux.eu/media/1997/exec-summary-metals-2050.pdf (accessed 10 February 2022).

DeWit, A. Decarbonization and Critical Raw Materials: Some Issues for Japan. The Asia-Pacific Journal | Japan Focus 2021, Volume 19, pp1-13. Available online: https://apjjf.org/-Andrew-DeWit/5532/article.pdf (accessed 17 February 2022).

Institute for European Studies. Metals for a Climate Neutral Europe A 2050 Blueprint; Eurometaux, 2019; pp 1-9. Available online: https://eurometaux.eu/media/1997/exec-summary-metals-2050.pdf (accessed 10 February 2022).

Cox, B.; Innis, S.; Kunz, N.C. et al. The mining industry as a net beneficiary of a global tax on carbon emissions. Communications Earth & Environment 2022, Volume 3, 17. https://doi.org/10.1038/s43247-022-00346-4

Gadre, R.; Jain, A.; Jaiswal, S.; Gombar, V.; Traum, D. India’s Clean Power Revolution. BloombergNEF, 2020; pp.1-68. Available online: https://data.bloomberglp.com/professional/sites/24/2020-06-26-Indias-Clean-Power-Revolution_Final.pdf

Ministry of New and Renewable Energy. India Achieves 100GW Milestone of Installed Renewable Energy Capacity. 2021. Available online: https://pib.gov.in/PressReleasePage.aspx?PRID=1745254

Gupta, V; Biswas, T; Ganesan, K. Critical Non-Fuel Mineral Resources for India’s Manufacturing Sector: A Vision for 2030. CEEW Report; Department of Science & Technology: Government of India, Council on Energy Environment and Water: New Delhi, India, 2020. Available online: https://www.ceew.in/publications/critical-non-fuel-mineral-resources-indias-manufacturing-sector#:~:text=The%20critical%20minerals%20including%20beryllium,%2C%20nuclear%20energy%2C%20and%20smartphones (accessed 30 January 2021).

Gupta, V; Biswas, T; Ganesan, K. Critical Non-Fuel Mineral Resources for India’s Manufacturing Sector: A Vision for 2030. CEEW Report; Department of Science & Technology: Government of India, Council on Energy Environment and Water: New Delhi, India, 2020. Available online: https://www.ceew.in/publications/critical-non-fuel-mineral-resources-indias-manufacturing-sector#:~:text=The%20critical%20minerals%20including%20beryllium,%2C%20nuclear%20energy%2C%20and%20smartphones (accessed 30 January 2021).

Independent. 2021. Available online: https://www.independent.co.uk/news/indian-economy-hit-by-covid19-shrinks-by-73-in-202021-new-delhi-indian-arvind-kejriwal-covid-united-states-b1856987.html (accessed on 05 February 2022).

Chadha, R. Skewed critical minerals global supply chains post COVID-19: Reforms for making India self-reliant*. Brookings Institution India Center Discussion Note. Brookings India: New Delhi, India, 2020: Brookings India, pp.1-7. Available online: https://www.brookings.edu/research/skewed-critical-minerals-global-supply-chains-post-covid-19/ (Accessed on 29 December 2021).

Ernst & Young (EY). Managing the impact of COVID-19 on India’s supply chains– Now, Next and Beyond; Ernst & Young (EY), 2020; pp 1-130. Available online: https://assets.ey.com/content/dam/ey-sites/ey-com/en_in/topics/government-and-public-sector/2020/09/managing-the-impact-of-covid-19-on-india-supply-chains.pdf (Accessed on 29 December 2021).

Ernst & Young (EY). Managing the impact of COVID-19 on India’s supply chains– Now, Next and Beyond; Ernst & Young (EY), 2020; pp 1-130. Available online: https://assets.ey.com/content/dam/ey-sites/ey-com/en_in/topics/government-and-public-sector/2020/09/managing-the-impact-of-covid-19-on-india-supply-chains.pdf (Accessed on 29 December 2021).

Chadha, R; Sivamani, G. Critical Minerals for India: Assessing their Criticality and Projecting their Needs for Green Technologies. CSEP Working Paper Volume 19. Centre for Social and Economic Progress: New Delhi, India 2021: pp. 1-40 Available online: https://csep.org/wp-content/uploads/2021/12/Critical-Minerals-for-Green-Technologies-1.pdf (accessed on 29 December 2021).

Chadha, R; Sivamani, G. Critical Minerals for India: Assessing their Criticality and Projecting their Needs for Green Technologies. CSEP Working Paper Volume 19. Centre for Social and Economic Progress: New Delhi, India 2021: pp. 1-40 Available online: https://csep.org/wp-content/uploads/2021/12/Critical-Minerals-for-Green-Technologies-1.pdf (accessed on 29 December 2021).

Chadha, R; Sivamani, G. Critical Minerals for India: Assessing their Criticality and Projecting their Needs for Green Technologies. CSEP Working Paper Volume 19. Centre for Social and Economic Progress: New Delhi, India 2021: pp. 1-40 Available online: https://csep.org/wp-content/uploads/2021/12/Critical-Minerals-for-Green-Technologies-1.pdf (accessed on 29 December 2021).

Chadha, R; Sivamani, G. Critical Minerals for India: Assessing their Criticality and Projecting their Needs for Green Technologies. CSEP Working Paper Volume 19. Centre for Social and Economic Progress: New Delhi, India 2021: pp. 1-40 Available online: https://csep.org/wp-content/uploads/2021/12/Critical-Minerals-for-Green-Technologies-1.pdf (accessed on 29 December 2021).

Gupta, V; Biswas, T; Ganesan, K. Critical Non-Fuel Mineral Resources for India’s Manufacturing Sector: A Vision for 2030. CEEW Report; Department of Science & Technology: Government of India, Council on Energy Environment and Water: New Delhi, India, 2020. Available online: https://www.ceew.in/publications/critical-non-fuel-mineral-resources-indias-manufacturing-sector#:~:text=The%20critical%20minerals%20including%20beryllium,%2C%20nuclear%20energy%2C%20and%20smartphones (accessed 30 January 2021).

Chadha, R; Sivamani, G. Critical Minerals for India: Assessing their Criticality and Projecting their Needs for Green Technologies. CSEP Working Paper Volume 19. Centre for Social and Economic Progress: New Delhi, India 2021: pp. 1-40 Available online: https://csep.org/wp-content/uploads/2021/12/Critical-Minerals-for-Green-Technologies-1.pdf (accessed on 29 December 2021).

Chadha, R. Skewed critical minerals global supply chains post COVID-19: Reforms for making India self-reliant*. Brookings Institution India Center Discussion Note. Brookings India: New Delhi, India, 2020: Brookings India, pp.1-7. Available online: https://www.brookings.edu/research/skewed-critical-minerals-global-supply-chains-post-covid-19/ (Accessed on 29 December 2021).

Chadha, R. Skewed critical minerals global supply chains post COVID-19: Reforms for making India self-reliant*. Brookings Institution India Center Discussion Note. Brookings India: New Delhi, India, 2020: Brookings India, pp.1-7. Available online: https://www.brookings.edu/research/skewed-critical-minerals-global-supply-chains-post-covid-19/ (Accessed on 29 December 2021).

Chadha, R. Skewed critical minerals global supply chains post COVID-19: Reforms for making India self-reliant*. Brookings Institution India Center Discussion Note. Brookings India: New Delhi, India, 2020: Brookings India, pp.1-7. Available online: https://www.brookings.edu/research/skewed-critical-minerals-global-supply-chains-post-covid-19/ (Accessed on 29 December 2021).

Chadha, R; Sivamani, G. Critical Minerals for India: Assessing their Criticality and Projecting their Needs for Green Technologies. CSEP Working Paper Volume 19. Centre for Social and Economic Progress: New Delhi, India 2021: pp. 1-40 Available online: https://csep.org/wp-content/uploads/2021/12/Critical-Minerals-for-Green-Technologies-1.pdf (accessed on 29 December 2021).

Gupta, V; Biswas, T; Ganesan, K. Critical Non-Fuel Mineral Resources for India’s Manufacturing Sector: A Vision for 2030. CEEW Report; Department of Science & Technology: Government of India, Council on Energy Environment and Water: New Delhi, India, 2020. Available online: https://www.ceew.in/publications/critical-non-fuel-mineral-resources-indias-manufacturing-sector#:~:text=The%20critical%20minerals%20including%20beryllium,%2C%20nuclear%20energy%2C%20and%20smartphones (accessed 30 January 2021).

Gupta, V; Biswas, T; Ganesan, K. Critical Non-Fuel Mineral Resources for India’s Manufacturing Sector: A Vision for 2030. CEEW Report; Department of Science & Technology: Government of India, Council on Energy Environment and Water: New Delhi, India, 2020. Available online: https://www.ceew.in/publications/critical-non-fuel-mineral-resources-indias-manufacturing-sector#:~:text=The%20critical%20minerals%20including%20beryllium,%2C%20nuclear%20energy%2C%20and%20smartphones (accessed 30 January 2021).

Gupta, V; Biswas, T; Ganesan, K. Critical Non-Fuel Mineral Resources for India’s Manufacturing Sector: A Vision for 2030. CEEW Report; Department of Science & Technology: Government of India, Council on Energy Environment and Water: New Delhi, India, 2020. Available online: https://www.ceew.in/publications/critical-non-fuel-mineral-resources-indias-manufacturing-sector#:~:text=The%20critical%20minerals%20including%20beryllium,%2C%20nuclear%20energy%2C%20and%20smartphones (accessed 30 January 2021).

Chadha, R; Sivamani, G. Critical Minerals for India: Assessing their Criticality and Projecting their Needs for Green Technologies. CSEP Working Paper Volume 19. Centre for Social and Economic Progress: New Delhi, India 2021: pp. 1-40 Available online: https://csep.org/wp-content/uploads/2021/12/Critical-Minerals-for-Green-Technologies-1.pdf (accessed on 29 December 2021).

Chatterjee, B; Chadha, R. Non-Fuel Minerals and Mining: Enhancing Mineral Exploration in India. Discussion Note. Brrokings Institution India Center: New Delhi, India, 2020, pp. 1-7. Available online: https://www.brookings.edu/wp-content/uploads/2020/04/Enhancing-Mineral-Exploration-in-India.pdf (Accessed 16 March 2022).

Chadha, R. Skewed critical minerals global supply chains post COVID-19: Reforms for making India self-reliant*. Brookings Institution India Center Discussion Note. Brookings India: New Delhi, India, 2020: Brookings India, pp.1-7. Available online: https://www.brookings.edu/research/skewed-critical-minerals-global-supply-chains-post-covid-19/ (Accessed on 29 December 2021).

Day.W; U.S. Department of the Interior, U.S. Geological Survey. The Earth Mapping Resources Initiative (Earth MRI): Mapping the Nation’s Critical Mineral Resources; U.S. Geological Survey, 2019; pp 1-2. DOI: https://doi.org/10.3133/fs20193007

The White House. FACT SHEET: Securing a Made in America Supply Chain for Critical Minerals; 2022. Available online: https://www.whitehouse.gov/briefing-room/statements-releases/2022/02/22/fact-sheet-securing-a-made-in-america-supply-chain-for-critical-minerals/

Office of Public Affairs, U.S. Department of Commerce. Department of Commerce Releases Report on Critical Minerals; U.S. Department of Commerce: Washington D.C, 2019. Available online: https://2017-2021.commerce.gov/news/press-releases/2019/06/department-commerce-releases-report-critical-minerals.html