As China’s financial commitments in Latin America grow, so does its influence. But some countries resent Beijing throwing its weight around

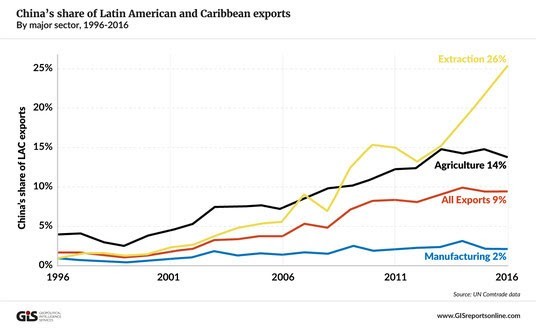

Over the past two decades, China has become a significant player in Latin America. The process began slowly, but as the Chinese economy began to hit spectacular levels of growth in the 1990s, it drove the price of several key raw materials higher. China became the leading buyer of many commodities produced in the region, making it an influential player in Chile (copper), Argentina and Brazil (soybeans), Peru (mining), as well as Ecuador and Venezuela (petroleum).

|

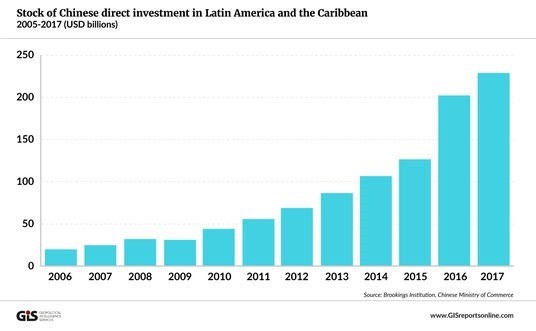

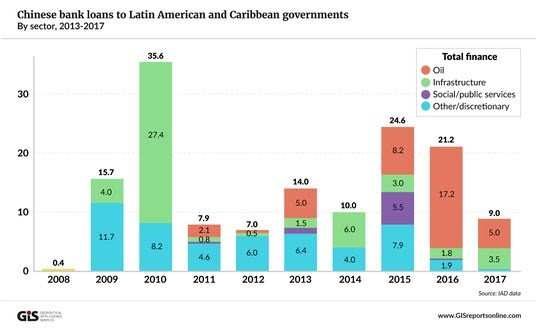

To buttress its growing role, China began to invest in a wide variety of industries throughout the region, notably in mining-related activities, infrastructure, and energy, providing $140 billion in loans to Latin America in the last decade. |

|

|

|

As the leading provider of infrastructure in the region, both as investor and financing agent, it began to accumulate sovereign debt, especially in Venezuela and Ecuador. From 2005 to 2015, China’s economic and financial influence expanded dramatically, but Beijing kept a very low political profile. Recently, that has begun to change.

It is no longer possible to consider China below the radar in Latin America, especially as the administration of US President Donald Trump has expressed scant interest in claiming geopolitical leadership there. With China’s trade, investment and lending growing rapidly, many countries in the region would like China to play a larger role in their development plans. Given the heavy historical legacy of opposition to U.S. hegemony in most of the region, some see Beijing as a welcome counter to Washington, a role the Chinese government has hitherto taken pains to avoid. While China has evinced little interest in governance in the region, it is gaining an unwanted reputation for disregard of environmental concerns, especially around the Amazon basin, and for frequent violations of local labor rights.

The Chinese role has become so important that there are now two academic centers devoted to following its every move in the region. One, the Global Development Policy Center at Boston University, has put together a rich database of macroeconomic activities, such as loans and investments. The other, the Centro de Estudios China-Mexico (CECHIMEX) at the National Autonomous University of Mexico (UNAM), does careful study at the firm level of Chinese investments in Latin America, and has a library of working papers on a variety of relevant topics.

The geopolitics of China’s involvement in Latin America are tantalizing. As Professor Juan Gabriel Tokatlian of the Argentine Universidad Torcuato di Tella has pointed out, this comes at a time when the influence of Latin America in world affairs is declining, as few countries actively participate in world affairs. The countries of the region, notably Brazil, Venezuela and Argentina, which at one point after the Cold War expressed interest in becoming rule-makers, are now increasingly playing the role of rule-takers. As I have attempted to explain at length in my recent book [Latin America in International Politics. Challenging US Hegemony (Lynne Rienner Publishers)] the nations in Latin America are very slow to express their agency at the global level. Efforts at regionalism, such as UNASUR, CELAC, ALBA, and the BRICS have expressed a desire to be seen as coming out from under the hegemonic shadow of the US. All of these efforts have achieved less than was promised for them.

How China uses its growing influence in the region will also depend, in large part, on how the United States chooses to deal with both China and Latin America. Many Latin Americans see the potential conflict between China and the United States as a battle between two hegemons. If such a struggle or competition were to occur, it would signal China’s readiness to assume a much more forward public role in hemispheric affairs. It is also possible that China might try to use its deep engagement in Venezuela and Ecuador as a card in the complex trade negotiations with the US. Such a move would have little impact given the lack of interest in the Trump administration is exercising strategic leverage in the region.

Crucial to the decisions that China must take in the coming months is its interest in creating a PetroYuan Zone, including Latin America. Many tactical decisions, especially in accumulating sovereign debt in Venezuela and Ecuador and in its energy investments in Argentina, are driven by its long term goal of establishing the Yuan as a trading currency in the region and globally. With at least one third of China’s oil coming from Latin America, and with China as the major trading partner of Brazil, Chile and Peru, the stakes are high. In Venezuela and Ecuador, the Chinese have put in place a defensive strategy that guarantees supply of energy at a predictable price, something they have not succeeded in doing with Russia, Saudi Arabia or other sources of energy.

Chile

China’s involvement in Chile began as a pure commodity play. Almost unintentionally on both sides, China has become the primary market for Chile’s principal export, copper, and the country’s principal trading partner. With the price of copper above $3.50/lb for most of the decade from 2004 to 2014, no one in Santiago complained about dependence on the Chinese market. When the Chinese economy slowed and the price collapsed, the Chilean government began to look for alternative trade options. The dependence upon the export of a single commodity, copper, to a single buyer, represents 25% of Chile’s exports and China buys nearly 28% of the country’s exports. Most significant, the government of Chile earns a royalty from copper exports by the national copper company, CODELCO. That concentration makes the Chilean economy and, by extension, the Chilean government, vulnerable to Chinese actions and decisions.

The result of Chile’s efforts to diversify its trading partners was the Pacific Alliance with Peru, Colombia and Mexico through which Chile is trying, with modest success thus far, to diversify its trading partners, open new areas for investment, and strengthen its currency through currency exchanges among the members. This has been a boon to Chile, but by no means a complete solution to its dependence on copper exports. From China’s perspective, Chile is its most stable and reliable source of copper. China is the world’s largest importer of copper. As Bloomberg reports, China gets about 1/3 of its 17.35 million tons of imported copper (ore plus refined product) from Chile and nearly as much from Peru, Chile’s northern neighbor. In passing, it might be noted that Peru’s exports are much more diversified than Chile’s, and it does not experience the same sense of dependence upon a single customer

Now, however, the Chile-China bilateral relationship is becoming complicated. As reported in the Nikkei Review, Chinese firm, Tianqi, recently purchased a major interest in Sociedad Quimica y Minera de Chile S.A. (SQM), the largest lithium producer outside of China. For decades, China has dominated the international lithium market, lithium being a key component in the batteries for electric vehicles. Chile and its economic development agency, CORFO, moved to block the sale of the stake held by Canadian company Nutrien to the Chinese firm Tianqi, only to fail after a bitter debate in the legislature.

It is interesting to note that SQM is in a joint venture with a company from Argentina to produce lithium from the Argentine side of the same salt flats under which the Chilean supply is found. At the same time, SQM is also a partner in a large development in Australia that is expected to come online by 2021. Tesla, Toyota, and Great Wall Motors have indicated their interest in joint ventures with SQM in the Chilean salt flats. Lithium is becoming one of the great geopolitical commodities of the 21st century. With the potential of the huge lithium reserve under the salt flats shared by Argentina, Bolivia, and Chile to threaten China’s ability to control the international price of lithium in the coming decade, China is actively exploring options.

The pattern of Chinese investment throughout the region follows its initial geopolitical drive to feed its voracious appetite for commodities, with results varying from country to country. In Chile, a fairly advanced and stable country, it operates through state corporations and state-controlled private companies.

Venezuela

China’s involvement in Venezuela, which also began as a commodity play, has taken a much different turn than in Chile. As the price of oil started to rise at the turn of the century, China, utterly dependent on foreign sources of energy (except for its own dirty coal), entered a series of barter deals with the regime of former Venezuelan President Hugo Chavez. This was part of Chavez’s plan to create an anti-U.S. front in the hemisphere, which he called the Bolivarian Alliance for the Peoples of Our America (ALBA). As the price of oil soared to over $100 per barrel in 2011-12, China bought more and more Venezuelan sovereign debt in exchange for oil at fixed, moderate prices. It also used currency swaps to invest in several Venezuelan oil projects, mainly in the heavy oil deposits of the Orinoco basin. China thus became a pillar for the survival of the regime of Nicolas Maduro, Chavez’s successor at a time of rising Venezuela-US tensions. Today, China has stumbled into what may be an uncomfortable position as the principal financial prop for the Maduro government, holding nearly US$60B of sovereign debt that trades at around 25 cents to the dollar. So parlous is the situation in Venezuela that the national petroleum company, PDVSA, is falling apart and production of oil has fallen by half in the past two years. If the production decline continues, China may be holding debt that is nearly worthless as a guarantee for oil that PDVSA may not be able to deliver. Still, China, along with Russia, which owns half of the PDVSA US subsidiary CITCO, Iran were three of a small group of countries that recognized Maduro’s stolen presidential election in 2018 and attended his lonely swearing in ceremony in January 2019.

Ecuador

Under President Rafael Correa, a fierce anti-imperialist, Ecuador was a founding member of ALBA and entered into a series of debt-for-petroleum swaps similar to the pattern followed in Venezuela. As the price of oil continued to rise, Correa doubled down by promoting Chinese investments in Ecuadorean infrastructure, especially dams on the tributaries of the Amazon and in the Andes.

However, Ecuador could never produce nearly as much oil as Venezuela. Now, Mr. Correa is out of power, the price of oil has fallen precipitously, and the new administration of President Lenin Moreno is not sure it is comfortable having the country’s oil mortgaged to the Chinese. To cover their position in oil, the Chinese have doubled down on their investment in infrastructure. However, to strengthen his argument against dependence on the Chinese, Moreno has given considerable political space to the NGOs that monitor the environment and allege that China has committed numerous violations of Ecuador’s environmental protection laws. Moreno has also supported the claims of indigenous peoples who say that Chinese oil contractors are exploring for oil on their lands. Correa had encouraged those investments in exploration. Moreno wants to shut them down. To make matters worse, the biggest infrastructure investment in a massive dam has literally sprung a leak. At this point, the Chinese are trapped in a relationship that may not work out as initially planned.For his part, Moreno has swallowed some of his anti-dependence rhetoric and borrowing a new US$800m from the Chinese to keep his government afloat.

Brazil

The Brazilian case is entirely different from all others in Latin America, even though it too began with trade in commodities – in this case for soybeans. China is the largest buyer of soybeans in the world and Brazil is the largest exporter of the commodity, having replaced the U.S. in that position in 2017. Argentina is the third-largest exporter, far behind Brazil and the U.S. Brazil has the capacity to produce significant amounts of petroleum for export as well as other strategic raw materials. With the massive Car Wash corruption scandal, the government petroleum company, Petrobras, had to stop all plans for expansion in 2015, Not until 2018 did it begin to invite investors to partner with it to increase production. With the election of the far-right Jair Bolsonaro as president in 2018, it remains to be seen whether Brazil will crack down on Chinese investment. In his augural address, Bolsonaro indicated he would join Trump in cracking down on the Maduro regime in Venezuela and declared that he would not let the Chinese take over the Brazilian economy. Thus far, there are no actions to back up this rhetoric.

Over the past two decades, the price of soybeans has fluctuated significantly, from a low of $4.40 per bushel in 2001 to $17.40/bushel in 2012, and then back down to less than $9/bushel today. Throughout this period, China has bought vast quantities of soybeans, while its companies made direct investments in the soybean production chain, including land, processing plants and companies that export. Under the previous government of the Workers Party (PT) these investments did not cause alarm. And, unlike Africa, Brazil and the other Latin American countries will not tolerate Chinese labor in the projects. The Chinese have also loaned $5 billion to the Brazilian national petroleum company, Petrobras, and have made investments downstream in the Brazilian energy grid. China was a prized trading partner and valuable ally for Brazil under Workers’ Party rule. Brazil’s economy, after all, is the seventh-largest in the world, so Chinese activity never had as high a profile there as it had in Chile, Ecuador or Venezuela.

Cuba

The only other individual country worth mentioning in a discussion of China’s role in Latin America is Cuba. Beginning in the Cold War, Cuba turned to the Soviet Union and to China for support in dealing with the embargo imposed by the U.S. With the collapse of the Soviet Union, Russia has not had the resources to be of much help and China has been reluctant to step into a complicated situation, although it has consistently supported Cuba in the UN and spoken out against the US embargo. For a while, Hugo Chavez was able to help the Castro regime with cheap oil. The successor Maduro government has attempted to continue that aid. However, the collapse of Venezuelan production has made it difficult to maintain Venezuelan largesse with Cuba, although the flow of cheap oil has continued even as Venezuela’s oil production has plummeted.

The Cubans have tried to persuade the Chinese to fund the construction of a deep-water port on the island and to provide some form of financial support. Beijing has shunned the role of lender because of Cuba’s dual currency regime, which, in the absence of any commodity export such as oil – sugar does not much interest the Chinese – would make recovering their investment very difficult. Perhaps as an act of solidarity, Chinese banks have provided modest support for infrastructure investments and to cover short-term cash flow problems. The size of the Cuban economy is so small, however, that these gestures do not amount to significant economic exposure. The Trump administration’s hostility toward Cuba may be one reason that the Chinese have thus far remained on the sidelines.

Positive impression

Aside from these individual country cases, China has burnished its role as a partner in the development of the region through its new development bank, the Asian Infrastructure Investment Bank (AIIB) and its Belt and Road Initiative, both extending from Asia to the world. Most Latin American countries have joined the bank, and it has already made loans in the region of several hundred million dollars. In fact, if the AIIB’s Latin America portfolio continues to grow at the rate it has for the past two years, it will match or exceed that of the Inter-American Development Bank, the region’s Bretton Woods Institution, in less than a decade.

The other way in which China is making a positive impression in Latin America is its willingness to participate, as an investor or lender, in the region’s large infrastructure projects, such as the Interoceanic Highway, building on its achievements in its Belt and Road Initiative (BRI) in Eurasia. Just a few years ago, China was ready to partner with Brazilian construction giant Odebrecht in building the Bi-Oceanic Railway. However, that project has never gone beyond the drawing boards, partly because of political instability in Brazil and Peru, as well as the huge corruption scandal that bankrupted Odebrecht.

One final point on perspective. While Chinese foreign direct investment (FDI) is significant in several Latin American countries, it is only 10 percent of China’s total investment overseas. Chinese FDI is a pittance compared to the stock of U.S. investment in the region, and a tiny fraction of total world FDI, which in 2017 stood at $1.4 trillion. Moreover, Latin American producers export three times more to the U.S. than they do to China. And when it comes to soft power, China’s influence is negligible, compared to that of the U.S. Nevertheless, in the last few years, Chinese state-run news agencies Xinhua and People’s Daily have established Spanish-language operations, which now span Latin America and have become more aggressive as the Trump administration appears to have less interest in the region.

For the moment, the rise of China in Latin America is a function of a coincidence between Chinese need for commodities together with its interest in strategic investments, including currency swaps for its projected Yuan Zone plus the willingness of most of the nations in the hemisphere to use China’s new presence and its promises of more investments as a means of asserting their independence from the United States. It remains an open question whether China’s expanded trade and construction presence will enable key Latin American countries to secure more significant agency and autonomy, or, as Tokatlian suggests, will it create a dual dependence on China and the United States. In pure economic terms, the United States remains the predominant external player in the region. But, China has expanded its role in commodity markets and infrastructure projects.