Abstract

Over the past decade, China has been greening its electric power system faster and more thoroughly than any other industrial power. In the course of the years 2007 to 2016, China’s dependence on thermal power capacity declined from 77% to 64%, and can be expected to tip below 50% within another decade if the trend continues. In terms of electricity generated, the contribution of thermal power has dipped from 82% to 72% over the last decade. But it is also true that China’s growth model continues to pump out greenhouse gases. The issue: is the green transformation happening fast enough?

Keywords: Electric power, renewable energy, greenhouse gases

We have been tracking China’s green shift across the power sector now for several years.1 The 2016 data are now in, released by the China Electricity Council and the National Energy Administration.2 The new data reveal a strong continuation of China’s green shift within the power sector as greening trends at the margin exceed blackening trends. In other words, even as China’s 7 percent annual growth and its growing coal consumption continues to drive the output of the world’s leading producer of greenhouse gases, China’s domestic dependence of power generation on fossil fuels, with their threat of pollution and energy insecurity, is diminishing.

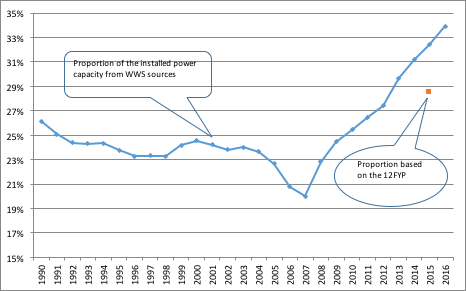

The headline results are that in the year 2016, China’s total electric power capacity increased to just over 1.6 trillion watts (1.65 TW), with water, wind and solar sources accounting for 34% — up from 32.5% in 2015. There is a consistent trend here that goes back for more than a decade. Since 2007, China’s dependence on WWS sources has risen from 16% to 25% in 2016 in terms of electric generation, and from 20% to 34% in terms of electric power generating capacity It is difficult to overstate the significance of these trends. They mean that in the largest electric power system in the world, in the country that currently has the highest carbon emissions, there is under way a significant green shift that is comparable to the best in the world. Of particular significance is the fact that this process it is driving down costs of green energy — for China and the world — and becoming the planet’s dominant business for production and export of green technology and green products.

Examining the power generation sector, as in previous years we wish to focus on the leading edge (changes in terms of capacity added, electricity generated and investment) as distinct from the system as a whole. In capacity addition and electricity generation, the year 2016 saw it greening faster than it is continuing its black trajectory. The investment in clean energy, however, fell from its level in 2015, due to reasons we will discuss below.

In 2016, additional capacity amounted to 125 GW (more than two billion-watt power stations added each week). Of this, thermal sources (mainly coal-burning) added 53 billion watts (53 GW) while WWS renewables sources added 64 GW, well in excess of thermal sources. Of the new capacity added in 2016, WWS sources accounted for 52%, and thermal sources for just 43%. The rest is the addition in nuclear power generation capacity (5%). So while China is still adding a billion-watt power station burning coal each week, it is adding wind turbines and solar farms at an even greater rate.

In terms of electricity actually generated, in 2016 China generated 5,990 TWh of electricity (around 6000 TWh or 6 trillion kWh), 5% up on 2015, which is lower than the economic growth in the year (6.7%). In fact, the growth of electric generation has been lower than economic growth in the country since 2014, revealing a new trend that China may start to delink its electricity consumption from economic development. The delinking is partly a result of a change of the economic structure towards an economy more based on service and high-value manufacturing activities, and partly due to growing energy efficiency. Total electricity generated from WWS sources amounted to 1488 TWh (around 1.5 trillion kWh), up 11.4% on the total for 2015. To give a sense of the vast scale of China’s renewables generation, this sum of 1488 TWh is comparable to the total electricity generated by Germany, France and the UK combined.3 Looking at the margin, i.e. at the additional electricity generated in 2016, there was more additional electricity generated from WWS sources (152 TWh) compared with that in 2015, than from thermal sources (102 TWh).

China invested US$ 132 billion (885 billion yuan) in new power supply systems in the year 2016, with power generating facilities accounting for US$51 billion (343 billion yuan) and investment in the grid for US$81 billion (543 billion yuan). Within the category of power generating facilities, thermal sources accounted for US$18 billion (RMB 117 billion yuan) of new investment, with hydropower and wind power accounting for US$22 billion (61 billion yuan) and US$13 billion (90 billion yuan) respectively, plus US$7.6 billion (51 billion yuan) of investment in nuclear power. Even without accounting for investment in solar power, the data for which are currently not available, the investment in power generation facilities based on renewable sources (water and wind) far exceeded that on thermal power generation facilities (151 billion yuan vs 117 billion yuan).

The bottom line: we see that once again, in 2016 the increases in capacity, in electricity generated and in investment all showed green sources outranking black, thermal sources at the margin – where the electric power system is changing. g. Even as China continues to expand its consumption of energy based on black thermal sources (although in a diminishing rate), its green consumption is growing even more rapidly. But the great question remains: is the greening proceeding fast enough? China’s black electrical system remains a potent source of carbon emissions even as it greens at the margin. And the immediate pollution costs continue to mount. Our analysis aims to elucidate the rate and direction of China’s greening – but it cannot undo the damage already inflicted and the further damage that is likely to ensue as thermal power continues to be generated. Although China is greening its power system at a rate that is unprecedented for industrial countries, it could doubtless further accelerate the process with more concentrated policy and market guidance.

The 2016 results

As before, we check the data on power generation showing results for 2016 as published by China Electricity Council. The data revealing trends in electric generating capacity, in actual electric energy generated and in investment, are summarized in Table 1.

Table 1. Power generation and changes, China, 2015-2016

|

Capacity GW |

|

Generation (TWh) |

|

Investment RMB billion * Data currently unavailable ** The calculation does not take inflation into account – The figure in 2010 was too small to make a meaningful comparison with the level in 2016 |

1. Generating capacity

First, in terms of electric power generating capacity, we note that China’s is now by far the largest electric generation system on the planet. It had grown to a capacity of 1.5 trillion watts in 2015 – as compared to 1.17 trillion watts in the US in the same year, and lower levels for EU countries and Japan. The total capacity in 2016 reached 1.6 trillion watts, with year on year growth of 8% — meaning that currently China’s capacity additions still outpace the country’s overall economic growth rate. However, much of the additional capacity is owing to the completion of previously initiated projects in the pipeline. As the investment data indicate, the capacity addition is likely to moderate in the next years, partly due to the change in the Chinese economic structure towards less energy-intensive, more value added economic activities, and also the effect of improvements in energy efficiency.

It is China’s overall rate of renewable energy-based electricity generating capacity additions that is so striking. In Figure 1 we show that China increased its generating capacity from water, wind and sun from 20% in 2007 to 35.5% in 2016 – or a 14.5% increase in a decade. The chart shows very clearly the direction in which China’s power generation system is headed.

|

Figure 1. China: Trends in power sources generated from Water, Wind and Sun, 1990 to 2016 Source: data up to 2007 is adapted from the EIA of the US, data after 2008 is taken from the China Electricity Council |

The individual items for water, wind and sun capacity additions in 2016 (and over the decade to 2016) also need to be noted. The addition of 17 GW of wind power capacity was large, as is the cumulative total of 150 GW – although not as large as capacity additions in 2015 (about 35 GW), and not as large as claimed by the Global Wind Energy Council (GWEC). In fact the GWEC claims that China’s wind power capacity additions in 2016 were 23 GW, bringing global installed capacity to 487 GW (nearly half a terawatt). GWEC claims that China added 23.3 GW in 2016 and reached a cumulative total of 169 GW – but the more cautious figure put out by the NEA and CEC in Jan 2017 is likely to be more accurate.4 In any case, the target for wind power capacity to be reached by 2020 as issued in late 2016 by the 13th FYP for energy, at 210 GW or more, seems a safely conservative target and one likely to be exceeded, given that China had already reached a total of around 150 GW by 2016.

The buildout of China’s wind power capacity continues to be impressive, as revealed by the growth over the past decade (Fig 2)

|

Figure 2. China wind power capacity, 2007-2016 Source of primary data: China Electricity Council |

The capacity of solar power added in 2016 was truly impressive, notching up a gain of 34 GW for 2016, more than doubling the addition in 2015 (16 GW), and reaching a cumulative total of 77.4 GW. (According to GlobalData the world’s cumulative solar PV capacity reached 271.4 GW in 2016, with China accounting for 19.7%.5) The expansion of solar-based electricity is highly significant, especially given there was little solar power generating capacity in the country before 2010. The 13th Five Year Plan for energy in China foresees only a modest 2020 target for solar power of 110 GW – a target that is widely viewed as very likely to be exceeded since it implies less than a further doubling between now and 2020.

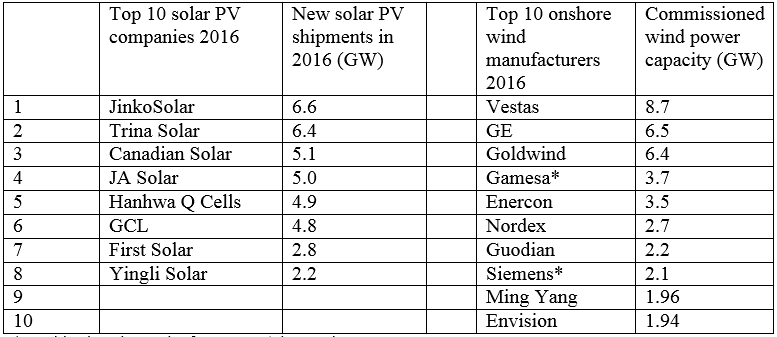

China’s wind and solar power companies continued to perform very well in international competition in 2016. China has 7 out of the world’s top 8 solar PV companies; and has 4 out of the top 10 onshore wind turbine manufacturers in 2016, according to the latest data from GlobalData (for solar PV companies) and BNEF (for wind manufacturers) respectively. All the top eight solar PV companies are based in East Asia; while most of the top 10 wind manufacturers are European and Chinese firms.

Table 2 The top solar PV companies6 and the top onshore wind manufacturers in the world7

|

*Combined total capacity for Gamesa/Siemens in 2016: 5.8 GW |

As for hydropower, this continues to be the dominant non-thermal source of power in China, aided by gigantic installations like the Three Gorges Dam system, some of which have been criticized for their adverse impacts on riparian ecosystems and local communities. But China is approaching the limits to its hydro power additions, with the year 2016 seeing only 12 GW added, bringing the installed capacity to 332 GW. The 13th FYP for energy foresees a target for hydro capacity in China of 340 GW by 2020 – a target that appears to be realistic, and also reflects the fact that China is approaching its limits of damming rivers to exploit their hydro capacity. (But note that hydro engineering is now a Chinese speciality, and it can be expected that Chinese hydro companies are bidding strongly for hydro projects around the world.)8

2. Electricity generated

China is the world’s largest generator of electric energy. The total generated in 2016 was 5990TWh (or billion kWh), up 295 TWh over the energy generated in 2015. The additional electricity generated was only 5.0% higher than the amount generated in 2015 – a strong indicator that China is indeed decoupling its power production from economic growth. It is of course disappointing that China actually added some coal-burning power capacity in 2016 and generated more thermal electric energy than in the year 2015 – a point we shall return to below. Over the period between 2010 and 2016, however, the total electric power generation grew decisively faster than the thermal electric power generation, with the former increasing by 70% while the latter by 48%.

In terms of the total electric power system, China is still much more ‘black’ than green. In 2016 its WWS sources accounted for 25% of total electric energy generated, while thermal sources accounted for 4288 TWh, or 71.6% of China’s total electricity generated. The rate of decline of thermal sources is nevertheless impressive – falling from 82.4% of electricity generated in 2008 to 71.6% in 2016 – an 11% drop in 10 years.9 While the share of fossil fuel-based electric power generation is not declining as fast as the decline in its share in generating capacity (which reached as low as 62.5% of total installed capacity in 2016 and is on target to reach 50% green capacity by the late 2020s) due to the relatively lower capacity factors of renewable energy technologies, the former is still on target to reach a tipping point of thermal electric energy falling below 50% in the early 2030’s.

However, curtailment continues to be a major challenge to further expansion of WWS-based electricity generation.10 According to the data from NEA, the total curtailment in wind power generation in 2016 amounted to almost 50 TWh, increasing from 34 TWh in 2015, although the situation improved in the second half of 2016 over that in the first half of the year. The curtailment issue in the solar power sector was also concerning. The curtailment rate in five provinces in China, where about 40% of the country’s total solar PV capacity is located, reached 20%, with 7 TWh of power generation being curtailed.

China is taking three main measures in response to the challenge, which have implications for investment in the power sector over the next few years.11 Those include: first, orderly development of renewable-based electricity generating capacity, especially in areas where curtailment is particularly severe; second, investment in long distance transmission capacity of the grid and development of micro gird access; and third, construction of pumped storage stations to improve the grid’s energy storage capacity.

On the other hand, the Chinese government has also recently taken dramatic measures to correct the surge of construction of coal-fired power stations in the previous year.12 As per the NEA’s directives, a number of coal-fired power generation projects that had been previously approved, including many that were already under construction, were cancelled or suspended in 2016 and early 2017. Meanwhile, according to a media report, only 22 GW of new coal-fired power generating capacity was approved for construction in 2016, including only 6GW in the second half of the year, a significant drop compared with the 142 GW of coal-fired power generating capacity approved for construction in 2015.13

3. Investment in new energy systems

The data on investment in renewable-based electricity generation capacity in 2016 is disappointing. According to the CEC and NEA, investment in hydropower stations and wind power stations dropped by 22% and 25% respectively from the levels of 2015, and investment in thermal power facilities stayed at the same level with respect to the previous year. These developments reflect a more cautious approach taken by investors facing rising demand of electricity in the country due to concerns that power generated by their renewable energy projects would not be able to be sold in the market when completed, but also partly result from the rapidly falling costs of power generation equipment, especially those in the area of renewable energy such as wind turbines and solar PV.

A widely quoted source of investment data is the Bloomberg New Energy Finance (BNEF). The BNEF data on investment in clean energy covers a number of sectors, including renewables, low carbon services such as finance, legal and other services and supports for clean energy, and energy efficiency technologies. According to the BNEF, China invested US$88 billion in the broad area of clean energy (including renewables) in total in 2016, a 26% fall compared with the 2015 level of US$119 billion.14

However, renewable energy investment levels in China can be expected to pick up over the next several years if the targets as set out in the Renewable Energy 13th Five Year Plan are to be achieved.15 According to the Plan, total investment of 2.5 trillion yuan ($US375 billion) on renewable energy is required over the period between 2016 and 2020, including 700 billion yuan on wind power, one trillion yuan on solar, 600 billion yuan on hydropower, and the rest for biomass power, biogas, geothermal energy, solar water systems etc. This would translate to about 500 billion yuan (US$75 billion) of investment per year on average.

Developments involving coal

China has been struggling with its coal dependence for many years now, and the year 2016 saw further demonstrations of central planners’ determination to get off coal as principal fuel source. The 13th FYP for energy released at the end of 2016 set an important standard in setting an overall coal consumption cap of 4.2 billion tonnes (reiterating the cap first announced in the 2014-20 Energy Development Strategy Action Plan). As revealed in Fig. 3 China’s coal consumption peaked in 2013 at 4 billion tonnes, and it has been decreasing each year (although at a rate that moderated in 2016 over 2015), while electricity generated from burning coal has flattened out in the last five years.

|

Figure 3. China’s “black” energy system, 1980-2016: Coal consumption and electricity generation |

Source of primary data: The data for conventional thermal electricity generation is available from the China Electricity Council (CEC); the data for total coal production is available from the BP Statistical Review (2016) ‘Statistics of World Energy’; the data for coal consumption for thermal power generation is available from the National Bureau of Statistics, China.

As shown above in Table 1, the share of fossil fuel-based power plants, predominantly coal fired stations, in China’s generating capacity has been falling by over 10% a decade, to reach 66% by 2015 and just 64% in 2016. The 5YP for energy released by the NEA calls for the share of fossil fuel-based generating capacity in total generating capacity to fall to 61% by 2020, and that of coal to 55% – which assumes that the current rate of reduction of 10% a decade can be maintained (or improved). On top of this consumption limit, the 13th FYP specifies a target for capping thermal power capacity below 1,100 GW (1.1 TW) – not far above the 2016 level of 1,054 GW of thermal capacity.

Consistent with this stringent goal, in March 2016 the NEA ordered a halt to construction of new coal-fired power projects in 15 regions where capacity was in surplus. In April the NEA went further and introduced what is known as the ‘traffic lights’ control system based on capacity analysis region by region. In January 2017 the NEA announced that 104 planned or under-construction coal plants were being suspended, amounting to 120 GW of thermal capacity being decommissioned (at least until 2018).16

The London-based Carbon Tracker Initiative released a report in November 2016 stating that as of July 2016 China had 895 GW of operating coal-burning capacity plus another 205 GW of capacity under construction and 405 GW of extra capacity planned – amounting to investment in unneeded coal-burning capacity of more than half a trillion dollars (CTI 2016).17 Thus the suspensions announced by NEA in January, amounting to 120 GW of capacity being decommissioned, go some way to relieving the situation described by CTI.18

According to China’s 13th FYP for energy, released in October 2016, the share of coal in primary energy consumption is envisaged to fall from its current level of 64% to 58% by 2020, while the share of non-fossil fuel in primary energy shall be at least 15%. Its level currently stands at 13%, which is lower than the level of Germany (about 20% in 2015) but comparable to the level of the US (14% in 2015).

Renewable-based electricity in China in international perspective

The result in 2016 is that China is the world’s largest builder of renewable energy systems by far. Again there are three aspects to the comparative analysis of the scale of China’s domestic energy system compared with that of other leading industrial countries – in terms of WWS capacity, in terms of electricity generated from renewable sources, and in terms of investment.

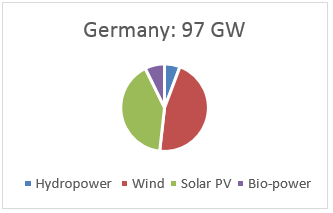

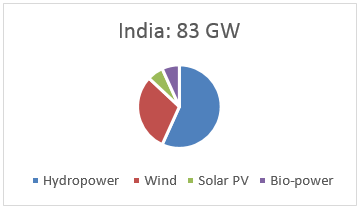

Taking generating capacity first, China is a clear world leader compared with other leading industrial powers, as shown in Fig. 4.

China is likewise the world’s leading generator of WWS (green) electricity. As a point of comparison, the US generated just over 4,100 TWh of electricity in 2016, of which fossil fuel-based electricity accounted for 65%, nuclear power accounted for 20% and renewables including hydro accounted for 15%, according to the Energy Information Administration. The WWS-based electricity generation in the US amounted to 512 TWh in 2016, which is about one third of the WWS-based electricity generation in China (1488 TWh).

On the financial front, China has again outperformed the rest of the world in terms of investment in clean energy. According to BNEF, of a total investment in clean energy in 2016 of US$287.5, China was stated to account for $87.8 billion (30.6%) while the EU accounted for $70.9 billion and Japan for just $22.8 billion.

The London-based consulting firm E3G surprised the world with a chart showing China pulling ahead of the EU in clean energy investment in the decade up to 2015.20There will be great interest in any update that E3G may care to publish in 2017.

Globalization of China’s energy system

Alongside China’s emergence internationally as a renewables superpower, the fear remains that China’s globalization is driving further expansion of its coal and fossil fuel activities. The issue was put starkly in an article in ClimateHome: ‘China cuts coal at home, grows coal abroad’.21 Is this really happening?

The argument is that Chinese companies and banks continue to drive global coal expansion, with state-owned companies, backed by state loans, building coal-fired power plants across the world. Now there is no doubt that much of China’s internationalization strategy, particularly the infrastructure connectivity projects involved in One Belt One Road, involve further expansion of fossil fuels. There are pipelines, coal-loading facilities, and new coal-burning power plants. It would be surprising if these items were absent from any list of Chinese investments abroad. But the point is surely that these ‘black’ investments, like those involved in China’s domestic activities, are increasingly matched by green investments abroad. The China-backed Asian Infrastructure Investment Bank (AIIB) has been created to drive the financing of many of these projects, and it explicitly describes itself as a green bank, with green projects like the world’s largest solar farm being built in Pakistan with Chinese financing as clear evidence of this trend. India tends to be cited widely as the site of China’s “next” coal boom – yet it is worth noting that India is desperately seeking to build its green capacity, through the National Solar and Wind Power programs, while actually shutting down coal-fired plants.22 In the year 2016 the Indian Energy Ministry announced plans to cancel four proposed coal-fired power plants, having a combined capacity of 16 GW, while the draft National Electricity Plan released at the end of the year concludes that beyond already partially completed plants, India needs no further coal-fired power plants.23 At the same time that India’s dependence on coal is seen as diminishing, its reliance on solar and wind is rising. In the first week of February 2017 the state of Madhya Pradesh staged a public auction for bids to build solar arrays in the Rewa Solar Park, with the winning bid coming in at Rupees 3.59-3.64/kWh (US$53/MWh) – competitive with the best in the world and one that was 25% lower than bids lodged a year earlier.24 India is greening its black electric power system in emulation of what China has done a decade earlier. These developments in the greening of India’s electric power sector are not only of enormous benefit to India, such plans also cast China’s prospects for exporting coal-fired plants to India in a fresh light.

Related articles

- John Mathews and Hao Tan, China’s New Silk Road: Will it contribute to export of the black fossil-fueled economy?

- Sung-young Kim and John A. Mathews, Korea’s Greening Strategy: the role of smart microgrids

- Andrew DeWit, Japan’s Bid to Become a World Leader in Renewable Energy

- John A. Mathews and Hao Tan, The Greening of China’s Black Electric Power System? Insights from 2014 Data

- John A. Mathews and Hao Tan, “China’s Continuing Renewable Energy Revolution: Global Implications”

- John A. Mathews and Hao Tan, “Jousting with James Hansen: China building a renewables powerhouse”

- John A. Mathews, The Asian Super Grid

- Andrew DeWit, Japan’s Energy Policy at a Crossroads: A Renewable Energy Future?

- Sun-Jin YUN, Myung-Rae Cho and David von Hippel, The Current Status of Green Growth in Korea: Energy and Urban Security

Notes

For the NEA see press release issued on 16 Jan here; for the CEC see here. The 13th Five Year Plan for electric power sector was issued in Nov 2016, here.

The latest figures for total electricity generation in the three EU countries are: Germany 648 TWh; France 569 TWh and the UK 338 TWh, or 1555 TWh in total – compared with 1488 TWh just for electricity generated from WWS sources in China. It is worth noting that the total electricity generation of OECD countries has barely increased since the late 2000s.

One explanation for the divergence may be that the GWEC estimate may include non grid-connected wind capacity. See the GWEC report for 2016 here.

See ‘Global installed solar PV capacity will surpass 756 GW by 2025, GlobalData’, by Joshua Hill, CleanTechnica, June 28 2016.

A very recent example concerns China’s Gezhouba Group which has been contracted to build a big hydropower project on the Indus River in Pakistan (as part of China’s One Belt One Road strategy), as reported in the Hindustan Times, here.

Curtailment refers to the situation where power could be potentially generated and supplied to the grid based on existing capacity but in reality has to stay idle, because grid companies determine the priorities among various power generation facilities and technologies when the total demand for electric power at a given time is less than the supply.

Those measures are indicated in the Power Sector 13th FYP, as articulated by the spokesperson of the National Energy Administration, here.

See e.g. the reports by Greenpeace on those development here. On the validity or otherwise of China’s coal consumption statistics, see our earlier article in APJ, posted in November 2015, here.

See the CTI report ‘Chasing the Dragon? China’s coal overcapacity crisis and what it means for investors’ (2016). London: Carbon Tracker Initiative.

The chart for China is based on the 2016 data released by the CEC and NEA; the charts for other countries are based on the 2015 data, available from REN21 (2016)’s report.

We elaborate on this point in our companion article on China’s globalization of its energy system as part of its One Belt One Road strategy, here.