Abstract

Apple’s commercial triumph rests in part on the outsourcing of its consumer electronics production to Asia. Drawing on extensive fieldwork at China’s leading exporter—the Taiwanese-owned Foxconn—the power dynamics of the buyer-driven supply chain are analysed in the context of the national terrains that mediate or even accentuate global pressures. Power asymmetries assure the dominance of Apple in price setting and the timing of product delivery, resulting in intense pressures and illegal overtime for workers. Responding to the high-pressure production regime, the young generation of Chinese rural migrant workers engages in a crescendo of individual and collective struggles to define their rights and defend their dignity in the face of combined corporate and state power.

Keywords:

Foxconn; Apple; global supply chains; labour; China; outsourcing; consumer electronics manufacturing; collective actions

Introduction

The magnitude of Apple’s commercial success is paralleled by, and based upon, the scale of production in its supply chain factories, the most important of them located in Asia (Apple, 2012a: 7). As the principal manufacturer of products and components for Apple, Taiwanese company Foxconni currently employs 1.4 million workers in China alone. Arguably, then, just as Apple has achieved a globally dominant position, described as ‘the world’s most valuable brand’ (Brand Finance Global 500, 2013), so too have the fortunes of Foxconn been entwined with Apple’s success, facilitating Foxconn’s rise to become the world’s largest electronics contractor (Dinges, 2010). This article explores the contradictions between capital and labour in the context of the global production chains of the consumer electronics industry. Drawing on concepts from the Global Commodity Chains and Global Value Chains framework (Gereffi and Korzeniewicz, 1994; Bair, 2005; Gereffi et al., 2005), the article analyses the power dynamics of the buyer-driven supply chain and the national terrains that mediate or even accentuate global pressures.

|

The principal focus is on labour in the electronics supply chain, including working conditions and labour as agency, consistent with recent studies of labour as the key element in global production chains or networks (McKay, 2006; Smith et al., 2006; Taylor and Bain, 2008; Webster et al., 2008; Taylor et al., 2013). In particular, the concentration of capital in China and the important roles played by Asian contractors open new terrains of labour struggle (Silver, 2003; Appelbaum, 2008; Silver and Zhang, 2009). This inquiry evaluates the incentives for Apple to outsource and to concentrate production in a small number of final-assembly facilities in China. It also examines the potential risks or disincentives that might compel Apple to respond more directly, or responsibly, to negative publicity surrounding labour conditions and the collective actions of workers in its supply chain. While the specific detail is concerned with the interaction between Apple and Foxconn, the article briefly considers the relationship between other buyers (e.g. Dell) and contractors (e.g. Pegatron). Consequently, it locates emergent labour struggles more broadly in the electronics sector as a whole.

The authors draw on interviews with 14 managers and 43 workers outside of major Foxconn factory complexes, where employees were not subjected to company surveillance. The manager interviewees were responsible for production management (four persons), commodity procurement (three persons), product engineering (two persons) and human resources (five persons). All workers interviewed were rural migrants aged 16–28, who worked in assembly (semi-finished and finished products), quality testing (functionality and audiovisual appearance), metal processing and packaging. These interview data are complemented by fieldwork observations conducted between June 2010 and May 2013 in Shenzhen (Guangdong), Taiyuan (Shanxi) and Chengdu (Sichuan), which are major industrial centres in coastal, northern central and south-western China. New enterprise-level data have provided evidence of the replication of Foxconn’s management methods across its plants, the tensions between Foxconn and its largest corporate buyers, the working experiences and discontents of workers, and explosive episodes of labour protest. Primary evidence is supplemented by company annual reports, scholarly studies, reports from labour rights’ groups and journalistic accounts.

The article is structured as follows. First, the literature on global outsourcing and the challenges to labour will be reviewed. The next section will consider the growth of China as an industrial power and the emergence and distinctive character of a new working class. These discussions will be followed by an analysis of the Apple–Foxconn business relationship, and the responses of workers to heightened production demands in the ‘just-in-time’ regime. The concluding part will consider the future of the young generation of China’s rural migrant workers who are struggling to define and defend their rights and dignity in the multilayered network of corporate interests and state power.

The politics of global production

The corporate search for higher profits has been enhanced by efficient transportation and communications technologies, neoliberal trade policies and international financial services, as well as access to immigrants and surplus labour. Multinationals have reduced, if not eliminated, major barriers to capital mobility across spaces of uneven development (Harrison, 1997; Harvey, 2010). Within contemporary global supply chains, scholars (Henderson and Nadvi, 2011; Sturgeon et al., 2011) highlight the power asymmetry between buyers and contractors, in which giant retailers and branded merchandisers play decisive roles in establishing and dominating global networks of production and distribution. Under buyer-driven commodity chains, Lichtenstein (2009) and Chan (2011) find that American retailers and branded merchandisers constantly pressure factories as well as logistic service providers to lower costs and raise efficiency and speed. ‘The determination of retailers to cut costs to the bare bone leaves little room for [China-based] contractors to maintain labour standards’ (Bonacich and Hamilton, 2011: 225). The distinction between retailers and merchandisers in their control over suppliers has become insignificant when ‘most global retailers have successfully developed private-label (or store-label) programs, where they arrange with manufacturers or contractors to produce their own label’ (Bonacich and Hamilton, 2011: 218). In the electronics industry, Lüthje (2006: 17–18) observes that brand-name firms have focused on ‘product development, design, and marketing’, gaining a larger share of the value created than hardware manufacturing, which is mostly outsourced and performed by formally independent contractors. ‘Contract manufacturers’ have emerged to provide final-assembly and value-added services to technology firms and giant retailers (Starosta, 2010; Dedrick and Kraemer, 2011).

Asian contractors have been upgrading and growing in size and scale. Lee and Gereffi (2013) explain the co-evolution process that capital concentration and consolidation of branded smartphone leaders in China and other global supply bases has advanced alongside the expansion of and innovation within their large assemblers, notably Foxconn and Flextronics. Appelbaum (2008) finds that East Asian contractors, ranging from footwear and garments to electronics, have been integrating vertically in the supply chains. Starosta (2010) focuses on the rise of ‘highly concentrated global contractors’ in the electronics industry, in which they serve multiple brand-name firms in different product markets. Not only production tasks, but also inventory management, are being increasingly undertaken by strategic factories, resulting in ever stronger mutually dependent relations between buyers and suppliers. Giant manufacturers, rather than smaller workshops, are more able to ‘respond to shortening product cycles and increasing product complexity’ (Starosta, 2010: 546). Nevertheless, Yue Yuen, the world’s largest footwear producer, could only ‘pass on less than a third of the cost increase to its customers’, including Nike, when ‘costs rose sharply’ (Appelbaum, 2008: 74). Intense bargaining by big buyers over costs and profits has kept a tight rein over producers, frequently slashing profit margins.

In global outsourcing, electronics suppliers are compelled to compete against each other to meet rigorous specifications of price, product quality and time-to-market, generating wage pressure as well as health and safety hazards at the factory level while shaving profit margins (Smith et al., 2006; Chen, 2011). Brown (2010) argues that ‘contractor factories’ are often not provided with any financial support for corporate responsibility programmes required by brands; ‘instead they face slashed profit margins and additional costs that can be made up only by further squeezing their own labor force’. High-tech commodity producers therefore ‘focus their labor concerns on cost, availability, quality, and controllability’ to enhance profitability in the export market (McKay, 2006: 42, italics original).

Workers’ adaptation, or resistance, to capitalist control has to be understood in this new context of global production, in which concentration of capital at the country, sectoral and/or firm level has reconfigured the class and labour politics. In her longitudinal survey of world labour movements since 1870, Silver (2003) documents the rise of new working class forces in sites of capital investment for the automobile industry in the twentieth century. She defines ‘workplace bargaining power’ as the power that ‘accrues to workers who are enmeshed in tightly integrated production processes, where a localised work stoppage in a key node can cause disruptions on a much wider scale than the stoppage itself’ (Wright, 2000; Silver, 2003: 13). Recently, Butollo and ten Brink (2012) and Hui and Chan (2012) reported the factory-wide strike at an auto parts supplier in Nanhai, Guangdong, which paralysed Honda’s entire supply chain in South China, resulting in wage hikes and increased worker participation in trade union elections. Periodic and limited worker victories aside, managerial assault and/or state repression of labour protests are still commonplace.

A neoliberal state collaborates with private entrepreneurial elites by providing infrastructural support and ensuring law and order, thereby facilitating capital accumulation and economic growth. In China’s capitalist transformation, on the one hand, the state has stimulated employment and industrial development through large-scale financial investment and favourable policy implementation (Hung, 2009; Chu, 2010; Naughton, 2010). On the other hand, it has severely restricted workers’ self-organisation capacity and fragmented labour and citizenship rights among worker subgroups, despite ongoing pro-labour legal reforms (Solinger, 1999; 2009; Perry, 2002; Lee, 2007; 2010; Pun et al., 2010; Selden and Perry, 2010). In our sociological research, we explore the dialectics of domination and labour resistance within the political economy of global electronics production.

Global production and a new working class: Japan, China, East Asia

Between 1990 and 2006, the expansion of intra-Asia trade accounted for about 40 percent of the total increase in world trade (Arrighi, 2009: 22). China’s growing dominance has reshaped regional production networks previously dominated by Japan and its former colonies Taiwan and South Korea. The rise of Japan and East Asian capitalism in the 1950s and 1960s was integral to the Cold War geopolitical order. To contain the spread of Communism and consolidate its global economic reach, the United States provided military and economic resources to its ‘client states’, encouraged Taiwan and South Korea to open up their markets to Japanese trade and investment, and fostered the growth of a regional power centred on Japan’s export-oriented industrialisation (Evans, 1995: 47–60; Selden, 1997). Japanese firms received subsidised loans to create new industries and exported finished products to Western markets. In the 1960s, Toshiba, Hitachi, Panasonic, Sanyo, Ricoh, Mitsubishi, Casio and others moved to Taiwan to start operations (Hamilton and Kao, 2011: 191–193). Similarly, Japanese trading companies began sourcing garments and footwear from Taiwan, South Korea and Hong Kong.

From the mid-1960s, IBM, the leader in business computing, shifted its labour-intensive production from the United States and Europe to Asia in order to cut costs. The microelectronics components of IBM System 360 computers were assembled by workers in Japan and then Taiwan because ‘the cost of labour there was so low’ that it was cheaper than automated production in New York (Ernst, 1997: 40). RCA, the consumer electronics giant, swiftly moved to ‘take advantage of Taiwan’s cheap labour and loose regulatory environment’ in the export-processing zones in the late 1960s (Ku, 2006; Ross, 2006: 243–244; Chen, 2011). Electronics assembly grew rapidly in Taiwan, South Korea, Singapore and Hong Kong (‘the Asian Tigers’), and later Malaysia, Thailand, Indonesia and India. In the early 1970s, the Philippines hosted manufacturing plants for semiconductor firms such as Intel and Texas Instruments. In these newly industrialising countries, most factory workers were young women migrants from the countryside (Ong, [1987] 2010; Deyo, 1989; Koo, 2001; McKay, 2006).

In the late 1970s, China set up special economic zones to attract foreign capital and boost exports as the means to integrate regional and global economies. The inflow of overseas Chinese capital has long been significant, combined with growing capital from Japan, the United States, Europe and other countries since the early 1990s (Huang, 2003). Hong Kong and Taiwanese entrepreneurs, ranging from low-end component processing to sophisticated microchip assembly, invested in the Pearl River Delta and the Greater Shanghai region (Leng, 2005). By the mid-1990s, Beijing’s Zhongguancun Science Park and Shanghai’s Zhangjiang Hi-Tech Park became prominent technology powerhouses, building on foundations of industrial development and local government support (Segal, 2003; Zhou, 2008). Over two decades, the Chinese national economy underwent a transformation from one based on heavy industry, with guaranteed lifetime employment and generous welfare for urban state sector workers, to one that relies heavily on foreign and private investments and massive use of rural migrant labourers in light of export-oriented industries (Friedman and Lee, 2010; Kuruvilla et al., 2011).

Foxconn became China’s leading exporter in 2001 following the country’s accession to the World Trade Organization and further liberalisation of international trade. It has maintained this position ever since (Foxconn Technology Group, 2009: 6). Foxconn’s expansion is intertwined with the Chinese state’s development through market reforms, and it has followed the national trajectory from coastal to inland locations in recent years. The Chinese state attempted to rebalance the economy by initiating the ‘go west’ project, through which financial capital and human resources were channeled to central and western provinces (Goodman, 2004; McNally, 2004). Taking advantage of lower wage levels, the strategy was designed to stimulate employment and promote ethnic unity while obtaining foreign investment. Ross (2006: 218) concludes that in Chengdu, Sichuan’s provincial capital, ‘it was impossible not to come across evidence of the state’s hand in the fostering of high-tech industry’.

The creation of a new rural migrant-centered industrial class by domestic and transnational capital, with the collaboration of the Chinese state at all levels, lies behind the growing protest, driven by multiple factors. Compared with older workers, this generation of employees, the vast majority being rural migrants born since the 1980s, has strong expectations of higher wages, better working conditions and prospects for career advancement (Pun and Lu, 2010). From the mid-2000s, labour shortagesii have driven up wages and strengthened workers’ power in the market, although wage gains resulting from higher state minimum wage levels and strike victories have been undermined by inflation (Selden and Wu, 2011). Foxconn, not unlike other foreign-invested factories, adjusts basic wages and recruits mostly teens and young adults to run the assembly lines. ‘Over 85 percent of Foxconn’s employees are rural migrant workers between 16 and 29 years old’, according to a senior human resources manager in Shenzhen (Interview, 14 October 2011). By comparison, 2009 national data showed that 42 percent of rural migrants were between 16 and 25 years old and another 20 percent were between 26 and 30 (China’s National Bureau of Statistics, 2010).

In recent years, Foxconn has adapted to local labour market changes to employ more male than female workers as fewer young women become available as a result of female infanticide,iii reversing the historical pattern of a feminised workforce in electronics. Company statistics show that male employees increased from 59 to 64 percent between 2009 and 2011 (Foxconn Technology Group, 2012e: 12). This labour is employed in a production network in which vertical integration, flexible coordination across different facilities and 24-hour continuous assembly bolster its market competitiveness. It manufactures hardware components and assembles products for a very large number of global companies, with Apple being its largest client (Chan, 2013).

The Apple–Foxconn business relationship

Apple, Foxconn and China’s workers are at the center of high-tech production, but relations among them are highly unequal. Apple Computer (later Apple Inc.) was incorporated in 1977 and is headquartered in Cupertino, California in Silicon Valley. In 1981, Apple, which had initially produced its own computers, started to contract offshore facilities in Singapore, along with onshore final-assembly contractors, to ramp up upgraded Apple II personal computers (Ernst, 1997: 49–52). From the early years, it outsourced most component processing, assembly and packaging to contractors, above all in South Korea, Japan, and China. In 1982 Apple Computer President Mike Scott commented: ‘Our business was designing, educating and marketing. I thought that Apple should do the least amount of work that it could and … let the subcontractors have the problems’ (Ernst, 1997: 49). In the 1990s, Apple, Lucent, Nortel, Alcatel and Ericsson ‘sold off most, if not all, of their in-house manufacturing capacity—both at home and abroad—to a cadre of large and highly capable US-based contract manufacturers, including Solectron, Flextronics, Jabil Circuit, Celestica, and Sanmina-SCI’ (Sturgeon et al., 2011: 236). Today, Apple retains its only Macintosh computer manufacturing complex in Cork, Ireland (Apple, 2013a).

If Apple’s competitive advantage lies in the combination of corporate leadership, technological innovation, design and marketing (Lashinsky, 2012), its financial success is inseparable from its globally dispersed network of efficient suppliers based mainly in Asia. Pivotal to Apple’s growth is effective management of production by its suppliers, including final assemblers. Apple’s 2012 annual report filed to the United States Securities and Exchange Commission describes a challenge to its highly profitable business:

Substantially all of the Company’s hardware products are manufactured by outsourcing partners that are located primarily in Asia. A significant concentration of this manufacturing is currently performed by a small number of outsourcing partners, often in single locations. Certain of these outsourcing partners are the sole-sourced suppliers of components and manufacturers for many of the Company’s products (Apple, 2012a: 7).

Apple identifies the concentration of its manufacturing base ‘in single locations’ and in the hands of ‘a small number of outsourcing partners’ as a potential risk. However, analysts observed that, ‘because of its volume’—and its ruthlessness—‘Apple gets big discounts on parts, manufacturing capacity, and air freight’ (Satariano and Burrows, 2011). Group interviews with two mid-level production managers at Foxconn’s Shenzhen industrial town reveal that during the 2008–09 global financial crisis,

Foxconn cut prices on components, such as connectors and printed circuit boards, and assembly, to retain high-volume orders. Margins were cut. But the rock bottom line was kept, that is, Foxconn did not report a loss on the iPhone contract. [How?] By charging a premium on customized engineering service and quality assurance. The upgrading of the iPhones has in part relied on our senior product engineers’ research analyses and constructive suggestions (Interviews, 10 November 2011; 19 November 2011).

In 2009, in the wake of recession, the Chinese government froze the minimum wage across the country. Foxconn accommodated Apple’s and other corporate buyers’ squeeze while continuing to reduce labour expenditures, including cuts in wages (mainly overtime premiums) and benefits (Interview, 9 November 2011).

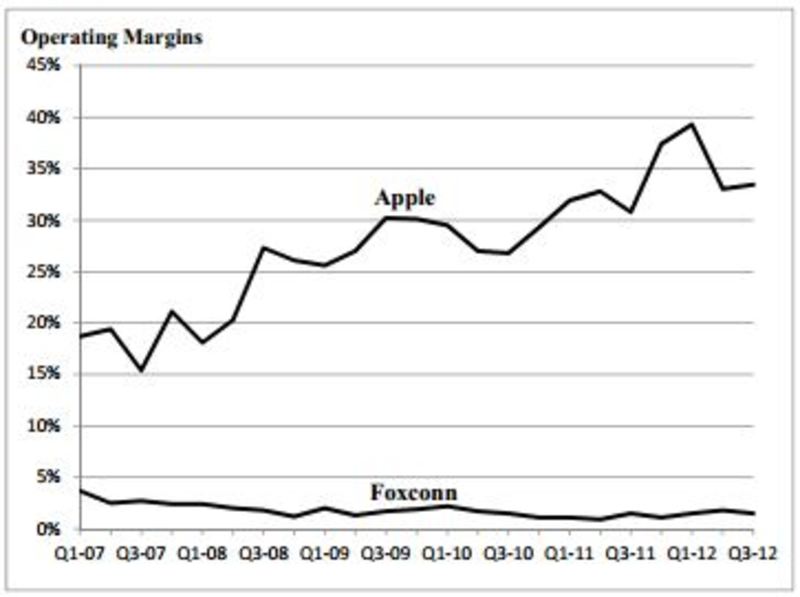

Foxconn’s operating margins—the proportion of revenues remaining after paying operating costs such as wages, raw materials and administrative expenses—has declined steadily over the past six years, from 3.7 percent in the first quarter of 2007 to a mere 1.5 percent in the third quarter of 2012, even as total revenues rose in the same period with the expansion of orders (Figure 1).iv By contrast, Apple’s operating margins peaked at 39.3 percent in early 2012 from initial levels of 18.7 percent in 2007. The changes indicate Apple’s increased ability to pressure Foxconn to accept lower margins while acceding to Apple’s demands for technical changes and large orders. Foxconn’s margins are constantly squeezed by technology giants including, but not limited to, Apple. As Foxconn expanded its plants in interior China (and other countries), expansion costs and rising wages further impacted revenues.

Twelve major business groups within Foxconn compete on ‘speed, quality, engineering service, efficiency and added value’ to maximise profits (Foxconn Technology Group, 2009: 8). ‘Two “Apple business groups,” iDPBG [integrated Digital Product Business Group] and iDSBG [innovation Digital System Business Group], are rising stars in these past few years’, stated a Foxconn Chengdu production manager,

iDPBG was established in 2002. At the beginning, it was only a small business group handling Apple’s contracts. We assembled Macs and shipped them to Apple retail stores in the United States and elsewhere. Later we had more orders of Macs and iPods from Apple. In 2007, we began to assemble the first-generation iPhone. From 2010, we also packed iPads, at the Shenzhen and new Chengdu facilities (Interview, 6 March 2011).

iDPBG currently generates 20 to 25 percent of Foxconn’s business. To increase its competitiveness, Foxconn Founder and CEO Terry Gou established iDSBG in 2010 when the company won the iPad contracts. iDSBG now primarily manufactures Macs and iPads, contributing 15 to 20 percent of company revenues. ‘Approximately 40 percent of Foxconn revenues are from Apple, its biggest client’ (Interview, 10 March 2011).

Dedrick and Kraemer (2011: 303) find that computer companies currently ‘engage in long-term relationships’ with their main contractors but sometimes shift contracts to those who can offer better quality, lower cost or greater capabilities. Foxconn’s vice president Cheng Tianzong told journalists, ‘Some major clients are very concerned with the Foxconn employee suicides, but many of them are our long-term partners. So it doesn’t affect Foxconn’s orders’ (quoted in Zhao, 2010). However, soon after the spate of suicides at Foxconn’s facilities in spring 2010, Apple did ‘shift some iPhone and iPad orders to Pegatron to diversify risks’, according to a Foxconn commodity manager at Chengdu’s factory (Interview, 13 March 2011). Apple has tightened controls over Foxconn by splitting contracts with another Taiwanese-owned firm, Pegatron. This diversification demonstrates the power asymmetries between Apple and its manufacturers as Foxconn and others seek to retain market position as producers of the iPhone and iPad.

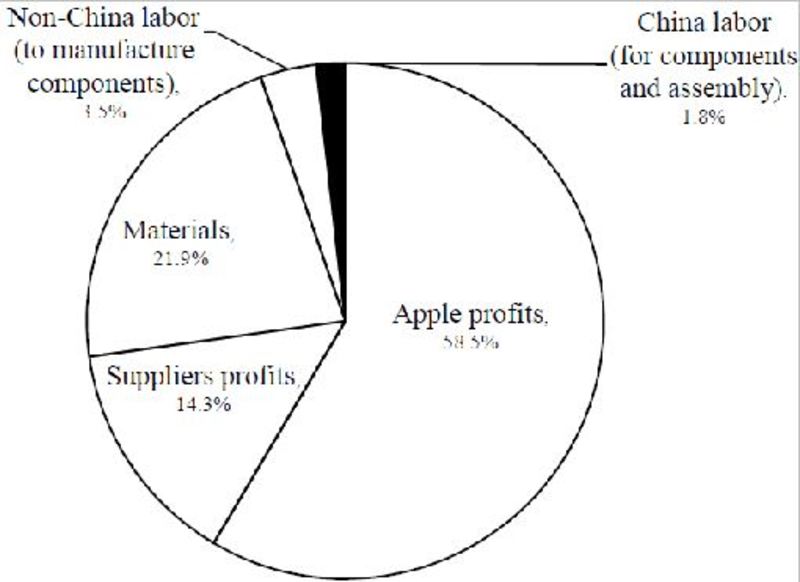

Apple (2013b) obtains products and services ‘within tight time frames’ and ‘at a cost that represents the best possible value’ to its customers and shareholders. Figure 2 shows the breakdown of value for the iPhone between Apple and its suppliers. Apple’s strength is well illustrated by its ability to capture an extraordinary 58.5 percent of the value of the iPhone despite the fact that manufacture of the product is entirely outsourced. Particularly notable is that labour costs in China account for the smallest share, only 1.8 percent or nearly US$10, of the US$549 retail price of the iPhone. This ineluctable drive to reduce costs and maximise profits is the source of the pressure placed on Chinese workers employed by Foxconn, many of them producing signature Apple products. While Apple and Foxconn together squeeze Chinese workers and demand 12-hour working days to meet demand, the costs of Chinese labour in processing and assembly are virtually invisible in Apple’s balance sheets. Other major component providers (such as Samsung and LG) captured slightly over 14 percent of the value of the iPhone. The cost of raw materials was just over one-fifth of the total value (21.9 percent).

|

|

Representatives from Apple and other major clients regularly monitor onsite quality processes and production time to market. A mid-level Foxconn production manager recalled: ‘Since 2007, Apple has dispatched engineering managers to work at Foxconn’s Longhua and Guanlan factories in Shenzhen to oversee our product development and assembly work’ (Interview, 29 November 2011). A Foxconn human resources manager provided this eyewitness account of Apple’s hands-on supervision:

When Apple CEO Steve Jobs decided to revamp the screen to strengthen the glass on iPhone four weeks before it was scheduled to shelf in stores in June 2007, it required an assembly overhaul and production speedup in the Longhua facility in Shenzhen. Naturally, Apple’s supplier code on worker safety and workplace standards and China’s labour laws are all put aside. In July 2009, this produced a suicide. When Sun Danyong, 25 years old, was held responsible for losing one of the iPhone 4 prototypes, he jumped from the 12th floor to his death. Not only the short delivery deadline but also Apple’s secretive culture and business approach, centered on creating great surprise in the market and thereby adding sales value to its products, have sent extreme pressure all the way down to its Chinese suppliers and workers (Interview, 7 March 2011).

Attention to procurement and production detail, including last-minute changes of product design and tight control over prices, assures super-profits for Apple. The purchasing and marketing policy adopted by Apple, the ‘chain driver’, conflicts directly with its own supply-chain labour standards and the Chinese law.

Tracking demand worldwide, Apple adjusts production forecasts on a daily basis. As Apple CEO Tim Cook puts it, ‘Nobody wants to buy sour milk’ (quoted in Satariano and Burrows, 2011); ‘Inventory … is fundamentally evil. You want to manage it like you’re in the dairy business: if it gets past its freshness date, you have a problem’ (quoted in Lashinsky, 2012: 95). Streamlining the global supply chain on the principle of market efficiency and ‘competition against time’ is Apple’s goal.

Consequently, excessive overtime at final-assemblers and other suppliers is required to meet increased work schedules. Two major sources of production-time pressure commonly felt by factory and logistic workers are well documented by Apple.

The Company has historically experienced higher net sales in its first fiscal quarter [from September to December] compared to other quarters in its fiscal year due in part to holiday seasonal demand. Actual and anticipated timing of new product introductions by the Company can also significantly impact the level of net sales experienced by the Company in any particular quarter (Apple, 2012a: 8).

In a rare moment of truth, Foxconn CEO’s Special Assistant Louis Woo, explained in an April 2012 American media program the production pressures that Apple or Dell apply:

The overtime problem—when a company like Apple or Dell needs to ramp up production by 20 percent for a new product launch, Foxconn has two choices: hire more workers or give the workers you already have more hours. When demand is very high, it’s very difficult to suddenly hire 20 percent more people. Especially when you have a million workers—that would mean hiring 200,000 people at once (quoted in Marketplace, 2012).

The dominance of giant technology firms, notably Apple, in terms of price setting, onsite production process surveillance, and timing of product delivery, has profound consequences on labour processes. Foxconn’s competitive advantage, the basis for securing contracts with Apple and other brand-name multinationals, hinges on its ability to maintain flexibility. The mega factory has to reorganise its production lines, staffing and logistics in a very short time to be demand-responsive. Whereas transnational suppliers, such as Foxconn, have grown rapidly through ‘internal development and acquisition’ (Sturgeon et al., 2011: 235), their drive for profits and higher positions along the global value chains tend to go with the same pattern: the emergence of powerful ‘market makers’, or leading firms, in their supply networks (Hamilton et al., 2011). The results in competitive manufacturing have been coercive factory conditions and, contentious labour relations, on the ground, to which we now turn.

Chinese workers’ collective actions

Foxconn not only has factory complexes in Shenzhen and all four major Chinese municipalities of Beijing, Shanghai, Tianjin and Chongqing, but also in 15 provinces throughout the country (Figure 3). Foxconn Taiyuan in north China’s Shanxi province, with 80,000 workers, specialises in metal processing and assembly. It manufactures iPhone casings and other components in the upstream supply chain and sends the semi-finished products to a larger Foxconn Zhengzhou complex in adjacent Henan province for final assembly. In 2012, the subtle shift in production requirements from iPhone 4S to iPhone 5 and the speedup to meet Apple’s delivery time placed Foxconn and its workers under intense pressure. However, this tightly integrated production regime simultaneously provided workers with leverage, enabling them to demonstrate their collective strength in the fight for their own interests.

|

|

Foxconn Taiyuan erupted in factory-wide protests on September 23–24, 2012. ‘At about 11 p.m. on 23 September 2012’, a 20-year-old worker reported, ‘a number of security officers severely beat two workers for failing to show their staff IDs. They kicked them until they fell’ (Interview, 26 September 2012). At the male dormitory, workers passing by were alerted by screams in the darkness. An eyewitness said, ‘We cursed the security officers and demanded that they stop. There were more than thirty of us so they ran away’ (Interview, 27 September 2012).

Soon after a squad of fifty company security officers marched to the dormitory, infuriating the assembled workers. At midnight, tens of thousands of workers smashed security offices, production facilities, shuttle buses, motorbikes, cars, shops and canteens in the factory complex. Others broke windows, demolished company fences and pillaged factory supermarkets and convenience stores. Workers also overturned police cars and set them ablaze. The company security chief used a patrol car public address system to order the workers to end their ‘illegal activities’. The situation was getting out of control as more workers joined the roaring crowd.

By 3 a.m., senior government officials, riot police officers, special security forces and medical staff were stationed at the factory. Workers used their cell phones to send images to local media outlets in real time. Over the next two hours, the police contained the labour unrest, detained the most defiant workers and took control of the factory gates. The factory announced a special day off for all production workers, on September 24, Monday. A 21-year-old worker recalled:

We demanded higher pay and better treatment. In my view, the protest was caused by very unsatisfactory working conditions. It was merely sparked by the abuses of the security guards. Over these past two months, we couldn’t even get paid leave when we were sick (Interview, 28 September 2012).

With global consumer demand for the new iPhone 5 at a peak, shipping delays were a source of concern for Apple. On September 21, 2012 (eight months after iPhone 4S’s China release), Apple launched the iPhone 5 and sold over five million units during that weekend. CEO Tim Cook stated, ‘we are working hard to get an iPhone 5 into the hands of every customer who wants one as quickly as possible’ (Apple, 2012b). The ever-tightening shorter production cycle pressurises workers and managerial staff, so that Foxconn Taiyuan workers could not even take one day off in a week, and the sick were compelled to continue to work. At the same time, with Apple demanding fulfillment of impossible targets, the power of workers to display their power peaked.

As justification for its use of paramilitary force, Foxconn blamed the workers, alleging that they were fighting among themselves. The company statement read:

A personal dispute between several employees escalated into an incident involving some 2,000 workers. The cause of this dispute is under investigation by local authorities and we are working closely with them in this process, but it appears not to have been work-related (quoted in Nunns, 2012).

|

|

The underlying cause was that workers are subjected to an oppressive management regime driving them to meet the extreme production demands (Ruggie, 2012). Foxconn, Apple and many other multinational corporations, as well as the Chinese government, have thus far shown little interest in understanding the direct relationship between companies’ purchasing practices and labour problems in the workplace. ‘On the factory floor’, an 18-year-old worker informed us, ‘the metal-processing section supervisor’s attitude is very bad … We’re coerced to meet the extremely tight production deadline’ (Interview, 29 September 2012). Foxconn leaders’ investigation of the ‘personal dispute’ necessitated turning their eyes away from shop floor conditions.

Less than two weeks later, on October 5, 2012, over 3,000 Foxconn Zhengzhou workers protested collectively against unreasonably strict control over product quality on the line at Zone K. From late September to early October 2012, consumers in the United States and elsewhere complained about scratches on the casing of a particular batch of the new iPhone 5, leading to product quality control investigations of final assembly at the 160,000-strong Foxconn Zhengzhou plant. According to testimony, new quality standards for not exceeding a 0.02 mm appearance defect in iPhone 5 were contributing to workers suffering eye strain and headache. When workers were penalised for not meeting the new standards, quarrels erupted between workers and quality control team leaders on Friday afternoon, resulting in group fighting and injuries.

Production managers yelled at the assembly-line workers and threatened to fire them if they did not ‘cooperate and concentrate at work’. Li Meixia (a pseudonym) posted on her Sina microblog that she and her co-workers were angered and walked out of the workshop. In response, another worker posted a statement, which was quickly removed by October 6:

We had no holidays during the National Day celebrations and now we’re forced to fix the defective products. The new requirement of a precision level [of iPhone 5 screen structure] measured in two-hundredths of a millimeter cannot be detected by human eyes. We use microscopes to check the product appearance. It’s impossibly strict.

In the case-manufacturing process, workers were also instructed to use protective cases to prevent scratches of the ultra-thin iPhone 5, and close attention to the most minute detail at the fast pace was and remains a major source of work stress, according to testimony. The strike at one workshop eventually paralysed dozens of production lines in Zones K and L. Senior managers threatened to fire the leading strikers and the quality control team leaders, and demanded that night-shift workers adhere to stringent quality standards. The brief strike did not win workers’ demand for reasonable rest.

Given the nature of company unions (Traub-Merz, 2012) and strict corporate controls over workers in both plant and dormitory, Foxconn workers at the Taiyuan and Zhengzhou factories have not organised across factories on a large scale in a coordinated manner. Workers were, however, acquiring public communication skills and raising their consciousness about the need for joint struggle to achieve basic rights. Soon after the September 2012 protest, a 21-year-old high-school graduate with two years’ work experience at Foxconn Taiyuan wrote an open letter to Foxconn CEO Terry Gou and circulated it on weblogs (the following excerpt is translated by the authors):

A Letter to Foxconn CEO, Terry Gou

If you don’t wish to again be loudly woken at night from deep sleep,

If you don’t wish to constantly rush about again by airplane,

If you don’t wish to again be investigated by the Fair Labor Association,

If you don’t wish your company to again be called by people a sweatshop,

Please use the last bit of a humanitarian eye to observe us.

Please allow us the last bit of human self-esteem.

Don’t let your hired ruffians hunt for our bodies and belongings,

Don’t let your hired ruffians harass female workers,

Don’t let your lackeys take every worker for the enemy,

Don’t arbitrarily berate or, worse, beat workers for one little error.

In the densely populated factory-cum-dormitory setting, many rural migrant workers as young as 16 or 17 years old, spoke of their involvement in collective labour protests (Pun and Chan, 2013). If the language of strikes and worker participation is new for some, it is not for others. The testimony of a teenage female worker at Foxconn’s Shenzhen Longhua plant is illustrative:

I didn’t know that it was a strike. One day my co-workers stopped work, ran out of the workshop and assembled on the grounds. I followed them. They had disputes over the under-reporting of overtime hours and the resulting underpayment of overtime wages. After half a day, the human resources managers agreed to look into the problems and promised to pay the back wages if there was a company mistake. At night, in the dormitory, our ‘big sister’ explained to me that I had participated in a strike (Interview, 15 October 2011)!

The wildcat strikes and labour protests at Foxconn form part of a broader spectrum of labour action throughout China over recent decades (Pringle, 2013). The Taiyuan worker’s open letter to Foxconn CEO Terry Gou closes with the following paragraph:

You should understand that working in your factories,

workers live on the lowest level of Chinese society,

tolerating the highest work intensity,

earning the lowest pay,

accepting the strictest regulation,

and enduring discrimination everywhere.

Even though you are my boss, and I am a worker:

I have the right to speak to you on an equal footing.

The sense in which ‘right’ is used is not narrowly confined to that of legal right. Chinese workers, facing pressure from the company, the local state and their own union, are demanding to bargain with their employers ‘on an equal footing’. They are calling for dignified treatment and respect at work and for a living wage.

Conclusion

Marx and Engels ([1848] 2002: 223) analysed capital’s irresistible impulse to create new markets globally. ‘All old-established national industries have been destroyed or are daily being destroyed. They are dislodged by new industries … In place of the old wants, satisfied by the productions of the country, we find new wants …’ Production, distribution and consumption must continue in perpetuity if profits are to be made and capital accumulated. Barriers to trade at all levels have to be drastically reduced. In the twenty-first century, consumer electronics has grown to become one of the leading global industries, and Chinese labour is central to its development. An ever quicker and newer product release, accompanied by shorter product finishing time, places new pressures on outsourced factory workers in the Apple production network. At the workplace level, very short delivery times imposed by Foxconn in response to the demands of Apple and other multinational corporations make it difficult for suppliers to comply with legal overtime limits. Price pressures lead firms to compromise workers’ health and safety and the provision of a decent living wage. The absence of fundamental labour rights within the global production regime driven by Apple and its principal supplier Foxconn have become a central concern for Chinese rural migrant workers, who form the core of the most rapidly growing sector of the new industrial working class.

The integration of Asian manufacturers in global and regional production networks, tight delivery schedules for coveted products, and the growing shortage of young workers as a result of China’s demographic changes have enhanced workers’ bargaining power. The ascent of ‘global neoliberal capitalism’ has created ‘opportunities for counter-organization’ (Evans, 2010: 352), as attested not only by the rise of transnational labour movements and global anti-sweatshop campaigns but specifically by growing labor unrest in China. Increasingly aware of the opportunities presented by the demand by Apple and other technology giants to meet quotas for new models and holiday season purchases, workers have come together at the dormitory, workshop or factory level to voice demands. Internet and social networking technology enables workers to disseminate open letters and urgent appeals for support (Qiu, 2009). The question remains whether workers will be able to win the right to freedom of association and ultimately strengthen a nascent labour movement that is capable of challenging the unfettered power of capital in a milieu in which fundamental labor rights such as the right to strike are lacking.

A historical counterweight to global capital, West and East, exists in workers’ and civil society’s response. Under public pressure, in February 2013, Foxconn proclaimed that workers would hold direct elections for union representatives. If implemented fairly, and if the unions are organised to uphold the rights enshrined in the Chinese Trade Union Law, Labour Contract Law and the international labour conventions, this would impact upon the balance of power between management and workers. At present, the vast labour force at Foxconn and many workplaces are striving to expand social and economic rights, bypassing the state- and management-controlled unions. A new generation of workers, above all rural migrant workers, is standing up to assert their dignity and rights. Workers’ direct actions have been perceived by political leaders and elites as so threatening to social stability that government and employers have been forced to grant certain policy concessions, including higher wages, and to propose higher minimum wages. The Chinese state is also seeking to raise domestic consumption and hence living standards, in part in response to the struggle of aggrieved workers and farmers (Hung, 2009; Carrillo and Goodman, 2012). Apple and Foxconn now find themselves in a limelight that challenges their corporate images and symbolic capital, hence requiring at least lip service in support of progressive labour policy reforms. If the new generation of Chinese workers succeeds in building autonomous unions and worker organisations, their struggles will shape the future of labour and democracy not only in China but throughout the world.

Acknowledgements

We are very grateful to Phil Taylor, Debra Howcroft and four reviewers for their insightful comments. We also thank the independent University Research Group on Foxconn, SACOM (Students and Scholars Against Corporate Misbehavior), GoodElectronics Network, Jeffery Hermanson, Gregory Fay, Chris Smith, Jos Gamble and Sukhdev Johal. An earlier version of this paper was presented at the Center for East Asian Studies in the University of Bristol on November 15, 2012, where Jenny Chan enjoyed constructive discussions with Jeffrey Henderson and the seminar’s participants.

This is a revised version of an article published in New Technology, Work and Employment 28(2): 100-15.

Article first published online: 18 JUL 2013 (full article freely accessible online here).

© 2013 John Wiley & Sons Ltd.

Recommended citation: Jenny Chan, Ngai Pun and Mark Selden, “The politics of global production: Apple, Foxconn and China’s new working class,” The Asia-Pacific Journal, Vol. 11, Issue 32, No. 2, August 12, 2013.

The Authors:

Jenny Chan ([email protected]) is a Ph.D. candidate, Great Britain-China Educational Trust Awardee and Reid Research Scholar in the Faculty of History and Social Sciences at Royal Holloway, University of London. She was Chief Coordinator (2006–2009) of Hong Kong–based labour rights group Students and Scholars Against Corporate Misbehavior (SACOM).

Ngai Pun ([email protected]) is Professor in the Department of Applied Social Sciences at Hong Kong Polytechnic University and Deputy Director in the China Social Work Research Center at Peking University and Hong Kong Polytechnic University.

Mark Selden ([email protected]) is Senior Research Associate in the East Asia Program at Cornell University, Coordinator of The Asia-Pacific Journal and Professor Emeritus of History and Sociology at State University of New York, Binghamton.

The authors have jointly written a book entitled Separate Dreams: Apple, Foxconn and a New Generation of Chinese Workers (Ngai Pun, Jenny Chan and Mark Selden, forthcoming).

Related articles

• Jenny Chan, A Suicide Survivor: the life of a Chinese migrant worker at Foxconn

• Jenny Chan and Ngai Pun, Suicide as Protest for the New Generation of Chinese Migrant Workers: Foxconn, Global Capital, and the State

• Mark Selden and Wu Jieh-min, The Chinese State, Incomplete Proletarianization and Structures of Inequality in Two Epochs

• Ching Kwan Lee and Mark Selden, China’s Durable Inequality: Legacies of Revolution and Pitfalls of Reform

References

Appelbaum, R.P. (2008), ‘Giant Transnational Contractors in East Asia: Emergent Trends in Global Supply Chain’, Competition & Change 12, 1, 69–87.

Apple (2011), ‘Annual Report for the Fiscal Year Ended September 24, 2011.’ (accessed 31 December 2011).

Apple (2012a), ‘Annual Report for the Fiscal Year Ended September 29, 2012.’ (accessed 31 December 2012).

Apple (2012b), ‘iPhone 5 First Weekend Sales Top Five Million.’ 24 September. (accessed 25 September 2012).

Apple (2013a), ‘Our Suppliers.’ (accessed 1 March 2013).

Apple (2013b), ‘Apple and Procurement.’ (accessed 1 March 2013).

Arrighi, G. (2009), ‘China’s Market Economy in the Long Run’, in H. Hung (ed.), China and the Transformation of Global Capitalism (Baltimore, MD: The Johns Hopkins University Press), pp. 22–49.

Bair, J. (2005), ‘Global Capitalism and Commodity Chains: Looking Back, Going Forward’, Competition & Change 9, 2, 153–180.

Bloomberg (2012), ‘Apple Profit Margins Rise at Foxconn’s Expense.’ 5 January. (accessed 6 January 2012).

Bonacich, E. and G.G. Hamilton (2011), ‘Global Logistics, Global Labor’, in G.G. Hamilton , M. Petrovic and B. Senauer (eds), The Market Makers: How Retailers are Reshaping the Global Economy (Oxford: Oxford University Press), pp. 211–230.

Brand Finance Global 500 (2013), ‘Apple Pips Samsung but Ferrari World’s Most Powerful Brand.’ 18 February. (accessed 19 February 2013).

Brown, G. (2010), ‘Global Electronics Factories in Spotlight’, Occupational Health and Safety. 4 August. (accessed 5 August 2010).

Butollo, F. and T. ten Brink (2012), ‘Challenging the Atomization of Discontent: Patterns of Migrant-Worker Protest in China during the Series of Strikes in 2010’, Critical Asian Studies 44, 3, 419–440.

Carrillo, B. and D.S.G. Goodman (eds) (2012), China’s Peasants and Workers: Changing Class Identities (Cheltenham: Edward Elgar).

Chan, A. (ed.) (2011), Walmart in China (Ithaca, NY: Cornell University Press).

Chan, J. (2013), ‘A Suicide Survivor: The Life of a Chinese Worker’, New Technology, Worker and Employment 28, 2, 84–99.

Chen, H.-H. (2011), ‘Professionals, Students, and Activists in Taiwan Mobilize for An Unprecedented Collective-Action Lawsuit against A Former Top American Electronics Company’, East Asian Science, Technology and Society 5, 4, 555–565.

China Daily (2012), ‘China’s Gender Imbalance Still Grave.’ 29 March. (accessed 30 March 2012).

China’s National Bureau of Statistics (2010), Monitoring and Investigation Report on the Rural Migrant Workers in 2009.’ (In Chinese). (accessed 20 March 2010).

Chu, Y. (ed.) (2010), Chinese Capitalisms: Historical Emergence and Political Implications (Basingstoke: Palgrave Macmillan).

Dedrick, J. and K.L. Kraemer (2011), ‘Market Making in the Personal Computer Industry’, in G.G. Hamilton , M. Petrovic and B. Senauer (eds), The Market Makers: How Retailers are Reshaping the Global Economy (Oxford: Oxford University Press), pp. 291–310.

Deyo, F.C. (1989), Beneath the Miracle: Labor Subordination in the New Asian Industrialism (Berkeley, CA: University of California Press).

Dinges, T. (2010), ‘Foxconn Rides Partnership with Apple to Take 50 Percent of EMS [Electronic Manufacturing Services] Market in 2011.’ iSuppli. (accessed 28 July 2010).

Ernst, D. (1997), ‘From Partial to Systemic Globalization: International Production Networks in the Electronics Industry.’ Berkeley Roundtable on the International Economy Working Paper 98. (accessed 1 August 2012).

Evans, P. (1995), Embedded Autonomy: States and Industrial Transformation. Princeton (Princeton, NJ: Princeton University Press).

Evans, P. (2010), ‘Is It Labor’s Turn to Globalize? Twenty-First Century Opportunities and Strategic Responses’, Global Labour Journal 1, 3, 352–379. (accessed 31 December 2010).

Foxconn Technology Group (2009), ‘2008 Corporate Social and Environmental Responsibility Annual Report.’ (accessed 1 February 2013).

Foxconn Technology Group (2012a), ‘Non-Consolidated Results for the Twelve Month Periods Ended December 31, 2011.’ 27 March. (Printed version).

Foxconn Technology Group (2012b), ‘Non-Consolidated Results for the Three Month Periods Ended March 31, 2012.’ 14 May. (Printed version).

Foxconn Technology Group (2012c), ‘Non-Consolidated Results for the Six Month Periods Ended June 30, 2012.’ 31 August. (Printed version).

Foxconn Technology Group (2012d), ‘Non-Consolidated Results for the Nine Month Periods Ended September 30, 2012.’ 30 October. (Printed version).

Foxconn Technology Group (2012e), ‘2011 Corporate Social and Environmental Responsibility Annual Report.’ (accessed 1 February 2013).

Foxconn Technology Group (2013a), ‘Global Distribution.’ (accessed 10 February 2013).

Foxconn Technology Group (2013b), ‘Consolidated Results for the Twelve Month Periods Ended December 31, 2012.’ 25 March. (Printed version).

Friedman, E. and C.K. Lee (2010), ‘Remaking the World of Chinese Labour: A 30-Year Retrospective’, British Journal of Industrial Relations 48, 3, 507–533.

Gereffi, G., J. Humphrey and T. Sturgeon (2005), ‘The Governance of Global Value Chains’, Review of International Political Economy 12, 1, 78–104.

Gereffi, G. and M. Korzeniewicz (eds) (1994), Commodity Chains and Global Capitalism (Westport, CT: Praeger).

Goodman, D.S.G. (2004), ‘The Campaign to “Open Up the West”: National, Provincial-Level and Local Perspectives’, The China Quarterly 178, June, 317–334.

Gu, B. and Y. Cai (2011), ‘Fertility Prospects in China.’ United Nations Population Division, Expert Paper No. 2011/14. (accessed 20 April 2012).

Hamilton, G.G. and C. Kao (2011), ‘The Asia Miracle and the Rise of Demand-Responsive Economies’, in G.G. Hamilton , M. Petrovic and B. Senauer (eds), The Market Makers: How Retailers are Reshaping the Global Economy (Oxford: Oxford University Press), pp. 181–210.

Hamilton, G.G., M. Petrovic and B. Senauer (eds) (2011), The Market Makers: How Retailers are Reshaping the Global Economy (Oxford: Oxford University Press).

Harrison, B. (1997), Lean and Mean: The Changing Landscape of Corporate Power in the Age of Flexibility (New York: The Guilford Press).

Harvey, D. (2010), The Enigma of Capital and the Crises of Capitalism (New York: Oxford University Press).

Henderson, J. and K. Nadvi (2011), ‘Greater China, the Challenges of Global Production Networks and the Dynamics of Transformation’, Global Networks 11, 3, 285–297.

Huang, Y. (2003), Selling China: Foreign Direct Investment during the Reform Era (Cambridge: Cambridge University Press).

Hui, E.S. and C.K. Chan (2012), ‘The Prospect of Trade Union Reform in China: The Cases of Wal-Mart and Honda’, in R. Traub-Merz and K. Ngok (eds), Industrial Democracy in China: With Additional Studies on Germany, South-Korea and Vietnam (Beijing: China Social Sciences Press), pp. 103–120. (accessed 2 January 2013).

Hung, H. (ed.) (2009), China and the Transformation of Global Capitalism (Baltimore, MD: The Johns Hopkins University Press).

Koo, H. (2001), Korean Workers: The Culture and Politics of Class Formation (Ithaca, NY: Cornell University Press).

Kraemer, K.L., G. Linden and J. Dedrick (2011), ‘Capturing Value in Global Networks: Apple’s iPad and iPhone.’ (accessed 1 October 2011).

Ku, Y. (2006), ‘Human Lives Valued Less Than Dirt: Former RCA Workers Contaminated by Pollution Fighting Worldwide for Justice (Taiwan)’, in T. Smith , D.A. Sonnenfeld and D.N. Pellow (eds), Challenging the Chip: Labor Rights and Environmental Justice in the Global Electronics Industry (Philadelphia, PA: Temple University Press), pp. 181–190.

Kuruvilla, S., C.K. Lee and M.E. Gallagher (eds) (2011), From Iron Rice Bowl to Informalization: Markets, Workers, and the State in a Changing China (Ithaca, NY: Cornell University Press).

Lashinsky, A. (2012), Inside Apple: The Secrets Behind the Past and Future Success of Steve Jobs’s Iconic Brand (London: John Murray).

Lee, C.K. (2007), Against the Law: Labor Protests in China’s Rustbelt and Sunbelt (Berkeley, CA: University of California Press).

Lee, C.K. (2010), ‘Pathways of Labor Activism’, in E.J. Perry and M. Selden (eds.), Chinese Society: Change, Conflict and Resistance, 3rd edn (London: Routledge), pp. 57–79.

Lee, J. and G. Gereffi (2013), ‘The Co-Evolution of Concentration in Mobile Phone Value Chains and its Impact on Social Upgrading in Developing Countries.’ Capturing the Gains Working Paper 25. (accessed 1 April 2013).

Leng, T.-K. (2005), ‘State and Business in the Era of Globalization: The Case of Cross-Strait Linkages in the Computer Industry’, The China Journal 53, January, 63–79.

Lichtenstein, N. (2009), The Retail Revolution: How Wal-Mart Created a Brave New World of Business (New York: Metropolitan Books).

Lüthje, B. (2006), ‘The Changing Map of Global Electronics : Networks of Mass Production in the New Economy’, in T. Smith , D.A. Sonnenfeld and D.N. Pellow (eds), Challenging the Chip : Labor Rights and Environmental Justice in the Global Electronics Industry (Philadelphia, PA: Temple University Press), pp. 17–30.

Marketplace (American Public Media) (2012), ‘The People Behind your iPad.’ 12 April. (accessed 13 April 2012).

Marx, K. and F. Engels ([1848] 2002), The Communist Manifesto (London: Penguin Classics).

McKay, S.C. (2006), Satanic Mills Or Silicon Islands? The Politics of High-Tech Production in the Philippines (Ithaca, NY: Cornell University Press).

McNally, C.A. (2004), ‘Sichuan: Driving Capitalist Development Westward’, The China Quarterly 178, June, 426–447.

Naughton, B. (2010), ‘China’s Distinctive System: Can It Be A Model for Others?’, Journal of Contemporary China 19, 65, 437–460.

Nunns, C. (2012), ‘Apple Profits Unharmed by Foxconn Factory Riots’, GlobalPost. 26 September. (accessed 27 September 2012).

Ong, A. ([1987] 2010), Spirits of Resistance and Capitalist Discipline: Factory Women in Malaysia, 2nd edn (Albany, NY: State University of New York).

Perry, E.J. (2002), Challenging the Mandate of Heaven: Social Protest and State Power in China (Armonk, NY: M. E. Sharpe).

Pringle, T. (2013), ‘Reflections on Labor in China: From a Moment to a Movement’, The South Atlantic Quarterly 112, 1, 191–202.

Pun, N., C.K. Chan and J. Chan (2010), ‘The Role of the State, Labour Policy and Migrant Workers’ Struggles in Globalized China’, Global Labour Journal 1, 1, 132–151.

Pun, N. and J. Chan (2013), ‘The Spatial Politics of Labor in China: Life, Labor, and a New Generation of Migrant Workers’, The South Atlantic Quarterly 112, 1, 179–190.

Pun, N. and H. Lu (2010), ‘Unfinished Proletarianization: Self, Anger and Class Action of the Second Generation of Peasant-Workers in Reform China’, Modern China 36, 5, 493–519.

Qiu, J.L. (2009), Working-Class Network Society: Communication Technology and the Information Have-Less in China (Cambridge: MIT Press).

Ross, A. (2006), Fast Boat to China: Corporate Flight and the Consequences of Free Trade – Lessons from Shanghai (New York: Pantheon Books).

Ruggie, J.G. (2012), ‘Working Conditions at Apple’s Overseas Factories’, The New York Times. 4 April. (accessed 5 April 2012).

Satariano, A. and P. Burrows (2011), ‘Apple’s Supply-Chain Secret?’ Hoard Lasers, Bloomberg Businessweek. 3 November. (accessed 17 March 2013).

Segal, A. (2003), Digital Dragon: High-Technology Enterprises in China (Ithaca, NY: Cornell University Press).

Selden, M. (1997), ‘China, Japan, and the Regional Political Economy of East Asia, 1945–1995’, in P.J. Katzenstein and T. Shiraishi (eds), Network Power: Japan and Asia (Ithaca, NY: Cornell University Press), pp. 306–340.

Selden, M. and E.J. Perry (2010), ‘Introduction’, in E.J. Perry and M. Selden (eds), Chinese Society: Change, Conflict and Resistance, 3rd edn (London: Routledge), pp. 1–30.

Selden, M. and J. Wu (2011), ‘The Chinese State, Incomplete Proletarianization and Structures of Inequality in Two Epochs’, The Asia-Pacific Journal 9, 5, 1–35. (accessed 31 January 2011).

Silver, B.J. (2003), Forces of Labor: Workers’ Movements and Globalization since 1870 (Cambridge: Cambridge University Press).

Silver, B.J. and L. Zhang (2009), ‘China as an Emerging Epicenter of World Labour Unrest’, in H. Hung (ed.), China and the Transformation of Global Capitalism (Baltimore, MD: The Johns Hopkins University Press), pp. 174–187.

Smith, T. , D.A. Sonnenfeld and D.N. Pellow (eds) (2006), Challenging the Chip: Labor Rights and Environmental Justice in the Global Electronics Industry (Philadelphia, PA: Temple University Press).

Solinger, D.J. (1999), Contesting Citizenship in Urban China: Peasant Migrants, the State, and the Logic of the Market (Berkeley, CA: University of California Press).

Solinger, D.J. (2009), States’ Gains, Labor’s Losses: China, France, and Mexico Choose Global Liaisons, 1980-2000 (Ithaca, NY: Cornell University Press).

Starosta, G. (2010), ‘The Outsourcing of Manufacturing and the Rise of Giant Global Contractors: A Marxian Approach to Some Recent Transformations of Global Value Chains’, New Political Economy 15, 4, 543–563.

Sturgeon, T., J. Humphrey and G. Gereffi (2011), ‘Making the Global Supply Base’, in G.G. Hamilton , M. Petrovic and B. Senauer (eds), The Market Makers: How Retailers are Reshaping the Global Economy (Oxford: Oxford University Press), pp. 231–254.

Taylor, P. and P. Bain (2008), ‘United by A Common Language?’, Antipode: A Radical Journal of Geography 40, 1, 131–154.

Taylor, P., K. Newsome and A. Rainnie (2013), ‘Putting Labour in Its Place’: Global Value Chains and Labour Process Analysis, Competition & Change 17, 1, 1–5.

Traub-Merz, R. (2012), ‘All-China Federation of Trade Unions: Structure, Functions and the Challenge of Collective Bargaining’, in R. Traub-Merz and K. Ngok (eds), Industrial Democracy in China: With Additional Studies on Germany, South-Korea and Vietnam (Beijing: China Social Sciences Press), pp. 11–60. (accessed 2 January 2013).

Webster, E., R. Lambert and A. Bezuidenhout (2008), Grounding Globalization: Labour in the Age of Insecurity (Malden, MA: Blackwell Publishing).

Wikinvest (2013), ‘Apple: Operating Margin.’ (accessed 10 January 2013).

Wright, E.O. (2000), ‘Working-Class Power, Capitalist-Class Interests, and Class Compromise’, American Journal of Sociology 105, 4, 957–1002.

Zhao, J. (2010), ‘Suicide Occurs after Foxconn Ceo’s Visit’, Caixin. 27 May. (accessed 28 May 2010).

Zhou, Y. (2008), The Inside Story of China’s Hi-Tech Industry: Making Silicon Valley in Beijing (Lanham: Rowman and Littlefield).

Notes

1 Foxconn’s parent corporation is Taipei-based Hon Hai Precision Industry Company. The trade name Foxconn alludes to the corporation’s ability to produce electronic connectors at nimble “fox-like” speed.

2 Gu and Cai (2011) conclude that Chinese fertility is presently 1.6 children per woman, down from around 2.5 children per woman in the 1980s. In the next few years the number of young labourers aged 20 to 24 years will peak. China’s 2010 Population Census, moreover, showed that the age group 0–14 comprised 16.6 percent of the total population, down 6.29 percent compared with the 2000 census data.

3 The National Bureau of Statistics has acknowledged that the gender imbalance had reached 119:100 in 2009 before dipping slightly to just under 118:100 in 2010. The 2011 data reported 117.78 baby boys for every 100 girls (China Daily, 2012).

4 Foxconn’s revenues or net sales increased from US$51.8 billion in 2007 (Foxconn Technology Group, 2009: 11) to US$131 billion in 2012 (Foxconn Technology Group, 2013b). During the same period, the net sales of Apple soared from US$24.6 billion (Apple, 2011: 24) to US$156.5 billion (Apple, 2012a: 24).