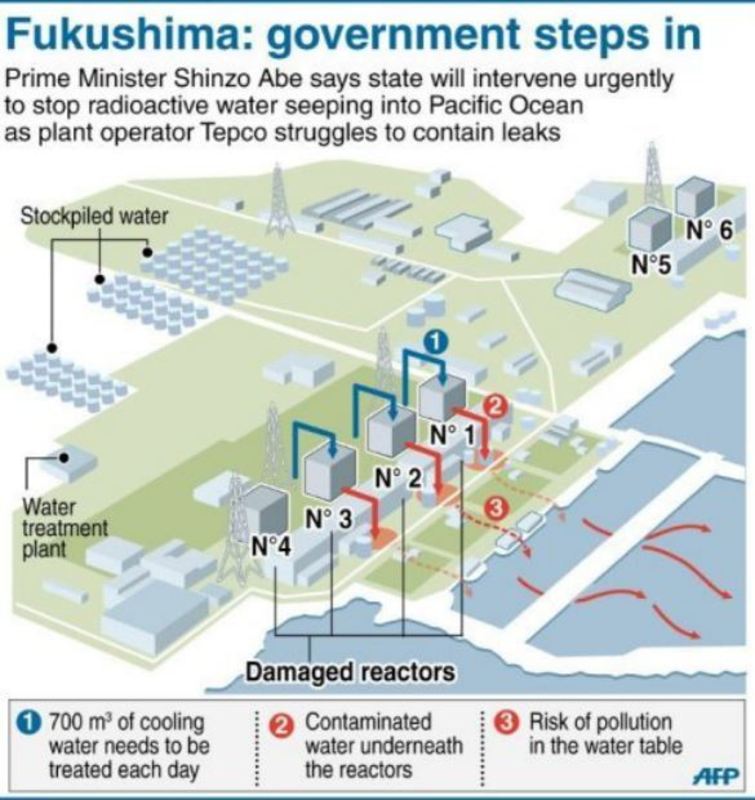

Japan’s ruined and radioactive reactor plant at Fukushima Daiichi has been an abiding source of concern among knowledgeable observers. There are a host of good reasons for this reemergence. As this Mainichi survey observes, it is now clear that several hundred tons of radiation-contaminated water is entering the ocean per day. Over the past week, it suddenly returned as an intense focus of concern in the Japanese1 and quality overseas press.2 There are a host of good reasons for this reemergence. As this useful summary of articles and expert statements reveals, it is now clear that several hundred tons of radiation-contaminated water is entering the ocean.

|

|

The usual suspects, including Tepco as well as various talking heads, have been assuring anxious observers that nothing untoward is going on, that health risks are minimal, and so on. But at the same time, Japan’s Nuclear Regulation Authority (NRA) was steadily ramping up its warnings to Tepco to be more pro-active and forthcoming on the crisis. And on top of that, Shinkawa Tatsuya, Director, Nuclear Accident Response Office at the Ministry of Economy Trade and Industry’s (METI) Agency for Natural Resources and Energy is on record warning that the leaks may have been going on for two years and that there is a risk of the reactor buildings toppling.

Along with many other shocked observers, Neils Bohmer, nuclear physicist and general manager of the international environmental group Bellona, points out that what is happening at Fukushima Daiichi shows the efforts underway are still largely improvised. He adds that the “setbacks that have troubled Tepco in its efforts to bring the plant to heel would be nearly comical were it not for the gravity of the situation”. Beyond Nuclear’s Paul Gunter, Director of the highly respected organization’s Reactor Oversight Project, argues in a very fact-packed and concise August 9 RT America broadcast that cesium 137, strontium 90 and “a full range of radioactive contaminants” is moving “which indicates that the damaged cores of these reactors…are now contributing to the contamination of the Pacific Ocean.” He describes in detail how Tepco’s installation of a temporary, “chemical” wall between Fukushima Daiichi and the ocean, in order to prevent leakage into the Pacific, became in effect a dam that has now been breached and overflowed.

|

Gunter describes the Japanese Government as “in chaos,” with a clear failure of command and control of Fukushima and a dangerous reluctance to turn to international assistance. If his depiction of the situation as chaotic seems overdone, consider the buck-passing going on among Tepco, the NRA, METI, and the Abe Government. And consider the incentives for it.

As to Tepco itself, it is far more interested in devoting its scarce financial and human resources to getting its reactors at Kashiwazaki Karuiwa, the world’s largest nuclear plant, restarted as soon as possible. The site was heavily damaged by the 2007 Chuuetsu offshore earthquake, and Tepco needs restarts there in order to have any prospect of remaining a viable business entity. That possibility of getting back into the black is, of course, predicated on the Fukushima Daiichi crisis being taken over by the government and dealt with via public funds. Tepco clearly cannot do the job on its own, and has repeatedly argued that point. Current estimates of the total cost of clean up within Fukushima Prefecture alone amount to YEN 5.13 trillion (USD 50 billion),3 with total costs of decommissioning and compensation assessed (perhaps conservatively) by the Japanese Government as roughly YEN 10 trillion (USD 100 billion) at present.4 Tepco knows that it cannot restart any of the assets at Fukushima Daiichi, even the 2 reactors (Fukushima Daiichi Numbers 5 and 6) that remain operable. The more resources it pours into Fukushima Daiichi, the less it has to deploy elsewhere on projects where it has the prospect of making money. So Fukushima Daiichi is a black hole so far as Tepco is concerned.

As for the NRA, it is a new organization, and strapped for staff. It already has about 40 of its scant personnel deployed up at Fukushima Daiichi. It has an additional 80 staff divided into three teams currently assessing reactor safety upgrades (those that have applied for restarts) throughout the country. As noted, the NRA has been very public in insisting that Tepco be more forthcoming and forthright with information and efforts up at Fukushima Daiichi. But the NRA cannot force Tepco to act as it deems necessary. This was made clear by the fact that Tepco took its time in revealing the leakage of radiation into the sea, even though the NRA had been insisting on action for weeks. As for independent action, the NRA is limited in what it can do because it is a regulatory agency and lacks the human and financial resources to cope with the enormity of what is unfolding at Fukushima Daiichi.

The METI and the Abe Government are the public sector and thus have the resources to deal with the crisis. But they are both wary of the political risks inherent in stepping right up to the plate. One of the games being played in the wake of Fukushima – and the root cause of why this new crisis has erupted – is that the central government is wary of getting stuck in a tar pit of multiplying costs and responsibility. The approach hitherto has been to dribble in assistance (such as last year’s YEN 1 trillion nationalization of Tepco)5 without taking command of the situation and imposing stringent conditions on Tepco and the other utilities.

Even the current commitment by PM Abe Shinzo to “take action” has been marked by ambiguity over how much assistance will be devoted to the crisis and in what form. At present, METI and the Abe Cabinet are mooting the construction of a 1.4 kilometre system of pipes filled with coolant to freeze the soil around the damaged plant. Whether the state will foot only a portion of the cost or most of it is unclear. This very expensive6 and novel idea was first raised by the construction firm Kajima, and found its way into a May 30, 2013 report METI produced on dealing with the crisis. The METI Minister, Motegi Toshimitsu, in fact insisted to Tepco President Hirose Naomi that the firm implement the report’s recommendations. But evidently, the great expense of the measure put Tepco off. Tepco stuck to its chemical wall approach, injecting materials into the ground, and here we are.

And even if the “frozen ground” approach gets budgeted and underway, it will only work for a short time. In the interim, among a host of other problems, there is roughly 400,000 tons of contaminated water in a massive tank farm on site, with plans to add an additional 300,000 tons of capacity over the next three years. But the annual increase in water storage is 150,000 tons, so Tepco is due to run out of space and has no plan for what to do.7 Moreover, the tanks are “built from parts of disassembled old containers brought from defunct factories and put together with new parts, workers from the plant told Reuters. They say steel bolts in the tanks will corrode in a few years.” Tepco has said it does not know how long the tanks will stand up to the elements and chemistry, and apparently has no plan for what to do when nature takes its toll here as well.8

Back to the Future of Failed Banks and Toxic Assets?

What is unfolding at Fukushima and in Tokyo bears much resemblance to the post-bubble financial crisis that crippled the Japanese economy in the 1990s and into the 2000s.9 Just as in the 1990s, almost all the actors are dithering and pointing fingers. The public coffers are likely to dribble in just as much as PM Abe thinks the taxpayers will stomach. But just as with the bank bailouts of the past, which eventually cost at least YEN 100 trillion, the public is going to have to pick up the cost of this crisis as well, whether through higher power costs or taxation.

The public finances have already been deployed in a number of initiatives, including the injection of YEN 1 trillion into Tepco on July 25 of last year.10 They will apparently be used again to freeze the ground around the site. In all likelihood, public money will have to be used to cope with soon-to-be insufficient and corroding tank storage. And that is just on-site. Look beyond the plant itself, and there is the huge burden of clean-up and compensation in the region. Further beyond that, there is the prospect that the nuclear-holding utilities are going to find themselves with very stranded and toxic assets, due to the increasingly fraught political economy of restarts.11

|

|

The Abenomics people certainly did not have this crisis on the radar when they were conferring with advisors on how to revive the Japanese economy. As with cabinets during the 1990s post-bubble years, the Abe Government may be inclined to do the least and hope that nothing more serious happens on their watch. This “kick the can down the road” is what most governments do, as we saw in the most recent global financial crisis and other massive public-policy challenges. It is what the entire world is doing in the face of climate change, due to the power of vested energy interests as well as the mistaken perception that action will be enormously expensive and economically debilitating.12

The Abe Government are perhaps yet to grasp that they need to move quickly and decisively. It is clear that post-Fukushima Tepco and its Fukushima Daiichi plant is going to continue delivering economically and politically costly surprises. To use the language of risk analysis, business as usual at Fukushima Daiichi has become a very fat and increasingly short-tailed risk.

For one thing, Abe’s desire to restart nuclear assets elsewhere has likely been set even further back by this new crisis, as the NRA is now even more distracted from safety checks. Japan will be without nuclear power again from September, when the two reactors at Ohi go into their scheduled maintenance. And it may be ten months from that, to July of 2014, before any restarts are possible.13 At the same time, the Abe government is just about to initiate a 3-stage deregulation of the power sector that is to be protracted over several years between 2015 to perhaps as late as 2020.14 This agenda may have to be accelerated, as the monopolies are already fighting fiercely in the face of a steadily rising number of new entrants – including Mitsui in September – into the power market.

The Abe regime’s first two arrows of monetary and fiscal activism were followed by a third arrow of structural reforms that was roundly denounced. Observers rightly wanted to see a focus on initiatives that had some credible prospect of reviving the Japanese economy, lifting it over the hump of shrinking population, declining productivity and other sobering structural challenges. They ignored the fact that much of the third arrow centred on energy and efficiency. Perhaps the virtual certainty of further costly mishaps at Fukushima Daiichi (and indeed elsewhere) moves the option of nationalizing the nuclear plant as well as the power grid a little more into view as serious and very promising structural reform.15

Make no mistake: this option would involve considerable short-term pain. But it would enhance public safety16 as well as do in one fell swoop what is being instead done in dribbles, and dangerously. It would also potentially create a vast ecosystem for innovation and deployment of new business models as well as the ICT, renewables and efficiency gear that are already part of the national agenda.

Some Elements of the Emerging Post-Fukushima Reality

A full-on drive in the energy sphere was beyond the pale pre-Fukushima. But now the Japanese bureaucratic-political elite is very much in support of renewables and efficiency. For example, METI’s Natural Resources and Energy Agency Manager Kimura Youichi is calling for accelerated deployment of renewables via the FIT and other policies.17 This statement from Kimura follows a previous call for more renewables and efficiency from Yamamoto Taku, Chair of the LDP’s Natural Resources and Energy Commission.18 Arguments that pre-Fukushima – and even a year or so ago – were iffy or even beyond the pale are now becoming common sense. And the opposite is true as well: recall that on February 19 of 2009, the METI Vice-Minister declared the smart grid is not necessary in Japan.19 That statement was made only four years ago, and reflected conventional wisdom in his ministry at the time, due to the dominance of the monopoly utilities. But were the same argument to be enunciated now, the bureaucrat would be laughed off the stage.

And this is all accelerating. Consider the implications of Toyota, Mitsui and other huge, blue chip Japanese firms entering the country’s power markets, as competitors with the monopolies. Think of what that and other rapid and significant change means for bureaucrats drafting policy options, politicians looking to make good as policy entrepreneurs, and other players in a business with YEN 18 trillion in annual power sales.

Yet this huge power market, the world’s third largest, is just one segment of what is a rapidly expanding and proliferating sector. Consider the implications of ICT-enabled diffusion of efficiency and renewables, something that only a few specialists were discussing 4 years ago. The multi-functionality of ICT is already being deployed, in places like Austin Texas.20

Just like Austin and elsewhere, Japan is flush with innovation in this strategic area. The August 10 edition of the Nikkei newspaper describes, for example, Toshiba’s “building energy management system” (BEMS) that is able to measure and aggregate power consumption in multiple buildings. From October, Toshiba will begin testing this BEMS in the vicinity of Kawasaki station.

Toshiba’s Lazona Kawasaki Toshiba building |

Toshiba’s Lazona Kawasaki Toshiba Building, centring the BEMS in that building and linking the Kawasaki Municipal Office as well as multiple private business buildings. The systems measure their power consumption as well as monitor whether any of the individual buildings have gone into unusual circumstances. It is expected that the system will result in power conservation of roughly 20%. Among the players participating in this test are NREG Toshiba Properties, the Kawasaki Chamber of Commerce, Kawasaki Azeria, Tokyo Gas, Kawasaki City and others. Toshiba is also participating in other projects within Kanagawa Prefecture. In Yokohama city, for example, Toshiba is a partner in the district energy supply and demand management system under the auspices of the “Yokohama Smart City Project.”21

The August 8 edition of the Nikkei newspaper also reports that Japanese private capital is centring its R&D on efficiency and renewables. The newspaper notes that R&D spending at Japanese firms has increased by 24%. The Nikkei 2013 survey of R&D expenditures shows that of the top 261 firms, 63 (or 24%) plan on increasing their R&D by double digit figures. The overall increase in R&D expenditure plans is 5.4%, which compares to the 4.3% level of 2012. Not surprisingly, the top three firms are automakers, with next generation fuel-cell and battery-powered eco-cars as their focus. The overall total for the 261 firms is slated to be YEN 11.38 trillion, the fourth consecutive year of increases. Toyota’s expenditures were up 11.4% to a total of YEN 900 billion. The second rank was Honda, with an increase of 12.4% to a total of YEN 630 billion. Like Mitsui, these firms are both players in the power markets as well.

Along with the automakers, high levels of R&D increase were seen in machinery makers as well as energy efficiency equipment. Mitsubishi Heavy recorded a 23.8% increase in R&D expenditures to a total of YEN 70 billion with a focus on high-efficiency gas turbines, fuel cells, offshore wind power and other energy related projects. Among electronics and IT makers, the top performers included Hitachi, with a 6.3% increase to a total of YEN 363 billion and Toshiba with an increase of 12.7% to a total of YEN 345 billion. Though Hitachi and Toshiba are often associated with nuclear power, Hitachi’s R&D investments focus on water management systems, railways, battery storage as well as a cooperative effort with Toshiba on developing flash memory and next-generation power grids as well as other ICT-oriented projects.

The survey also asked for information on which areas firms are focusing, with multiple replies allowed. The top area of focus was energy efficiency at 50.2%, with renewable energy technology at 44.4%.

As to power markets and the number of new players, the August 7 Nikkei reveals there are 91 firms at present. In 2012, the number of firms with a record of power sales totaled 33 firms, and their share of the total deregulated power market (including that of the 10 monopolized utilities) was a mere 3.5%. In most cases, these firms have to use the power grid that is controlled by the monopolized utilities. But as noted, the public sector is planning on separating generation from transmission of power, and it is expected that the new power producers (or PPS) will have more opportunity to grow. In the wake of the March 11, 2011 Tohoku disaster, and the deficiencies in power supply as well as the power-price increases by the monopoly utilities, circumstances changed for the PPS’s. The PPS power prices are generally 5 to 15% lower than the monopolized utilities. Their customers among business firms as well as local governments are increasing dramatically. This is especially true in the catchment area for the largest of the monopolies, Tepco, where the PPS share is roughly 10% at present. Within this year, including the entry of Mitsui in September, the number of PPS firms nationwide is expected to exceed 100 firms.

The Japanese in favour of fast action know they can compete if they rapidly diffuse the demand-response, renewables and other efficiency and new energy equipment and business models their firms are innovating and in which “smart city” projects have developed and deployed in Kitakyushu, Keihanna, and elsewhere throughout the country. But they also know that with the monopoly utilities in place and owning the grid, progress will be glacial. However, were Japanese state managers to opt for disruptive change in the face of burgeoning costs from Fukushima, Japan may be able to leapfrog as it were.

So if the Fukushima Daiichi crisis is as bad as some of the expert comment suggests, then fast and massive action might be unavoidable. Perhaps PM Abe will act this time rather than neglect the economy as he did 6 years ago. One big question is whether Abe’s LDP can find the wisdom and political traction to nationalize the nuclear capacity and grid, putting both in competent, well-funded hands. If so, we might see Japan rocket ahead on smartening the grid, deploying radical efficiency, and diffusing renewables. That kind of disruptive change would not be alien to an Abenomics that is already generally aimed at ICT-centred growth and smart-energy deregulation. Perhaps the Fukushima meltdowns and lingering crisis can provide the needed impetus.

Andrew DeWit is Professor in the School of Policy Studies at Rikkyo University and an Asia-Pacific Journal coordinator. With Iida Tetsunari and Kaneko Masaru, he is coauthor of “Fukushima and the Political Economy of Power Policy in Japan,” in Jeff Kingston (ed.) Natural Disaster and Nuclear Crisis in Japan.

Recommended citation: Andrew DeWit, Water, Water Everywhere: Incentives and Options at Fukushima Daiichi and Beyond,” The Asia-Pacific Journal, Volume 11, Issue 32, No. 6, August 12, 2013.

Related articles

•Andrew DeWit, “In the Dark With Tepco: Fukushima’s Legacy for Nuclear Power,” http://japanfocus.org/-Andrew-DeWit/3974

• Andrew DeWit Abe, Big Data and Bad Dreams: Japan’s ICT Future?

• Andrew DeWit, Green Shoot: Abenomics and the 3rd Arrow

• John A. Mathews, Mei-Chih Hu, Ching-Yan Wu, Concentrating Solar Power – China’s New Solar Frontier

• Andrew DeWit, Abenomics and Energy Efficiency in Japan

• Andrew DeWit, Distributed Power and Incentives in Post-Fukushima Japan

• John A. Mathews, The Asian Super Grid

• Andrew DeWit, Japan’s Energy Policy at a Crossroads: A Renewable Energy Future?

• Andrew DeWit, Japan’s Remarkable Energy Drive

• Andrew DeWit, Megasolar Japan: The Prospects for Green Alternatives to Nuclear Power

• Peter Lynch and Andrew DeWit, Feed-in Tariffs the Way Forward for Renewable Energy

• Sun-Jin YUN, Myung-Rae Cho and David von Hippel, The Current Status of Green Growth in Korea: Energy and Urban Security

• Son Masayoshi and Andrew DeWit, Creating a Solar Belt in East Japan: The Energy Future

• Andrew DeWit and Sven Saaler, Political and Policy Repercussions of Japan’s Nuclear and Natural Disasters in Germany

• Andrew DeWit and Iida Tetsunari, The “Power Elite” and Environmental-Energy Policy in Japan

1A useful compilation of recent NHK English-language broadcasts on the incident is available here.

2One of the best articles on this crisis and its implications is Patrick J Kiger, “Fukushima’s Radioactive Water Leak: What You Should Know,” National Geographic, August 7, 2013.

3On this, see The Sankei Shimbun (in Japanese) “Clean-Up Costs in Fukushima Prefecture as Much as YEN 5 trillion,” July 24, 2013.

4On this, see (in Japanese) “Whither Japan? Energy and Nuclear Restarts in the Wake of Abe’s Electoral Triumph,” Mainichi Shimbun, July 26, 2013.

5On the scale and implications of the nationalization, see “Tepco’s nationalization: State power,” The Economist, May 11, 2012.

6Some estimates suggest it will be about YEN 30 to 40 billion (about USD 350 million). See (in Japanese) “(the flow of contaminated water) Hoping for a quick response from the central government,” Fukushima Minpo, August 10, 2013.

7Patrick J Kiger, “Fukushima’s Radioactive Water Leak: What You Should Know,” National Geographic, August 7, 2013.

8See the very good work on this by Antoni Slodkowski and Mari Saito, “Fukushima clean-up turns toxic for Japan’s Tepco,” Reuters, July 30, 2013.

9On the 1990s crisis and the policy response, in comparison with Sweden, see Sven Steinmo, Emre Bayram and Andrew DeWit “Bailing out the Bankers or the Banking System: Comparing Sweden’s Response to Financial Crisis,” February 14, 2014 (under review).

10For the details, see “Tepco to be nationalized on July 25 with YEN 1 trillion transaction,” Japan Times, May 22, 2013.

11The most thorough treatment of this comes (in Japanese) from Keio University Professor, and former member of the National Commission on Nuclear and Other Power Costs, Kaneko Masaru, in “Nuclear is More Expensive than Thermal Generation,” Iwanami Booklet No 880, August 3, 2013. Kaneko’s work deploys the modeling used to calculate power costs, and determines that the vast majority of the nuclear reactors are uncompetitive, especially when one adds in the costs of new safety measures, new costs for decommissioning, and other expenses that keep mounting up.

12In fact, fast action reduces the far more expensive costs of adaptation as well as has the potential for first-mover advantage. That’s one reason the core agencies of the Obama Administration are collaborating with the US military to get around Congress and test-bed as well as deploy the world’s most advanced renewable and efficiency-related equipment.

13Even experts at Japan’s nuclear-friendly Institute of Energy Economics suggest the first restarts may be as late as July 2014. See Osamu Tsukimori, “Two years on from meltdowns, experts predict July 2014 restart for some reactors,” Reuters, August 6, 2013.

14A nice summary of the deregulation and its context can be found at Daniel P Aldrich, James E. Platte, and Jennifer F. Sklarew “What’s Ahead for Abe’s Energy Agenda?” Asia Unbound Blog, Council on Foreign Relations, July 30, 2013.

15This option is already being discussed in political and bureaucratic (not to mention business) circles. For one exponent’s arguments, see (in Japanese) LDP Diet Member Kohno Taro’s comments in “Before Restarts, Decide a Cap on Nuclear Waste,” Toyo Keizai, July 18, 2013.

16As noted in the first paragraph, even the METI authorities are warning that the facilities could topple. That risk implies that the fuel pools are in danger as well.

17The interview with Kimura is in the August 5 edition of the Japanese weekly Distributed Generation, and is titled “Aiming at a Further Expansion of Renewables Via Stable Management of New Energy Policy.”

18See the interview with Yamamoto (in Japanese) in the June 5 edition of the weekly newspaper, Decentralized Energy.

19See the Vice-Minister’s February 19, 2009 comments here.

20See for example Jeff St. John, “AutoGrid, Austin Energy and the ARPA-E Home Challenge,” GreenTech Media, February 26, 2013.

21On the Yokohama Project, see here.