This article describes the impressive, resilience-targeted greening of Japan, evident in nationwide deployments of renewable energy, radical efficiency, and other core aspects of sustainability. These developments are already underway, and include public- and private-sector actors as well as community groups. The greening also has promising stamina due to being increasingly deeply inscribed in the fiscal, regulatory and other mechanisms of a rapidly emergent industrial policy.

But first, let us have a brief look at the background of the current public debate. On June 5, Japanese PM Abe Shinzo let loose his third arrow of reform, part of a triad that includes 1) the radical expansion of the money supply, 2) aggressive fiscal policy, and 3) structural reform (largely understood as deregulation). Abe’s first two arrows were roundly applauded by the ranks of global banks and in the pages of the Financial Times as well as the Japanese press. The euphoria over “Abenomics” indeed lifted Japan’s Nikkei 225 stock index 41% between mid-November of 2012 and late May of this year. But the third arrow’s release saw the Nikkei drop 3.8%. This shot was roundly denounced by most domestic and overseas observers as a “misfire,” and “same old, same old” of minimalist tax and regulatory tinkering in so-called “special economic zones.”1

|

Certainly by mainstream standards the third arrow was a sucker-tipped dart rather than a crossbow bolt. But the naysayers overlooked the arrow’s context and even most of its content. The former includes Japan’s accelerating shift to local resilience forced by the Fukushima shock’s startling exposure of systemic risks in the social economy as well as enormous opportunities to bolster communities and foster competitive export industries. Part of this movement in response to multiple shocks includes energy-related deregulation and other reforms ongoing throughout Japan. These regulatory initiatives indeed compose much of the 3rd arrow. Moreover, the arrow’s much-maligned special economic zones also come in the midst of aggressive post-Fukushima nationwide testing and deployment of world-class smart city projects. The global context for what Japan is doing includes at least 2400 smart-city initiatives, salient among them being American military bases readying themselves for climate change, cyber-attacks, renewable energy and other realities of our era. Responsive public and private agents seek both to spearhead innovation and deployment, in a race for green growth, as well as build the mechanisms of mitigation, adaptation and sustainable growth we urgently need.

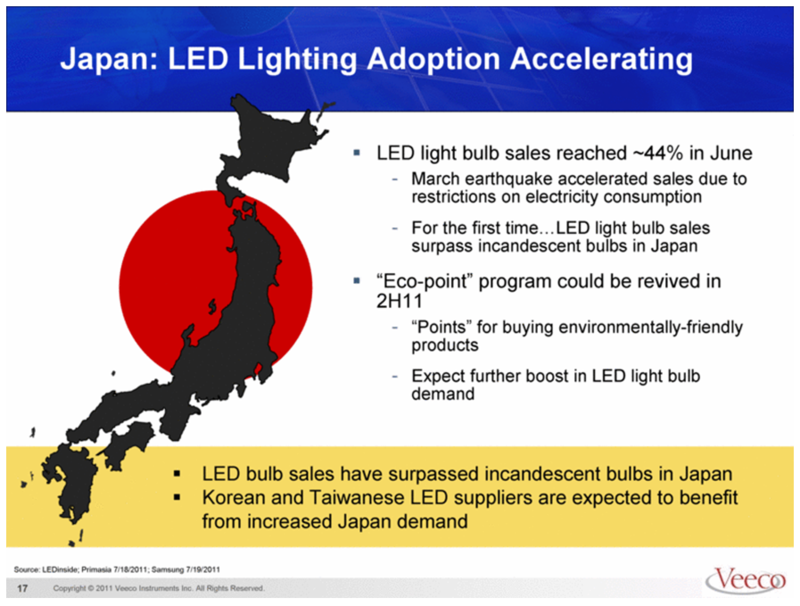

Japan seems advantageously positioned in this contest because a great deal of constructive “structural reform” is already being driven by smart policy as well as escalating power prices that put a premium on energy alternatives. These “reforms”2 include the deployment of 40% more efficient trains, the unfolding of the world’s largest solar market this year, 40% more efficient electric motors, the diffusion of 40% of global LED demand, the emergence of extraordinary new materials, and other promising potential pillars of a sustainable new growth paradigm. And this is not a flash in the pan, another in a litany of faddish and impractical fixes for Japan’s mind numbing demographic, debt and other challenges.

|

|

Green is in fact an accelerating global race, with the most recent (and if anything conservative) International Energy Agency (IEA) projections indicating that renewable power will even overtake natural gas in the global power mix by 2016.3 And as I detail in this article, industrial policy to exploit Japan’s green-growth opportunity is already becoming institutionalized.

Why Were These Critical Details Overlooked?

Before turning to those details, let us ponder why Japan’s profusion of initiatives are not already common knowledge. Recall that the frostiest reception given to the third arrow of structural reforms came from the global investment class and the institutions and media that cater to them. It is worth noting that many had a hand in producing, selling or at least applauding the toxic assets that nearly melted down the global economy 5 years ago. We hear few qualms from them that the regulatory response to that chaos has been, at best, minimalist.4 Their main concern is making money, especially by taking other people’s money and allocating it to carbon- and resource-intensive business as usual, while passing on the social, environmental and myriad other costs to society and the state. As Pavan Sukhdev, Deutsche Bank senior banker and head of the United Nations Environmental Programme’s Green Economy Initiative describes in his Corporation 2020, corporations’ conventional wisdom continues to downplay the urgent need for sustainability.5 In their rerun of Polanyi’s Great Transformation, one likely to have no sequel, social and other protection must be sacrificed to squeeze growth out of the depleted and all-depleting conventional economy. Abe’s first two arrows thrilled them with the prospect of reflation of the unsustainable status quo. In the third, they wanted to see the evisceration of employment and various forms of welfare protection, saw no prospect of blood on the floor, and finding it absent, loudly voiced their disappointment.

A second problem, related to the above, is that the larger, op-ed commentariat’s ambit of concern overlooks robust green growth and the steadily increasing urgency of it. They also pay little attention to the content of the post-Fukushima miracle underway in Japan, generally interested only in macroeconomic indices. As they did after the after the global crash of 2008-09, these academics and analysts continue to deem green growth too expensive and too limited in scale to support a sustainable recovery. Whether Keynesians or Austerians, they are thus stuck in the status quo, like drunks fighting in a stupor while looking for the “structural reform” keys to recovery under the proverbial streetlight.6

But perhaps the most significant obstacle to a green agenda is the shooter himself. Abe is far more keen – as former PM Kan Naoto publicly derided7 – to hawk nuclear reactors in his frantic overseas salesman efforts and is generally uninterested in talking about Japan’s burgeoning green growth. So scarcely a word passed Abe’s lips about the multiple pages of green content of the third arrow as well as the extensive deployment of core enabling technologies (such as smart grids) supported by the first two arrows. Abe simply lacks a green vocabulary, even though he is surrounded by green-growth advocacy in his own party8 and even in his own home (his wife being pro-renewable and anti-nuclear). Contributing to Abe’s myopia, no doubt, is that his real passion is in positioning himself to win elections, especially the July 21 Upper House election. His main interest is in further “airbrushing history” while rewriting the Japanese constitution.9 And his economics seems rooted in cynical old-style pork barrel spending, whose fruits are plainly evident in the fact that, earlier this year, his own electoral constituency of Shimonoseki turned down yet another Abe-backed public-works mayoral candidate and instead seeks to become a smart city.10

What was Overlooked?

A lot of investment, among hedge funds as well as the conventional energy sector, rides on whether Japan restarts a significant share of its nuclear capacity or continues importing large quantities of natural gas and other fossil fuels.11 Hence, much attention to the third arrow centred on the prospect of deregulating Japan’s YEN 18 trillion per year power market, currently dominated by 10 monopoly utilities. But that reform can be expected to confront at least several years of wrangling and an uncertain outcome in light of business prospects.

Observers should have read through the details on energy. One reason is that even the conservative estimates of the LDP government recognize that the domestic clean energy market, including renewable energy as well as energy-management devices, totals YEN 4 trillion at present, and is likely to grow to YEN 10 trillion by 2020. The global clean energy market is valued at roughly YEN 40 trillion at present and is projected to grow to YEN 108 trillion by 2020 and YEN 160 trillion by 2030.12

The third arrow is also packed with numerous examples of constructive, resilience-building deregulation. Last year’s (July 1, 2012) implementation of the feed-in tariff13 has been followed by a flood of initiatives to sweep away the regulatory network that impedes the rapid diffusion of renewable energy.14 These rules include unduly strict regulations governing the use of waterways, farmland and other ecosystem assets.15 Japan’s regulatory network governing waterways, for example, was meant to protect local residents’ and other actors’ rights to water from rivers. But these same rivers are now an energy resource where small hydro (i.e. not traditional large-scale dams, but rather small-scale hydropower generation equipment) can be deployed. The problem with current rules is that they impede the deployment of small hydro, even where it does not impede local and downstream residents’ rights to the water per se. The diffusion of small hydro simply harvests some of the energy within the moving water rather than – in contrast to the so-called “golden age” of gas fracking in America and elsewhere – consuming the water itself or polluting it.16

Other notable deregulatory moves include halving the several years required for environmental assessments of wind and geothermal projects, allowing solar to be deployed on farmland under use, and otherwise amending rules to bring them into line with those in renewable energy leaders such as Germany and Denmark. The deregulation also includes measures to facilitate recycling, community power projects, and small-scale cogeneration to produce heat and power, and a

These initiatives matter a great deal for a number of reasons. One is that the power business is the fastest growing sector in Japan. On June 13, the Tokyo Shoko (“Commerce”) Research Ltd, established in 1892 as Japan’s first credit reporting agency, released its “National Business Starts” survey for 2012. During the year, there was an increase of 1.2% in new businesses, to a total of 103,074 firms. Within the specific are of electricity, gas, heat distribution and water, the 2011 total of 82 firms grew by over ten times to total 826 businesses.17 The tally for this year will almost certainly be far larger, as very large capital has entered the fray. For example, from July 1 of this year, Toyota Motors entered the power-supply market through a new subsidiary “Toyota Turbines and Systems.” And in June the internet business, Rakuten, set up “Rakuten Energy” in order to provide services in solar deployment as well as energy conservation. Both of these initiatives directly threaten the monopolized utilities’ business models.18

Slings and Arrows, and Radical Efficiency

Moreover, even closer attention to what is actually going on at Japan’s subnational, central agency, corporate, and citizens group levels provides ample evidence of accelerating deployments of radical efficiency and renewables along with a sea change in thinking.

One key item worth noting is that Japan is likely to represent fully 40% of global LED sales in 2012 and 2013.19 Lighting is roughly 20% of global power consumption, and the development and deployment of LEDs not only crunches power demand and material consumption, but also helps bring down prices to make cheap and efficient lighting available in the developing world.

Other notable developments include a new (opening in July of 2013) Honda factory in Saitama Prefecture, whose power consumption and emissions are 40% below conventional factories, and which is selling power generated by rooftop solar through the feed-in tariff.20 Another inspiring initiative in the building sphere is the diffusion of “smart malls,” beginning with the March 15 opening of refurbished Aeon Mall in the city of Kitakyushu. This project is the first phase in a Ministry of Lands, Infrastructure and Transport (MLIT)-led initiative to halve energy demand in the Aeon Group (Japan’s largest retailer) by 2020.21

These smart industrial policy projects are plentiful. Another example is seen in the July 5 Nikkei report that a long-life (20 year) large-scale vanadium redox flow battery will be installed in Hokkaido in order to facilitate the uptake of renewable energy. The battery will be built by Sumitomo Electric, and will be installed and operating on the grid by 2015. The installation cost for the battery will be in the neighborhood of YEN 20 billion. One reason for installing this new battery is that the regional utility’s storage capacity is at present only 60,000 kWh, which is roughly equivalent to the daily consumption of 6000 average homes. But a larger ambition is at work as well: the Ministry of Economy, Trade and Industry (METI) aims to stimulate renewables as well as the electricity storage business by funding this project, in line with a government decision last July to adopt a battery storage industrial policy strategy. Sumitomo Electric is thus at present in the process of testing a 5,000 kWh version of the battery at its factory in Yokohama. From next year, it will begin large-scale production of these batteries at its factory in Osaka. The present outlook is for a business of approximately YEN 100 billion over the next 5 to 6 years. The core of the strategy is to develop next-generation battery storage and raise Japan’s share of the global market from the current level of under 20% to roughly half by 2020.22

Another example of fast and smart action is seen in the July 4 Nikkei report on Sumitomo Heavy Industry’s development of a gear motor with roughly 40% increased efficiency. This motor will be put onto the market from October, and integrates a reduction drive and motor complex that uses materials with lower resistance as well as a refashioned iron core. The motor is to comply with METI’s new efficiency standards that are to be introduced from April 2015. The new rules apply to 0.75 to 375 kilowatt industrial use motors, and require an average of 6% efficiency increases. Sumitomo’s device is in the 0.75 to 11 kilowatt range, and it plans to introduce larger high-efficiency motors from 2014. Sumitomo commands roughly 70% of the domestic market for gear motors as well as reduction drives, but has less than 10% of the global market. It is hoped that this new motor series will help it to gain a larger foothold in the Western and Chinese and other markets that have higher efficiency standards. It also plans to raise the level of sales for its machine components that include these reduction drives by 6% over the previous year to a total of YEN 97 billion.23

As with LEDs and lighting, the significance of more efficient motors cannot be overstated. Electric motors are ubiquitous in industry and everyday life (think elevators, fans, air conditioners, etc) and consume roughly 50% of all electricity produced globally. And about 96% of the total cost of motors, on average, is the power that they consume over their 15 to 20-year life-span. The present era of innovation has been depicted as “the most exciting time in the nearly 200-year history of industrial electric motors,” and now Japan is back in the running.24

The July 4 Nikkei Shimbun also carries an important article on the domestic data centre business. Data centres appear slated to increase by 18.5% over the previous year, according to research done by IDC Japan and released on July 3. The increase in cloud computing has led to a significant interest in investing in data centres. The research firm surveyed a total of 270 businesses in general business as well as finance and the data centre area per se. Among general businesses, about 7.3% were interested in setting up in-house data centres. The reasons for the increased interest in data centres include the spread of cloud computing as well as the concern for resilience in the face of natural disasters and fires and other hazards. Importantly, in tandem with the construction of new data centres, there is also a significant decrease in the number of old data centers. The survey found that fully 18.9% of older data centres were slated for closure. New data centres have much more efficient cooling systems and other mechanisms that bring about significant energy efficiency and conservation, reducing the cost of operations. This cost-cutting is another aim, apparently, for constructing new data centres. In consequence, even though investment in data centres overall will increase, the number of data centres per se will decrease. And this is a large business sector: According to the survey, the total new investment in data centers for 2012 was YEN 215.7 billion, and this is projected to increase to YEN 255.2 billion by 2017.25

Another set of encouraging green-growth examples is found in the June 15 edition of the Nikkei Shimbun. The article outlines plans by all the large private rail firms to deploy very energy-efficient rolling stock. On the morning of June 15, for example, Tobu Rail started service with a special lightweight railcar that consumes 40% less power. And Hankyu Rail will be deploying energy-efficient cars with 100% LED lighting from the fall. The Nikkei article is in fact replete with examples throughout the country, of rail lines deploying rolling stock that have 35 to 40% levels of efficiency gain over conventional stock. The background to this decisive action by the firms is the rising cost of power (such as Kansai Electric’s 17% power price hike) plus their inability to pass on that cost to customers through increases in fares and freight rates. These incentives have led the rail firms to deploy rolling stock with levels of energy efficiency that many specialists thought either impossible or economically unwise.26

This phenomenon is not peculiar to the rail lines. Teikoku Databank recently surveyed firms in Saitama Prefecture, to assess their responses to power price hikes. The results indicate that 53% of the firms believe they can not pass on the cost of power price increases, while 34% believe that they can only pass on some portion of the power price hike. Only one percent believe that they can pass on all of the cost of the power price increases. And 67% believe that the price increases will lead to a worsening of business conditions.

And that part of the survey results is where most experts would stop and say, “well, more proof that nuclear power restarts are absolutely necessary.” However, if one reads on, one finds that when asked what they plan to do in response to the increased price of electrical power, and given a set of choices, the firms chose conservation and efficiency increases. That is, 73% report that they are going to increase energy conservation and 48% report that they are going to replace current equipment and lighting with more efficient gear. The number of firms sampled in mid-to-late April totaled 779,with a response rate of 45% (a total of 351 firms).27

And this result is not peculiar to Saitama. A similar survey by the same firm, Teikoku Databank, was undertaken in Chiba Prefecture, and over the same period (albeit with the total of 492 firms, of which 223 provided usable responses). The results from Chiba indicate that 47% of the firms believe they cannot pass on any part of the increased power price, and only 5% believe that they can fully pass on the power price increase.

And when asked what they plan to do to respond to the power price increase, 74% chose conservation as their first choice, and that was followed by replacing equipment and lighting with more efficient equipment.28

Just from the above, we can tentatively draw a number of conclusions. One is that crunching power demand is something that Japan’s private sector is now accustomed to and has evolved a variety of mechanisms to achieve. These include the obvious, such as “cool business” attire as well as setting air conditioners to 28°, turning off lights and other power-consuming equipment when not being used, and the like. But we are also seeing the dramatic increase in awareness of the efficiency-increase option, and the aggressive deployment of radical efficiency gear by large firms in machinery, retail, railroads, and other sectors. Small to medium-sized firms likely do not have sufficiently robust bottom lines to allow them to undertake this kind of efficiency increase on their own. There are subsidy programmes to help them cover the costs, but often that is not enough to incentivize action. Consciousness change is important, often even more than pecuniary incentives. Moreover, Japan has yet to innovate a proper business model for rapidly diffusing very efficient gear among the very dispersed markets of ordinary households as well as small to medium-sized private businesses. But because big private firms are now moving aggressively in the efficiency space, we are likely to see the government and other actors (such as financial agencies) accelerate work on deploying some of the innovations that we already see underway in the United States, including on-bill financing and other mechanisms. These mechanisms help to aggregate the very dispersed investment opportunity of individual firms’ and households’ energy efficiency retrofit with big capital that of course is in search of decent returns that do not involve a great deal of risk.29

The Arrow of Public Opinion

The opportunity to grow green is being overlooked by Abe, but it is being implemented by core central agencies, the private sector and major local governments. The public is also on side. Opinion polls show that opposition to nuclear restarts as well as a nuclear-led growth strategy continues to be the majority position.30 Moreover, surveys of consumer sentiment and related areas indicate that Japanese consumers or households in general have a very high level of environmental awareness and desire for renewable and efficient deployment. A Dentsu (Japan’s biggest advertising firm) survey of 1000 people between 15 and 64 years of age living in the Kanto area determined that their greatest concern was the environment (at 69%, first among a list of choices) with natural disasters next at 55.1%, followed by aging at 53.9%. Items that were most closely associated with resolution of the environmental problem included LEDs at 96.1% and solar power generation at 93.2%.

Moreover, compared to last year’s survey, items that showed sharp change include “local production and local consumption” (chisan chishou). The awareness of this very important item – which is the core of local resilience – rose from 54.4% in 2009, to 67.3% in 2011 and to 76.8% this year. Other survey items that showed remarkable movement include smart houses, at 46.1% (versus 30.9% in 2011) and smart cities, at 37.2% (versus 12.7% in 2011).31

Conclusion

We have presented several examples of significant structural reform in Abe’s third arrow as well as noting important creative endeavors at the local level and throughout various business sectors. This activism also works in tandem with an increasingly robust industrial policy on green growth. That policy centers on smart cities, renewable energy, efficiency, and other power-related infrastructure. It is driven by Japanese local governments’ desire to create viable economies, to counter the high price of power, to assure resilience, and a variety of other factors. It is also driving striking changes in thinking, which encourage further diffusion as well as defend what has already been done. International investors can ignore the Fukushima shock and its implications, but Japanese local governments and central agencies cannot.

Andrew DeWit is Professor in the School of Policy Studies at Rikkyo University and an Asia-Pacific Journal coordinator. With Iida Tetsunari and Kaneko Masaru, he is coauthor of “Fukushima and the Political Economy of Power Policy in Japan,” in Jeff Kingston (ed.) Natural Disaster and Nuclear Crisis in Japan.

Recommended citation: Andrew DeWit, “Green Shoot: Abenomics and the 3rd Arrow,” The Asia-Pacific Journal, Vol 11, Issue 27, No. 3, July 8, 2013.

Related articles

• John A. Mathews, Mei-Chih Hu, Ching-Yan Wu, Concentrating Solar Power – China’s New Solar Frontier

• Andrew DeWit,Abenomics and Energy Efficiency in Japan

• Andrew DeWit,Distributed Power and Incentives in Post-Fukushima Japan

• John A. Mathews,The Asian Super Grid

• Andrew DeWit,Japan’s Energy Policy at a Crossroads: A Renewable Energy Future?

• Andrew Dewit,Japan’s Remarkable Energy Drive

• Andrew DeWit,Megasolar Japan: The Prospects for Green Alternatives to Nuclear Power

• Peter Lynch and Andrew DeWit,Feed-in Tariffs the Way Forward for Renewable Energy

• Sun-Jin YUN, Myung-Rae Cho and David von Hippel,The Current Status of Green Growth in Korea: Energy and Urban Security

• Son Masayoshi and Andrew DeWit,Creating a Solar Belt in East Japan: The Energy Future

• Andrew DeWit and Sven Saaler,Political and Policy Repercussions of Japan’s Nuclear and Natural Disasters in Germany

• Andrew DeWit and Iida Tetsunari,The “Power Elite” and Environmental-Energy Policy in Japan

Notes

1 One example of the criticism is the Economist’s “Misfire: Shinzo Abe disappoints with a timid attempt at structural reform,” June 15.

2 In the literal sense of the word: “amendment of what is defective, vicious, corrupt, or depraved”. Perhaps in due time the mainstream economic debate will put sustainability at the core of “structural reform.”

3 On this, see: “Renewables to surpass gas by 2016 in the global power mix,” International Energy Agency, June 26, 2013. The IEA not only tell us that “Renewables are now the fastest-growing power generation sector,” but also that developed countries with smart, “long-term” policies (like Japan) are well-positioned to take advantage of a revolution that is increasingly salient (and likely to account for two-thirds of deployment) in the developing countries.

4 Not only have the regulatory changes been scarce, but the extent and degree of criminality and outright incompetence is only now becoming apparent. On this, see the beautifully written overview of UK banks’ truly “rotten” state by John Lancaster “Are We Having Fun Yet?” London Review of Books, Vol. 35 No. 13 July 4, 2013.

5 Pavan Sukhdev, Corporation 2020: Transforming Business For Tomorrow’s World. Island Press, 2013.

6 Note, however that Paul Krugman is beginning to make the connections, although not yet between green and the Abenomics he applauds. See Paul Krugman, “Invest, Divest and Prosper,” New York Times, June 28, 2013.

7 Former PM Kan Naoto in fact got so outraged with PM Abe’s efforts to sell nuclear technology that on June 17 he derided him as “the salesman for the nuclear village”

8 For example, the LDP Special Committee on ICT Strategy submitted a report on May 21 of 2013, titled “Digital Japan 2013: Taking Back Japan via ICT.” The report is a compendium of new strategies for innovating and diffusing ICT throughout all sectors of the economy and society, and argues for a nationwide rollout of the renewable and efficiency-centred reconstruction in Tohoku. The report is available here. A summary in the June 11 edition of ICT Pro is available here.

9 As eminent Japan scholar and Columbia University Professor Gerald Curtis observes, “there’s a battle inside Abe between the pragmatic realist and the ideologue who’s committed to a view of history that’s shared by no one outside Japan, and very few people within Japan.” See Rick Wallace,” Behind Shinzo Abe’s economic program lurks a desire to airbrush history,” The Australian, April 27, 2013.

10 On the unpopularity of PM Abe’s pork-barrel politics in Shimonoseki, see (in Japanese) “PM Abe’s Big Treat to his Region,” Sentaku, March 2013. Among other white elephants from the Abe group, Shimonoseki finds itself saddled with the YEN 750 billion Choshu Dejima manmade island with few visiting vessels, as well as the roughly YEN 750 billion Shimonoseki North Bypass highway that also has few users. The present author, formerly resident in Shimonoseki, hopes their smart-city initiative flourishes and gets them over the enormous mountain of debt and maintenance costs incurred by these and other wasteful projects. On the white elephants and their costs, see (in Japanese) “PM Abe appears to be a nuisance for his local district,” Gendai, March 12, 2013.

11 For example, many investors bought into the utilities’ distressed debt and are keen to see their gamble pay off through nuclear restarts that raise the value of their holdings.

12 On this, see p 69 of the Economic and Fiscal Council’s June 2013 draft (in Japanese) of the “Growth Strategy“

13 On the feed-in tariff, see Andrew DeWit “A Crossroads for Japan: Revive Nuclear or Go Green?” Yale Environment 360, May 29, 2012.

14 On regulatory hurdles in Japan, see “Japan’s feed-in tariff system for clean energy mired in regulations,” Asahi Shimbun, May 22, 2013.

15 On deregulation to promote small hydro and other renewables, see (in Japanese) pp 8-18 of the “Plan for Implementing Deregulation,” Cabinet, Government of Japan, June 14, 2013.

16 On fracking in the US and its potential harm to water resources, see Sandra Postel “Fracking’s Threats to Drinking Water Call For a Precautionary Approach,” National Geographic, June 28, 2013.

17 The survey overview is available at the firm’s website.

18 Reports indicate that Toyota’s foray is aimed at forcing the big utilities to cut their costs as well as to erode their monopoly. On these points, see (in Japanese) “Power Conservation: Toyota’s Initiative To Reduce Power Costs,” Mainichi Shimbun, July 5, 2013.

19 See Sui Han, “LED lighting CAGR to reach 31% in 2010-2020, says Toshiba Lightech,” Digitimes, January 17, 2013.

20 The factory is located in the town of Yorii and will employ roughly 2000, producing 250,000 cars per year in a 950,000 square metre facility. An overview (in Japanese) of the facility is available at Honda’s website.

21 In English, see “Aeon Mall Yahata Higashi to Open Anew on March 15” On the MLIT’s programme, see (in Japanese) “Realizing 50% Power Reduction Eco-Stores via Highly Efficient Air Conditioning and Solar Power,” Smart Japan, April 11, 2013.

22 See (in Japanese) “Hokkaido Electric to Add Sumitomo Electric Built Battery to Grid to Adjust Power Fluctuations, Increase Renewables,” Nikkei Shimbun, July 5, 2013.

23 See (in Japanese) “Sumitomo Heavy Develops a Gear Motor that Cuts Power Loss by 40%, Aiming at Global Energy-Efficiency Standards,” Nikkei Shimbun, July 4, 2013.

24 Alex Chausovsky, “Shaping the Future with Super-Efficient Electric Motors,” Electronics 360, March 5, 2013.

25 See (in Japanese) “18% of Data Centre Businesses Plan New Build,” Nikkei Shimbun, July 4, 2013.

26 The Nikkei article is (in Japanese) “Tobu and Major Private Rail Firms are Deploying Low-Energy Rolling Stock in Response to Power-Price Increases,” Nikkei Shimbun, June 15, 2013. As to outdated expert opinion on what was deemed possible or practical, see Nippon Keidanren’s “Views on the Options for Energy and the Environment” dismissal of robust renewable and energy-efficiency goals in July of 2012. They have a somewhat abridged version in English here.

27 See (in Japanese) “Survey Shows 50% of Saitama Firms Cannot Pass on the Power Price Hike,” Nikkei Shimbun, June 5, 2013.

28 See (in Japanese) “Survey Indicates 60% of Chiba Businesses Report a Worsening of Business Conditions and 47% Cannot Pass on Power Price Hikes,” Nikkei Shimbun, June 4, 2013.

29 Concerning on-bill financing, see Casey J Bell, Steve Nadel and Sara Hayes, “On-Bill Financing for Energy Efficiency Improvements: A review of Current Program Challenges, Opportunities, and Best Practices,” American Council for an Energy-Efficient Economy, Research Report E118, December 8, 2011:

30 On this, see (in Japanese) “59% Opposed to Nuclear For Growth, 58% Opposed to Restarts,” Asahi Shimbun, June 11, 2013.

31 See (in Japanese) “Clean Consumer Survey,” Nikkei Ekorojii, July, 2013. The survey can also be accessed online.