A New ARMZ Race: The Road to Russian Uranium Monopoly Leads Through Mongolia

Peter Lee

The people who brought about Chernobyl are pressing to become the world’s leading source for nuclear power equipment, materials, and services.

|

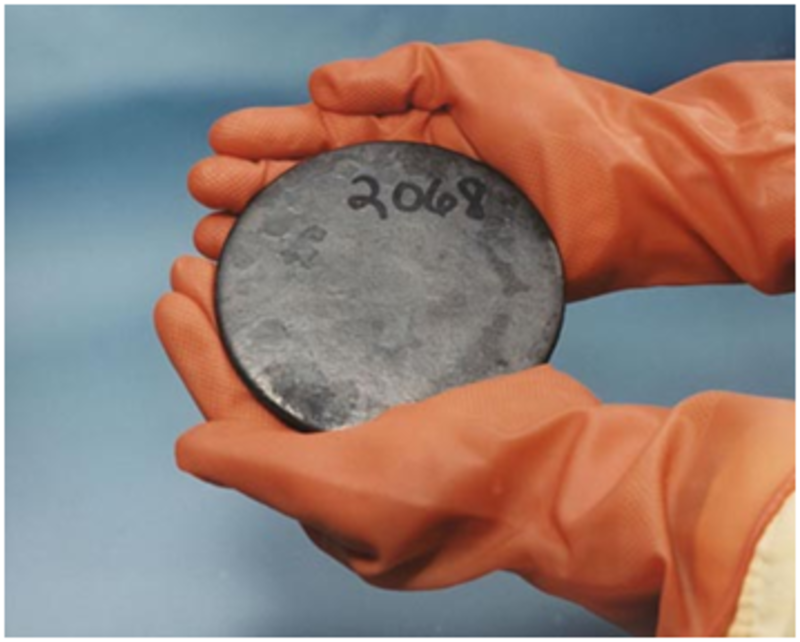

Uranium metal (source) |

Russia’s quasi-state nuclear power authority, Rosatom, has ambitions of becoming the world’s one stop shop for nuclear plants, uranium fuel, and spent fuel services. Currently accounting for 20% of the world’s nuclear power stations and 17% of global nuclear fuel fabrication, Rosatom wants to double in size, and become the dominant player in uranium ore and spent fuel in the process.

The United States—which counts the Russian nuclear weapons reset as one of its few unambiguous geopolitical wins—thus far is apparently happy to turn a blind eye to Russia’s uranium ambitions, even when Russia’s quest for the strategic ore leads it into some strategic hotspots, and when the implications for nuclear accidents grows.

In places like Kazakhstan, Canada, Niger, Australia, the United States, and Mongolia, Rosatom’s (AtomRedMetZoloto) Uranium Holding Co. or ARMZ is seeking to dominate worldwide uranium production.

Over the last two decades, Russia has aggressively leveraged the nuclear legacy of the Cold War competition between the United States and the Soviet Union. In the nuclear arms race with the United States, the USSR always opted for quantity and size rather than quality. As the US poured R&D into smaller, more efficient warheads, the Soviets made sure they had a lot of bombs.

When the USSR collapsed, Russia inherited over a thousand tons of weapons-grade fissile material and a sizable nuclear refining and fabricating infrastructure. As Russia lurched through its post-Soviet adjustment, its control over most of the USSR’s nuclear assets became one of the few effective bargaining chips in its dealings with the United States, and not only for negotiation of the START treaty.

Russia’s holdings of weapons-grade highly-enriched uranium (HEU) became a key currency in US-Russian diplomacy. Under the “Megatons for Megawatts” program, it was agreed that 500 tons of Russian HEU would be downblended and shipped to the United States for use in commercial nuclear reactors. Today, approximately half of the fuel in U.S. nuclear power plants comes from ex-Soviet warheads (link).

Russia also uses its various uranium stockpiles to help meet its commercial export obligations—which reportedly exceed its domestic production capabilities by 6000 tons per year. Since the end of the Cold War, releases of material from Russian and US stocks have accounted for almost 60% of uranium demand, exerting significant downward pressure on uranium prices and mining activities.

Russia treats its nuclear industry as a national resource and it is aware that the uranium cupboard—at least as it pertains to HEU and other legacy stocks—will be bare in ten to fifteen years. As a matter of prudence, economics, and national security, it is making plans for the future (link).

The future includes an expected spike in uranium ore prices from $55 to $70-$80 a pound as the price of commercially-mined ore is no longer depressed by a steady stream of government-owned HEU downblends into the marketplace.

It also includes a spike in demand, even though much of Europe and Japan have bailed out on nuclear power (even in nuke-friendly France, denuclearization has muscled its way onto the political agenda). This spike assumes that South Korea, India, and China among others decide that a $64 billion nightmare like the Fukushima cleanup will never happen to them, and they continue with their programs to build nuclear power plants…with the encouragement of the senior nuclear states.

|

Fukushima Daiichi Unit 3, March 2011 (source) |

Energy-poor South Korea, despite post-Fukushima jitters, still maintains its commitment to increase nuclear’s share of its power generation portfolio to 60% and to export nuclear reactors.

After suspending approvals of new plants, China has apparently decided that its nuclear power plant program will proceed, albeit with some safety-related modifications. According to the Wall Street Journal, some older reactors lacking passive safety features will be phased out more quickly than originally planned, and focus will be placed on the construction of more modern reactors based on a Westinghouse design licensed in 2007 (link).

India would like to triple the nuclear share of its power generation industry, and the central government seems firm in its post-Fukushima resolve despite heightened popular opposition to its nuclear program. India, in addition to serving as the poster child for selective enforcement of the Non-Proliferation Treaty by virtue of its perceived utility as an anti-China bulwark, is also the symbol of reckless nuclear diplomacy/commercial huckstering by the Western powers, as typified by Australia’s recent decision to cope with the post-Fukushima slowdown in its uranium business by overturning a ban on selling uranium ore to one NPT non-signatory, i.e. India.

Much of the developed world may have rejected nuclear power for its own use. However, in a recent Newsweek article, non-proliferation wonk Henry Sokolski pointed out that nuclear diplomacy—specifically making nuclear technology available to potential allies in the developing world, safety and environmental anxieties be damned—is an overriding preoccupation both of Russia (Iran, Bangladesh, Vietnam, Turkey, India) and the United States and its nuclear friends (Jordan, Vietnam, India, Saudi Arabia). This even remains true post-Fukushima (link).

If the nuclear power industry continues to grow as anticipated, there will be a shortfall of supply as existing uranium reserves worldwide experience accelerated depletion after the legacy feedstock kitty is gone (link).

And the future will also probably see Russia and ARMZ at the heart of the global nuclear fuel industry. Indeed, Russia is exceptionally well positioned to become the prime player in the 21st century commercial nuclear industry, in large part because of its dominant role in refining uranium ore into usable fuel. Russia has the world’s largest uranium refining capacity, inherited from the USSR’s oversized weapons program. Its estimated refining capacity is four to five times that of the United States, and almost half of the world’s total. It is an advantage that Russia is likely to keep, thanks in part to American anxieties over proliferation and its policy of discouraging any new entrant—not just Iran—from developing refining capability.

One of the more utopian schemes to reassure nervous operators of nuclear power plants that they can have continued access to nuclear fuel even if they can’t refine it in country is the proposed “Nuclear Fuel Bank”. It is not surprising that Russia promptly agreed to host the fuel bank because, in the words of the International Atomic Energy Association (IAEA), “Russia has already produced the low-enriched uranium” needed to stock it (link).

One thing Russia doesn’t have, however, is plenty of domestic uranium ore. Access to imported low-cost uranium ore is key to keeping the Russian refineries humming—and profitable. Therefore, ARMZ—which accounted for only 7% of the world’s uranium production when its sourcing was limited to Russia—has gone abroad to tie up sources of supply in the grand tradition of transnational energy companies.

|

Open pit uranium mine, Kakadu National Park, Australia (source) |

Journalist and Kazakhstan hand Hal Foster described ARMZ’s strategy and ambition in 2010 (link):

[AMRZ hopes to] produce between 25 and 30 percent of the world’s supply [of uranium ore] by 2030.

ARMZ is already in the process of becoming a powerhouse, accounting for 40 percent of the world’s enriched uranium.

Chief Executive Sergei Kiriyenko has made no secret of ARMZ’s desire to become one of the driving forces on the international uranium market. …

That’s because it gives ARMZ a much larger share of world reserves at a time when the price of uranium is expected to soar due to the increasing demand for reactors. “We’re looking at a shortage-driven market, with an inflexible supply.”

Depending on how one keeps score, ARMZ is already perhaps the third or fourth largest producer of uranium ore, thanks to a recent overseas acquisition binge. But that doesn’t take into account ARMZ’s aggressive efforts to lock up supply from outside sources and the extra clout the Russian government brings to the table on its behalf.

ARMZ’s business approach can be seen in its most important move into the near-beyond of Kazakhstan, which has quickly become the world’s leading supplier of uranium ore, with one-third of the global market. Although Kazakhstan controls only an estimated 12% of world reserves, it is most aggressive in exploiting them. In 2009, it increased output by 69% over the previous year, and has promised to double production by 2015.

The primary production technique involves drenching the underground ore body with sulfuric acid to leach out the uranium. Environmentalists may not be reassured by Kazatomprom’s declaration that “the natural hydrochemical environment of uranium deposits of South Kazakhstan has a unique capability for self-restoration” (link).

|

Uranium mine, Kazakhstan (source) |

This has not, however, slowed Russian advances into Kazakhstan. Russia has displayed an integrated commercial and governmental strategy toward Kazakhstan and its uranium industry. On the commercial side, beyond its direct investments in Kazakhstan, ARMZ purchased a controlling interest in Canada’s Uranium One, thereby gaining control of the company’s sizable interests inside Kazakhstan. ARMZ thereby became the owner of almost half of America’s uranium output (US capacity constitutes just 3% of global output). Link.

On the governmental side, the two nations have signed agreements for construction of nuclear reactors and uranium refining capacity.

And there is this, as reported by Martin Sieff (link):

Russia’s Rosatom nuclear agency and Kazatomprom, the national nuclear development corporation of Kazakhstan have reached agreement about setting up a joint venture to market uranium around the world.

Kazakhstan has … joined Russia in a new customs union that became operative on July 1. Coordinating uranium exports and uranium production policy is the first concrete achievement of cooperation between the two nations under the CU umbrella.

The government-to-government angle may have also involved some combination of traditional Soviet heavy-handedness and new-style nomenklatura skullduggery against Mukhtar Dzakishev, the young technocrat credited with leading Kazatomprom’s charge to the top of the uranium league table.

In March 2010, Dzakishev was sentenced to 14 years for various crimes, including alleged collusion with a self-exiled opponent of Kazakhstan’s president to illegally and profitably transfer control over uranium reserves or production rights to overseas companies. There are widespread allegations that Dzakishev’s conviction is a political hatchet job—or an effort to remove a potential stumbling block from Russia’s uranium cooperation with Kazakhstan, as Joanne Lillis reported at Eurasianet (link):

…suspicions have been aired that Dzhakishev’s case was linked to a redistribution of lucrative uranium assets. Misgivings were compounded after interrogations of Dzhakishev, in which he suggested that Russian nuclear interests had benefited from his arrest, were leaked in a video that was posted on the YouTube video sharing site.

With this background, we can turn to the Russian campaign in Mongolia, another sector of Russia’s near-beyond with significant uranium reserves. Thanks to the travails of a small Canadian company, Khan Resources—and its court filings–we have a privileged view of how Russian nuclear sausage is made.

Mongolia has a major uranium play at Dornod, a reserve discovered during the socialist era and exploited for a time by the USSR. It has reserves of at least 25,000 tons, and can support an extraction rate of 2000 tons per year—an estimated cash flow of $300,000,000 per year, much of it probably profit.

|

Abandoned township for Soviet specialists, Dornod (source) |

After the Communist regime was replaced by a multi-party democracy in 1989, the Dornod deposit was opened up to investment by international commercial mining interests. Through a series of transactions, by 2009 the rights to exploit the deposit were held by Khan Resources of Canada (58%), a Russian company (21%), and the Mongolian government (21%).

|

Canadian/Mongolian/Russian cooperation in happier days at Dornod (source) |

According to court documents, Khan claimed that it had expended $20 million dollars on surveys and construction at the mine site by this time. However, in 2009 the Russian government and ARMZ turned their interest toward Mongolian uranium and proceeded in government/business tag team fashion similar to what they had employed in Kazakhstan.

Russia feels a strong sense of entitlement over Dornod. A 2010 Pravda news report on Dornod was titled Russia to retrieve control over uranium. The Soviets and Russians operated the mine from 1988 to 1995, had 10,000 Russian workers on site, and claimed to have invested US$600 million overall on Mongolian uranium exploration and development. Ore from Dornod was moved by rail 400 km to ARMZ’s Priargunsky operation in the Trans-Baikal region of Russia, which still mines domestic uranium and processes it into yellowcake.

Russia’s nuclear establishment covets Dornod as a component of a “single infrastructure” of uranium extraction and refining that signals Priargunsky’s return to economies of scale (Dornod material would double the current output of the Priargunsky refinery). Link.

On the government to government level, in January 2009, the Russian and Mongolian governments announced a joint venture in the field of uranium extraction. According to Khan Resources’ court filings, this signaled the beginning of a campaign to squeeze it out of the Dornod project. Toward the end of the year, ARMZ made a hostile takeover bid against Khan in Canada; the Khan board rejected it.

Then, in January 2010, the Mongolian parliament or Great Khural passed a law giving the Mongolian government an uncompensated 51% share in any project—like Dornod—in which it had previously invested money. Khan acquiesced, but its efforts to determine its new diminished share in the project were frustrated by a boycott of proceedings by its Russian partner.

The situation was further complicated when Khan entered into ultimately fruitless negotiations to be acquired by a Chinese company, Overseas Uranium Corporation of the China National Nuclear Corp. According to Pravda, bringing the Chinese into the picture did not endear Khan Resources to Sinophobic Mongolians (link).

Yet, Ulan Bator with whom the Canadians have not coordinated their actions did not want the Chinese. On these grounds, TSAUK [CAUC, the acronym of Khan’s operating combine in Mongolia] had its license revoked, and the Mongols will be developing the uranium deposit with Russian companies.

ARMZ then publicly announced that Khan’s mining licenses for Dornod had been invalidated. Khan’s Mongolia interests have currently descended into legal limbo, where the Russian and Mongolian governments expect them to remain until Khan runs out of cash and must abandon the hunt.

There is no question that the driving force for restructuring the Dornod project to exclude Khan comes from the Russian side. The focus of Vladimir Putin’s July 2009 visit to Mongolia was reportedly Mongolian uranium. President Medvedev came to Ulaanbaatar a month later, with ARMZ’s president in tow, also to discuss uranium. To sweeten the deal, Russia wrote off over 98% of Mongolia’s debt and promised to “give Mongolia 375 million rubles for the vaccination of livestock to increase the import of meat and milk to the Russian market” (link).

|

President Medvedev of Russia and President Elbegdorj of Mongolia, 2009 (source) |

It is also rumored that Russia’s precondition for participating in the Tavan Tolgoi coal mining project (and building an expensive and economically suspect railroad line from the mine to Russia) is a cooperative Mongolian attitude on Dornod.

President Elbegdorj’s relations with the Russian leadership are rumored to be icy, and it was further rumored that the mysterious summer 2011 interruption of Russian diesel fuel deliveries that threatened Mongolia’s harvest (and its full enjoyment of the Nadam Festival) was a message to President Elbegdorj to toe the line on the uranium issue that preoccupies Russia.

While Mongolia deepened its uranium ties with Russia, Mongolia’s nuclear negotiations with the United States came undone. In September 2011, President Elbegdorj pulled the plug on secret negotiations with the United States and Japan to establish Mongolia as a nuclear waste storage facility, and fired the negotiating team—including the Ambassador-at-Large, A. Undraa, who had gone to the US earlier in the year to discuss the US proposal—after a bizarre cavalcade of denials and misinformation (link).

In May 2011, the Mongolian embassy in Vienna had posted a vociferous denial of the rumor, which read in part (link):

Mongolia’s mass media clarified the issue with relevant officials in accordance with information distributed by the world’s bigger news agencies such as Reuters, CNN and Japan’s Mainichi newspaper and distributed the position of Mongolia’s officials. Authorities of the Foreign Affairs Ministry, Nuclear Energy Agency (NEA) and Mon-Atom state-run company all denied this information and affirmed that Mongolia’s government has not held any talks on burying nuclear spent fuel with any one nor is there legal basis for any such activity.

The US government, despite the fact that it had originally floated the proposal, obligingly papered over the situation with a supporting statement that Jeffrey Lewis of Arms Control Wonk characterized regretfully in May 2011 as “a lie” (link):

I really hate to use the word “lie” to describe the DOE statement. However, Dick Stratford [Director of the Office of Nuclear Energy, Safety, and Security in the Bureau of International Security and Nonproliferation at the U.S. Department of State] confirmed at the Carnegie International Nuclear Policy Conference that US and Mongolian officials had held “discussions about whether or not Mongolia would harbor – or take a spent-fuel storage depot for third-country fuel.” Conveniently, I asked Stratford directly and on-the-record about US-origin spent nuclear fuel. He said “Yes, I would support allowing [South Korea and Taiwan] to transfer U.S.-obligated spent fuel.”

There is, of course, understandable resistance within Mongolia to using its pristine steppes and/or deserts as a dump for nuclear waste. But the Mongolian denial also included this interesting passage:

Mongolians are not stupid to store other countries nuclear waste if they do not buy nuclear fuel from Mongolia. [emphasis added]

In reporting the collapse of the deal, Mainichi stated:

The Mongolian government was considering processing uranium into nuclear fuel and exporting it in an attempt to make good use of the uranium resources. For this purpose, Mongolia was exploring the idea of introducing “nuclear fuel lease contracts” in which Mongolia would receive spent nuclear fuel from countries that buy uranium nuclear fuel from Mongolia.

If Mongolia—with US support—was able to establish itself as an accredited nuclear waste depository, and leverage that capability to become a preferred supplier of nuclear fuel for users with spent fuel disposal problems, Mongolia would have become an important—and independent—player in the uranium fuel business.

If this was actually the plan, Mongolia’s President Elbegdorj backpedaled with breathtaking speed. In a September 15, 2010 interview, he stated (link):

[T]he nuclear waste of other countries is a ‘snake grown up in another body’, he said. “Receiving back the nuclear waste after exploiting and exporting uranium must not be, as I think, this is a pressure from foreign superpowers, and we must throw out this delusion.”

For whatever reason—thanks to a law banning the importation, transit, and storage of nuclear waste—Mongolia is now down to one partner for its uranium program, Russia, and one apparent role, provider of feedstock to ARMZ’s Priargunsky plant inside Russia.

The contretemps over the Mongolian storage facility, and the barely disguised eagerness of the United States and Japan to pursue it, highlights the Achilles’ heel of the developed world’s push to sell nuclear power to potential allies, proxies, and clients in the developing world. Despite perennial optimistic mutterings about “closing the nuclear fuel cycle” i.e. recycling nuclear leftovers into useful byproducts instead of nasty waste, the spent fuel problem is still wide open.

France and Britain have spearheaded attempts to turn spent fuel recycling into a viable business at their commercial scale facilities at THORN, Sellafield, and Le Hague. Spent rods are dissolved in nitric acid; the nuclear material is shipped back to the grateful customer together with the unrecoverable direct waste, which is presumably less popular.

|

“Swimming pool” at La Hague reprocessing facility, with Cerenkov radiation (source) |

However, the facilities produce a significant amount of new nuclear waste in the form of radioactive process water and other materials, and the expense, dangers, and headaches of reprocessing the fuel—into MOX, a nuclear fuel nobody particularly wants—have stalled the nuclear recovery business.

Japan’s attempts to set up its own spent fuel processing facility at Rokkasho have been an expensive and embarrassing failure (link).

Currently, Japan has its spent fuel processed in France and England, but it still has to take residual waste back. Japanese media reported the first post-Fukushima return of Japanese nuclear waste from Europe in September 2011: 76 stainless steel canisters on a special vessel, the Pacific Grebe. The report noted that eight more shipments of waste will be returned to Japan before 2020 and will have to find a home somewhere (link).

That home apparently will not be the United States. The United States simply gave up on processing spent fuel, deciding that when the Yucca Mountain repository in Nevada was built, it would store the unprocessed spent rods and whatever other nuclear nasties are shipped there. Then, the Obama administration gave up on Yucca Mountain completely, cancelling the project apparently without a Plan B.

|

Yucca Mountain test tunnel (source) |

Presumably, any new nuclear customer will adopt the same ugly ad hoc methods that the US employs: cooling the rods for five years in on-site tanks, then shipping them “somewhere” if and when “somewhere” exists at that time.

If Vladimir Putin has anything to say about it, “somewhere” will be Russia. Russia has openly thirsted for the spent fuel market. A decade ago, Russia was offering to close the fuel cycle, at least commercially, by promising to handle spent rods from the nuclear stations it supplied. The Duma passed a bill permitting imports of spent fuel in 2002. Minatom (the Russian state-run nuclear corporation) optimistically predicted that spent fuel imports could add up to 20,000 tons and $20 billion in profits over the next 20 years.

|

Nuclear fuel reprocessing, Mayak (source) |

An interesting item of fallout, as it were, from the Fukushima disaster was the revelation that Russia had offered to receive Fukushima’s spent fuel—now dangerously overheating in the cooling ponds of the stricken facility—back in 2002.

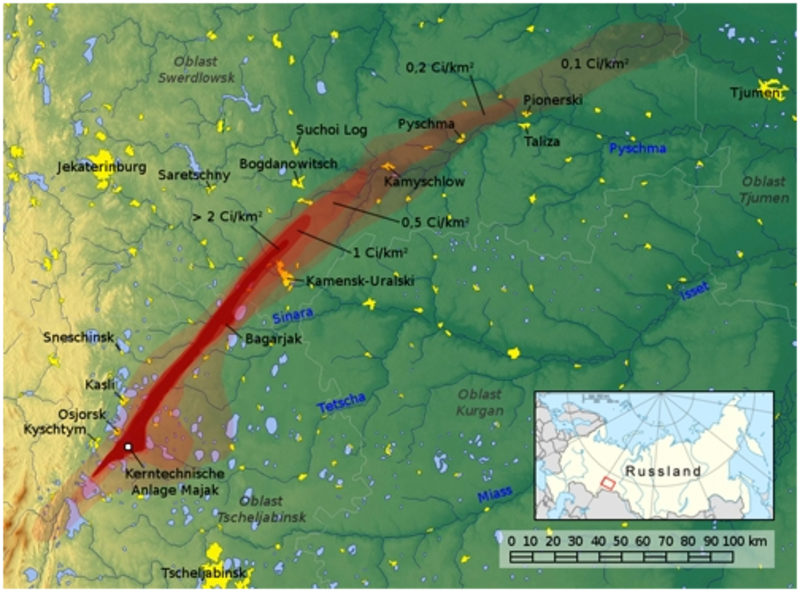

This was despite the fact that Russia’s attempts to set up a modern facility at Krasnoyarsk had failed for budgetary and technical reasons, and the primary location inside Russia for processing spent fuel from nuclear reactors is the terrifying Mayak Production Association facility, near the town of Kyshtym in the Ural Mountains. In 1957, Mayak experienced one of the worst catastrophes in the history of the nuclear industry, a chemical explosion that blew apart a storage tank and sent a plume of radioactive material that contaminated over 800 square kilometers of adjacent real estate now immortalized as the East Ural Radioactive Trace.

|

The East Ural Radioactive Trace (source) |

Bulgaria, the Czech Republic, Hungary, and Slovakia all stopped shipping their spent fuel to Mayak, depriving it of a significant source of revenue. Finland stopped shipping spent fuel, partially in response to an unfavorable report by the Bellona Foundation, a nuclear and environmental watchdog based in Norway (link).

Mayak earned another black eye in November 2011, when the Swiss nuclear energy authority Axpo suspended plans to send its spent fuel to Mayak until greater “transparency”, i.e. responsiveness to reports of environmental problems around the facility, was achieved (link).

|

Techa River near Mayak, with radiation warning (source) |

However, the Russian government did not lose its enthusiasm for exacerbating its colossal nuclear waste problems (including the headache of decommissioning the reactors in its fleet of nuclear submarines) by importing more spent fuel that it had no facilities for handling.

If the ex-Soviet bloc and squeamish European operators are eliminated, Russia’s hopes for its spent fuel business reside entirely with the United States. Because of proliferation concerns, the United States has the final say on piles of spent fuel rods for reactors it supplied to Taiwan, South Korea, and Japan. Remarkably, 80% of the world’s spent fuel rods are effectively in the custody of the United States.

The US, while eager to let friends and allies into the nuclear power club, is somewhat loath to let them get into the spent fuel reprocessing game. The fear is that reprocessing may lead to a proliferation of weapons-grade plutonium, thereby turning friends and allies into peers and regional powers.

South Korea is pushing for the right to reprocessing its large collection of spent fuel rods. The United States, mindful that the ROK is seriously thinking about the nuclear weapons option as denuclearization talks with North Korea stagger on in an inconclusive fashion, is not enthusiastic:

Per AFP, December 6, 2011 (link):

South Korea is reportedly pushing for US permission to recycle spent nuclear fuel for power generation as the two countries resumed talks to revise a 1974 pact on the use of atomic energy.

…

But the US side is reportedly opposed to the spread of reprocessing even to South Korea for fear that such a move might undermine global nonproliferation efforts and provoke North Korea and Japan.

The bilateral pact, signed in 1974 and due to expire in 2014, bans South Korea from reprocessing spent fuel for fear of proliferation because it could yield plutonium, a key ingredient in building atomic bombs.

America’s inability to solve the spent fuel problem at Yucca Mountain or elsewhere is, therefore, a matter of significant heartache to current and future customers of nuclear plants as well.

Russia could not involve itself in US-related nuclear matters and materials either as a processor or mere recipient of spent fuel rods… until January of 2011, when the so-called “123” agreement—named after the relevant clause of the US Atomic Energy Act and permitting cooperation between Russian and the United States on peaceful uses of nuclear energy—entered into effect after a decade of study, discussion, and, at the hands of the United States, delay.

With Yucca Mountain off the table, the United States appears ready to hold its nose, look the other way, wash its hands of, ignore—take your pick of the most suitable metaphor—Russia’s dismal environmental and reprocessing record and let it handle the spent fuel problem that America simply cannot solve for itself or its allies.

Not surprisingly, the suspicion exists that, instead of carefully processing the spent fuel in shiny, modern, carefully managed, and expensive facilities, Rosatom will simply dump cans of waste in a hole somewhere.

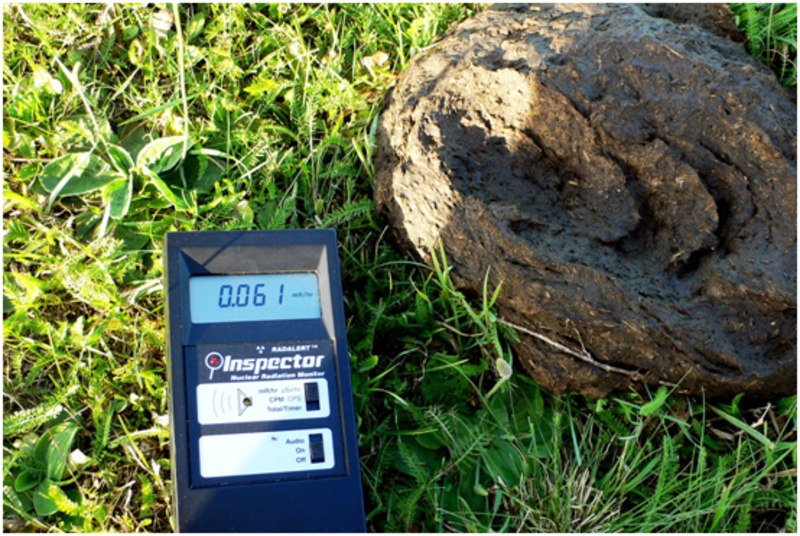

|

Radioactive cow manure, meadow of Techa River, near Mayak (source) |

In the last stages of the debate before the pact was ratified, a Russian anti-nuclear group dourly, but no doubt accurately, predicted in a news brief that “US Pact Could Turn Russia into World’s Nuclear Waste Dump” (link). It went on to say:

“If this agreement comes into effect, it will lift the last hurdle to the transfer of spent nuclear fuel from countries such as Japan, Taiwan, or South Korea to Russia,” says Aleksei Yablokov, one of Russia’s top experts on nuclear safety who once served as an adviser on environmental issues to late President Boris Yeltsin. “Formally, this fuel would be reprocessed, but in practice it would simply be buried.”

With this perspective, it is easy to see why secret tripartite discussions between the United States, Japan, and Mongolia concerning a spent fuel repository would have caused a Level 7 nuclear meltdown of rage in Vladimir Putin’s bosom.

The secret effort would have represented a betrayal of what the Russians, at least, regard as a key element of the re-set with the United States: a profitable future as the final destination for US-controlled spent nuclear fuel.

It can also be speculated without too much difficulty that the payday of $20 billion dollars over 20 years was of no slight importance to Vladimir Putin’s nomenklatura comrades who still pull the strings in Russia’s state-controlled national security industries and whose financial contentment is crucial to Putin’s political well-being.

It is not too surprising, then, that once news of the US talks with Mongolia leaked (the Mongolian mining establishment is reportedly rife with pro-Russian elements), the Russians made the strongest possible representations both to the Mongolian and US governments, and the plug was rapidly and shame-facedly pulled on the enterprise. In any case, after the smoke clears, Russia can be expected to be firmly entrenched in Mongolia in the uranium trade, and in the spent fuel business worldwide.

The US government’s lack of interest in the Russian push to dominate the uranium trade “by any means necessary” is interesting. The United States apparently believes that Russia already possesses so much weapons-grade material that allowing it to become the world’s repository for uranium, nuclear fuel, and spent fuel reprocessing will not significantly increase the risk of theft and proliferation.

Also, since peaceful nuclear energy has emerged as a Russian economic linchpin (and a bulwark of Vladimir Putin’s power)—and the Russian government has stepped up to solve an intractable spent fuel problem that the United States cannot resolve—the US seems willing to cede leadership in key sectors of this industry to Russia. However, the dismal track record and lack of transparency and accountability Russia has previously displayed in the management of the planet’s most dangerous materials, opens the US decision to serious question.

Given the West’s eagerness to use the supply of nuclear technology and equipment as a diplomatic wedge to win favor in developing countries, the decision to let Russia handle the spent fuel back end looks a lot like moral abdication.

Peter Lee writes on East and South Asian affairs and their intersection with US global policy. He is the moving force behind the Asian affairs website China Matters which provides continuing critical updates on China and Asia-Pacific policies. His work frequently appears at Asia Times.

Recommended citation: Peter Lee, ‘A New ARMZ Race: The Road to Russian Uranium Monopoly Leads Through Mongolia,’ The Asia-Pacific Journal Vol 9, Issue 50 No 2, December 12, 2011.

Articles on related subjects

• Miles Pomper, Ferenc Dalnoki-Veress, Stephanie Lieggi, and Lawrence Scheinman, Nuclear Power and Spent Fuel in East Asia: Balancing Energy, Politics and Nonproliferation

• Richard Tanter, Arabella Imhoff and David Von Hippel, Nuclear Power, Risk Management and Democratic Accountability in Indonesia: Volcanic, regulatory and financial risk in the Muria peninsula nuclear power proposal

• MK Bhadrakumar, Sino-Russian Alliance Comes of Age: Geopolitics and Energy Politics

• Geoffrey Gunn, Southeast Asia’s Looming Nuclear Power Industry

• MK Bhadrakumar, Russia, Iran and Eurasian Energy Politics