Fallout From the Fukushima Shock: Japan’s Emerging Energy Policy

Andrew DeWit

Japan’s tragic March 11 earthquake, tsunami and its continuing nuclear crisis struck in the midst of the world’s unfolding financial, economic, environmental and energy crises. The Fukushima Shock is drastically reshaping Japan’s energy policy and politics. This opportunity for change is being seized by a rapidly expanding coalition of large Japanese and foreign firms, small and medium businesses, subnational governments, farmers, NPOs, and others. Their interests are united and focused by the feed-in tariff policy championed by former PM Kan Naoto. They are further channeled and reinforced by the YEN 23 trillion commitment for the 10-year rebuild of Tohoku, a project committed to renewables and smart-city infrastructure. Meanwhile, Japan’s central government is adrift, its fiscal and regulatory tools blunted by a continuing rearguard action to undermine renewables and keep nuclear as the main pillar of Japan’s power economy. The clash between contending energy regimes is being played out at the international level as well, and remains very fluid and difficult to predict. What is certain is that it involves strikingly different political coalitions and implies equally contrasting infrastructure choices, institutions and ideas. In Japan, the challenge is whether to protect a monopolized, centralized, expensive, and probably cul de sac power economy or opt to innovate a potentially world-beating decentralized smart-power economy. The evidence suggests Japan risks forfeiting an historic opportunity if renewable power generation does not become the main pillar of an emerging, smart power economy.

Costing Fukushima

Eight months on, we have a fairly accurate accounting of how catastrophic were the events of March 11. The earthquake and tsunami killed over 20,000 people and did at least ¥20 trillion (USD 220 billion) worth of damage to Japan’s Northeast region of Tohoku. This is the costliest natural catastrophe in human history, and will be matched by history’s most expensive rebuild.

The toll from the man-made disaster is not yet clear, as assessing damage from the reactor meltdowns at Fukushima Daiichi continues.1 What is clear is that the crisis is also driving an accelerating revision of Japan’s all-important “basic energy policy.”2 The current basic energy policy, adopted in June of 2010, commits Japan to producing 53% of its electricity via nuclear power by 2030. This figure is a dramatic leap from nuclear’s roughly 30% share of power-generation capacity just prior to Fukushima. The plan is predicated on the construction of 14 new reactors by 2030. The long-range aim is to produce 60% of Japan’s primary energy – meaning not just electrical power, but all energy supply – by the end of the century. This profound, unparalleled devotion to nuclear power is underpinned by the “nuclear village,” a network of public and private-sector actors who fervently agree on prioritizing nuclear for pecuniary, idealistic and other reasons.3

Prior to March 11, the emphasis on nuclear power was largely accepted in the Japanese public debate as the only reasonable option. Against the backdrop of climate change, geopolitical risks, and other undeniable realities, nuclear power was deemed the rightful pillar of the “energy best mix.” Nuclear was billed as 1) the cheapest source of power, 2) among the best for achieving a low-carbon society and thus protecting the environment, 3) and ideal for building energy self-sufficiency, through recycling of nuclear waste in a plutonium economy. Nuclear was also seen as the main engine of a public-private “All Japan” export drive into expanding global markets for energy and environmental infrastructure.

But Fukushima has transformed the Japanese public’s resigned acceptance of nuclear power into strong opposition. The most recent public opinion poll, released by the national broadcaster NHK on November 4, indicates that about 70% of respondents want reduced reliance on, or even a complete withdrawal from, nuclear power. And 86% are worried by the prospect of restarting any of the 43 out of 55 reactors currently offline due to maintenance schedules or technical problems. This poll result confirms a trend from the spring, when the scale of the Fukushima Shock became clear even as the central government’s political and bureaucratic elite’s coddling of the nuclear village continued.

This opposition was embraced by former PM Kan Naoto, but his successor Noda Yoshihiko’s rather pliant stance towards the nuclear village has led to speculation of its revanche.4 Noda and his closest advisors determined that Kan went overboard in seeking to get out of nuclear power and instead shift to renewables and into the fertile ground of renewables’ expanding political coalition. Noda wants to backtrack into the welcoming arms of Keidanren, TEPCO (Tokyo Electric Power Co.) and the other old-establishment corporate interests that were alienated by Kan’s approach.5

|

Keidanren wants to preserve as much of the status quo as it can, just as it did for example in the early 1990s when it blocked reform of the unsustainable and non-performing loan laden financial sector.6 Keidanren then sought to preserve the prerogatives of the collusive financial sector in the face of the PM’s attempt to compel their businesses to accept capital injections and inspections. That stance helped usher in a decade or more of “roads to nowhere” Keynesianism and other policy failures. In the current case, Keidanren seems genuinely concerned that the nuclear village’s assets could become stranded, thereby leading to higher fuel costs and threating the financial sector that holds all that debt from Tepco (fully 8% of Japanese corporate debt market) and the other monopolized utilities.7 Thus PM Noda is inclined – at least in rhetoric – to restart idled reactors, resume “All-Japan” (public-private) overseas nuclear sales efforts, and perhaps even seek to maintain the regional power monopolies that are core to the nuclear village.8

In spite of the confusion in the central government, the village and its nuclear assets will not recover the extraordinarily dominant position they held before the earthquake. They are fighting a rearguard action. All of the nuclear village’s arguments about cost, safety and environmental protection have been deeply undermined by the Fukushima meltdowns, corporate duplicity, the intransigence of nuclear waste disposal, the broader issues of fiscal subsidization and structural corruption that have received in-depth coverage and debate since 3/11.9 Like the MOF-centred financial sector before it, or the telecommunications regime of the 1990s, the travails of TEPCO appear to be the unwinding of yet another of Japan’s collusive networks of public-private inflexibility and costly policy failure. Like any other set of institutions, these large organized sectors that deliver quasi-public goods need to be kept responsive to changing opportunities. But many wind up good only at scotching reform, outlive their usefulness, and then impose massive direct or dead-weight costs. So a major question is how long this “square the circle” policymaking of Keidanren and the DPJ will continue in the face of mounting costs and lost opportunity.

One indication of how confused the central bureaucracy is can be gleaned from METI’s October 28 release of its “Energy White Paper 2010.” The white paper marks an explicit and official retreat from the policy of centring the energy economy on nuclear. By contrast, last year’s “Energy White Paper 2009” was confident of moving forward on nuclear recycling, new plants, the expansion of human resources for a burgeoning industry, and so on. But the 2010 report admits that continuing with this aggressive policy, one which has been especially pronounced since 2004, will be extremely difficult. The report offers no explicit figures for future levels of nuclear or other power supply, and only observes that these will be decided by a thorough consideration of costs, energy security and other pertinent matters. Nor does the report deal with what many knowledgeable observers (including the International Energy Agency) regard as the necessity of deregulating the power economy so as to spread the gains of power generation and foster innovation. The white paper is, after all, prepared by METI, and in the midst of huge cross-cutting pressures. But the writing is on the wall.10

Local Government and Business as an Axis of Opposition

In sharp contrast with the muddle at the centre, the momentum for moving out of nuclear and into renewables is striking at the local level. Right after March 11, the nuclear village became the focus of an increasingly powerful challenge from advocates of renewable energy. The most prominent actor in this expanding campaign is Softbank CEO Son Masayoshi and his fast success in organizing local governments. His “Natural Energy Council” for prefectures now has enrolled 35 of 47 prefectures, and a similar council for “designated cities” (generally, those with a population over 500,000) includes 17 of 19. Son was also instrumental in keeping the feed-in tariff, or FIT, on the policy agenda during the fraught months following March.11

Let me turn briefly to the FIT or Feed-in Tariff, as it is crucial to understanding Japan’s post-Fukushima political economy of energy.12 The FIT is a low-cost, high impact policy for diffusing renewable power generation. It’s been adopted in over 80 countries and states, supports roughly 75% of global solar and 45% of global wind, and (by the World Bank, the International Energy Association, and other international bodies) has been deemed the most effective policy tool for diffusing renewable energy and ramping down its costs. The FIT does two very important things. First, it guarantees a long-term (15 to 25 years) market for power produced by renewables. And second, it pays producers a premium price to reflect the currently higher cost of generating that power relative to conventional power such as coal-fired generation. That guaranteed price of course represents a cost to the utility, which is compelled by law to purchase the power from a legitimate renewable power producer. But the FIT allows the utility to pass that cost onto the customer, meaning households and businesses that consume electrical power. This allows the cost of shifting to renewable energy sources to be spread out thinly over households and industrial sectors. This is crucial during the early stages of renewable production while new technologies and a larger market make possible sharp cost reductions.

|

Feed-in Tariff

Perhaps because it’s so strongly identified with Germany, the FIT remains obscure in North American circles and thus still somewhat on the margins of the mainstream international debate over energy and climate policy options. But note that the Pentagon, America’s biggest energy consumer, is seeking to do much the same thing as the FIT. Its Army, Navy and other arms advertise the “land and demand” of their bases in aggressively seeking to attract renewable-energy investment and meet their targets of 50% renewables by 2020 (Navy) and “zero net energy” bases by 2020 (Army). The US military understands we’re collectively in an energy revolution, and it is explicitly committed to leading it even as the political elite in Washington explores the limits of dysfunctional governance.13 While the military can guarantee a long-term market, it lacks the mechanism to guarantee a premium price and ratchet it down. An October 27 study by the Rand Corporation, commissioned by the US Army, lays bare this problem of inadequate tools to structure appropriately robust incentives.14

Back to Son at Japan’s Softbank: He helped pull the FIT out of the constraining hands of the nuclear village. The smarter elements in the village long understood the power of the FIT, and had sought to use it as a supplementary tool for ratcheting down dependence on fossil-fuels as well as boosting the domestic industry.15 METI was for example helping to evolve the domestic oil industry by encouraging such firms as Showa Shell to replace old refineries with installations of solar panels. Together with former PM Kan, Son got the FIT redefined in the public debate as the key device to lever renewables into the pillar position in the power economy, not only reducing reliance on fossil fuels but also displacing nuclear power and eventually eliminating dependence on it. The FIT plays a critical role in the energy revolutions underway in Germany, Spain, China and elsewhere. But it has emerged as especially important in the Japanese context. In the midst of concerns about hollowing out due to the high yen and Japan’s shrinking economy, the FIT is attracting investment from such world-class foreign firms as Siemens as well as such well-known domestic interests as Marubeni, Mitsui, NTT and others.16 The FIT is also encouraging Japanese households, farmer organizations, local governments, financial firms, NPOs and coops and a host of other actors to move into the manufacturing and service sectors of the rapidly expanding and diversifying renewable power economy.17

In political economy terms, the FIT’s guarantee of stable markets and prices for renewables gives countervailing and powerful pecuniary incentives to those interests that want to change the conventional, increasingly nuclear-centred energy economy. Without the FIT, these interests would likely still be part of an inchoate movement expressing collective outrage about Fukushima but lacking a concrete program of action. Many domestic interests are quite taken with a no-growth “Edo model” of simply shrinking the status quo rather than building a new power economy adequate to Japan and the world’s daunting needs for sustainable energy. Japan, however, has no green party or other effective vehicle for aggregating these disparate interests and channeling them into the heart of policymaking. So without the FIT, this potentially very powerful majority movement would have inadequate incentives to act concretely on their concerns about nuclear power and their desire to shift towards renewables.

Let us return later to the struggle between the nuclear village and the advocates of a green energy shift, a struggle that is now being fought out in the central government’s fiscal and administrative institutions as each side tries to outmaneuver the other. Consider the larger context of this fight and some of its implications.

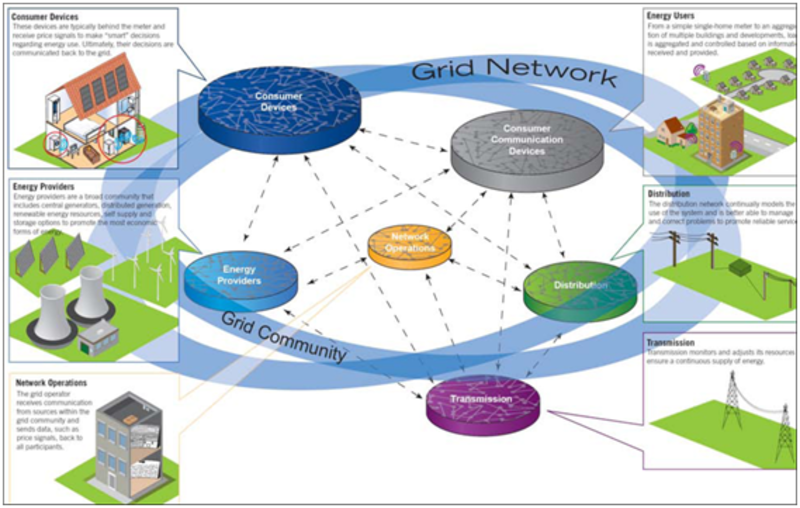

The Smart Revolution

What is perhaps less well-known about Japan’s power market as well as power markets in general is that they are undergoing a so-called smart revolution.18 For Japan, the timing could hardly be better. The revolution centres on mixing information technology with the power transmission grid. Through applying IT to the grid, consumers are becoming able to adjust their own power consumption and power production through apps on their mobile phones as well as other devices.19 Power companies are learning how to accurately monitor power consumption and production in real time. Among other benefits, this will allow them to handle the flux of power from renewable sources, achieve greater efficiency, and reduce the massive amounts of generating capacity needed to cope with peak demand. This interactive smart grid project has already seen the diffusion of smart meters. The smart grid is also being rolled out, especially in China.20 A great number of countries and leading firms, such as Siemens, GE, Hitachi, Samsung, and the like are already testing various approaches in a bid to become the leader that sets the global standards in this rapidly evolving market.

|

A conception of the smart grid

That aspect of the power economy is just one part of the enormous and potentially disruptive changes underway. The smart grid is part of a larger development, generally referred to as smart cities or smart communities. The common thread running through the smart city concept is one of low-carbon emission and highly interactive urban designs that help humanity cope with rising energy demand and rapidly worsening environmental damage.21

Rapid urbanization is a major driver of this new business model. In 2007 about 50% of the global population lived in cities, whereas cities comprise only 1% of surface area. By 2050, 70% of the global population is expected to live in cities. And current projections for global population see it climbing from 7 billion at present, to over 9 billion by 2050. Global population is estimated to continue rising to 10 billion by century’s end, but may go as high as 15 billion.22 By comparison, the global population was 2.5 billion in 1950 and passed the 4 billion mark in 1975. These numbers give us some idea of the speed and scale of the challenge. Cities consume 75 percent of energy as well as release 80 percent of greenhouse gas emissions. So it is no mystery that smart cities have become an enormously promising area of business. Like the Pentagon, re-insurers, infrastructure firms, urban planners, and a host of other private and public actors are already running into the reality of climate change and unsustainable energy regimes. Urban specialists note that the past decade has seen a litany of costly volatility in conventional energy prices, worsening geopolitics associated with conventional energy production supply and consumption, and rapidly mounting damage from global warming.23 These threats and other pressures on the urban context are making resilient, low-impact urban centers not only attractive but essential. The total scale of this smart city business, including smart water (think IT and pipes) and other infrastructures, has been assessed at USD 41 trillion.24

There is, in short, a revolution going on in power markets globally as well as the urban contexts into which they supply power. These changes represent both an enormous business opportunity and the larger context for Japan’s travails over TEPCO and the nuclear village. All the countries and city regions caught up in this revolution have strengths and weaknesses in terms of their capacity to take advantage of these rapidly emerging megatrends. Developed countries, for example, tend to have considerable sunk costs and deeply entrenched vested interests that make it difficult for them to develop and install smart grids and smart cities. These are projects whose innovative potential appear to be maximized via the development and diffusion of test models in real urban settings. But the developed economies also have enormous research capacity, financial resources, manufacturing capacity and other assets that give them an advantage in the competition.

By contrast, developing countries, especially the rapid developers, have burgeoning urban centers and power markets that give them the opportunity to leapfrog certain aspects of building power markets in urban and other contexts. They are advantaged in being able to install the most advanced technologies, and test them in the real context of rapid development. This affords them the chance to innovate technologies and urban models that could become formidable competition in the global marketplace. On the other hand, developing countries are less endowed with research, financial and other assets. That is unless they are China, which is not only in the midst of rapid development but also has extensive research, financial and other assets as well as a surpassing attraction for such multinationals as Honeywell, GE and so many others who seek to tap China’s potentially large domestic market.

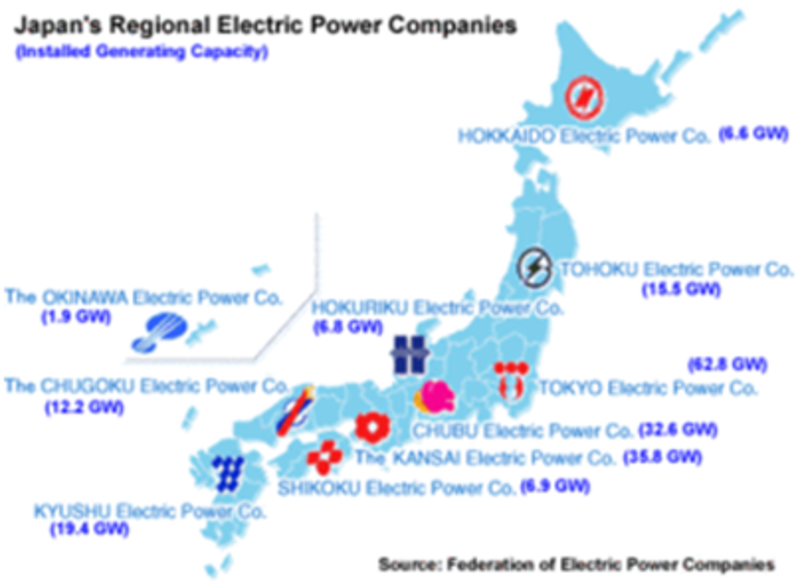

In any event, for several years Japan has been seen as deeply handicapped in this ongoing competition.25 Japan’s METI and other agencies were certainly not unaware of smart grids and smart cities. But their perspectives were shaped through regulatory and cognitive capture by the utilities. On February 19, 2009, the vice minister of METI went so far as to insist that Japan actually didn’t need a smart grid.26 Japan’s monopolized utilities, divided into 10 regional monopolies, were generally satisfied with the status quo of their highly balkanized and inflexible power network. They were unwilling to innovate, unless those innovations maintained the status quo that was so lucrative for them and their allies in the nuclear village. They understood that a truly smart grid would be a serious threat to their monopolies by, among other things, encouraging deregulation and the entry of serious competition. And so even when Japan sought to develop smart city, smart grid and other kinds of test projects, their innovative potential was blunted by potent vested interests seeking to control their scope.27

Again, prior to the March 11 earthquake and tsunami and the ensuing Fukushima nuclear crisis, smart grids and smart cities were not seen as priorities for the Japanese political economy. The nuclear village wanted to sell nuclear technology, domestically and overseas, and got commitments toward this from the national government. The local electrical monopolies were also not interested in putting in smart grids because it might mean lower power demand (and fewer nukes) and would also help the renewable producers that had long been trying to get access to the grid. Moreover, the nuclear village could also see what is going on overseas, with deregulation of power markets in places like Germany and Sweden coupled with the rapid rise of renewable energy production and a tendency to erode the credibility of the nuclear alternative.

Creative Destruction in Power Markets

The nuclear village’s conservatism, its risk aversion, is not particularly unusual in global perspective. Utilities in the advanced countries in particular tend to have very conservative investors such as pension funds that prioritize stable and predictable returns. Think about it: utilities have massive capital investments that they have to depreciate over decades, and that is simply not a kind of business that encourages innovation. It is somewhat akin to the telecommunications markets before the emergence of the Internet, mobile phones, smart phones and other devices that have laid waste to the old model of the monopoly telephone network as well as the land-line. In the creative destruction that took place in the telecommunications business, highly regulated, inflexible and generally very large firms proved to be ill-equipped to cope with disruptive change. Japan’s utilities confront a similar challenge in the smartening of power networks and the diffusion of renewable sources of power production. That seems one major reason for the pushback from the establishment grouped within the nuclear village, since their nuclear power source is the key element of the status quo business model. They want to preserve this model as much as they can, especially because it is crucial for paying off debt incurred for assets before March 11 as well as compensation and other costs being incurred now.

Japan was further handicapped from moving forward by the fact that it is an aging society whose population and economy are shrinking. It also has a very burdensome legacy of public-sector debt from the collapse of the bubble economy two decades ago and successive policy failures thereafter. These and other difficulties have – it seems – have made Japan even more risk-averse than developed economies generally are, and thus unlikely to be the site for historic innovations in IT, power, urban design, and so on. One glaring handicap is the fact that older people tend not to welcome significant change in their circumstances unless those circumstances are unendurable. And older people tend to vote in what they perceive to be their economic self-interest, a recipe for making urban innovation difficult.

But in the wake of March 11, the debate over how to rebuild Tohoku rejected the desire to see things returned to pretty much as they were before the natural and man-made disasters. There has instead been a focus on the opportunity as well as necessity of reconstructing the region in a smart way. The committees that studied the options for reconstruction were apprised of the ongoing revolution in urban forms and the power economy, and came down squarely in favour of smart, renewable and decentralized options. This awareness has diffused among the region’s local communities, where the major decisions will be made. That is why we see Fujitsu, NEC and other Japanese world-class firms pitching their smart-city and related technologies to these communities.28

Tohoku as Smart Keynesianism

So with the shock of March 11, an entire region’s sunk costs were removed from the table. The devastated area is now becoming a testbed for advanced smart grid and smart city projects centred on renewable power. This redesign of the region also appears to be becoming a template for initiatives elsewhere in Japan.

A quick glance over the past decade shows that Japan’s locals and their supervisory agencies have almost literally been waiting for a crisis like this. Japanese local finance and administration is a litany of constraints and cutbacks, of declining expectations. One of the most difficult challenges has been amalgamation of villages and towns. This program was aimed at reducing operating costs and shutting down communities that were too far removed from urban poles and being rendered fiscally and economically unsustainable by rapidly declining and aging populations. Amalgamation reduced Japan’s cities, towns and villages from over 3200 just over a decade ago to about 1700 at present. It has been even more difficult to build resilient and compact communities in peripheral areas, though General Affairs, National Lands and other central agencies have sought to. But suddenly, the devastation of an entire region has brought momentum into fiscal and administrative policymaking. In particular, it has injected considerable vitality into initiatives for “green decentralization,”29 which focus on bolstering local governments’ self-sufficiency and resilience as well as incomes by making them, the local communities, more diverse suppliers of power and other commodities to urban centers.

Assessing the Balance of Power

The number of de jure villages has declined and continues to do so, but the nuclear village remains a very potent force in Japanese power politics. It unites the influence of administrative agencies, power unit manufacturers such as Toshiba, Hitachi and Mitsubishi, financial interests that hold the paper on expensive nuclear assets (and so don’t want to see them stranded), and other interests. The institutions that underpin the nuclear village are diverse, but include public finance that underwrites much of the cost of building reactors as well as developing the technology for the so-called self-sufficient plutonium economy that recycles nuclear material. It also includes the public sector guarantee in the event of accidents and so forth. The institutions are also very much centered in the central government. National energy policy, including the regulatory and fiscal tools to foster the industry, is determined by very few actors. This makes sense as nuclear power generation is a highly centralized kind of power technology. Nuclear reactors are in the gigawatt or at least hundreds of megawatts class of power production and are often grouped together for efficiencies in terms of transmission lines as well as the politics of “not in my backyard” and other reasons. The grid that takes the power and delivers it to centers of consumption is part of the infrastructure that underpins this complex of interests, institutions and ideas. In political economy turns, a relatively small number of actors is fostered and dominates a power market worth about 16 trillion yen. On top of those annual income flows, there are the massive opportunities for power unit manufactures, as a given nuclear reactor construction project can cost several billion dollars. This results in highly concentrated benefits while the costs are diffused among utility ratepayers and taxpayers.

So where are we in this struggle between incumbent and emergent interests? As noted, there is an increasingly clear vision of a smart rebuild of the devastated region with the great majority of Japan’s 47 prefectures and 19 designated cites signed onto a drive for renewable energy. They are also organizing an array of linkages among themselves at the regional level, looking for broader renewable opportunities. The Tokyo Metropolitan Area is not a member of these natural energy organizations. But it is keen on building its own power capacity, and hence is ready to press for deregulation of the power economy. So it too is effectively allied against the status quo, even though it is invested heavily in TEPCO paper (via the Metro area’s pension fund).

A larger constellation of interests is more or less strongly allied in this effort to get smart and renewable. NTT Docomo, Mitsui, Marubeni and other firms have announced their intentions to enter the power-generation business, tearing away chunks of the YEN 16 trillion electricity market currently monopolized by the nuclear village. Many firms in renewable energy equipment, construction, finance, and other sectors are also looking forward to benefiting from renewables. They were interested in the FIT before March 11, and are even more so now.

Also among the nuclear village’s antagonists are other government agencies, such as the Ministry of Farms, Fisheries and Forests, whose areas of jurisdiction have been ravaged by the meltdown in energy policy. They want a seat at the table determining new energy policy where they can represent farmers and other interests whose livelihoods have been severely damaged and who would benefit from the distributed economic opportunities of an energy shift driven by the FIT. Other ministries, including even METI, are keen to secure budget appropriations aimed at fostering research and investment in renewables, smart grids and other elements of the emerging 21st century power economy.

Thanks to Softbank CEO Son and former PM Kan, as well as the debate on reconstruction, these actors are uniting behind deregulating the power sector, building the smart grid, and getting a robust FIT. These policies are aimed at encouraging the deployment of renewables and thus distributing power-generation opportunities across regions and socioeconomic groups.

In addition, fiscal pressures have helped force an ongoing deconstruction of several of the fiscal and regulatory supports for the nuclear village. Public-sector investment in the long-range goal of building the nuclear economy is being withdrawn, particularly the ambitious plans for new reactors. The rethink of the basic energy plan is also being done in a committee that has added 8 pro-nuclear members, 8 explicitly anti-nuclear members and the remaining 9 being neutral. Just a few months ago, the inclusion of explicitly anti-nuclear voices in the heart of energy policymaking would have been simply unthinkable.

It remains unclear how generous will be the levels of support from the FIT, whose revised version is slated to become effective next July. The price-setting functions were taken away from METI and turned over to 3rd-party advisory agencies whose membership is yet to be decided. Considerable bureaucratic action centres on getting loyal people into these committees. Yet the signaling effect of the August 26 Diet adoption of the expanded FIT has, in itself, led to massive investment and organization. These developments indicate a powerful nexus of interests that will not allow price-setting to be left to hired guns from the nuclear village.

Moreover, it is yet to be determined how reconstruction expenditures will be rationalized and guided because the new “Reconstruction Agency” is yet to be put in place. This agency is a new section in the central government, and will be in operation by at least April 1 of next year for a period of 10 years. The agency’s direct head will be the prime minister with a cabinet level officer (the reconstruction minister) in charge of the administrative end. The agency will be empowered to render binding decisions concerning the allocation of expenditures and other matters in the area under reconstruction. The staffing and advisory roles in this new agency could become critical for shaping the character of the reconstruction of the devastated region’s power economy as well as how the power economy interacts with urban design and other critical functions.

But at present it seems unlikely that vested interests working at the central level could roll back the momentum in the regions.

The Real Battleground

It would appear that within the governing DPJ, the retreat from nuclear power is already generally understood as unavoidable. That is perhaps why the investments in R&D and infrastructure for achieving the designs of the current nuclear-centred basic energy law can be backed away from without great controversy. But that recognition is not shared by the nuclear village and its allies, which generally want the plants restarted, the nuclear power plant export drive continued (with domestic construction a possibility in a very uncertain energy future), the monopolies retained, and so on. In short, they want the costs of Fukushima passed onto taxpayers and power consumers with as little reform as possible. Whether that is a tenable position remains to be seen.

At present, perhaps the biggest issue is how much of the existing nuclear plant can be restarted. No politician wants to act quickly on this, as none can be sure that an effort to push restarting the reactors does not become embroiled in a new scandal, a new accident, or some other unforeseeable risk. Although the old-line business community, especially through Keidanren, is pushing hard for restarts, politicians face a very different set of incentives than do the executive class. The old-line business community insists that companies will leave the country because of uncertainty about the power supply. But this argument does not appear to be gaining much traction, as most people are aware that the rising yen and other issues are driving the hollowing out that is occurring. They can also see the FIT and related renewable developments attracting inward investment.30

The fight over nuclear versus renewables will continue, with various victories on either side. Who wins the overall war, so to speak, will depends on price setting in the FIT, deregulating power, and building a national and international grid. The more triumphs scored by the greens, and the greater the compression from collapsing external demand, the greater the impetus to build on the FIT and Tohoku’s smart reconstruction, and move rapidly towards renewables and the requisite infrastructures. And that movement, to the extent it occurs, will surely hasten the evolution of elements of the nuclear village. Toshiba, Mitsubishi and others all have the capacity to make whatever generation capacity and smart infrastructure is demanded of them. Even some of the monopolized utilities might manage to reinvent themselves and their business models and grow renewables. But to do that, in these fraught circumstances, they require smart policy regimes that compel them to abandon their efforts to hug the status quo and instead innovate rapidly and intelligently.

But if the nuclear village were to prevail in the effort to restart much or all of their assets, we may see the problem of public distrust and its implications for consumer spending worsen. In a context of already flat incomes, weak domestic demand and rapidly weakening overseas demand (due to the EU crisis and high yen), this outcome would likely be a negative for Japan. The country would have increasingly costly, cul de sac power and significantly reduced impetus for growing fast into renewables. That blunting of incentives would then limit the momentum for diffusing the smart cities, green financial services, and other innovations that are already arising through the Tohoku rebuild. In a rapidly ageing society, there is enormous risk of falling back into complacency.

The present context is too fluid for anyone to render a definitive statement about the future course of Japan’s energy mix. But in a world marked by accelerating crises, it seems best for the central government to follow the lead of the locals and speed up the adoption of sustainable energy as the heart of a new energy regime.

Andrew DeWit is Professor of the Political Economy of Public Finance, School of Policy Studies, Rikkyo University and an Asia-Pacific Journal coordinator. With Kaneko Masaru, he is the coauthor of Global Financial Crisis published by Iwanami in 2008.

Recommended citation: Andrew DeWit, ‘Fallout From the Fukushima Shock: Japan’s Emerging Energy Policy,’ The Asia-Pacific Journal Vol 9, Issue 45 No 5, November 7, 2011.

Articles on related subjects:

• Sun-Jin YUN, Myung-Rae Cho and David von Hippel, The Current Status of Green Growth in Korea: Energy and Urban Security

• Son Masayoshi and Andrew DeWit, Creating a Solar Belt in East Japan: The Energy Future

• Kaneko Masaru, The Plan to Rebuild Japan: When You Can’t Go Back, You Move Forward. Outline of an Environmental Sound Energy Policy

• Andrew DeWit, The Earthquake in Japanese Energy Policy

• Andrew DeWit and Sven Saaler, Political and Policy Repercussions of Japan’s Nuclear and Natural Disasters in Germany

• Andrew DeWit and Iida Tetsunari, The “Power Elite” and Environmental-Energy Policy in Japan

• Edward B. Barbier, Toward a Global Green Recovery: The G20 and the Asia-Pacific Region

• Arjun Makhijani and Mark Selden, Carbon-Free and Nuclear-Free: A Roadmap for U.S. Energy Policy

Notes

1 At this writing, recent revelations include the French Institute for Radiological Protection and Nuclear Safety’s October 26 estimate that marine radioactive pollution was 30 times the Japanese government’s published figures. The Norwegian Institute for Air Research also reported on October 21 that tallying of 1000 international monitoring sites suggests atmospheric releases were well beyond Japanese estimates. See “Fallout levels twice estimate,” October 29 2011 Japan Times, link.

2 On the 2010 energy plan, see John Duffield and Brian Woodall, “Japan’s new basic energy plan,” Energy Policy, 39 (2011).

3 On the nuclear village and related matters, see Jeff Kingston, “Ousting Naoto Kan: The Politics of Nuclear Crisis and Renewable Energy in Japan,” The Asia-Pacific Journal Vol 9, Issue 39 No 5 September 26, 2011, link.

4 On the Kan and Noda regimes, see for example Daniel Sneider “Japan in a Post 3/11 World – Part I,” October 5, 2011, Yale Global Online, link.

5 See “Warm welcome for Noda,” Daily Yomiuri, September 2 2011, link.

6 In August of 1992, Keidanren was one of the main sources of opposition to former PM Miyazawa Kiichi’s plan to clean up the bad asset crisis. See Emre Bayram, Sven Steinmo and Andrew DeWit “The Bumblebee and the Chrysanthemum: Comparing Sweden and Japan’s Response to Financial Crisis,” manuscript under review. As Stephen Vogel notes in his Japan Remodeled: How Government and Industry are Reforming Japanese Capitalism (Cornell 2006, p 56), Keidanren has long had trouble advancing reform positions on energy issues because the energy sector is a pillar of the association’s finances.

7 The already massive scale of Fukushima’s compensation and clean-up costs have left Tepco clearly bankrupt, no matter how much the nuclear village’s hired hands spin the numbers on various committees. That is why the November 5 Economist now calls for its nationalization, warning that “the longer the government dithers over nationalizing Tepco, the more the costs will rise and the impetus for action will wane.” See “Japan’s nuclear conundrum: The $64 billion question,” The Economist, November 5: link.

8 On this see, “Noda to back exports of nuclear technology to Vietnam,” The Asahi Shinbun, October 28, 2011, link.

9 The subsidization includes the use of public monies to purchase land and otherwise clear the way for construction of plant. The corruption is evident in the regulatory coddling of TEPCO and other utilities

10 The White Papers from 2004 are available here.

11 See “Natural energy sources a growth sector everywhere but Japan,” The Asahi Shinbun, August 2, 2011, link.

12 The most authoritative and user-friendly site on feed-in tariffs is maintained by Paul Gipe: link.

13 The point is, of course, not to laud the military. They are responding to such institutional incentives as the rising human and energy cost of fighting wars for oil as opposed to other military priorities. But it is surely useful to look from their perspective and understand what they are learning about the climate and energy crises as well as options for an energy shift. Perhaps the most outspoken advocate of renewables among military circles is Navy Secretary Ray Mabus: link.

14 On the US military’s programmes see, “Suzanne Goldenberg “Military thinktank urges US to cut oil use,” November 2 2011, The Guardian, link. See also the introduction and download link to the October 27 released RAND report on encouraging cooperation between Army bases and utilities to expand renewables: link.

15 The use of the FIT for reducing reliance on fossil fuels was indeed one of the elements of the METI-led strategy to dump the Kyoto Agreement and stress single-country approaches: link.

16 See “Siemens returns as does domestic vigour: the race in the wind market intensifies” (in Japanese) October 15 Sankei Newspaper, link.

17 See “Tepco’s Deal With Devil Signal End to Postwar Era,” Bloomberg Businessweek, October 21, 2011, link.

18 A concise introduction is available at “Towards a Distributed-Power World: Renewables and Smart Grids Will Reshape the Energy Sector,” Boston Consulting Group, June 2010, link.

19 For an example of how this is playing out in America, a relative laggard in the smart revolution, see this link.

20 See Melanie Hart “China aims to dominate US in smart grid investments just as it has with renewables,” at Climate Progress, October 24, 2011, link.

21 For a recent Indian perspective, see Hari Pulakkat “How smart cities are drawing city of tomorrow and redrawing cities of today,” November 3 2011 Economic Times of India, link.

22 See Paul Harris “Population of world could grow to 15bn by 2100,” October 22 2011, The Guardian, link.

23 A through study of the issues is available in “Climate Neutral Cities: How to make cities less energy and carbon intensive and more resilient to climatic challenges,” Economic Commission for Europe, Committee on Housing and land management seminar, October 2011: link.

24 See “Smart Cities: Exporting the Environmental City,” (in Japanese) Japan IBM: link. See also “The outline of the Chinese smart grid becomes evident,” (in Japanese) July 5, 2010, Nikkei Newspaper, link.

25 For example, “Smart City projects revived by disasters,” October 4, 2011, link.

26 See his comments during the press conference: link.

27 On this, see for example Scott Victor Valentine, “A STEP toward understanding wind power development policy barriers in advanced economies,” Renewable and Sustainable Energy Reviews 14 (2010), link.

28 One example is seen in “NEC to pitch smart-city projects to over 30 municipalities,” in Nikkei November 3: link.

29 This policy line is detailed in depth at the General Affairs Ministry website.

30 A recent entrant into the Japanese power market is venerable Marubeni, which has committed heavily to geothermal builds. Marubeni had evolved a business model of using overseas FITs by acting as the middle man for independent power producers. Marubeni’s subsidiary “Smartest Energy,” is the biggest such firm in the UK. Its helpful guide to FITs is instructive: link.