Abstract: Although Bangladesh has seen a delayed appearance of COVID-19 with the first identified case on March 8, 2020, it was still caught off guard, with regard to its healthcare and economic preparedness. COVID-19’s impact on Bangladesh’s economy is particularly pronounced because of the country’s reliance on globalized supply chains of international fashion brands and human resource exports. Banks have considerable exposure to industries in general and ready-made garments in particular. The effect on these sectors, combined with a shrinking consumer economy has hit all sectors hard. This paper, based on expert interviews, primary data from government websites, and news reports, attempts to assess current and potential damages to Bangladesh, at a time when the country has yet to reach the peak in its infection growth rate.

Background

Globalization has brought great benefits to the apparel industry as international fashion companies farm out production to cost-effective centers for manufacturing. By carefully orchestrating a supply chain that spans multiple countries, they are still able to deliver products to stores in time. COVID-19 has exposed the vulnerability of these cross-country supply chains, with negative consequences for Bangladesh. There are other global impacts that will affect the Bangladesh economy as well as local impacts on demand and supply in-country. This paper aims to shed light on these global and local economic impacts of COVID-19.

At the time of writing, a global recession is a reality, but the jury is still out on the likely duration. Current mitigation measures such as masking, targeted shutdowns, and social distancing will flatten out the trajectory of infections in countries still struggling with controlling infections. However, the focus, in almost all countries by now, is on how to open economies affected by COVID-19, and how businesses can adapt to the post-COVID-19 world (McKibbin & Fernando, 2020). Earlier, the International Monetary Fund (IMF) opined that the recession will be worse but more short-lived than the global financial crisis of 2008 (International Monetary Fund, 2020). The duration matters greatly for Bangladesh, because its economic fate is closely tied to that of countries that enable the two R’s that drive it: ready-made garments (RMG) and remittances.

The 2 R’s: RMG & Remittances

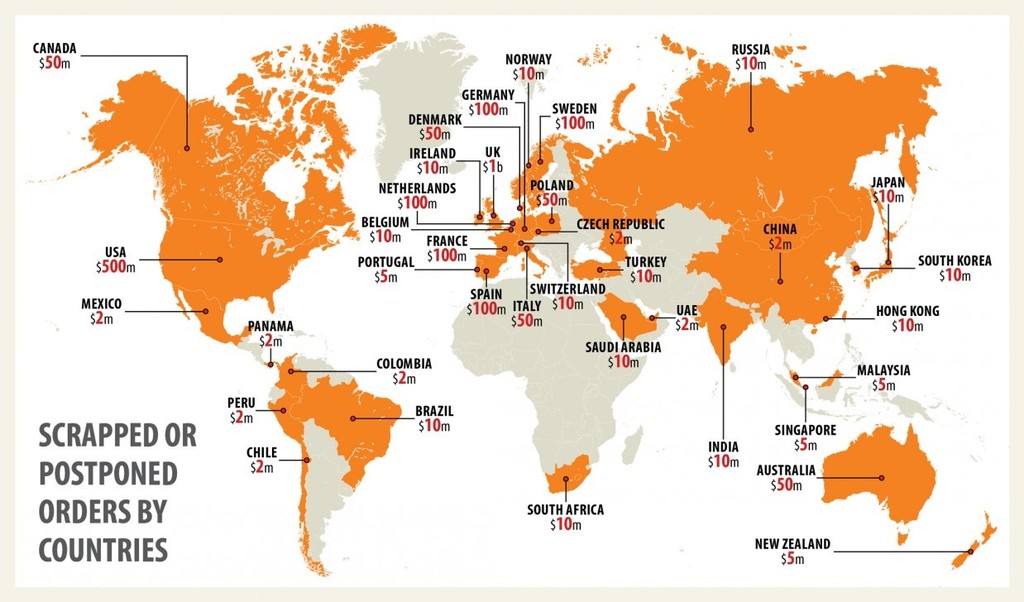

Large Ready-made Garments (RMG) companies which buy from Bangladesh are literally closing doors, many permanently, to reduce costs. Stores have closed for H&M, GAP, Zara, Marks & Spencer, Primark, which are all major buyers of Bangladeshi RMG products. Since the onset of COVID-19, shopping came to a virtual standstill as people avoid discretionary spending globally. As of June 26, it is estimated that 1,931 global brands have canceled or are likely to cancel orders worth $3.7 billion from Bangladeshi garment factories (Preetha & Islam, 2020) (Figure 1).

|

Figure 1: Map of RMG Buyers Scrapping or Postponing Orders by Countries. Source: Preetha & Islam (2020) |

H&M, one of the largest buyers of Bangladeshi garments, has had to “temporarily pause new orders as well as evaluate potential changes on recently placed orders.” (Bain, 2020). However, H&M is also one of the 14 brands which has agreed to pay for export orders planned before the pandemic (Rahman, 2020). According to Bangladesh Garment Manufacturers and Exporters Association (BGMEA)’ data, Primark tops the list of buyers in terms of total value of orders postponed or cancelled, at $300 million, which is tantamount to the salary of 2 million garment industry workers for a month. If the virus continues to impact global supply chains, buyer demand, and of course, health and safety of workers, by Q4 2020, loss in export revenues could reach US$ 4.2 billion.

This is not surprising because slowdowns in the US and EU economies have long had ripple effects in the Bangladesh economy (Rabbi, 2020) (Figure 2). This correlation is most evident for the global financial crisis in 2008, when Bangladesh’s GDP growth curve mirrored those of US and EU, albeit the drop off at that time was less severe than for the developed economies.

|

Figure 2: Relationship between GDP Growth Rates: BD, EU, US, and the World. Source: Rabbi (2020) |

Meanwhile, international credit ratings agency Moody’s predicted that the RMG sector in Bangladesh will recover by the end of the year, as demand recovers and supply chain shocks are overcome (Higgins & Diron, 2020). However, this may not happen simply because Bangladesh’s infections, at the time of writing, have not peaked, whereas competitors in the international apparel market like Vietnam are almost virus-free.

Meanwhile, the other pillar of the Bangladesh economy, remittances sent by migrant workers, will also take an inevitable hit. Bangladesh has around 10 million workers overseas, a majority in the Middle East and the US, UK, and Malaysia. Travel restrictions as well as economic slowdowns and curfews in host countries, e.g., Saudi Arabia, UAE, Qatar, Kuwait, Malaysia, US and the EU means that the workers are losing out on wages. The Japan News tells of a Jahirul Islam, 30, who will lose out on 2 months’ pay, after being instructed by his employer, the Abu Dhabi Sports Academy, to go home. While he decided to stay put for fear of not being able to re-enter, there are news reports that an untold number of migrant workers have returned. There are also disconcerting stories of migrant workers being shepherded into “labor camps” in Qatar (Bhuyan, 2020; Amnesty International, 2020).

Furthermore, oil prices have fallen precipitously, which is expected to lessen demand for migrant workers in the Gulf states. Oil prices are often an effective leading indicator of inward remittances (Figure 3). History shows that falling oil prices have a lagged effect on remittances into Bangladesh. Prices have fallen because of reduced demand from sectors such as aviation and transportation sectors, as well as tensions between Russia and Saudi Arabia.

|

Figure 3: Relationship between Crude Oil Price and BD Remittance. |

Overall, the drop in export revenues, RMG worker layoffs, and reduced flow of remittances will impact demand in the urban and rural consumer economy of Bangladesh.

Impact on Consumer Demand

A significant part of the story of the hit to RMG factories is that many workers have lost their jobs or are without pay. Between April till June 2020, it is estimated that about 24,000 workers have been terminated, although the National Garment Worker Federation (NGWF) says that the actual number is much higher (Mirdha, 2020). Garments workers send money back to their villages, as do overseas migrant workers from Bangladesh.

The lack of domestic and international remittances creates pressure on the rural economy at a time when urban-rural economic linkages have also been severely disrupted. To speak of the urban economy, between March 25 leading up to Eid-ul-Fitr, malls were shut down as per directive of the Bangladesh Shop Owners Association. Only kitchen markets, grocers’ shops, shops selling daily essential commodities and pharmacies were allowed to stay open (New Age, 2020). Usually, retailers do 50-60% of their annual businesses during Pohela Boishakh, i.e., the Bengali New Year, as well as during the two Eid festivals, Eid-ul-Fitr and Eid-ul-Azha. However, retail sales were paltry during Pohela Boishakh and Eid-ul-Fitr and although it may pick up a little for Eid-ul-Azha, the shrinkage in consumer demand during COVID-19 is significant (The Business Standard, 2020).

In one interview, a retailer with a relatively high capital investment opined she would focus more on her online sales and shut down most of her outlets. Our research suggests that several large retailers have already strengthened their online operations, which has had a positive impact on sales. At the time of writing, Bangladesh supermarkets have had more resilient business, albeit for food items and groceries.

Of course, one of the hardest hit sectors is aviation. In interviews conducted with one of the largest travel agencies in Bangladesh, there was considerable concern about paying staff salaries at a time when customers were seeking cancellations, refunds, and holidays were clearly out of the question. Globally, travel agencies have digitized significant components of their value chain, especially booking and payments. Certain Bangladeshi travel startups have invested in this space, and as a result, may fare better than the competition in the wake of the crisis. However, travel agencies constitute a fragmented sector in Bangladesh, and owing to COVID-19, many small ones are expected to close shop. Airlines and hotels have also been badly hit.

Overall, the current economic situation may seriously undermine the livelihood of the underprivileged cohort of the population. The Center for Policy Dialogue (CPD) predicts that the effect of COVID-19 will be worst for people who are dependent on daily wages and low-income groups (Centre for Policy Dialogue, 2020). Lack of access to basic healthcare, knowledge of hygiene and an inadequate social safety net has always been a challenge for this cohort and the pandemic is likely to increase these challenges, exponentially.

Challenges for the Financial Sector

COVID-19 catches the Bangladesh financial sector at an inopportune time. Banks were trying to come to terms with the Ministry of Finance directive of 6% and 9% caps to interest rates on deposits and loans; vulnerable asset quality; moribund capital markets; and a struggling microfinance sector as access to donor funds and bank financing has become more competitive. It is worth noting that since 2019, private sector credit growth was already declining (Figure 4).

|

Figure 4: Growth Rate of Private Sector Credit. Source: Bangladesh Bank |

A CEO of a leading private commercial bank suggests that banks were taking time to adjust to the 9% directive, as many were reluctant to lend at this rate. As effects of COVID-19 intensify, given that there have been several large-scale order cancellations for RMG clients, many loans may go into default, which is worrisome for the sector.

In the coming months, government sector bank borrowing may increase from levels in the early days of COVID. Government borrowing will take place to finance the large stimulus bill as well as large projects such as the Padma Bridge, Padma Rail Link, Karnaphuli Road Tunnel and the Greater Dhaka Sustainable Urban Transport Project, which will have a positive impact on economic growth. Private sector lending has been greatly hampered by the lending rate cap, particularly, the SME and retail lending space, given that the latter have higher cost of operations, and the 9% interest rate cap is detrimental to business (Hussain, 2020). Meanwhile, the Bangladesh Bank has also attempted to pump cash into the economy. It has cut both the repo rate and cash reserve ratio by 25 and 50 basis points, respectively.

Moreover, the central bank has bought dollars from commercial banks, with the intention of curbing the taka’s appreciation against the dollar (Islam, 2020), has provided guidance on provisions for rescheduled loans, and instructed banks to extend payment deadlines to realize export proceeds, while allowing importers time to make import payments. Once the current risks of infection subside, the quantitative easing is expected to encourage banks to seek out investment opportunities and some of this liquidity may also find its way into the stock market.

Impact on Small Businesses and Startups

Even in good times, raising funds is difficult for small businesses and startups and even more so in times of economic turmoil. When it comes to SME’s, in an interest rate environment of 6% and 9%, access to finance will become more difficult as banks will be reluctant to make SME loans at 9%, since SME operations are more expensive and risky for banks. The Government has offered SMEs some reprieve in the stimulus package that is yet to be fully deployed. For Bangladeshi startups, COVID has also had adverse consequences (Table 1).

Table 1: Impact of COVID-19 on Startups

Fundraising for startups is difficult even in a healthy economy. At the time of Corona, when public equities are deemed risky and even gold prices have been shaky, startup investing will likely take a considerable hit in the coming months.

The silver lining to this economic scenario is that the Bangladesh Government has proactively enacted a stimulus package that will shore up RMG businesses, provide direct incentives to workers, buttress the banking system, ensure liquidity in the economy, support exporters and importers, and other impacted sectors such as tourism, aviation, and hospitality.

In the long run, COVID-19 will have exposed areas for improvement in Bangladesh’s health care system, IT infrastructure, workplace cultures, and adaptability of public and private sector leadership. The virus may also have the unintended consequence of enhancing the country’s social protection and emergency response capacity. It may also accelerate the digital transformation curve. This is a curve we do not wish to flatten, but only steepen.

Given the Bangladesh government’s commitment to ensuring quarantine at a time when official figures of COVID-19 affected persons are low compared to other countries; the potential of a well-considered stimulus package; speedy monetary and fiscal interventions; and not to mention, a large informal economy; there is a possibility that the economy may rebound by Q4 2020. Of course, much depends on the capacity of RMG and manpower importing countries to recover from economic shocks, and a slowing down of infection rates, which are yet to peak in Bangladesh. Meanwhile, the resilience and resourcefulness of Bangladeshi people will surely be tested.

Sources

Amnesty International, 2020. Qatari migrant workers in labor camps at grave risk amid COVID-19 crisis. [Accessed 20 March 2020].

Bain, M., 2020. Coronavirus threatens the livelihoods of garment workers around the world.

Bhuyan, M. O. U., 2020. Bangladeshi migrants hit hard in Middle East.

[Accessed 24 March 2020].

Centre for Policy Dialogue, 2020. CPD urges targeted expansionary measures to tackle Corona risks. [Accessed 21 March 2020].

Higgins, M. & Diron, M., 2020. Moody’s affirms Bangladesh’s Ba3 rating, maintains stable outlook. [Accessed 19 March 2020].

Hussain, S. R., 2020. SME and retail businesses will die out soon due to lending rate cap.

International Monetary Fund, 2020. The Great Lockdown: Worst Economic Downturn Since the Great Depression. [Accessed 23 March 2020].

Islam, S., 2020. BB buys US dollar from banks to keep forex market stable. [Accessed 10 March 2020].

McKibbin, W. & Fernando, R., 2020. Global macroeconomic scenarios of the COVID-19 pandemic, Canberra: Australian National University.

Mirdha, R. U., 2020. Stop terminating garment workers amid pandemic: Labour ministry tells owners. [Accessed 22 June 2020].

New Age, 2020. Shopping malls, markets across Bangladesh closed until March 31. [Accessed 22 March 2020].

Preetha, S. S. & Islam, Z., 2020. Is foul play the new normal?. [Accessed 26 June 2020].

Rabbi, R. H., 2020. Safeguarding Bangladesh’s economy during the Corona Pandemic.

Rahman, S., 2020. COVID-19 and the ready-made garment sector. [Accessed 24 June 2020].

The Business Standard, 2020. Survey: Consumers wary of spending money this Eid. [Accessed 21 May 2020].