Abstract: This paper assesses the role and the challenges of the use of critical raw materials in Japan’s program for achieving net-zero greenhouse gas emissions by 2050.

Keywords: Critical Raw Materials, decarbonization, greenhouse gases, mining, Covid-19, green energy

On October 27, 2020 Japanese Prime Minister Suga Yoshihide announced that his administration would set national policy on course to aim at net-zero in greenhouse gas (GHG) emissions by 2050. Japan is now one of dozens of countries committed to achieving net-zero by 2050. Japan’s decarbonization pledge is backed up by ambitions for a vast rollout of offshore wind, millions of tons of “green hydrogen,” and assertions that domestic automakers can achieve net-zero emissions from the entire life cycle1 of a vehicle.2

Japan’s commitment was strongly welcomed in an international climate-policy community shocked by the impact of the COVID-19 pandemic and seeking roadmaps for building back better on all fronts.3 Japan may yet possess the innovative capacity to realize these goals. But one pressing question is whether resource-scarce Japan has access to sufficient critical raw materials to make this happen. Equally important is asking whether Japan has a strategy to secure critical raw materials that also conform to rapidly strengthening sustainability rules.

It’s a Material World

The imperative of decarbonization is a global consensus. But it is important to note that no country’s net-zero commitments are backed up by detailed and credible planning. Even the much-lauded EU goals for a green recovery and decarbonization by 2050 lack clarity. The EU goals remain largely a vision rather than a roadmap. The hard work of land-use changes, lifestyle shifts, the relative proportion of decarbonizing technologies, and other fundamental issues remain to be decided. Yet what is clear is that decarbonization will require a lot of new mining for copper, cobalt, lithium, and other critical raw materials (also referred to as “critical minerals” and “critical and strategic minerals”4). These materials are used in especially high densities in green energy and electrified mobility.

Specialists have debated for several years whether there are adequate supplies of critical raw materials to meet the projected demand for global decarbonization. But these concerns about decarbonization’s material demand went mainstream at the start of this year. On January 11, the International Energy Agency (IEA) announced a series of special projects for 2021, leading up to the May 18 release of The World’s Roadmap to Net Zero by 2050.5 Key among the IEA special reports will be what IEA director Fatih Birol correctly described as the first comprehensive and global study of the supply constraints, lifecycle costs, environmental justice, and related challenges confronting the critical minerals used in electric vehicles, renewable energy equipment, and the myriad other elements of the clean energy transition. This IEA special report is to be titled The Role of Critical Minerals in Clean Energy Transitions and is slated for publication in April.

In IEA director Birol’s January 11 press conference, he pointed to lithium, nickel, cobalt and rare earths as among the critical minerals under the IEA’s review.6 That brief itemization is not exhaustive, as Birol well knows. What constitutes a “critical raw material” (CRM) – to use the European Commission’s abbreviation – varies by country and is based on each jurisdiction’s assessment of dozens of materials’ specific domestic economic importance, supply risk and related factors. The most recent CRM list from China dates back to 2016 and refers to 24 “strategic minerals.”7 This is the same number as Australia’s list, though they differ in composition and purpose.8 As of 2018, the U.S. identifies 35 CRMs.9 And Japan’s list comprises 34 CRMs,10 up from 30 in 2012.11

Interestingly, what is deemed a critical resource has largely evolved and expanded in line with the expansion of digital technology, clean energy and decarbonization goals.12 The EU is a notable example of this phenomenon. Its first triennial review of CRMs identified 14 materials in 2011, and the second review in 2014 expanded that to 20 CRMs. As investments in renewable energy and other green tech sectors have soared, the EU’s CRM list has ballooned. By 2017, it contained 27 materials. Last September, the number had grown to 30.13

All publicly available national lists include the 17 rare earth metals, generally grouping them as a single item, reflecting their outsized importance relative to their small quantities.14 In 2019, global mined production of rare earths was just 210,000 tons with a market value of about USD 8 billion, but the materials were essential to many multiples of that value in green energy, electric vehicles, electronics, and other applications.15 While most CRM lists converge on rare earths, cobalt, graphite, indium, and lithium, the view on other materials differs. For example, Japan has long determined copper to be critical, whereas the EU, U.S., Canada and Australia do not. Yet the global take on copper is rapidly moving closer to Japan’s position. One reason is that copper is used in more applications, in addition to clean energy, than any other CRM.16 Copper is also the “gateway” to many other CRMs because they are byproducts of copper production.17 And ramping up copper mining is fraught with environmental impacts, governance challenges, and other issues. Thus, copper is central to assessments of critical raw materials.18 And many experts and analysts are re-evaluating copper’s core contribution in the renewables space and – as Wood Mackenzie does – ranking it alongside aluminum, nickel, cobalt and lithium as an “energy transition metal.”19

Driving Concerns

As alluded to in the above, there are several drivers for this deepening convergence of concern regarding CRMs. One is the rapidly increasing global commitment to “green deal,” “green recovery,” and similarly named transformative policies to “build back better” from the ravages of COVID-19 and cope with climate change. These policies are imperative lest China’s currently carbon-intensive recovery become the norm for much of the planet.20

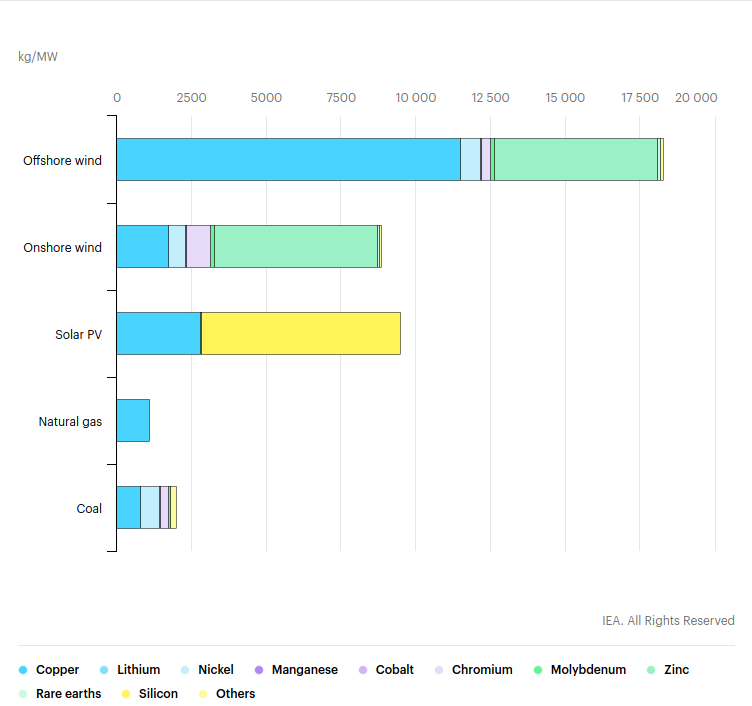

However, decarbonized power, housing, mobility, communications, and other industries are not built with intangible technologies and innovation. Greening requires prodigious amounts of very tangible CRMs whose environmental costs and geopolitical implications are increasingly huge. To be sure, the CRMs used in decarbonizing green are a dramatically different mix of materials than the fossil-fuels that distinguish the grey, or carbon-intensive economy and society. Put simply, solar panels and wind farms – the poster kids of green – do not burn any of the 7 billions tonnes of thermal coal forecast to be produced in 2020.21 But on the other hand, the CRM-intensity of green is striking. Hence, the more solar, wind and battery storage there is in the decarbonizing power mix, the higher the CRM intensity of installed generating capacity and the CRM intensity of generated power.

For example, as seen in figure 1, data from a March 2020 IEA report indicate that building offshore wind capacity is well over ten times more copper-intensive than natural gas- and coal-fired fossil fuel plant. The figure summarizes the kilogrammes of copper, lithium, nickel, and other CRMs required to build a megawatt (MW) of generation capacity for the different technologies. It shows that building a MW of intermittent wind and solar generating capacity requires many more multiples of CRMs than a MW of gas and coal plant. The expression of CRM-intensity is kgs/MW.

Figure 1: Minerals used in selected power generation technologies

Source: IEA, 2020

The figure actually understates the CRM-intensity of solar and wind. Wind and solar are intermittent, and produce only a fraction of their rated capacity, giving the installed plant a comparatively lower efficiency in using CRMs. So, in actual generated power output – or megawatt-hours (MWh) of electricity – solar and wind have an even greater CRM-intensity than other technologies.22

As for mobility, figure 2 shows us that the same IEA publication reveals electric vehicles require roughly five times as much CRMs as a conventional car. Similar to power generation via wind and solar, electric mobility has profound implications for required volumes of CRMs. Some of the best work on this has been done by Dutch researchers at Metabolic, Copper 8, and other cutting-edge consultancies. Their collaborative work is supported by the Dutch Ministry of Infrastructure and Water Management in addition to other stakeholders. Their work on the CRM implications of 30% EV by 2030 in the Netherlands, the EU, and the world warns that even with advanced battery chemistries, demand for cobalt, lithium and select rate earths outstrips global supply.23

Figure 2: Minerals used in selected transport technologies

Source: IEA, 2020

Another driver of growing concern over CRMs supply is dangerous uncertainty. Though CRM lists are being compiled and updated, the policy environment is opaque, the knowledge base concerning CRMs mining and processing is poor, and there are wildly optimistic assumptions regarding substitutability and recycling.

We have already seen that decarbonization policies and projects are rapidly increasing, driving CRM demand well beyond sustainability. Concerning knowledge erosion and recycling, on December 10, 2020, the Hague Centre for Strategic Studies (HCSS) released a very detailed, book-length report on “Securing Critical Materials for Critical Sectors: Policy options for the Netherlands and the European Union.”24 The HCSS analysis first examined the CRM implications of the Dutch and EU commitments to decarbonization. Their broad-based analysis included CRM demand for renewable energy (wind, solar, geothermal), energy grid infrastructure, carbon-capture and storage, electric vehicles, and semiconductors. The HCSS warn that recycling and other “circular economy” policies are quite inadequate to address the massive increase in required CRM volumes implied by decarbonization. They highlight the current magical thinking about CRM supply chains, not simply among policymakers but also industry participants, academics, and other stakeholders. The HCSS depicts it as “knowledge erosion” and their arguments merit quotation in full:

“Market actors are responsible for ensuring resilient supply chains for themselves, while the role of the government has been marginalized. A lack of long-term strategic direction and a phenomenon of knowledge erosion have resulted from reduced government involvement…

The phenomenon of knowledge erosion did not occur solely on the governmental level, but also on the industrial and academic levels. Due to heavy reliance on global value chains for imports of materials, intermediate and end products, the EU and the Netherlands currently lack the industrial knowledge and facilities to become self- sufficient. There is a lack of academic and professional focus on developing industrial expertise for mining, refining and other supply chain stages.”

One consequence of “knowledge erosion” is that CRM-intensive “green recovery” decarbonization scenarios unfold in a blissful state of logistical ignorance. Few scenarios pay any heed to CRM-intensity, let alone the fact that scaling up CRM mining and processing requires many years and a lot of money. And note, for example, that current copper projects are 33% smaller than the average project was in 2012; and these new projects are being undertaken by smaller firms with less experience.25 On top of these issues, the depletion of existing copper mining projects is striking. One recent assessment indicates that “without new capital investments…global copper mined production will drop from the current 20 million tonnes [Mt] to below 12Mt by 2034, leading to a supply shortfall of more than 15Mt. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.”26 In tandem, experts on the realities of lithium mining warn that battery-maker and other firms’ current planning for 2023 implies seven times more demand than any conceivable scenario for global supply.27

Another driver of concern over CRMs is the implications of these trends for human rights. Supply constraints are likely to increase the pressure to relax worker and environmental safeguards in order to maximize extraction from existing mines. The Industriall Global Union – representing 50 million workers in 140 countries – warned about these challenges in a November 20, 2020 report. They examined the global battery supply chain’s reliance on copper, cobalt, nickel and lithium, together with the implied acceleration of electric vehicle sales. Their expert consultation warned that:

“[t]he demand for critical raw materials for the low carbon energy transition batteries, cobalt, lithium, copper and nickel, etc. will likely follow the same upstream demand side (mining) narrative of human rights’ violations and unacceptable environmental consequences: child labour, destruction of the living environment of indigenous peoples, ecological destruction, water shortage etc.”28

One of the experts Industriall Global Union consulted with was Andy Leyland, head of Supply Chain Strategy at Benchmark Mineral Intelligence. Leyland noted that battery makers and electric vehicle manufacturers are pressing for cost reductions, at all points of the supply chain, including mining. For this reason, he warned that working conditions and other factors at existing mines are likely to degrade significantly in a “race to the bottom.” The result would be worsening environmental injustice at the point of production – i.e., generally the global south – while developed-country “green recovery” scenarios seek to implement environmental justice on the home front.

Prices are also a driver of concern. Andy Leyland forecast that prices for batteries will increase, even though virtually all expectations are for declining prices. Nearly every “green recovery” and 100% renewable energy scenario rests on the assumption of continued price declines in generation, transmission, storage (including batteries) and other aspects of power systems. These scenarios have even increased the call on CRMs by simplistic modeling of the economics of scaling “green hydrogen” to 100 GW in a decade. They assume that learning-curve dynamics will drive the price of renewable-produced hydrogen below the “blue hydrogen” produced by fossil fuels by 2030.29 Yet as Andy Leyland highlighted above, the patent fact is that “demand for the required raw materials will grow faster than new mining capacities can be created.”30 Clearly, some hard, strategic choices have to be made on maximizing the efficient use of CRMs, lest the cost of decarbonization be even worse inequality and energy poverty.

The general response to this kind of information is to argue for substitution of the supply-constrained CRM. But there are limits to that. One example is seen in the effort to use nickel to reduce reliance on cobalt in electric vehicle batteries. In collaboration with Panasonic, the US automaker Tesla has been at the forefront of this initiative. Indeed, Tesla’s goal is to entirely eliminate the role of cobalt in electric-vehicle (EV) batteries, and it is achieving notable success in this objective. However, the initiative has encountered something of a “whack a mole” phenomenon. This is because supplies of nickel are increasingly constrained, posing a challenge to large-scale substitution of cobalt in the high energy-density batteries required for electrified transport. Global demand for nickel in EV batteries is projected to increase from 3% of all sources of demand (such as stainless steel, non-ferrous alloys, and other products) in 2018 to 12% by 2023, as global automakers are expected to introduce over 200 new EV models. But the volatility of prices for nickel has been a drag on investment in increased mining capacity. In consequence, metals analysts warn that “[t]here is no new nickel in the pipeline” even as other specialists highlight the time required to find alternatives.31

Hence our precarious present, where green-energy scenarios of “overbuild”32 and “electrify everything” assume a cornucopia of copper and other CRMs that bemused analysts understand does not exist. The present is not intellectually sustainable, and we should not expect the geologic and other facts of CRMs to yield. Thus, it is indeed timely that the IEA undertake a global study of CRM.

Japan’s Supply-Chain Vulnerabilities

A more long-term set of issues for Japan, in particular, are supply-chain vulnerabilities. Just as Japan has virtually no fossil-fuel resources, it does not have significant terrestrial endowments of CRM. The country has had strong trade ties but, at times, a rocky political relationship with neighboring China. Over the last decade, Japan has somewhat diversified its rare earths supply, wary of China’s demonstrated capacity to restrict exports. Even so, 58% of Japan’s rare earth imports came from China in 2018, according to the Center for Strategic and International Studies “China Power” project.33 As figure 3 shows, the Center’s data reveal a persistent reliance on China for rare earth imports among all the major developed economies, and not just Japan.

Figure 3: Reliance on rare earth imports from China, 2008-18

Source: China Power, 2020

And as we see in Figure 4, a 2020 report from the Japan Oil, Gas and Metals National Corporation (JOGMEC) warns that China enjoys a continued monopoly in the separation and purification of rare earths. The figure shows the degree of Chinese dominance at various stages of the supply chain, from mining through to manufacturing. The figure shows that even though some rare earth mining takes place in the US and Australia, nearly all separation and purification is done in China. One reason is that China’s willingness to bear the enormous environmental damage from mining and purifying rare earths allows it to weaken the investment incentives of would-be competitors.

Figure 4: Risks in the rare earths supply chain

Source: JOGMEC, 2020

It is quite concerning for Japan, and not only Japan, that China dominates the mining and processing of rare earths and many other CRMs. Last month, Japan’s Ministry of the Economy, Trade and Industry (METI) stated in its vision for the domestic offshore wind industry that Japan must aim to produce at least 60% of components locally in order to cut costs.34 Under business as usual, the viability of this goal depends heavily on China’s interest in continuing to export a large share of its CRMs to Japanese manufacturers. Japan is perhaps uniquely exposed because it has scarce resource endowments in tandem with fraught relations with China. Increased access to rare earths is imperative for building a high-tech and decarbonizing domestic economy and exports, yet China is a strategic competitor rather than partner.

Yet China is increasingly using its own rare earth and other CRM, in domestic deployments of solar, wind, electric cars, 5G communications, and other devices. And as Chinese scholars now warn, given increasing demand and competing uses there simply may not be enough for China to continue satisfying the bulk of Japanese and other international demand.35

The ESG Imperative

The coal-fired power and lax environmental regulations that have helped make China a formidable player in CRMs, and by extension a major factor affecting Japan’s manufacturing and energy strategies, may soon work against it. Extracting and processing rare earths and other CRMs is very energy-intensive, with massive carbon footprints when undertaken in locales dependent on fossil-fuels, as China still is. Certainly, China is seeking to strengthen environmental rules relating to rare earths and other CRMs.36 But its big handicap may be energy, as the most recent data from the IEA show that China’s power mix in November 2020 was 66% coal and rising.37

China’s very GHG-intensive energy is an issue because of the striking rise in prominence of environmental, social and governance (ESG) rules. These rules are now forcing firms to forego the business-as-usual approach in securing CRMs, obligating them to accept responsibility for the lifecycle environmental cost of products. These rules are expanding among governments (especially the EU), global finance agencies (such as the Financial Stability Board), and investor services. ESG rules are thus becoming of increasing concern to miners. For example, figure 5 shows the results of a White & Case survey of 68 high-level stakeholders in metals and mining (not just CRM), released January 13, 2021. The survey shows that ESG is by far the top issue, at 45.4% versus second-ranked COVID-19 supply-chain risks at 13.6%.

Figure 5: Key risks for mining & metals in 2021

Source: White & Case, 2021

As with any other business sector, the extension of ESG rules into the CRMs involves three areas, or “scopes,” that apply to the firms producing them. First are scope 1 direct GHG emissions from the firm’s in-house fuel combustion and the like. Scope 2 include GHG emissions from the firm’s use of electricity and heat generated elsewhere. And scope 3 emissions are the indirect, value-chain emissions that are beyond the firm’s control but generally susceptible to its influence. Figure 6 portrays these 3 scopes in some detail, providing examples of how they relate to the reporting firm per se, in addition to its upstream and downstream activities. Of particular importance concerning CRMs is that their GHG-intensity is increasingly not simply an issue for the mining and processing firms. Rather the firms that use refined CRMs in building wind turbines, electric vehicles, and other devices also have to assess those materials’ ESG implications.

Figure 6: GHG scope and emissions across the value chain

Source: GHG Protocol, September 2011.

It would be wrong to assume that these ESG and other rules mean little in practice. ESG rules are becoming one of the primary mechanisms countries are using to build strategic autonomy and resilience. The EU experts have already undertaken detailed comparative assessments of the carbon footprints of CRMs made in China versus produced in Europe. Figure 7 provides a summary of the details for the CRMs aluminum, nickel, silicon and zinc. The data indicate that a given weight of Chinese-made aluminum was 2.8 times as carbon-intensive as its EU-made equivalent. For nickel, the difference was even greater, at 8 times. Similar China-EU gaps are evident for the silicon needed in solar, semiconductors, and other applications; and the zinc used in galvanizing steel, batteries, and other areas pertinent to decarbonization.

Figure 7: Carbon footprint of primary metals production, EU vs China (tCO2)

Source: Institute for European Studies, 2019

Indeed, the EU “taxonomy” of sustainability rules applied to its Critical Raw Material Action Plan is very strict. The carbon thresholds for aluminum (one of the EU CRMs) is so restrictive that “[o]nly producers with access to massive volumes of nuclear or hydropower can meet such a requirement.”38 Chinese aluminum, produced via its coal-based power grid, would certainly not make the cut.

The upshot of these rules is that a Japanese manufacturer of, say, wind power equipment will need to factor in the additional “cost” of the environmental impacts of CRMs they import. Put simply, in the choice between a bar of metal produced with clean energy and another with dirty energy, the former will become more attractive. At the very least, the cost of the metal will be assessed in terms of both production costs and ESG impacts. The resulting all-in cost may in time also include an emissions tax and similar measures.39

This new trajectory of competition and price-discovery is already emerging in certain energy fields, such as LNG. Producers are being encouraged to offer carbon offsets as part of the sale, anticipating compulsory rules. That is, businesses are anticipating stricter formal rules by bringing in measures that help reduce the overall LNG supply chain.40

Similar trends are already emerging in the CRM space – not in spite of, but because of the strategic importance of these materials. As US mining financier Robert Friedland put it in the January 18 meeting of the Association of Mineral Exploration annual conference, “There will be no one price for copper, there will be no more one price for gold… Everything will be priced in relation to its ESG components.”41

Whither Japan?

As it stands, Japan’s laudable zero-carbon ambitions effectively commit it to a massive increase in imported CRMs, even in the short run. Targets for 2050 matter far less than the fact that virtually all the major economies are implementing CRM-intensive green recovery projects. Japan’s green initiatives have this larger context. As we have seen, wind power and electric vehicles requires many multiples of CRM than the many gigawatts of conventional power and millions of vehicles they are to displace in a decade or so.

One would think resource-poor Japan would be leading the world on means to maximize CRM-efficiency and engagement with ESGs. But Japan has a weak mining industry and consequently poor public and specialist debate on CRMs. To date, resource-poor Japan has emphasized CRM recycling and substitution. But as the IEA and other studies show, those strategies are buckshot rather than silver-bullet solutions. And over the next several years, Japan will have to secure much larger volumes of CRMs in the midst of increasing resource nationalism, worsening ore-grades, and other complications. At the same time, life-cycle emission commitments will push Japan to be choosy: if it fails to procure ESG-conforming “green CRMs” rather than the environmentally costly “gray CRMs” it currently sources, it will risk forfeiting business in the midst of history’s biggest energy revolution. Yet so far, Japan’s domestic resource and energy-environmental policy debates have yet to grapple with the dilemmas. We have seen that Japan has a list of CRMs, but its policymaking has yet to link them to ESGs. The METI is yet to produce data on the CRM-intensity of, for example, the gigawatts of offshore wind and millions of tonnes of green hydrogen being bandied about.42 And Japan’s business media, green-energy advocates, and other stakeholders pay no attention to the enormity of CRM challenges in tandem with ESGs.

Japan has a significant opportunity. Its exposure to CRM supply uncertainties give it ample incentives to act. And its purchasing power affords it significant capacity to lead on CRMs – to be a rule maker rather than a rule taker. This may happen, as Japanese industry stakeholders at the core of Japan’s decarbonization industrial strategy are increasingly (and quite legitimately) concerned that rules “stipulated, regulated and decided by the EU will become the global standard.”43 The IEA’s announcement of its critical mineral initiative has been followed by a flurry of high-level international governance changes and collaborative deliberations. Perhaps we will see Japan’s comparative complacency on CRMs and ESGs undergo rapid change over the next few months.

Notes

On this, see (in Japanese) “Carmakers also aim for decarbonization by 2050,” Nikkei Shimbun, December 17, 2020.

One example is Japan NRG founder Yuriy Humber’s article “There are good reasons to celebrate Japan’s decarbonization pledge,” Nikkei Asia, December 12, 2020.

Other terms include “green energy metals,” “energy transition metals,” “battery metals,” and the like. These terms generally delineate subset groups of minerals and metals used in renewable energy, battery storage, and more specific applications.

The IEA announcement is summarized at “IEA to produce world’s first comprehensive roadmap to net-zero emissions by 2050,” International Energy Agency, January 11, 2021.

See Patrick Andersson, “Chinese assessments of ‘critical’ and ‘strategic’ raw materials: Concepts, categories, policies, and implications,” The Extractive Industries and Society, Volume 7/1, January 2020.

Australia’s critical minerals list reflects its resource endowments as much as assessments of domestic needs and supply risk. See Jack Bedder and Jack Anderson, “Critical materials: Australia releases updated critical minerals list,” Roskill Industry News, November 6, 2020.

See p. 47 in (in Japanese) “Arguments relevant to deciding the new international resource strategy,” October 4, 2019.

Japan’s 2012 list is summarized on p. 23 of (in Japanese) “Outline of the Strategy for Resource Security,” Materials presented to cabinet member meeting on promotion of package-style infrastructure exports, June 27, 2012.

See Jack Anderson, “Critical materials: EU releases updated critical raw materials list,” Roskill Industry News, September 4, 2020.

The EU list separates the rare earths into two categories of heavy and light elements. On the EU list and its evolution, see “Critical raw materials,” European Commission, nd.

A summary of the rare earth elements can be found at “Rare earth elements facts,” Natural Resources Canada, November 27, 2019.

The global data on rare earths are summarized in “Mineral Commodity Summaries, 2020” United States Geological Survey, January 31, 2020.

One good visual portrayal of copper’s role – too detailed for reproduction in the present paper – is available on the title page of “Critical materials for strategic technologies and sectors in the EU – a foresight study, 2020,” European Commission.

For this reason, many American experts argued their own country’s CRM list should include copper. See Veronica Tuazon, “’Critical Minerals’ list snubs copper, sparks discussion of criticality,” Earth Magazine, December 20, 2018.

See Dieuwertje Schrivers et al., “A review of methods and data to determine raw material criticality,” Resources, Conservation and Recycling, Vol. 155, April 2020.

See Simon Flowers, “The energy transition will be built with metals: Getting to grips with supply of the Big 5,” Wood Mackenzie, October 30, 2020.

In May of 2020, China’s recovery from COVID-19 was already generating more emissions than pre-COVID. See Lauri Myllyvirta, “Analysis: China’s CO2 emissions surged past pre-coronavirus levels in May,” Carbon Brief, June 29, 2020.

Renewable do of course dirty energy and a lot of metallurgical coal in their manufacture, but we do not address those issues here. On the coal data for 2020, see “Global coal production will grow this year despite covid-19,” Mining.com, April 9, 2020.

In this respect, an illuminating study of copper can be found in Branco W. Schipper, et al., “Estimating global copper demand until 2100 with regression and stock dynamics,” Resources, Conservation and Recycling, Vol.132, May 2018.

See “Securing Critical Materials for Critical Sectors: Policy options for the Netherlands and the European Union,” Hague Centre for Strategic Studies, December 10, 2020.

On these data, see the summary of comments by Saad Rahim, Chief Economist and Global Head of Research, Trafigura, in “JEF U: Commodity Market Perspectives from Trafigura’s Chief Economist,” Jefferies University, December 16, 2020.

See Zachary Shahan, “Voodoo Economics & Lithium — Lithium Supply = 15% of 2023 Global EV Sales Target,” Clean Technica, September 7, 2020.

See “Developing an global trade union battery supply chain strategy,” Industriall Global Union, November 20, 2020.

On this scenario, see “Making Green Hydrogen a Cost-Competitive Climate Solution,” International Renewable Energy Agency, December 17, 2020.

Rhiannon Hoyle, “Electric-Car Dreams Could Fall a Nickel Short,” The Wall Street Journal, September 29, 2019.

On overbuild scenarios, see Michael J. Coren, “It’s time to start wasting solar energy,” Quartz, December 30, 2020

See the data in “Does China Pose a Threat to Global Rare Earth Supply Chains?,” China Power. July 17, 2020.

See p. 61 in (in Japanese) “A Green Growth Strategy with Carbon Neutrality by 2050,” Japan Ministry of Economy, Trade and Industry, December 25, 2020.

See Jiashuo Li et al., “Critical Rare-Earth Elements Mismatch Global Wind-Power Ambitions,” One Earth 3, July 24, 2020.

On these developments, see Leslie Liang, “Rare earths: China’s new rare earth regulations strive for better industry management,” Roskill Industry News, January 18, 2021.

See “Electricity mix in China, January-November 2020,” International Energy Agency, January 15, 2021.

See Anna-Michelle Asimakopoulou, “The EU Taxonomy: a means to an end that risks being the end of many industries,” EURACTIV, January 20, 2021.

A discussion of these ESG-related tax and other measures can be found in the “OECD Business and Finance Outlook 2020 : Sustainable and Resilient Finance,” OECD, 2020.

For a detailed discussion and examples, see “Decarbonization of the LNG supply chain: challenges and the way forward,” Herbert, Smith, Freehills Legal Briefing, January 14, 2021.

See the quotations in Nicholas Bennett, “Revenge of the miners,” Business in Vancouver, January 18, 2021.

“Green hydrogen” implies a lot of CRM invest in wind and solar for power inputs plus to platinum and other materials for electrolizers. David Fickling, “Hydrogen is a trillion dollar bet on the future,” Bloomberg News, December 2, 2020.

This concern was expressed on December 6, 2020 to the Financial Times by Suntory chief executive Niinami Takeshi. Niinami is one of two private-sector advisors on Japan’s Council on Economic and Fiscal Policy, which is chaired by the prime minister and oversees integrated green-growth and industrial policy. See Niinami’s comments in Robin Harding, et al., “Japan warns against allowing EU to set emission rules,” Financial Times, December 6, 2020.