The US-China relationship continues to sour under the impact of Covid-19, with the Trump administration threatening to cut all ties with China in a move that would divide the world into two competing trade entities.1 It’s been a bad year for China, with accusations over the origins of the pandemic coming on top of China’s difficulties in managing the pro-democracy protests in Hong Kong.2 Under these circumstances, the energy perspective provides a fascinating set of insights into the evolving US-China relationship. The economic havoc unleashed by the Covid-19 pandemic has been bad enough, with reports of looming industry collapse by the International Energy Agency and others.3 But its economic impact has been exacerbated by an ugly price war in the oil industry, seeing prices tumble alongside a collapse in demand. At one point in April, the oil price reached a widely publicised negative level – an unprecedented phenomenon. Now the price is low but at present relatively stable, following a tripartite agreement between the world’s three largest oil suppliers – the US, Saudi Arabia and Russia. In the last few days, the oil price has recovered to nearly $30 per barrel, providing some modest relief.4 But the impact on the US has been severe, with the high-cost and highly debt-leveraged shale oil industry, which propelled the US to become the world’s largest oil producer, facing near collapse. It has long been the goal of both the Saudi and Russian oil industries to damage the upstart US shale industry, which was protected by relatively high oil prices. Now with this protection withdrawn, combined with collapsing demand, the US industry faces severe problems.

Meanwhile the clean energy transition continues apace, and looks like being strengthened in Asia by the chaos unleashed by the Covid-19 pandemic. In China in particular, but also in Japan and Korea, clean energy promises a lower cost energy alternative to the fossil fuels – coal, oil, gas – that powered Asia’s industrialization. The effect of the plunging oil price on everyone is decidedly mixed. The effect on China, the world’s largest oil importer, is entirely benign. China’s state-owned oil enterprises are benefiting from the low oil price by replenishing the national oil reserves. Meanwhile the US reliance on fossil fuels, notably shale oil where big players like Exxon-Mobil have been investing heavily, with full political support from President Trump, is about to take a severe beating. Had the US been diversifying its energy base and building a strong renewables sector, it would have taken advantage of this crisis (self-inflicted by major producers Russia and Saudi Arabia), to enhance its technological leadership. In the US power sector, solar and wind continue to grow only modestly (as shown in Fig. 4 below) while fossil fuel suppliers are now in deep trouble. Obvious opportunities are ignored — even pandemic-related loans for renewables to revive the economy remain untapped. Meanwhile China continues to ramp up its green economy sectors at a speed that could take it to a leadership on energy matters in the 21st century – from green electric power generation (solar and wind) and the manufactured devices involved, to green transport (electric vehicles EVs and fuel cell vehicles FCVs), energy storage, and the beginnings of a comprehensive hydrogen economy that could eventually phase out the fossil fuel economy.5

It takes a crisis to reveal the relative strengths of competing global giants. It is the oil price crisis and its impact on US shale oil production that is revealing just where China and the US stand with their very different energy strategies.

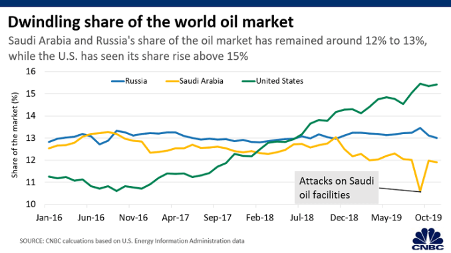

How oil market shares have evolved

The US ceased to be a dominant exporter of conventional oil in the 1970s – from which time US foreign policy was shaped by managing the flow of oil from Middle East suppliers such as Saudi Arabia, the United Arab Emirates, Kuwait, Iraq and Iran. But the technological innovation of hydraulic fracture (fracking), along with deep sea oil drilling and tar sands recovery, changed all that in the early 21st century. Horizontal drilling and other innovations helped create a new US oil industry based on huge reserves such as the Permian and the Bakken in Texas and Eagle Ford in Montana and North Dakota and into Canada. Fears of oil supplies peaking abated. The next decade of the early 2000s saw US oil fortunes transformed on the basis of unconventional oil – and focusing US energy interests once again on oil and fossil fuels and neglecting alternatives such as renewables.

|

Fig. 1: Global oil production shares: US, Saudi Arabia, Russia, 2016-2019 |

US oil production (with unconventional shale oil from hydraulic fracturing playing a major role) overtook Russian production in Feb 2018 and then Saudi production in July 2018, rising to account for 15% of global oil production by the end of 2019. This is costly production, due to the complex production methods and the high levels of debt leverage that enabled shale oil producers to break into the oil industry dominated by giant incumbents. This was a classic instance of Schumpeter’s argument that the dynamism of capitalism is unleashed by the capacity of innovators to break into an established industrial sector on the strength of debt finance. But in the case of shale oil, US producers need a break-even price of oil more than $45 per barrel in order to be profitable – a level that is much higher than costs of production of conventional oil producers.6 Over the past decade this break-even condition was satisfied, more or less (with the exception of an earlier price war in 2015 launched by Saudi Arabia to try to knock the US shale oil producers out of contention). But the combination of collapse in demand in March 2020 due to the pandemic, and the oil price war between Russia and Saudi Arabia, destroyed these favorable circumstances. The US shale oil industry has been in free fall ever since. According to an influential op-ed in the NY Times, “Energy independence was a fever dream, fed by cheap debt and frothy capital markets.”7 The Financial Times is adopting a similarly pessimistic tone in stating that at current levels (around $20 a barrel) the US shale oil industry cannot cover its costs, and bankruptcies are inevitable.8

How the oil price war unfolded

Oil prices have been maintained in recent years by agreements to curtail production by OPEC members (led by Saudi Arabia) and extended beyond OPEC to include Russia (OPEC +). In early March, OPEC and Russia agreed to extend production curtailment designed to bring supply into closer alignment with falling demand, under the impact of Covid-19. This agreement, the latest in an arrangement involving the OPEC+ countries, did not last. By March 13, it was clear that Russia would not go along with further cuts (which its strategists saw as unduly benefiting the US shale oil industry). So Saudi Arabia, under its mercurial crown prince, MBS, responded by launching a major price war, with its lead oil supplier Saudi Aramco offering steep discounts to leading customers, particularly in the EU, and at the same time drastically expanding the level of supplies. This price war was fuelled by long-standing rivalry between these two major oil producers, as well as their joint hostility to the US shale oil industry.

What followed was global chaos in the oil market – what the FT called “8 days that shook the oil industry – and the world”.9 Over the course of March and April, oil prices fell dramatically, actually reaching negative territory on April 20 – due to oil storage options dwindling and futures traders scrambling to find places to store unwanted deliveries. Saudi Aramco announced yet steeper discounts for its customers in April, leading to lower prices on the commodity exchanges.10 The dramatically lower oil prices in turn led to stock market mayhem.

The collapse in oil prices has been a dramatic illustration of the consequences of an otherwise strong cartel (in this case OPEC + Russia) falling apart, and the protagonists having the market muscle to engage in a “nuclear level” price war. It is the timing of this price war combined with the collapse in demand due to the pandemic that has unleashed the chaos that could prove ruinous to the US shale oil industry with profound impact on the US economy.11

|

Fig. 2. Crude oil prices in 2020 |

A price war generally lasts as long as the protagonists can withstand the damage they create. In this case the damage was enormous – described in the industry as a “nuclear version” of a price war. Saudi Arabia could withstand prolonged price cutting because of its low costs – reported to be as low as $4 per barrel.12 Russia likewise was prepared for a long price reduction, particularly because its supply lines – in the form of pipelines – are superior to those of its OPEC rivals. But it was the impact on the US shale oil industry that was most savage.

US shale oil production had been riding high after a decade of substantial investment, powered by debt leveraging. US oil production overtook that of Saudi Arabia and Russia as the shale revolution prospered. But this industry was uniquely vulnerable to a downturn because of its high costs.

The predictions from oil industry observers are dire. The Norwegian oil consultancy Rystad predicted on April 22 that the US shale oil industry was set for its biggest monthly decline in history amidst the “double whammy” of the oil price collapse and demand destruction due to Covid-19. The number of new- start fracking operations (lifeblood of the industry) in April fell by 60% (to below 300 wells – 200 in the Permian and 50 wells each in the Bakken and Eagle Ford). Rystad is predicting numerous bankruptcies in the US shale oil industry in 2020.13 The US business magazine Forbes describes the situation as “fracking’s new world order” where only the strongest US companies will be able to survive.14

What about the effects on China? China is the world’s largest oil importer (after the EU), and consumer (after the US), importing more than 70% of its crude oil requirements in 2019 – equivalent to 10.1 million barrels per day. With its largest oil supplier, Saudi Arabia, locked in a price war with Russia, its second largest supplier, China is able to take tactical advantage of the lower prices to expand its strategic oil reserves.15 But there is not the slightest hint that this welcome reduction in prices will shift China’s energy strategy, which favors a green shift linked to manufacturing and urbanization. As argued earlier, this shift has everything to do with maintaining energy security and relieving air pollution from burning of fossil fuels.16 It does not appear to be side-tracked by the economic slowdown sparked by the Covid-19 pandemic. The story is a complicated one, because China’s scale of industrialization is so large, and its early dependence on fossil fuels (coal, oil, gas) was so complete. So it is worth examining China’s quite different energy strategy, and the extent to which it is maintained even at a time of US-China hostility. While it remains a major user of coal, and still has the world’s largest carbon emissions, what is less widely known is that China is a world leader in the shift to renewables. It is a fortunate side effect of this consistent strategy that it is also a low-carbon strategy that can mitigate climate change.

The alternatives to oil – “manufactured energy” based on renewables

In the international political economy of the oil industry, Russia and Saudi Arabia have long been leaders because of the fortuity of large domestic oil reserves combined with national strategic choices made to build their economies around these accidents of geography. But China and the US are different. They need broad energy supplies – and their national great power strategies turn largely upon what their energy choices imply for securing those supplies. The US rose to great power status in the 20th century on the back of its oil industry, and it has been an oil power for the past century and more – reviving its industry dominance in the past decade by the turn towards alternatives like shale oil. China on the other hand has never been an oil power but has grown to become a major oil consumer and importer, with its troika of state-owned oil firms PetroChina, Sinopec and CNOOC. China has looked for stability in oil supplies even as it accesses supplies from late arrivals such as Iran (which became a major oil producer in the 1970s and is now a major supplier to China), Namibia and South Sudan – with all the geopolitical complications associated with these powers. For example, when China became an early customer of oil imported from South Sudan, the country was plunged into a civil war that curtailed these supplies. (As early as 2011, the year of South Sudan’s independence, China National Petroleum Corporation (CNPC) established an office in the country – but it had to withdraw when the civil war intensified.17) Such are the geopolitical constraints that have shaped China’s energy strategies towards favoring manufactured green choices and away from fossil fuel dependence.

Little wonder then that China has maintained an open-ended energy strategy, avoiding dependence on any single source (such as imported oil or coal) and maximizing its reliance on its strength in domestic manufacturing. As the rising 21st century great power, China first industrialized on the foundations of fossil fuels – coal, oil and natural gas. But the geopolitical constraints associated with this strategy (at the scale being pursued by China) proved to be severe, and have driven China to switch to a strategy where investments in clean energy outrank fossil fuel investments, and so the country’s energy system as a whole edges towards being more green than black (even if there are occasional instances of backsliding). When I last looked at these issues in detail, covering the years to 2017, the trend towards the greening of China’s electric power system was clear.18 But the system as a whole continued to be more black than green; electric power generated in 2017 was sourced overall from thermal sources to the extent of 71% with 25% from WWS sources.19 This shows that the transition at such a large scale is complex, and huge industries like coal mining and transport and coal burning cannot be phased out overnight if jobs and livelihoods are not to be savaged.

Neverthelss China’s overall energy strategy, based as it is on utilizing a foundation of urbanization, electrification and reliance on domestic sources of manufactured energy, has continued to place emphasis on renewable sources that provide a measure of domestic energy security. Wind power based on manufactured wind turbines; solar PV power based on manufactured solar cells; hydroelectric power based on dams and water turbines – these are the foundations of an energy strategy based on manufacturing rather than on drilling and digging for supplies beset by geopolitical uncertainties.

China’s investments in its domestic electric power system have been favoring renewable green (water, wind, sun: WWS) sources over black, fossil fuel sources, for the past several years. The impact is visible clearly in the rising trend towards WWS electric power, shown in Figure 3.

|

Fig. 3. China electric power generation, 1990 – 2019 Source: Author (with thanks to Ms Carol X. Huang) |

The chart shows that in the past decade, China’s electric power capacity sourced from green renewable sources (WWS) has increased from 24% to 38% — or a 14% green shift in a decade. This is a huge shift for such a large system. At this rate, China’s electric power capacity would exceed 50% WWS within the next decade – by 2030 or possibly earlier. This would be a tipping point of enormous significance – meaning that China’s electric power system (the biggest in the world) would be more green than black by this date. The chart reveals that China’s actual generation of green electricity (from WWS sources) has risen over the same decade from 18% to 27% of total electric generation – or a 9% green shift in a decade.20 Green power would then feed into other sectors including transport (EVs and FCVs as well as electric trucks, buses and fuel cell powered ships), construction and wider industry such as steel and cement. Because a green electric power system is based on manufacturing, and its costs are declining as per the manufacturing learning curve, so the greening trend can be expected to accelerate.

Meanwhile the US with its Trump-sanctioned bets being placed on the instabilities and high costs of shale oil, as opposed to the diminishing costs and energy security of manufactured energy associated with the green shift, is headed into an energy danger zone. US electric power capacity is still dominated by fossil fuels (LNG 43% and coal 21%, plus oil 3% — totalling 67%) with WWS sources accounting for just on 24% in 2019.21 The nuclear share remains at 9%, stable over many years, while wind and solar are rising slowly. The US counterpart to China’s green shift in electric power is shown in Chart 4, from the year 2005 when the US entered shale oil production. While there is a slow increase in renewables (mostly wind and solar with hydro barely changing) it is not on anything like the scale seen in China.22 Of course these are trends that could well be buffeted by continuing trade hostility between the US and China – but there is a momentum behind China’s strategic direction, given the continuing likely fall in costs of generating power from WWS sources, associated with the learning curve.

|

Fig. 4 US vs China: WWS sources of electric power (capacity and generation), 2005-2019 Source: Author, based on data from the BP Statistical Review and (for 2019) the Energy Information Administration (EIA). Thanks to Ms Carol X. Huang for the chart. |

The continuing trade war between the US and China largely bypasses these central energy issues, because the US and China are pursuing such different strategies. China is clearly not attempting to oust the US as an oil producer, while the US, since 2005 and particularly under Trump, is clearly not attempting to oust Chinese global ambitions in renewables and green energy. The result is a stand-off so far where Trump’s anti-China rhetoric has yet to claim any major casualties – but the election year 2020 could hold further surprises.23

These differences in trends in electric power capacity between China and the US are emblematic of starkly contrasting energy strategies. And it looks in early May as if a strategy based on continued reliance on extracting liquid fossil fuels from the ground, utilizing high-cost technological innovation in the form of hydraulic fracture, deep sea drilling and tar sands recovery is not such a good bet as contrasted with rising electrification, rising reliance on renewables (WWS) and the building of vast domestic manufacturing industries to supply the devices needed. China has discovered a formula for driving its industrial development with an energy strategy, building the industries of the future (renewable power, electric transport, regenerative farming) and allowing them to progressively take over the fossil fuelled incumbents. China has discovered that the costs of the clean energy transition are no more than would be required to maintain the fossil fuel status quo – and build new export-oriented industries at the same time, while reducing its dependence on foreign energy imports. It has taken an oil price crisis and a pandemic to reveal the clear differences between these competing national strategies and their contrasting implications.

Acknowledgments: My thanks to Dr Michael Peck and Prof Linda Weiss for their comments on an earlier draft, and to Ms Carol X. Huang for her assistance in drawing the charts.

Notes

‘Hong Kong in 2020: Pandemic, protest, and great power rivalry’, Mark W. Frazier, Asia Pacific Journal: Japan Focus, May 15 2020.

‘Renewable power surges as pandemic scrambles global energy outlook’, report finds, Science Mag, April 30 2020.

‘Oil prices stage a modest recovery as demand rises and supply drops’, New York Times, May 17 2020.

‘Covid-19 will not slow Southeast Asia’s shift from coal to renewables’, Sara Jane Ahmed, Nikkei Asian Review, May 11 2020.

‘Coronavirus may kill our fracking fever dream’, Bethany McLean, New York Times, Apr 10 2020. Bethany McLean is the author of Saudi America: The Truth About Fracking and How It’s Changing the World (Columbia Global Reports, 2018).

‘Will American shale oil rise again?’, Derek Brower and David Sheppard, Financial Times, April 25 2020.

‘Will American shale oil rise again?’, Derek Brower and David Sheppard, Financial Times, April 25 2020.

See my 2017 book, John A. Mathews, Global Green Shift, London, Anthem Press – and accompanying webpage.

New capacity added in 2017 amounted to 132 GW, of which 52 GW was thermal capacity (mainly coal) and 77 GW was sourced from WWS; likewise in terms of investment, fresh investment in 2017 on power generation was RMB 270 billion, of which RMB 74 billion went to thermal sources and 156.5 billion went to clean WWS sources. Both these results indicated that the system was greening more than blackening at the margin. See ‘The greening of China’s energy system outpaces its further blackening: A 2017 update’, John A. Mathews and Carol X. Huang, with comments from Thomas Rawski and Mark Selden, Asia Pacific Journal: Japan Focus, May 1 2018.

The shift in green power for electricity generation includes generation from hydro power, wind power and solar power, with their different capacity utilization rates. Hence the extent of the green shift for electric generation is lower than for capacity.

As shown in Fig. 4, by 2019 the US had built electric capacity from WWS sources amounting to just over 25%, compared with China’s level of 38.4%; and in terms of actual electricity generated, the US generated 18.7% from WWS sources, compared with China’s level of 26.4%. China has clearly advanced a lot closer to installing a clean energy economy in recent years.

See Mel Gurtov and Mark Selden, The dangerous new US consensus on China and the future of US-China relations, Asia-Pacific Journal: Japan Focus, Aug 1 2019, 17 (15/5).