|

In the twenty-first century, American-Chinese relations offers both a challenge and an opportunity for the United States, China, and the entire world. Since both countries re-opened their doors to each other in 1971, their economic and financial ties have been widely viewed as the “ballast” (ya cangshi压舱石) of an uneasy relationship.

A comparison between their embedded commercial relations now and pre-rapprochement affirms the U.S.-centered interdependency between the two giants.2 Their trading volume in 2012 reached an all-time high of $536.2 billion on U.S. books and $484.7 billion in Chinese calculation.3 In 1972, it stood at a mere US$4.7 million.

At present, with a population five times larger than America’s, China boasts an economy that is less than half the size of the U.S. economy. But forty years ago China’s Gross National Product was only about 7 percent of that of the United States. In 2012 China exceeded the United States as the largest trading nation in the world, and the United States became China’s largest export market.

Is China’s economic ascendancy a fundamental threat to American power and influence? Evolving trade patterns and institutions in the bilateral economic sphere during the last four decades suggest that China has neither the interest nor the wherewithal to remake or unmake the entire world economic system that the United States designed and dominated since World War II.4

The First Decade, the 1970s: Institution Building

The decade 1971–80 witnessed rapid institution building and the lifting of some of the barriers to the flow of goods, technology, and people between China and the United States. These changes transformed U.S.-China trade relations and China’s place in the world economy.

China was marginal to world trade in 1971 when President Richard Nixon announced his upcoming visit to China. A New York Times reporter wrote, “The news of President Nixon’s coming trip to Communist China, sensational as it is politically, produced virtually no effect on the stock market.” On August 15, 1971, in an attempt to redress inflation and unemployment, the Nixon administration devalued the U.S. dollar by 8 percent by imposing a system of wage and price controls and fixing the exchange rates for American currency. As a result, “one country after another began to float its currency against the dollar,” the Times noted. A few days later, James Reston filed this report from Shanghai:

The “dollar crisis” was no crisis in China. Even here in this commercial capital of the People’s Republic there was no public evidence that anybody was paying the slightest attention to Washington’s “new economic policy.”…Two days after President Nixon devalued the old greenback and sent a hiccup through all the banks and stock exchanges of Europe, I cashed $500 worth of American travelers checks at the old exchange rate in Peking. No problem. No questions asked. And even a day later, the banks here in Shanghai were still paying out on cabled dollars from New York as if nothing had happened.5

However, China’s economic and financial isolation was not to last. In March 1971, the State Department eased restrictions on U.S. citizens visiting China, and the following month American table tennis players toured the country in what became known as “ping-pong diplomacy.” In April, the Nixon administration announced five measures aimed at removing restrictions on commerce and travel between the United States and China. Under this initiative, the United States expedited visas for visitors from the People’s Republic. U.S. currency controls were also relaxed, allowing American citizens to remit money to Chinese citizens or organizations without prior Treasury Department approval.

There was also limited liberalization of commercial activity. In June 1971, Nixon officially ended the U.S. trade embargo on China, sweeping aside the legal barriers which had hindered significant economic interaction between the two nations since 1950. With restrictions lifted, U.S. companies were allowed to export certain non-strategic goods directly to China and haul Chinese cargo between non-Chinese ports. Nixon also eliminated the Foreign Assets Control requirement that subsidiaries of American firms in CoCom (Coordinating Committee for Multilateral Export Controls) countries had to obtain a Treasury license—in addition to a host country license—for the export of strategic goods and technology to mainland China.6 In 1973 Nixon decided that the United States should approve the export of eight state-of-the-art inertial navigational systems (INS) for four Boeing 707 aircraft sold to China, in addition to the INS required for three Anglo-French Concorde aircraft.

With full diplomatic relations established in 1979, the two governments moved to eliminate the remaining legislative and administrative hurdles to commercial relations.

|

Deng Xiaoping and Jimmy Carter restore U.S.-China diplomatic relations, 1979 |

Of critical importance, on January 24, 1980, Congress passed a trade agreement conferring contingent Most Favored Nation (MFN) status on China. This exempted Chinese exports to the United States from the high tariff rates stipulated by the Smoot-Hawley Act of June 1930, a measure that was long used to distinguish friends from foes among U.S. trading partners.

But despite China’s MFN trade status, new legal and political impediments to Sino-American trade relations arose. Under U.S. law, trade with the People’s Republic fell within the purview of the Jackson-Vanik Amendment contained in Title IV of the 1974 Trade Act. The Jackson-Vanik Amendment linked trade benefits with the human rights policies of Communist (or former Communist) countries. Not only did it deny preferential trade relations to offending nations, but those nations could not receive credits or credit or investment guarantees from the U.S. government. The U.S. president retained the authority to waive application of the Jackson-Vanik Amendment to a particular country, but Congress was required to review semi-annual reports on that country’s continued compliance in upholding freedom of emigration. In short, the amendment provided the legal grounds for the annual congressional renewal of China’s Most Favored Nation status until 2001, when China joined the WTO, whose rules prohibit members from imposing additional trade restrictions on other members.

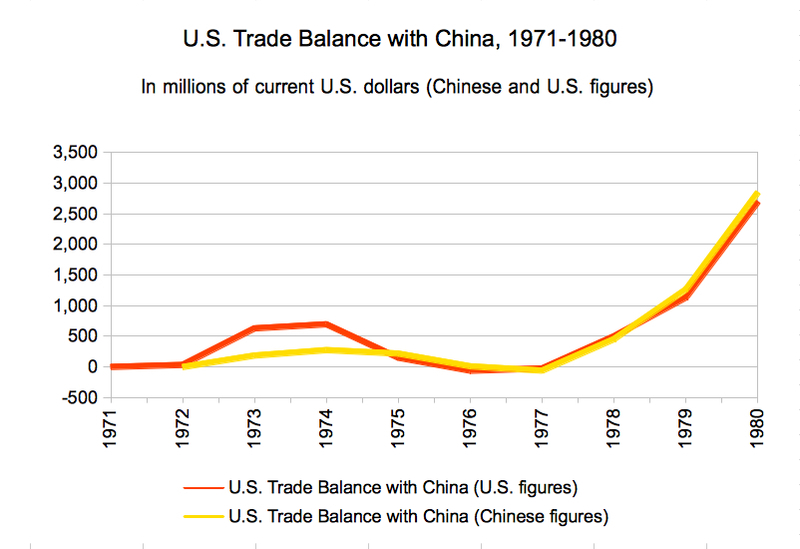

Chart 1, based on U.S. and Chinese sources, presents trade data for the first decade of renewed commercial activity between the two countries. The data show continued growth in trade—albeit at a low level—with a trough in U.S. exports to China during 1975–1977. With the exception of 1979 and 1980, the U.S. and Chinese figures rarely agreed with each other; however, their differences were marginal compared to the considerable discrepancies in trade statistics between the United States and China that began in the mid-1980s. The United States continued its restrictions on exports of technology and equipment to China. But during this period the United States sold to China more products than it bought from China, although America’s trade with China never amounted to more than 1 percent of total U.S. world trade. By the end of the decade, the total trade between the two nations was doubling each year, from US$1.1 billion in 1978 (U.S. figures; Chinese statistics recorded $991.7 million), to $2.3 billion in 1979 (Chinese figures: $2.4 billion), to $4.8 billion in 1980.

|

U.S. Trade Balance with China, 1971-80 |

The Second Decade, the 1980s: Reform and Growth

Throughout the 1980s, the normalization of political relations between the two countries and China’s economic reforms paved the way for acceleration in the American-Chinese transfer of goods, values, ideas, personnel, and technology. These interactions were mutually beneficial, although from the U.S. point of view China trade was still small. However, as early as 1984 the U.S. had become China’s third-largest trading partner, trailing only Japan and Hong Kong, then still a British colony. On the other hand, as America’s 14th-largest trade partner, China accounted for a paltry 1.7 percent of total American foreign trade in 1988 and 2.2 percent in 1990.

The 1980s witnessed the restructuring of the Chinese domestic economy, coinciding with China’s opening to the outside world. Here the position of Hong Kong as an entrepôt linking East with West was crucial. A key step involved harnessing Hong Kong’s trading power in world markets by encouraging Hong Kong firms to sign export processing contracts with businesses in China’s newly established Special Economic Zones in Guangdong and Fujian Provinces. By the mid-1980s the number of companies engaged in the direct export and import trade had increased dramatically, and the central government relaxed controls over local agencies and prioritized revenue creation. Government tax incentives to both domestic and foreign investors virtually turned China’s entire littoral into a lucrative export-processing zone.

These dual trade reforms resulted in an annual growth of around 10 percent in China’s Gross National Product (GDP) from 1983 to 1987, and a 15.8 percent annual expansion in international trade. China’s foreign trade virtually tripled from US$20.6 billion in 1978 to US$60.2 billion in 1985, while trade with the United States increased sevenfold, from about US$1 billion to over US$7 billion. The U.S.-China opening was a signal for China’s emergence in the world economy, paving the way for rapidly expanding Chinese trade with Europe and the Asia-Pacific.

U.S.-China economic relations were facilitated by the steady liberalizing of U.S. controls over American exports of advanced technology. In 1980, such exports to China were reassigned from category Y (the Warsaw Treaty countries) to category P (new trading partners with the United States). Then in May 1983 under the Reagan administration (1981–89) they were assigned to category V (American allies), thereby allowing additional exports. A three-tiered system of export licenses further streamlined the licensing process, placing 75 percent of export license applications in a “green zone” under the sole control of the Department of Commerce.

In the second half of the decade, finished manufactures and technologically advanced products began to enter the China market. At the same time, textiles and clothing accounted for more than 40 percent of the total value of Chinese exports to the United States. After Hong Kong and Macau, the primary conduits for overseas Chinese capital, the U.S. was the largest investor in China, with about $3 billion in assets by 1985.

Following Chinese economic reforms of the 1980s, U.S. consumer goods companies were increasingly drawn to China. American companies entered the country by forming joint ventures with a Chinese company or government agency. Early participants included such giants as H. J. Heinz, R. J. Reynolds Tobacco, Coca-Cola, American Express, American Motors, AMF, Inc., General Foods, Beatrice, Gillette, Pepsi-Cola, Eastman Kodak, AT&T, Nabisco, and Bell South.

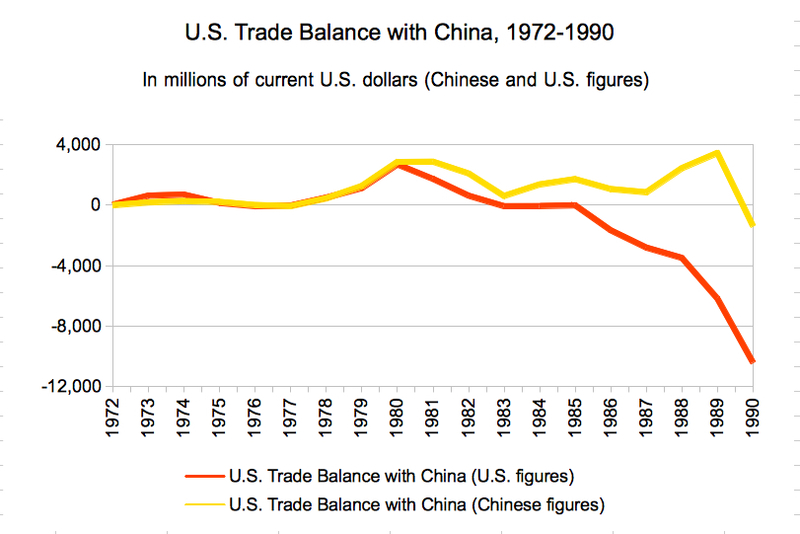

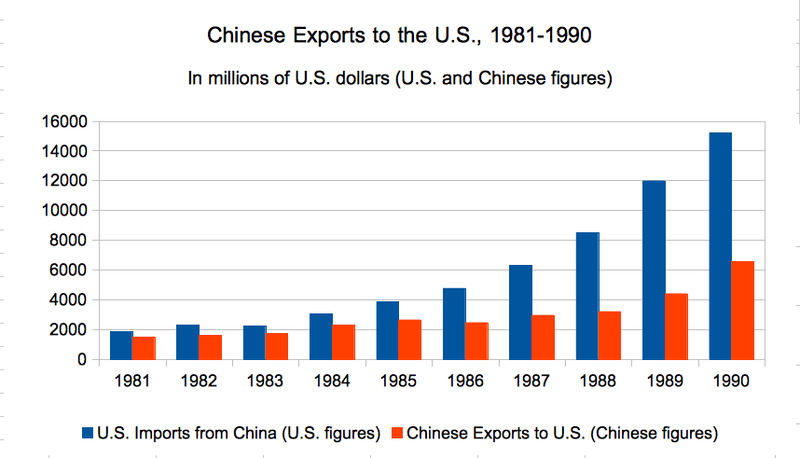

While bilateral trade advanced at breakneck pace, the two nations wrangled over trade statistics, as illustrated in Charts 2 and 3. American statistics show that 1986 was a turning point, with a US$1.67 billion trade deficit against the United States, which kicked off a deep, quarter-of-a century trade deficit with the People’s Republic. In stark contrast, the Chinese figures for 1986 show a more than US$1 billion deficit against the P.R.C.—one point on the long curve of a trade deficit stretching from 1973 through 1992.

|

Chinese Exports to the U.S., 1981-1990 |

A complex array of local, regional, and international factors contributed to U.S.-Chinese disagreements over the size and causes of the trade deficit. We will focus on one point of dispute—whether American and Chinese exports and imports channeled through Hong Kong should legitimately be considered part of U.S.-China trade.

Hong Kong’s intermediary role in connecting China with the world was vital to the Chinese economy during this period. In the mid-1980s, over 30 percent of China’s foreign exchange passed through Hong Kong. The United States was the largest foreign investor in Hong Kong, with 54 percent of the total, followed by Japan (21 percent) and the United Kingdom (7 percent). In 1984 the U.S. was the leading export market for Hong Kong, with about US$7.8 billion worth of exports, and the colony’s second-largest re-export market, handling trade worth approximately US$1.5 billion. In 1984, China provided 25 percent of Hong Kong’s imports (and 45 percent of its food imports), overtaking Japan as the territory’s leading supplier. In the same year, American exports channeled through Hong Kong to China amounted to US$375.9 million, while China exported over US$1.125 billion worth of goods through Hong Kong to the U.S. The Chinese insisted that these Hong Kong re-exports accounted for 50 percent of China’s total exports to the United States that year (they accounted for almost one-third according to the U.S. statistics).

|

U.S. Trade Balance with China, 1972-1990 |

According to Chinese trade figures, 60 percent of Chinese exports to the United States in the mid-1980s were initially consigned to buyers in Hong Kong who resold them to a third party, who then shipped them to the United States. A further 20 percent of Chinese exports to the U.S. were re-exported via a third country. Although the Chinese accepted that such goods had originated in China, they argued that the 40–100 percent appreciation accrued through re-export markups should not be computed as China’s direct imports to the U.S. According to China, the added value of re-exports to the United States in 1992 and 1993, amounting to US$5.23 billion and US$6.3 billion, respectively, should be deducted from Chinese export figures for those years.

Although U.S. trade statistics did not record goods traded to China via Hong Kong, they did trace the countries of origin of all imports, including re-exported goods. Similarly, prior to 1993 the Chinese authorities did not keep an account of the final destinations of goods exported through Hong Kong—figures which might have compromised the value and volume of Chinese exports to the American market. The differences in accounting practices suggest that “the discrepancies between official trade figures may be brought down by as much as three-quarters when adjustments are made.”7

While statistical differences would soon lead to escalating frictions between China and the United States, the 1980s were years of enthusiasm on both sides. Their commercial relationship grew 44 percent per year. But a decade of sustained improvement in Sino-American relations suffered serious setbacks sparked by the Tiananmen crisis of 1989 and the collapse of their common enemy, the Soviet Union.

The Third Decade, the 1990s–2001: Discord and Developments

Since the late 1980s, there has been a dissonance between the fluctuating political and military relations between China and the United States and their expanded ties in the areas of trade, society, religion, and culture. From George H. W. Bush’s time in office (1989–93) through the Clinton years (1993–2001), and under President Jiang Zemin (1989–2002) and Premier Zhu Rongji, the two powers weathered a number of critical developments that set new directions for their economic relationship.

The Tiananmen Crisis

As the common threat of the Soviet Union dissipated, China and the United States drifted into an uneasy relationship in which their expanded economic ties belied the uncertainty of geopolitics. The gravest challenge to the bilateral relationship since the rapprochement of 1972 originated in the Tiananmen student protests in Beijing in May–June 1989. They turned out to be a global event that put China under an unprecedented—and unfavorable—media spotlight.

In reaction to the violent crackdown in China, President Bush ordered suspension of all government-to-government sales and commercial exports of weapons, and suspension of bilateral visits between military leaders. He also urged a sympathetic review of requests by Chinese students in the United States to extend their stay, and offered humanitarian and medical assistance through the Red Cross to those injured during the Chinese army’s assault on the square. In addition, he ordered a review of other aspects of the bilateral relationship.

Following a two-year setback (1989–91), China’s transition to a market-oriented economy moved into high gear, symbolized by Deng Xiaoping’s “Southern Tour” of Shenzhen and other Special Economic Zones in South China in early 1992.

|

Deng Xiaoping’s southern tour, 1992 |

Deng’s strong endorsement provided the momentum for a new phase of economic reform. This second phase, led by Jiang Zemin and Zhu Rongji, rested on regulatory and administrative restructuring of the banking, taxation and corporate governance systems, as well as further exposure to world markets through China’s membership in the WTO. China’s strong commitment to reform yielded multiple outcomes—price stability replaced rising inflation; the number of state-owned enterprises (SOEs) dwindled while the number of private firms increased, so that the latter employed twice as many workers as the SOEs by the end of 2004; and increased market competition sharpened pressure on employers and employees alike, contributing to massive layoffs and social inequity.

In the wake of the Tiananmen crisis, American-Chinese relations were severely strained over the issues of human rights, Taiwan, and numerous other issues, while leaders in both countries attempted to improve the relationship and work towards a constructive strategic partnership. The annual renewal of Most Favored Nation (MFN) status for China quickly became a vehicle for American debate over human rights, tougher economic sanctions, and revocation of China’s MFN position.

Human Rights: Trade and Politics

Human rights issues were severed from the annual extension of China’s MFN trading status in spring 1994. Less than two weeks after his inauguration in January 1993, President Bill Clinton, with Tiananmen and his campaign attacks on President Bush’s “soft” stance on China behind him, appointed former American ambassador to China Winston Lord to head the Senior Steering Group (SSG) charged with advising him on China’s MFN status. On May 28, 1993, Clinton bypassed Congress and issued Executive Order 128590 linking the renewal of China’s MFN status to seven conditions tied to human rights issues. These conditions were free emigration, cessation of exports manufactured by prison labor, observance of the UN Declaration of Human Rights, preservation of Tibetan indigenous religion and culture, access to prisons by international human rights organizations, permission for international radio and TV broadcasts, and the release of prisoners held on political and religious grounds. Clinton’s intervention represented a sharp departure from George H. W. Bush’s position that political democratization would occur as China’s economic status improved. However, a year later, on May 26, 1994, the Clinton administration reversed its stance and decoupled human rights issues from MFN, an approach that enjoyed the support of American business, which argued that “the only way to undermine the regime is to infiltrate it.” Some business executives pledged that “missionaries and businessmen will work together to change China, unless Congress interferes.”8

This striking policy turnaround had three major implications. First, Clinton’s

reversal of his 1993 executive order raised questions about the ways in which moral issues such as human rights violations should be addressed in American politics and foreign policy.

Second, the China question became a political football in the U.S. The intense debate over China policy during both terms of the Clinton presidency (1993–2001) involved a wide spectrum of interest groups. On the one hand, the debate highlighted the checks and balances over the presidential prerogative in foreign affairs and Congress’s role in handling trade issues under the U.S. Constitution. On the other hand, it showed the extent to which bilateral relations had expanded since 1972 and China had “returned” to American politics.

Third, vacillation over linkage of human rights to economic interests set the tone for the roller-coaster ride that was to mark political relations between China and the United States in the years to come. Since 1995, the U.S. had sought a resolution condemning Beijing’s human rights practices from the UN Human Rights Commission in Geneva, but had been defeated, with virtually no support forthcoming from other countries. On the other hand, as critics and other observers pointed out, in China political dissidents received little sympathy and were viewed as “stupid” idealists by the majority of Chinese.9

China’s Entry into the WTO: A New Order

China’s entry into the World Trade Organization (WTO) on December 11, 2001 established a new order in its export-driven economy and in American-Chinese relations. It took 15 years of negotiations (1986–2001) for China to become the 143rd member of the WTO. Joining forces with China, the United States was the prime mover in China’s accession to the WTO.

Although the WTO came into being on January 1, 1995, its predecessor, the General Agreement on Tariffs and Trade (GATT), dates back to 1948. GATT was originally set up to regulate international trade in commodities, but over the years its role has evolved through several rounds of negotiations aimed at settling trade disputes. The last and largest of these was the Uruguay Round from 1986 to 1994, which led to the birth of the WTO. Reflecting changes in world trade, the WTO subsequently extended its purview to trade in services and intellectual property. Legally, WTO instruments constitute binding rules intended to help exporters and importers trade as efficiently as possible.

China was one of the original signatories of the GATT. In 1971, the GATT revoked Taiwan’s membership in line with UN recognition of the People’s Republic of China as the legitimate government of China, and PRC accession to membership in the Security Council. In the opinion of Long Yongtu, chief Chinese WTO negotiator, China’s readmission should have been a relatively straightforward process at the time. However, in the early ‘70s, China regarded the GATT as “a rich countries’ club,” mainly comprised of developed nations, and declined to join.

In 1986, China formally applied to join the GATT. Chinese leadership, now committed to the process of reform and “opening”, feared that failure to join the organization might result in enormous financial losses (e.g., in the textile industry). Progress in China’s bid to join the WTO was made in 1992 when, during his “Southern Tour” of the nation’s Special Economic Zones, Deng Xiaoping announced that China under socialism could adopt a market economy structure.

Compared with the talks held with 30 or so other countries, negotiations with the U.S. over China’s entry into the WTO were arduous. The Chinese felt that the American negotiators were domineering and dug in their heels. The WTO talks were suspended in 1989 in the wake of the Tiananmen Incident. They resumed over two years later when senior Chinese leaders became personally involved in the process, aware that membership in the WTO would be an important tool to undermine Western sanctions and deterrence against China.

Sino-American negotiators considered trade issues relating to over 4,000 classes of merchandise, in addition to U.S. access to Chinese banking, insurance and telecommunication industries. While China was eager to be part of the WTO, it sought to join as a developing country and insisted that the balance between obligations and rights be respected, especially by developed member states. “The developed countries, as the initiators and the biggest beneficiaries of globalization and liberalization, ought to shoulder even more international responsibilities and obligations and create conditions for the developing countries to actively participate in the process of globalization and liberalization and fully integrate into the world economy,” China’s UN envoy stated.10 Despite China’s misgivings, the leaders of both countries felt China’s WTO membership could improve their relationship. President Jiang Zemin and the Politburo made the political decision to push trade negotiations with the U.S., and Zhu Rongji participated directly in the final round.

China’s membership in the WTO has contributed to major growth in international trade and investment; commercial operations both in China and overseas have widened and grown increasingly sophisticated. In the course of 30 years, China emerged from relative economic insignificance to become, in 2005, the world’s third largest trading nation after the United States and Germany, and in 2012 the largest. In 1978, the total value of China’s trade was US$20 billion, 30th in the world. In 2005 China’s trade had rocketed to $1.4 trillion, and in 2012 it was $3.87 trillion.

American exports to China increased by 81 percent in the three years after China joined the WTO, compared with 34 percent in the three previous years. Similarly, American imports from China rose by 92 percent in the three years following China’s WTO entry, having risen by just 46 percent in the three previous years.

As the business environment in China improved, American entrepreneurs explored new opportunities. The lure of the China market has been felt across the board by American business. In 2004, Wal-Mart was America’s largest corporation, with revenues that made up 2 percent of the nation’s GDP. Of Wal-Mart’s 6,000 suppliers, 80 percent were in China.

Yet frictions in U.S.-Chinese relations remain in spite of their enhanced economic cooperation and flourishing bilateral trade. Trade imbalances, intellectual property rights, industrial policy, and investment environment are major American concerns. China, on the other hand, has demanded fair business and investment opportunities in American and world markets.

The Fourth Decade, 2001–2012: Cooperation and beyond the WTO

Compared with the ten years from 1990 to 2000, during the first decade of the 21st century the bilateral relationship between China and the United States expanded at all levels, notably in communications and crisis management. Both countries have attached great political importance to their economic relations. From the Chinese government’s standpoint, bilateral trade and foreign investment have been crucial for China’s modernization and international stature. For its part, the United States, while strengthening its trade with China, has repeatedly subjected economic activity involving China—including trade, investment and finance—to national security and moral constraints. Despite these and other contentious issues, the two governments have emphasized their economic collaboration and mutual benefits, and trade relations have expanded rapidly, producing the world’s most robust trade relationship.

Overall Trade Performance

During the first twelve years of the twenty-first century, American-Chinese trade and investment have played increasingly important roles in the economic life of both countries even as the regional and global context changed.

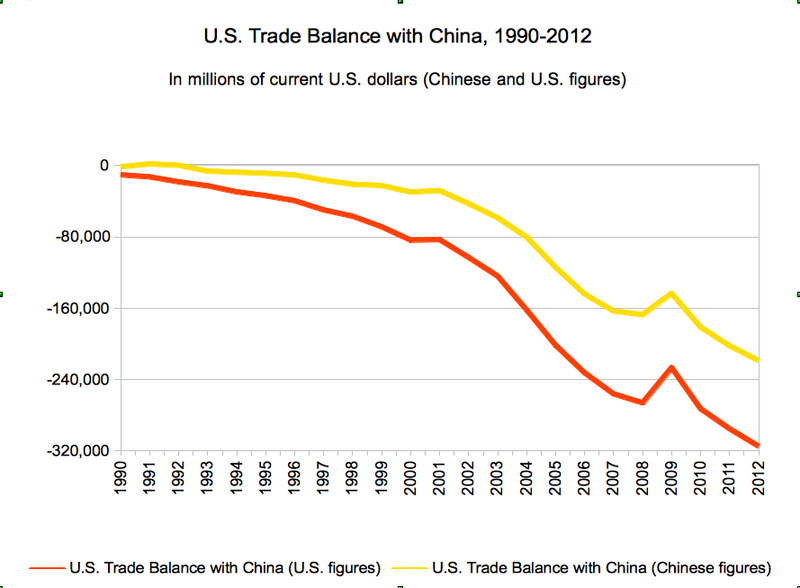

The two countries became one another’s largest or second largest trade partner. At the beginning of the 1990s, the total volume of their bilateral trade was less than 3 percent of total U.S. world trade; it grew to 14 percent in 2012. Since 1980, China’s trade with the United States has varied between 10 and 18 percent of its total international trade. China is the largest foreign holder of U.S. treasuries, thus allowing the United States to maintain its huge budgetary deficit. As of January 2013, China owned over $1.2 trillion in American debt out of total debt of over $16 trillion, more than 100 percent of the U.S. GDP in 2012.

Newly released figures from both countries show that in 2012 American exports and imports (in goods, excluding services) were worth US$3.82 trillion, while China’s total trade volume reached US$3.87 trillion. For the first time China thus exceeded the United States as the world’s largest trading nation. The 2012 U.S. trade deficit with China was $315.1 billion, a record high.

|

Chart 4 U.S. Trade Balance with China, 1990-2012 |

In 2010, China became the world’s second-largest economy, and some economists, such as Hu Angang, predicted that the Chinese economy would become twice as big as that of the United States by 2030.11 However, as of January 2013 the U.S. economy (with a GDP of US$14.624 trillion) was still well over twice the size of China’s ($5.745 trillion), and U.S. GDP per capita (US$48,100) was about nine times that of China ($5,400).12 Yet, as the world’s second largest importer, China was the largest or second largest export market for more than 78 countries in 2012, compared to only 20 countries in 2000. China’s trade surplus in 2012 nevertheless still came mostly came from its trade with the United States.

Does the U.S. Trade Deficit Really Matter?

To understand the U.S. trade deficit with China, we first and foremost must consider the profound changes taking place in both the American and Chinese economies and their impact on foreign trade.

Until the 1970s, the gap between U.S. government spending and taxes, and the gap between imports and exports, were both small. In the 1970s and 1980s, however, the U.S. federal budget deficit soared, savings regularly exceeded investment, and the foreign trade balance moved deeply into the red. Borrowing to service the growing national debt became the order of the day. American economists have disputed whether reducing the budget would have positive effects on investment, economic growth, and the foreign trade deficit. Two senior economists asserted that “it is by no means clear that the foreign trade deficit owes its existence to the budget deficit.”13 Nevertheless, policymakers in the 1970s and 1980s were concerned about both the federal budget deficit and the trade deficit.

It is against this background that America’s trade imbalance with China has sparked debate. The U.S. trade deficit with China in 2005 and 2006 was “the largest deficit it has ever recorded with a single economy in history.”14 Critics attributed the deficit to a raft of factors, most of which related to job losses in the U.S. manufacturing sector and obstacles to U.S. exports to China. American critics emphasized the low cost of Chinese goods and services, arbitrary suppression of the value of the Chinese currency (renminbi, CNY), market-access barriers, and lack of protection of intellectual property rights and government transparency.15

Some economists downplay the significance of the bilateral trade gap, and even take this argument to an extreme. One asserted:

The bilateral trade balance is a hot issue in official discussions and news media. However, to economists it is a non-issue. A country’s total trade deficit reflects the excess of its national spending over its domestic savings, and bilateral trade balances reflect international comparative advantages and consumer preference. They are topics in different areas of economics. Mixing them is a common mistake …. We have to ask ourselves whether it is total trade balance or bilateral trade balance that we care about. More basically, for an international-currency country such as the U.S., one needs to ask why we should care about either at all.16

Another major factor impacting the U.S. trade deficit with China is the shifting role of East Asia in the world economy. Despite China’s rapid increase in trade, over the decade 1997–2006 China’s share of U.S. global trade deficit remained static in percentage terms, increasing slightly from 27 percent to 28 percent. During the same period, however, the share of the American global trade deficit held by all East Asian countries declined from 70 percent to 45 percent, while the U.S. trade deficit with the rest of the world increased from 30 percent to 55 percent.17

The sharp reduction in trade surpluses with the United States that other East Asian nations experienced is explained by the change of destination in Asian manufacturing and direct investment from the United States to China. In 2004, funds from Hong Kong, Japan, South Korea, Singapore, and Taiwan accounted for nearly 60 percent of foreign direct investment in China. According to Swiss investment bank UBS AG and the U.S.-China Business Council, although more than 50 percent of P.R.C. exports by value were products of foreign companies operating in China, most of these firms are based in Hong Kong, Taiwan and Korea. The integration of the stronger East Asian economies combines China’s low-cost manufactures and efficient export arrangements with capital and technology from its regional partners.

Why has the United States been able “to run trade and payments deficits amounting to hundreds of billions of dollars annually with no audible protest from the rest of the world”? Michael Hudson’s critique of the coercive nature of the dollar’s supremacy offers a third explanation of the U.S. trade deficit with China:

Against dollar-surplus nations the United States was learning to apply a new, unprecedented form of coercion. It dared the rest of the world to call its bluff and plunge the international economy into monetary crisis. That is what would have happened if creditor nations [such as China] had not channeled their surplus savings to the United States by buying its Government securities.18

Latest Developments: Beyond the WTO?

Four recent developments and issues shed additional light on current and future trends in U.S.-China economic relations.

First, the financial crisis of 2008 has had structural and institutional effects on U.S. China trade and financial relations. In reaction to the post-2008 economic downturn and the sovereign debt and Euro crises, advocates of a new world economic order have called for a rebalancing of global demand. To some, this means that the United States must move swiftly to significantly reduce its massive trade deficit and save more and spend less, whereas emerging markets and economies with large surpluses—such as China—should spend more, boost the value of their currencies, and reduce exports. Others, who reject the characterization of China as a “currency manipulator” offered by some critics, argue that rebalancing the global economy will not be achieved without improving the efficacy and reforming the decision-making structures of the International Monetary Fund, the World Bank, and other international organizations. Such reforms would allow emerging economies to play a greater role in monitoring American economic policies.

As Greece, Ireland, Spain, and Italy are still beset by national indebtedness, the sovereign debt and Euro troubles have reverberated globally. Developing countries including the BRIC states (Brazil, Russia, India, and China) have called on leaders of the European Union member states, Japan, and the United States to carry out urgent reforms similar to those introduced by China to restructure its political and financial systems in the 1990s. In 1998, for example, China abolished 15 of its 40 or so ministries under the State Council, in order to further the transition from a planned to a regulated economy. This massive restructuring followed the fiscal, banking, and state-owned enterprise reforms that had begun in the early 1990s.19

Second, the continuing U.S. advantage over China in commercial services must be considered. Commercial services include a large variety of trade-related activities, such as data-processing, banking, accounting, insurance and education, legal counsel, management consulting, royalties and license fees, telecommunications, and transportation and travel. As the world’s largest importer and exporter of commercial services since the 1970s, the United States ran a surplus of $64 billion in 2003; in 2011 the surplus was $186 billion, with $976 billion worth of trade in services. In comparison, China has been a net importer of commercial services, especially since joining the WTO in 2001. China’s trade deficit in commercial services reached US$9 billion in 2003, and snowballed to $55 billion in 2011, with total commercial services imports worth $237 billion.20

Third, the United States and China have made strategic moves to hedge against future uncertainty and conflicts. Since entering the WTO in 2001, China’s export and import trade with other partners has increased more rapidly than its trade with the United States. In 2012, China’s fastest trade growth was with Hong Kong (an 83 percent increase from 2011), Taiwan (70 percent), South Africa (98.9 percent), and the Association of South East Asian Nations (ASEAN, 42.9 percent). This underscores the diversification of China’s partnerships, notably with Asian and Pacific nations; it has simultaneously reduced its dependence on the U.S. and established a position of power in key areas, notably East and Southeast Asia, but also Europe, Africa and Latin America. For its part, the United States in November 2011 announced a new emphasis on East Asia that projects a strengthening of its military and economic ties in the Asia-Pacific. The U.S. “pivot” or rebalancing policy21 has been widely seen as signaling an aggressive approach to China. One unintended consequence of the U.S. pivot was to bring Russia and China closer together in both economic and geopolitical terms.

Beginning in 2001 the WTO hosted a new round of trade negotiations, the Doha Development Round, which collapsed in July 2006 and then again in 2007 and 2008. Given the failure of the Doha Round of negotiations to facilitate free trade, the United States has been conducting Free Trade Agreement (FTA) negotiations with the European Union, and the Trans-Pacific Partnership (TPP) negotiations with countries in the Pacific, with the notable exception of China. Meanwhile, China has signed FTAs with two dozen countries and regions including Chile, Costa Rica, Hong Kong, Iceland, New Zealand, Peru, Taiwan, and ten ASEAN member states. These latest strategic and economic re-adjustments reflect new dynamics in U.S.-China economic relations outside the framework of the WTO.22

Fourth, China’s Overseas Direct Investment (ODI) in the United States soared from less than $1 billion in 2008 to a record $6.5 billion in 2012.23 Ranked fifth in the world last year, China‘s total outbound capital was $77.2 billion, invested in 141 countries, up 28.6 percent from 2011. Those countries and regions with the fastest growth rate of ODI from China were Russia (117.8 percent), the United States (66.4 percent), Japan (47.8 percent), ASEAN (52 percent), and Hong Kong (32.9 percent).24

Compared to many developed economies, China’s ODI is still relatively small, however. In 2010 the country’s ODI was only 6.5 percent of that of the United States. Manufacturing is the main focus of China’s overseas investment, yet significant obstacles, both political and technological, block China’s rapid advance in ODI. Acquiring foreign companies to gain new technology and high-tech products and linking up with well-known brands to obtain greater market share is a practical way of increasing their competitiveness overseas. The energy resources industry will continue to be the investment choice for many outbound Chinese companies.25

During the last four decades, deindustrialization in the United States and industrialization and urbanization in China have allowed China to emerge as one of the world’s biggest workshops, despite still lagging technically far behind some leading industrial countries. At the same time, China and the United States, as the two leading trading nations, share responsibility for the current state of global trade and finance and the unsettled post–World War II order in the Asia-Pacific. China’s absorption into the American-led economic orbit has set the stage for the next phase of development in the twenty-first century. But while in the past the client economies of the United States were small, China today is a giant and growing satellite. The next phase in the U.S.-China economic relationship will profoundly shape the future of the world economy.

Dong WANG is the author of China’s Unequal Treaties: Narrating National History (2005), Managing God’s Higher Learning: U.S.-China Cultural Encounter and Canton Christian College (Lingnan University), 1888-1952 (2007), and The United States and China: A History from the Eighteenth Century to the Present (January 2013). She is director and professor of contemporary Chinese history at the University of Turku in Finland, and is affiliated with Harvard University and the University of Duisburg-Essen in Germany.

Recommended citation: Dong WANG, “U.S.-China Trade: 1971-2012: Insights into the U.S.-China Relationship,” The Asia-Pacific Journal, Vol 11, Issue 24, No. 4, June 17, 2013.

1 This article draws on, updates, and expands from the following earlier publications: The United States and China: A History from the Eighteenth Century to the Present (Rowman & Littlefield, January 2013), chapters 10, 11 and 12; “China’s Trade Relations with the United States in Perspective,” The Journal of Current Chinese Affairs 39, no. 3 (October 2010): 165-210.

2 For an analysis of American-centered interdependency, see Michael Hudson, Super Imperialism: The Origin and Fundamentals of U.S. World Dominance (London: Pluto Press, 2003), pp. 377-393.

3 Since the 1980s, the two nations have drastically differed on the extent of trade and the trade deficit. The controversy over statistics originated in a number of areas: the two sides’ different accounting approaches to re-exports to and from China via Hong Kong; U.S. policy constraints on exports to China; the role of foreign firms in China; the multinational trade in commercial services; and global outsourcing and capital flows in the increasingly interdependent East Asian and world economy. See below for further explanation.

4 For the importance of norms and institutions in understanding economic change, see Douglas C. North, Understanding the Process of Economic Change (Princeton, N.J.: Princeton University Press, 2005).

5 James Reston, “China and the Dollar,” New York Times (August 20, 1971), p. 33.

6 Relaxation of Restrictions on Trade with the People’s Republic of China, National Security Decision Memorandum 155, February 17, 1972, Nixon Library. link (accessed on May 27, 2011).

7 Sarah Y. Tong, “The US-China Trade Imbalance: How Big Is It Really?” China: An International Journal 3, no. 1 (March 2005): 131-154.

8 Joseph Kahn, “Executives Make Trade with China a Moral Issue,” New York Times, February 13, 2000, link (accessed on December 14, 2011).

9 Erik Eckholm, “In China, So Many Liberties, So little Freedom,” New York Times, January 3, 1999, Section 4, p. 1.

10 Chinese UN envoy Huang Xueqi’s speech at the UN second committee, November 13, 1999, Summary of World Broadcasts, November 15, 1999, FE/3692 G/1 and G/2.

11 Hu Angang (胡鞍钢), Yan Yilong (鄢一龙), and Wei Xing (魏星), 2030 Zhongguo: Maixiang gongtong de fuyu [2030 中国:迈向共同的富裕2030 China: Striding towards co-prosperity] (Beijing: Renmin daxue chubanshe, 2011). Also see Arvind Subramanian, Eclipse: Living in the Shadow of China’s Economic Dominance (D.C.: Peterson Institute for International Economics, 2011).

12 The US-China Business Council, April 2011, “China and the US Economy: Advancing a Winning Trade Agenda,” p. 12, link (accessed on July 29, 2011), and its January 2013 version, link (accessed March 6, 2013), p. 11.

13 Gary M. Walton and Hugh Rockoff, History of the American Economy (Forth Worth, Tex.: The Dayton Press, 1998), 8th ed., pp. 733-735.

14 Pingfan Hong, “China’s Economic Prospects and Sino-US Economic Relations,” China & World Economy 14, no. 2 (2006): 45-55.

15 Han Yugui (韩玉贵), Lengzhan hou de Zhongmei guanxi [冷战后的中美关系Sino-American relations in the post-Cold War era] (Beijing: Shehui kexue wenxian chubanshe, 2007). Yang Guohua (杨国华), Zhongmei zhishi chanquan wenti gaiguan [中美知识产权问题概观A brief examination of the U.S.-China intellectual property question] (Beijing: Zhishi chanquan chubanshe, 2008). Ling Jintao (凌金涛), Zhishi chanquan yu Zhongmei guanxi, 1989-1996 [知识产权与中美关系Intellectual property rights and Sino-American relations] (Shanghai: Shanghai renmin chubanshe, 2007). John Frisbie, “China’s Implementation of its World Trade Organization Commitments: An Assessment by the US-China Business Council,” Testimony for the Trade Policy Staff Committee on October 2, 2009 (D.C.: The US-China Business Council, 2009).

16 Hang-Sheng Cheng, “Comments on Xianquan Xu’s Chapter,” in Shuxun Chen and Charles Wolf, Jr., eds., China, the United States, and the Global Economy (Santa Monica, Calif.: RAND, 2001), p. 253.

17 “US-China Trade in Context,” link (accessed on June 9, 2013).

18 Michael Hudson, Super Imperialism, p. 23 and p. 377.

19 “1998 nian Guowuyuan jigou gaige fang’an,” [1998 年国务院机构改革方案The State Council structural reform plan for 1998] link (accessed June 9, 2013).

20 The World Trade Organization, International Trade Statistics 2012, p. 29. link (accessed March 6, 2013).

21 Robert S. Ross, “The Problem with the Pivot,” Foreign Affairs 91, no. 6 (November/December 2012), link (accessed on March 8, 2013). Kevin Rudd, “Beyond the Pivot,” Foreign Affairs 92, no. 2 (March/April 2013), link (accessed on March 8, 2013).

22 On the inadequacy of the WTO, see Aaditya Mattoo and Arvind Subramanian, “From Doha to the Next Bretton Woods: A New Multilateral Agenda,” Foreign Affairs 88, no. 1 (January/February 2009): 15-26.

23 Todd Balazovic’s interview with Patrick Chovanec, “Trade Friction Is Teething Problem,” China Daily European Weekly, January 25-31, 2013, p. 32.

24 Chinese Commerce Minister Chen Deming’s press conference on March 8, 2013, link (accessed on March 8, 2013).

25 Zhang Huanbo, “Outbound Investment Strategy Needs to Be Revamped,” China Daily European Weekly, January 4-10, 2013, p. 9.