China’s Growing Economic and Political Power: Effects on the Global South

Alex E. Fernández Jilberto and Barbara Hogenboom

The impressive growth of the biggest developing country in the world is currently a key economic and political issue.

While the effects of

More importantly, with its industrialization and growth,

Several indicators for

| SSA | LAC | US | ||

| Population (millions) | 1,296 | 726 | 546 | 294 |

| GDP/cap. ($) | 1,500 | 601 | 3,576 | 41,440 |

| FDI ($ billions) | 62 | 20 | 69 | 121 |

| Export ($ billions) | 593 | 232 | 276 | 819 |

| Import ($ billions) | 561 | 212 | 237 | 1,526 |

Sources: CEPAL (2005), WTO (2005), and World Bank (2006)[1]

The expansion of

The rapid growth of

In international politics

This article starts with some facts and figures that illuminate what is meant by the global expansion of

Over the past few years, the world has become aware of the importance of

With its rapid economic growth and expanding export production,

The Chinese contribution to rising world demand and prices of oil and other hydrocarbons deserves special attention. Internationally, it is the second largest consumer of energy, only after the

Next to its imports of fuels, minerals, and metals,

Oil consumption by countries and regions, 2004

Source: World Bank (2005)

Transnational companies (TNCs) have played a key role in the expanding Chinese production for the world market, and even more so in the changing composition of Chinese exports. In the period from 1985 to 2000, the share of primary products and resource-based manufactures decreased from 49 to 12 percent, whereas the share of high technology products rose from 3 to 22 percent. The share of TNCs in Chinese exports rose from 9 to 50 percent between 1989 and 2001. Ninety percent of the exports of these companies are manufactured goods, such as machinery and equipment. There is also a large FDI component in technology intensive products: 91 percent in electronic circuits; 85 percent in automatic data-processing machines; and 96 percent in mobile phones (all in 2000). Apart from US and European companies, in China there are a large number of TNCs originating from Asia, mainly South Korea, Japan, Hong Kong, Taiwan, and Singapore (UNCTAD, 2002b: 161-6; 2005a: 2-3). To other developing countries

Regional distribution of net FDI inflows in

* annual averages

Source: CEPAL (2005)

While

Taken together, to developing countries,

The economic restructuring of China

What started as a gradual global move from socialist to capitalist economic measures in the late 1970s, turned into

The second phase of economic reforms that started in 1984 was the structural reaction to the inflation crisis, the economic chaos and the social instability that reigned in

The signing by

The general opening of

While entry into the WTO allows

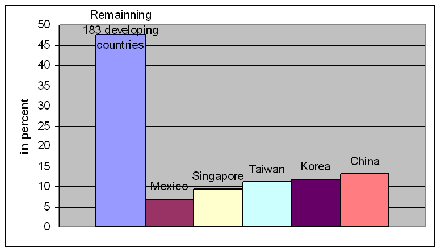

Shares of developing countries’ manufactures, 1990s

Sources: ILO (2004), UNCTAD (2002a)

Rather than the conditionality of the IMF and the World Bank, it was changing internal views that gave way to

The implementation of neoliberal policies in

The deepened globalization of the Chinese economy is strengthening its specialization in the industrial sectors in which it possesses major competitiveness and comparative advantages. These sectors are intensive in the use of manual labour, and correspond to the pattern of international competitiveness of the majority of the

The role of China in Asia

In its strategy of finding economic associations,

In addition, China actively participates in the Asia-Pacific Economic Cooperation (APEC) that integrates 21 countries with 2.5 billion inhabitants along the Pacific.[3] The APEC members jointly represent almost 60 percent of the world’s GDP and 50 percent of international trade. In the first ten years of its existence it has even generated 70 percent of global economic growth. APEC’s objective is to liberalize the markets of the group’s most developed countries by the year 2010, and to achieve in 2020 the complete liberalization of the APEC economies (Matus, 2004).

The strategy of “open regionalism” as implemented by China is to construct a regional and global political economy that reduces its dependency on the North American market, to generate more control over its vulnerability for global financial crises, and moreover, to transform Asia into a zone of mediation between the United States and China. With this last matter,

In the late 1990s, it was the East Asian financial crisis of 1997-98 that brought about new views on global relations and changes in Asian relations. The severity of the crisis came to many as a surprise and a shock. The next shock was that the international support was weak and misguided. The IMF imposed policy conditions that were not suited to the specificities of

In 2000, the AMF idea was revived by

The rapidly changing economic position of

This new attitude on South-South cooperation is an example of the general trend of a profound “de-Maoization” of

Since the beginning of the twenty-first century,

While

Peacefulness is stressed in the Chinese policy documents for bilateral and multilateral development relations with

In

The economic activities of the world’s largest developing country with the world’s poorest region have been rapidly growing and in the 1990s China-Africa trade increased 700 percent. In 2000, the China-Africa Forum started a new period of trade cooperation and investment, resulting in a doubling of trade from 2000 to 2003, and again from 2003 to 2005, when trade amounted to $32 billion. Much of this increase was due to the growing Chinese import of oil from countries like

The government of

With the

The global South and globalized markets

In the 1980s and 1990s, the transformation of the private sector into the predominant motor for economic development and a reduced role of the state in the economy were the main elements of international policy prescriptions for low-income countries. This became known as the Washington Consensus, because it was a view shared and effectively applied by US government agencies as well as the IMF and the World Bank (all based in

While the rise of China and the new South-South relations have come about in the context of neoliberal globalization, involving developing countries that have gone through profound neoliberal reforms, these trends implicate important criticisms of the dominant neoliberal approach to achieving economic development in developing regions. The economic success story of

The apparent paradox, then, is that economic liberalization has been as central to

Apart from setting an example for alternative development strategies,

Notes

[1] Some of the

[2] The rising FDI figures do not imply that it was mainly foreign private investment that financed

[3] The APEC countries are

[4]

[5] Speech at the 11th session on Economic Cooperation among Developing Countries,

[6] In a speech at the 42nd Munich Conference on Security Policy,

[7] An extensive overview of China’s global economic expansion and the effects on developing countries and transition economies can be found in two special issues that we guest edited for the Journal of Developing Societies (numbers 3 and 4 of volume 23, 2007) with case studies on Africa (by Piet Konings), Indonesia (by Thomas J. Lindblad), the Middle East (by Gouda Abdel-Khalek and Karima Korayem), Russia (André Mommen) and Latin America (by us).

Alex E. Fernández Jilberto is senior lecturer in International Relations at the

Bibliography

Bajpaee, Chietigj (2006) “

Cabanne, Claude and Elena Tchistiakova (2002) La Russie. Perspectives économiques et sociales.

Carl, Beverly (2001) Trade and the Developing World in the 21st Century. Ardsley: Transnational Publishers.

CEPAL (2005) Informe sobre Inversion Extrajera Directa 2005.

CEPII (2001) “Le bol de riz en fer est cassé”, La Lettre du CEPII, no. 2002 (juin),

Demmers, Jolle, Fernández Jilberto, Alex E. and Barbara Hogenboom (eds) (2001) Miraculous Metamorphoses. The Neoliberalisation of Latin American Populism.

_____ (2004) “Good governance and democracy in a world of neoliberal regimes”, in Jolle Demmers, Alex E. Fernández Jilberto and Barbara Hogenboom (eds) Good Governance in the Era of Neoliberal Globalization. Conflict and Depolitization in

DeWoskin, Kenneth (2001) “The WTO and the Telecommunication Sector in

Díaz Vázques, Julio (2003) “

Fernández Jilberto, Alex E. and Barbara Hogenboom (guest editors) (1997) The Political Economy of Open Regionalism in

_____ (2006) “The New Expansion of Conglomerates and Economic Groups: An Introduction to Global Neoliberalisation and Local Power Shifts”, in Alex E. Fernández Jilberto and Barbara Hogenboom (eds) Big Business and Economic Development. Conglomerates and Economic Groups in Developing Countries and Transition Economies under Globalisation, pp. 1-38.

Fernández Jilberto, Alex, E. and André Mommen (1996) Liberalization in the Developing World. Institutional and Economic Changes in

Golub, Philip (2003) “Pékin s’imposes dans une Asie convalescente”, Le Monde Diplomatique, octobre: 14-5.

Houweling, Henk (2004) “

Hu, Yifan, Frank Song and Junxi Zhang (2005) Does Privatization Work in

Huang, Yiping, Wing They Woo and Ron Duncan (1999) “Understanding the Decline of

ILO (2004) A Fair Globalization: Creating Opportunities for All.

IMF (1997) Partnership for Sustainable Global Growth.

_____ (2006) World Economic Outlook: Globalization and Inflation.

Jomo, K.S. (ed.) (1998) Tigers in Trouble. Financial Governance, Liberalisation and Crises in

Lall, Sanjaya and John Weiss (2004) “People’s Republic of

Lemoine, Françoise (1999) “Les Délocalisations au cœur de l’expansion du commerce extérieur chinois”, Economie et Statistiques, juin – juillet: 326-7.

_____ (2002) “Gagnants et perdants de l’ouverture chinoise”, Le Monde Diplomatique, avril: 22.

Li, Wei (1997) “The Impact of Economic reform on the Performance of Chinese Enterprises : 1980 – 1989”, Journal of Political Economy 105(5): 80-106.

Lin, Yi-min (2001) Between Politics and Market Firms, Competition and Institutional Change in post-Mao

Lin, Yi-min and Tian Zhu (2001) “Ownership Restructuring in Chinese State Industry : An Analysis of Evidence on Initial organizational Changes”, China Quartely 166: 305-41.

Matus, Mario (2004) “

Mckinnon, R. (1995) “Financial Growth and Macroeconomic Stability in

Morrison, Kevin and Christopher Brown-Humes (2005) “On the clime: a natural resources boom is unearthing both profits and perils”, Financial Times, april

National Bureau of Statistics (2003)

Pan, Ester (2006), “

Pant, Harsh V (2006) “Saudi

Park, Yung Chul and Yungjong Wang (2003) “Chiang Mai and Beyond”, in Jan Joost Teunissen (ed.)

Pottier, Claude (2003) Les Multinationales et la mise en concurrence des salariées.

Ramonet, Ignacio (2002) Guerres du XXe Siècle.

Si Zoubir, Lyes (2004) “Mutations incertaines de la l’économie”, Le Monde Diplomatique, octobre: 27-8.

UNCTAD (1995) World Investment Report 1995: Transnational Corporations and Competitiveness.

_____ (2002a) Handbook of Statistics.

_____ (2002b) World Investment Report 2002: Transnational Corporations and Export Competitiveness.

_____ (2003) World Investment Report 2003.

_____ (2004) Handbook of Statistics.

_____ (2005a) World Investment Report 2005: Transnational Corporations and the Internationalization of R&D.

_____ (2005b) Trade and Development Report 2004.

_____ (2006) World Investment Report 2005: FDI from Developing and Transition Economies: Implications for Development.

Walt, Vivienne (2006) “

Wang, Hui (2002) La Défaite du Mouvement Social de Tiananmen. Aux Origines du Néolibéralisme en

Wang, Jisi (2005) “

World Bank (1997) World Development Report 1997. The State in a Changing World.

_____ (2005) World Development Report.

WTO (2005) International trade statistics 2005.

Zheng, Bijian (2005) “

Zweig, David and Bi Jianhai, “

Alex E. Fernando Jilberto is Senior Lecturer in International Relations at the University of Amsterdam and the author of numerous works on the political economy of Latin America and developing countries Barbara Hogenboom is Lecturer in Political Science at the Centre for Latin American Research and Documentation (CEDLA) in Amsterdam. She writes on transnational politics, globalization and the political and economic development of Mexico and Latin America. They are coeditors of Big Business and Economic Development: Conglomerates and Economic Groups in Developing Countries and Transition Economies Under Globalization and Latin American Conglomerates and Economic Groups Under Globalisation.

This is a revised and developed version of an article that appeared in The Journal of Developing Societies Vol. 23, 3, 2007. Posted at