Keywords: Concentrating Solar Power (CSP); China; molten salts

Abstract

While all eyes have been focused on China’s dramatic recasting of the global solar PV industry, and the trade disputes engendered with the US and EU, there is another solar frontier now emerging, involving grid-connected concentrating solar power (CSP) plants. China is committed to developing capacity of 3 GW by 2015 (more than doubling cumulative world capacity) and 10 GW by 2020, which would make it by far the world’s CSP leader, with consequent dramatic impact on cost reductions, driving the diffusion of CSP around the world as key challenger and alternative to nuclear and fossil power.

While much attention has been focused on solar PV (photo-voltaic) technology, with the dramatic cost reductions in first-generation crystalline solar PV produced in China dominating debate, the large-scale potential of Concentrating Solar Power (CSP) has also been improving, and is now a promising candidate for providing dispatchable, baseload power. In this article we survey developments in CSP (as well as current patenting trends) to gain insight into the direction of its future technology and business evolution.

We have two main points to make. The first is to demonstrate how CSP with molten salts technology provides the promise and reality of dependable, dispatchable power on a 24/7 basis – thereby posing a realistic alternative to thermal fossil fuel and nuclear power and becoming a candidate for sustained energy policy. The second is to reveal how China is rapidly moving to a world leadership position in CSP, as it scales up its goals under the 12th Five Year Plan. By 2015 China plans to have installed more CSP capacity than the rest of the world combined. This will have a dramatic impact in lowering costs, both for China and for other countries.

While CSP costs were coming down and investment was starting to pick up in the mid-2000s, it looked as though CSP might outdo solar PV as the next solar wave.

| Photo-Voltaic (PV) | Concentrating Solar Power (CSP) |

| Solar energy is converted directly into electric power via the photoelectric effect, as in photovoltaic cells. | Solar energy is converted into energy, concentrated via fields of lenses and mirrors on a heat pipe, or tower, which produces temperature sufficient to turn water into steam and drive a turbine – just as in a thermal power station. |

The main kinds of CSP plants involve (1) fields of parabolic troughs, or mirrors, which can be rotated to follow the sun (hence called heliostats); (2) fields of flat Fresnel mirrors, which likewise follow the sun (lower efficiency but cheaper cost; (3) power towers, where the sun’s energy is focused on a single elevated point at the center of the field; and (4) parabolic dish systems, each of which carries its own point of collection. There is as yet no clear leader amongst these competing CSP technologies. Note that PV cells can also produce power from concentrated sunlight, when the systems are known as CPV.

But then the dramatic cost reductions driven by China’s expansion of PV production, combined with proven bankability of PV, reversed that situation, and investments in CSP slowed. Indeed some plants scheduled as CSP operations have been partially switched to PV — such as the much-discussed 1-GW facility at Blythe (California), destined to be the largest in the world, which has been scaled back. Spanish investments which had dominated the 2000s have been declining with the announcement by the new Popular Unity government elected in 2011 that financial support for CSP would be wound back, while planned installations in the US have met with (perhaps predictable) delays.

Even so, big new players are now weighing in and transforming CSP prospects once again. China leads the way, with its most recent announcement that it intends to build 3GW of CSP installations by 2015 – more than the current cumulative world total – and further ramp up to 10GW of commercial-scale activity by 2020. This is likely to have a dramatic impact on the learning curve, driving down costs of components and systems just as China’s large-scale entry into solar PV had a dramatic impact on costs in that sector. But China is not alone. Both India and South Africa are scaling up their interest, and have opened up reverse auctions for new CSP licenses that are also helping to drive down costs. The Middle Eastern and Gulf states are moving in a big way into CSP, to complement and offset their dependence on oil, with Saudi Arabia announcing a massive 25 GW goal to be met by 2030, and Qatar (currently the world’s largest gas exporter) to reach 1.8 GW of CSP capacity by 2020; the UAE is investing in a big way, and has already brought on stream the world’s most efficient CSP plant, the 100MW Shams1 plant in Abu Dhabi. In smaller ways, sun-rich countries such as Israel and Australia are also making tentative moves to support CSP.1

The range of CSP technologies and major projects

Modern CSP dates back to the series of Solar Energy Generating Systems (SEGS) established in the Mojave desert in California in the 1980s. While the US dithered over supporting such developments at the federal level, the impetus passed to Spain which offered feed-in tariff support for several facilities, mainly based on parabolic trough technology but also including power tower facilities and the use of molten salts as heat transfer fluid to provide long-term heat storage and the possibility of providing dispatchable, 24/7 power generation. As a result of these and other developments, there is now a well-established range of CSP technologies available – without any yet emerging as a ‘dominant’ technology where cost reduction might be driven by massive roll-out, changing the competitive dynamics in the industry.2 The original design associated with SEGS in California is for a field array of parabolic mirrors with changing orientation during the day to capture the maximum solar energy, focusing the sun’s energy onto a tube running the length of the field and containing oil as a heat transfer fluid (HTF). The heated oil then turns water into steam to drive a conventional turbine to generate power. This parabolic trough or parabolic mirror (PB) arrangement remains closest to a dominant technology. The major alternatives are threefold (as mentioned in the Box). (1) There is the concept of focusing the sun’s energy from the field of heliostats onto a single point placed on an elevated tower, or ‘power tower’ – with the advantage that higher temperatures can be secured by focusing the energy on a single point. There is (2) a field of flat-plate reflectors known as compact linear Fresnel reflectors (CLFR) that provides close to the same energy-capture efficiency as parabolic troughs but with much lower costs of construction. And there is (3) the concept of modular design utilizing parabolic dish construction, where each dish (rated at around 133kW) reflects and focuses light on its own collector, and then the high-temperature fluid is brought together for final power generation.

There are leading projects for each of these designs, indicating that they are all moving to the point where mass production is feasible and imminent. For parabolic trough technology, there are numerous Spanish installations (Andasol 1 and 2 et al.) while in the US the leading contender is Crescent Dunes (Tonopah, NV) a 110MW installation being developed by SolarReserve, and due for completion in December 2013. For power tower technology, there are again Spanish examples and a leading US contender in Ivanpah, a 370MW facility being erected in the Mojave desert and now under the control of BrightSource Energy, again with completion in sight in 2013. The world’s largest linear Fresnel array was opened in Spain in October 2012, the 30MW PE2 plant operated by Novatec Solar, majority owned by Transfield Holdings of Australia.

The most important technological development by far is the advance from using oil as a heat transfer fluid to the use of molten salts, which provide far superior heat retention properties. Molten salts (e.g. nitrate salts of sodium or potassium) were utilized as a means of heat absorption in nuclear reactors, and it was the Italian nuclear physicist Carlo Rubbia who came up with the original conception of transferring this energy absorption technology from the nuclear realm to that of solar power, where the molten salts would again absorb energy but in this case with a view to extracting it later in a power generating device. As Director of the Italian energy research institute ENEA, Dr Rubbia had the first molten salts demonstration facility established at the ENEA labs at Casaccia, outside Rome – where it continues to function today.3

Molten salts technology has now diffused around the world – with versions developed by Abengoa as well as the US engineering giant Pratt & Whitney/Rocketdyne (PWR), licensed exclusively to BrightSource Energy (BSE). But Italy and ENEA retain a strong interest.4 The world’s first fully commercial-scale CSP facility utilizing molten salts technology is the Gemasolar project established in Seville, Spain by Torresol, a joint venture between SENER and MASDAR from Abu Dhabi. The Torresol Gemasolar plant in Seville, Spain, is a 19.9 MW plant that covers 185 hectares; it counts as a baseload plant with heat storage of 15 hours (giving uninterrupted power supply). The plant is operating with 75% capacity factor, meaning it comes close to coal, nuclear and natural gas facilities.5 This then is the technological state of play as the world embarks on the next big push in CSP uptake – where the leaders this time will be coming from China, India, southern Africa and the Middle East.

The new Big Push from China, India, southern Africa and MENA countries

Attention is about to shift from European and US projects, important as they have been in establishing the technological options and starting a learning curve process, to new projects in the emerging countries. China leads the field, announcing in 2011 a goal of 21GW for solar power by 2015, including 1GW for CSP, and then raising the goal in 2012 to 30 GW for PV and 3 GW for CSP. Furthermore, the 12th Five-Year Plan has clearly recognized the potential of CSP, with the target being raised to 10GW of commercial-scale activity by 2020, and cost anticipated to be thereby driven down to something comparable to burning coal, as low as US$9 to 10 cent/kwh. This immediate goal of a 3GW push for CSP by 2015 would already exceed the entire global cumulative installation to date, of 2.5GW. It would therefore kick-start the learning curve and drive rapid cost reduction – with dramatic impact on further diffusion possibilities.

If these goals are fulfilled (and China has met or exceeded such targets in other fields) then China will emerge as the world’s leading CSP proponent. As specified in the 12th Five-Year Plan, the 10 GW of CSP installations by 2020 would be located mainly in Tibet, Inner Mongolia, Gansu, Ningxia, Xinjiang, Qinghai, and Yunnan, all provinces with high levels of insolation. In terms of individual projects, there are as yet no projects of commercial scale. China currently has two pilot solar power towers operating in Beijing – one is the 1MW Yanqing Solar Power station and the second is the 1.5MW Beijing Badaling Solar Tower, both completed in August 2012. The two projects are led and developed by the Institute of Electrical Engineering of the China Academy of Sciences (IEECAS). Working together with many Chinese public and private companies, the IEECAS has become the world’s second most important source of scientific papers on CSP, second only to the German Aerospace Center (DLR). The range of commercial-scale operations being planned or constructed in China is shown in Table 1.

Table 1

Solar thermal power plants under construction: private firms and state-owned firms

|

Name |

Location |

Capacity (MW) |

Expected completion |

Technology used |

|

Private firms |

||||

|

Delingha Solar Power Plant |

Qinghai |

50 |

2013 |

Solar tower |

|

Erdos Solar Power Plant |

Inner Mongolia |

50 |

2013 |

|

|

Jinshawan |

Inner Mongolia |

27.5 (where operations at 200kW are under way) |

2013 |

|

|

e-Cube 1 |

1.5 |

2013 |

Modular heliostat with Himin* (the first in the world) |

|

|

Chabei |

Hebei |

64 |

2014 |

Parabolic trough |

|

State-owned firms involved (Lluna, 2012) |

||||

|

Hanas New Energy Group |

Ningxia |

92.5 |

2013 |

parabolic trough solar and natural gas |

|

Lenon New Energy Co |

Inner Mongolia |

50 |

N/A |

parabolic trough |

|

Baoding Tianwei Group |

Sichuan province (which probably will be switched to Xinjiang) |

100 |

N/A |

parabolic trough |

|

Baoding Tianwei with China Datang Corporation Renewable Power Co |

Gansu/ Inner Mongolia |

10/50 |

2011 (the 1st phase) |

parabolic trough |

|

Shanghai Gongdian Energy Technology |

Hangzhou |

100 |

2009 (the 1st phase) |

Solar tower & heliostats |

|

Beijing Kangtuo Holding |

Inner Mongolia |

550 |

N/A |

N/A |

* Established in 1995, the Himin Solar Company has emerged as China’s principal supplier of heliostats and coated steel tube for heat collection; it operates technologies covering the field of CSP, including parabolic troughs, power towers, and dish collectors.

By far the biggest project announced so far in China is a deal struck in January 2010 with the US firm eSolar (headquartered in Pasadena, CA) to build a series of solar thermal farms totaling 2GW by 2020.6 The firm eSolar utilizes a modular technology based on 46MW units involving field arrays of small flat mirrors tilted to towards the sun and a power tower – a unit that can be replicated many times over.7

China adopts the strategy in all its energy dealings of opening up one field of investment after another in a planned sequence, with attention focused on the development of markets as well as the absorption of technology from around the world. This has worked extremely effectively in related renewable energy fields of wind power and solar PV, and now it is set to prove its worth in CSP as well.

The China CSP developments need to be seen in the context of the country’s major push towards renewable energies as a prime means of ensuring energy security, with the green development strategies complementing the black strategies based on coal and oil and gas. China’s strategies all along seem to have been focused on building green energy industries as fast as possible, driving down the costs through mass production, as principal means of building energy security (based on technological development and domestic renewable energy resources) and for avoiding potential conflicts based on exploitation and import of fossil fuels. The recent announcements from the National Development and Reform Commission of a cap of 4 billion tonnes on China’s coal consumption, and caps on carbon emissions, create further investment certainty in favor of renewables in China – and will work to support expansion of the CSP industry.8

Other newly industrializing countries are moving quickly to take advantage of the new state of play. India in particular, having missed out on world leadership in the earlier fields of wind power and solar PV is making a determined bid for a strong CSP sector, taking advantage of the country’s excellent insolation. Under the Jawaharlal Nehru National Solar Mission (JNNSM), it is anticipated that India will be producing 20GW of grid-connected solar power by 2020, of which 50% or 10GW would be CSP.9 In addition to large Indian companies like Tata Power, which are becoming involved in renewable energies, there are smaller Indian specialist firms such as Coromandal, Electrotherm and Lanco Solar emerging as significant players.10 Under phase 1 of the JNNSM program, a total of seven CSP projects amounting to 470MW were awarded – but with PV becoming more cost-effective, many of these are now delayed.11 The changes in relative costs help explain this development. Despite reports of delays, the Indian support for CSP is substantial and will help to drive down costs.

Southern Africa is emerging as a major CSP player, led by new contracts being let by South Africa. The demonstration potential of CSP projects in southern Africa is vast – estimated as being up to 40GW by South Africa’s principal electricity generator, Eskom. The major project in South Africa is aimed at building a 5GW solar park in the northern cape; this would be a 15km by 3km area devoted to CSP and PV solar farms (totaling 45 km2).12 Altogether, informed commercial expectations are for a 100-fold expansion over the next decade and a half, reaching 100 GW by 2025.13

The surprising new player in CSP is proving to be the Middle East and North Africa (MENA) region. Saudi Arabia has announced major projects amounting to 25GW to be phased in over the period 2013 to 2030, with its national CSP firm ACWA as the major mover. ACWA’s Bokpoort project in South Africa due to start in April 2013.14 Meanwhile ACWA has won an initial round of bidding to take charge of the 160MW project being promoted at Ouazazate, in Morocco.

It is also worth mentioning that Japan could also become a player, in its post-Fukushima mode. In a recent article in Asia Pacific Journal: Japan Focus, Andrew DeWit noted that several Japanese prefectures are commissioning new solar thermal (CSP) plants to take over from nuclear power. (See here.)

Costs and the incipient learning curve

The key to the widespread uptake of CSP – as in every renewable energy technology – is the decline in costs captured by the experience, or learning curve. The impact of falling costs has been dramatic in related sectors such as wind power and solar PV; now the impact in CSP can be seen to be imminent. There are many assessments as to likely cost reductions as uptake grows. The consulting firm AT Kearney in conjunction with ESTELA issued an influential report in 2010 where the likely cost reductions were 40-55% and anticipated market expansion was estimated as 100GW by 2025.15

The complication in these assessments of likely future trends is the impact of rapid cost reductions in solar PV, enhancing its competitiveness in large-scale power generation systems and turning it into an attractive alternative to CSP. This has been felt in the US, where large projects such as Blythe Solar Power Project have been downscaled and solar PV substituted for CSP. Likewise in India many of the CSP projects awarded under Phase 1 of the JNNSM have experienced delays due to continuing cost confusion and the rise of solar PV as a competitive alternative. While CSP costs dropped marginally, the capital costs for solar PV plants have dropped by half in just four years.16

Why CSP with molten salts is the way forward

Do these cost considerations mean that CSP will be defeated, after all, by concentrated solar PV? We do not think so. And the reason is that solar thermal power has the huge advantage (for grid-connected power generation) of dispatchability. This means that they can deliver power as and when it is needed – in the same way that conventional baseload power operates.17

CSP with molten salt technology delivers baseload, regular power. The key fluctuation with solar power has always been that it is available only during the day, and requires some kind of storage system to carry through to other times. But CSP with molten salt technology produces heat that lasts for 15 hours or beyond, and can be used to generate electric power or industrial heat continuously – and at industrial scale levels of 100 MW to 1 GW that, when aggregated, is more than enough for baseload power. Thus all the talk of needing gas-fired turbines as back-up can be dismissed as so much ‘hot air’. The idea that solar energy is too diffuse comes from early critiques of solar PV power by physicists (many of whom had links to the nuclear and fossil fuel industries); but concentrated solar power meets that charge head-on by explicitly concentrating the power, thus combating diffuseness. Concentrated solar PV will have this property as well, but only when the energy storage issue has been resolved. CSP with molten salts (referred to in China as a second generation technology) has already resolved the issue, and one can only anticipate rapid development as a result. The China CSP literature is already referring to third and fourth generation technologies (viz. hot air or gases as heat transfer fluids and solid state heat conservation systems).18

CSP and water requirements

CSP plants require significant amounts of water in order to cool steam turbines and to wash heliostats. In average, the CSP plants need as much as 3,500 liters of water per MWh. This compares to 2,000 liters/MWh for new coal-fired power plants and 1,000 liters/MWh for more efficient natural gas combined cycle power plants. According to a June 2009 Congressional Research Service paper titled ‘Water Issues of Concentrating Solar Power (CSP) Electricity in the US Southwest’: “Available freshwater-efficient cooling options, however, often reduce the quantity of electricity produced and increase electricity production costs, and generally do not eliminate water resource impacts.” However, the problem of lack of fresh water supply for CSP plants has been gradually relieved. In the United Arab Emirates, for example, Masdar Power was able to recycle waste water from the nearby sewerage treatment plant to be used as wet cooling for its 100MW SHAMS 1 parabolic trough development. The leading US contender, BrightSource Energy, is constructing the world’s largest CSP plant with 370 MW facility at Ivanpah (California), aiming to minimize water consumption. With an air-cooled condenser system, some companies in the US as well as in Spain have announced that they can reduce water usage by more than 90% compared to conventional wet cooling systems.19 The developer Solar Euromed has also claimed that its projects utilizing Fresnel reflector plant with dry cooling can reduce water consumption by up to 95%.20

Technology trajectory and patenting trends

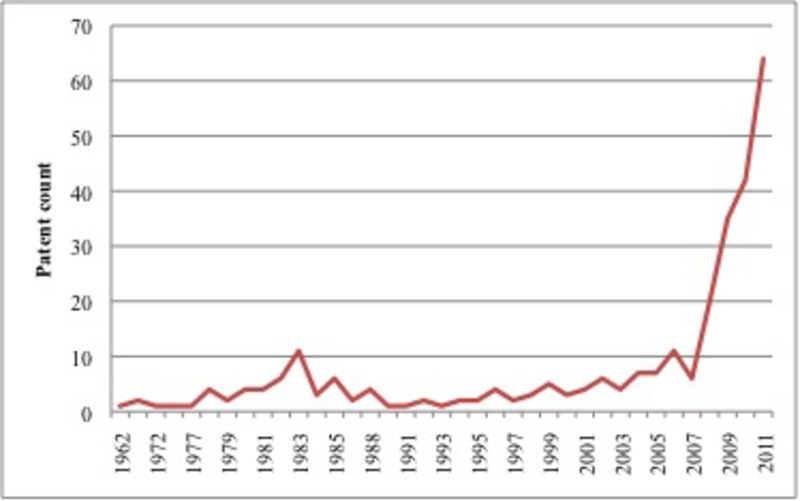

One can see the uptick in interest in CSP technologies from the patenting record, which shows a marked increase in 2007-08 and continuing thereafter (Fig. 1).21

|

Fig. 1. Global Concentrating Solar Power Patenting Trends, 1962-2011 / Source: Authors |

Even more interesting is the analysis of countries involved in this patenting surge. The US is predictably the leader, accounting for 106 CSP patents (out of 284, but it is followed by China (49 patents), Japan (24), Germany (20) and South Korea (14). These are the countries that are clearly looking to make their mark in the anticipated new wave of CSP investments – China in particular. Clearly in this case China does not intend to be just a ‘fast follower’ bringing technologies developed elsewhere to mass production and rapid cost reduction (as done for first generation solar PV) but is at the cutting edge in developing the CSP technologies themselves. European firms are also strong players with Germany and Italy at the forefront of patenting. Spain is the anomaly – at world leadership position in investing in CSP plants, but not yet registering a single patent.

Concluding remarks

While CSP has shown great promise as an alternative to thermal power stations, its development has been held back by the higher costs involved and most recently by the dramatically falling costs of solar PV, which can also be utilized to build MW-level power stations that are designed to feed power direct into the grid. But what has held back both kinds of development is the issue of energy storage and dispatchability – now solved in the case of CSP by the innovation of utilizing molten salts as the heat transfer fluid, giving up to 15 or 16 hours heat storage and the capacity to generate power right through the night, i.e. to generate on a 24/7 basis. This is the essential breakthrough that is likely to drive the next wave of CSP and solar power stations. Energy policy that ignores the role of CSP is likely to misjudge future technological and industrial trends.

John A. Mathews is Professor of Management, Macquarie University, Australia, and Eni Chair of Competitive Dynamics and Global Strategy at LUISS Guido Carli University in Rome. His research focuses on the competitive dynamics of international business, the evolution of technologies and their strategic management, and the rise of new high technology industries. He researches the development of the institutional capacities of firms and governments in the Asia-Pacific, internationalisation processes of firms and the theoretical explanations for latecomer firms’ success.

Mei-Chih Hu is an Associate Professor at the Institute of Technology Management, National Tsing Hua University, Taiwan (email: [email protected]). She currently is working with Taiwan’s newly established Science and Technology Ministry in assisting in the formulation of S&T policy and community platforms. Her project is focused on the innovation system of emerging green industries such as LEDs, solar photovoltaic, and bio-agriculture sectors in greater China. Her papers have been published in journals including Research Policy, World Development, Regional Studies, Scientometrics, Innovation and Industry, Technological Forecasting and Social Change,and Technology Analysis and Strategic Management.

Ching-Yan Wu received his PhD from Macquarie Graduate School of Management, Australia. He had more than ten years’ R&D experience in various industries. His research interests focus on the innovative and technological capabilities of Asian latecomers. He is actively involved in green technologies research. His papers have been published in the Journals of Research Policy, Industry and Innovation, and Technology Analysis and Strategic Management.

Recommended citation: John A. Mathews, “Concentrating Solar Power – China’s New Solar Frontier,” The Asia-Pacific Journal, Vol. 11, Issue 21, No. 2. May 27, 2013.

Articles on related subjects

• Andrew DeWit, The US Military, Green Energy, and the SPIDERS at Pearl Harbor, http://japanfocus.org/-Andrew-DeWit/3909

• Andrew DeWit, Abenomics and Energy Efficiency in Japan

• Andrew DeWit, Distributed Power and Incentives in Post-Fukushima Japan

• John A. Mathews, The Asian Super Grid

• Andrew DeWit, Japan’s Energy Policy at a Crossroads: A Renewable Energy Future?

• Andrew Dewit, Japan’s Remarkable Energy Drive

• Andrew DeWit, Megasolar Japan: The Prospects for Green Alternatives to Nuclear Power

• Peter Lynch and Andrew DeWit, Feed-in Tariffs the Way Forward for Renewable Energy

• Sun-Jin YUN, Myung-Rae Cho and David von Hippel, The Current Status of Green Growth in Korea: Energy and Urban Security

• Son Masayoshi and Andrew DeWit, Creating a Solar Belt in East Japan: The Energy Future

• Andrew DeWit and Sven Saaler, Political and Policy Repercussions of Japan’s Nuclear and Natural Disasters in Germany

• Andrew DeWit and Iida Tetsunari, The “Power Elite” and Environmental-Energy Policy in Japan

References

AT Kearney/ESTELA, 2010. Solar Thermal Electricity 2025. European Solar Thermal Electricity Association, available at: here

Braun, F.G., Hooper, E., Wand, R., Zloczysti, P., 2011. Holding a candle to innovation in concentrating solar power technologies: A study drawing on patent data. Energy Policy 39, 2441-2456.

Chien, J.C.-L., Lior, N., 2011. Concentrating solar thermal power as a viable alternative in China’s electricity supply. Energy Policy 39, 7622-7636.

CSPA, 2012. The economic and reliability benefits of CSP with thermal energy storage. Concentrating Solar Power Alliance, available at: here

EASAC, 2011. Concentrating solar power: Its potential contribution to a sustainable energy future. Policy report 16. European Academies/Science Advisory Council, available at: here

IRENA, 2012. Renewable energy technologies: Cost analysis series. Working paper, Abu Dhabi, International Renewable Energy Association, available at: here

Lilliestam, J., Bielicki, J.M., Patt, A.G., 2012. Comparing carbon capture and storage (CCS) with concentrating solar power (CSP): Potentials, costs, risks, and barriers. Energy Policy 47, 447-455.

Lluna, C.H., 2012. Solar Thermal Electricity in China in 2011 and Future Outlook. ESTELA, Brussels.

NREL, 2012. Renewable Electricity Futures Study. National Renewable Energy Laboratory, Golden, CO.

Piemonte, V., De Falco, M., Tarquini, P., Giaconia, A., 2011. Life Cycle Assessment of a high temperature molten salt concentrated solar power plant. Solar Energy 85, 1101-1108.

Utterback, J.M., Suarez, F.F., 1993. Innovation, competition and industry structure. Research Policy 22 (1), 1-21.

Notes

1 On recent developments involving CSP, see Lilliestam et al. (2012) for a review, comparing CSP with CCS; Chien and Lior (2011) on prospects for CSP in China; and Vallentin and Viebahn (2010 for a review of German contributions to the development of CSP value chains. The NREL (2012) Renewable Electricity Futures Study contains a section on CSP in Chapter 10, Solar technologies (Volume 2). The EASAC (2011) study on CSP seriously under-estimates the contribution from China and other emerging markets to future CSP activities. The ATKearney/ESTELA report (2010) provides influential estimates of cost reductions up to 2025.

2 On the emergence of a dominant technology (“dominant design”) and its impact on competitive dynamics, see Utterback and Suarez (1993).

3 The technology has been scaled up through the joint public-private Archimede project, where a 15MW facility has been established at Priolo Gargallo near Syracuse, in Sicily; it is generating power from an array of parabolic mirrors focusing the sun’s rays on a pipe carrying molten salts that runs around the field, and storing the heat in an energy storage unit from which steam is produced that turns a generator to produce electricity. The project is jointly developed by ENEA and Archimede Solar Energy, itself a JV between the Italian industrial engineering firm Angelantoni Industrie and Siemens Energy. See Piemonte et al. (2011) for an overview of the Archimede project.

4 The evolution of CSP has created an entirely new industrial sector to produce the heat collecting elements (HCEs) including specially designed and patented piping to carry the heat transfer fluid. Italy with its ENEA/Archimede project was an early starter, with the Angelantoni company producing a specially designed and patented tube called the high-temperature receiver tube, HEMS08, undergoing thorough testing at the Archimede 10MW demonstration site at Priolo Gargallo in Sicily. On the other hand in China, the Huiyin Group has developed its vacuum tube HCEs and is now receiving commercial orders.

5 This plant is operated by a JV company involving Masdar from Abu Dhabi and SENER, the Spanish engineering and construction firm. See ‘Energy plant makes a leap in solar power’, by Sara Hamdan, New York Times, 25 Oct 2011, available at: here. The financing of this plant is discussed below.

6 See ‘Pasadena’s ESolar lands 2000-megawatt deal in China’ by Todd Woody, LA Times, Jan 9 2010, at: here. This came shortly after another US company, First Solar, struck a 2GW deal to build solar PV farms in China.

7 In August 2011 it was announced that GE would invest $40 million in eSolar. China Shandong Penglai Electric Power Equipment Manufacturing has announced that they will be developing solar thermal plants using eSolar’s technology with investments totaling RMB$5 billion.

8 See Giles Parkinson, ‘China’s emissions cap proposal seen as climate breakthrough’, 22 May 2013, RenewEconomy, at: http://reneweconomy.com.au/2013/china-emissions-cap-proposal-seen-as-climate-breakthrough-40529

9 See Belen Gallego, ‘Why India will be a major player in CSP’, 7 Jan 2011, Renewable Energy World, at: here

10 Lanco Solar is developing multiple solar PV and solar thermal CSP projects, largely under the JNNSM program: here

11 See ‘Dust clouds, delays thwart India’s $1.4 billion solar plan’, Bloomberg BusinessWeek, Nov 16 2012, at: here

12 This South African solar park would set the standard for such developments in other countries. There is a debate underway in Taiwan, for example, to substitute renewables for the country’s 5GW nuclear plant fleet; see John Mathews and Mei-Chih Hu, ‘China key to Taiwan energy crisis’, Taipei Times, 13 Apr 2013, at: here

13 The 100 GW global projection by 2025 is made by AT Kearney and the European Solar Thermal industry association, in their investment report ‘Solar Thermal Electricity 2025’, available at: here ; It is noteworthy that Bill Gross, the founder of eSolar (a key proponent of CSP), is on record as saying that the world needs 2 TW of CSP – or 2000 times current levels; see: here

14 See ‘ACWA’S South African CSP Project Now Scheduled for Late April Start, CSP today at: here

15 IRENA made its own assessment in a report issued in early 2012 where it estimated that installed costs in 2011 were $4.60/W for parabolic trough technology and $6.30 to $7.50 for power tower technology with 6 to 7.5 hours of heat storage (IRENA, 2012).

16 This chart shows India’s CERC Benchmark capital costs for CSP and solar PV, available at: here

17 The CSPA report on CSP with thermal storage (2012) is one of the few studies to highlight the role of heat storage in changing the cost dynamics of CSP.

18 The papers referring to 3G and 4G CSP technologies are as yet only available in Chinese. On the use of hot CO2 in power generating units of CSP plants, utilizing Brayton Cycle, see the NREL report “10MW super-critical CO2 turbine test – Thermodynamic cycle to revolutionize CSP systems” at: here

19 See CSP World, Cutting water consumption in concentrated solar power plants, Originally published at World Bank’s Water Blog by Julia Bucknall, 20 May, 2013, Available at: http://www.csp-world.com/content/00925/cutting-water-consumption-concentrated-solar-power-plants

20See CSP Today, Quenching the thirst for water-free CSP, reported by Beatriz Gonzalez on Sep 3, 2012, available at: http://social.csptoday.com/markets/quenching-thirst-water-free-csp

21 Fig. 1 is constructed from an initial survey of CSP patenting results using keyword searching. A more complete analysis utilizing the patenting records themselves is a project that awaits funding. For an analysis of early trends in CSP patenting (1978 to 2004) see Braun et al. (2011).